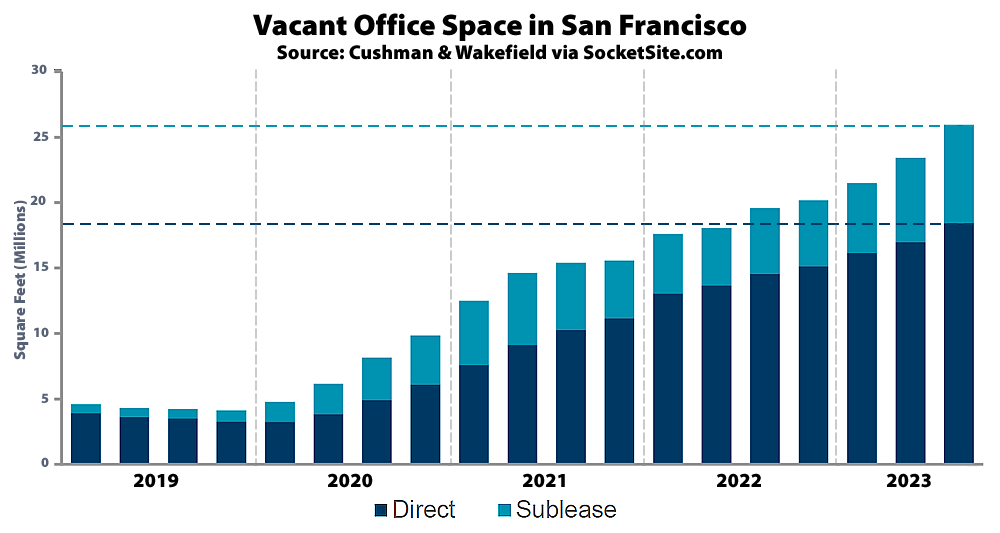

The effective office vacancy rate in San Francisco hit 30 percent at the end of last month, representing nearly 26 million square feet of vacant office space now spread across the city, which is up from 23 million square feet of vacant space at the end of June, with 18.5 million square feet of un-leased and non-revenue producing space, which is up from 14.7 million square feet of non-revenue producing space at the same time last year, and 7.5 million square feet of space which is leased but unused and being offered for sublet, which now includes Meta’s 435,000 square feet of space at 181 Fremont Street, according to data from Cushman & Wakefield.

For context, there was less than 5 million square feet of vacant office space in San Francisco prior to the pandemic and the office vacancy rate in San Francisco has averaged closer to 12 percent over the long term, with a much smaller base of buildings.

And while the estimated active demand for office space in San Francisco ticked up by 10 percent over the past quarter to 5.3 million square feet of space, which includes around a million square feet of space for AI company growth, that’s compared to over 7 million square feet of active demand in the market prior to the pandemic, at which point there was over 80 percent less vacant space as today and there’s another 2 million square feet of leased, revenue producing space in San Francisco that’s slated to come off lease by the end of this year.

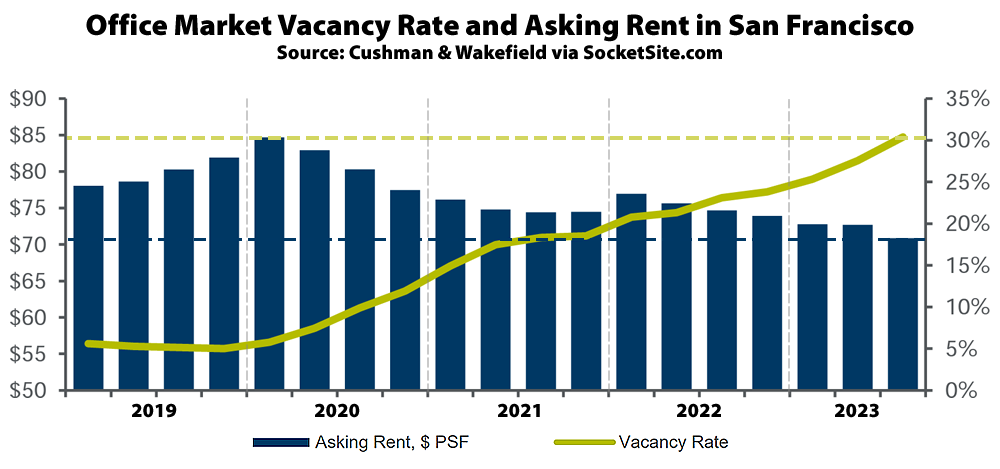

At the same time, while the average asking rent for office space in San Francisco ticked down by 2.5 percent at end of last month to $70.86 per square foot, that’s only 5.3 percent lower than at the same time last year and roughly 15 percent below its 2020-era peak, with landlords’ still fighting to keep asking rents up, the cost of capital having jumped, and another shoe poised to drop.

As always, “while it’s tempting to see, promote or editorialize an opportunity to convert all the vacant office space in San Francisco into housing, the conversion of existing office space to residential use still makes absolutely no economic sense for the vast majority of San Francisco buildings, due to the relative value of each use and the costs of conversion,” as we’ve outlined for over a year and others have finally started to figure out.

And yes, there are higher vacancy rate numbers still making the rounds, but it’s the consistency of the data set and context going back over a couple of decades, as our numbers do, that matters, with an escalation of poor reporting and cross analysis between data sets in the press and splattered across X.

It’s all part of Mayor London Breed’s “comeback” plan. Trust the process and don’t believe your own eyes, it’s coming back!

I haven’t heard he say that she plans for downtown office buildings to “comeback” to the vacancy rates they had pre-pandemic. Perhaps you’ve been following local politics more closely than I have, but my reading of the announced plans from The Mayor are more along the lines of adjustment to new realities, and not “comeback”. Please provide a link to what you’re calling her “comeback” plan.

I am going by what anyone can read at the Roadmap to San Francisco’s Future on The City’s website. The second section is headed “Attract and retain a diverse range of industries and employers”. The next one reads “Facilitate new uses and flexibility in buildings.”

I think most people in a position of responsibility, and the other top contenders for Mayor, now agree that focusing S.F.s economy (and city budget) mostly on one sector employing highly paid workers, many of whom are commuters, in downtown office building was a mistake.

The asking rates, I presume, are the actual nominal dollar figures, i.e. not “adjusted” for anything. And while this is correct – usually I have to go on a rant that you don’t get “real” prices by adjusting for inflation (you have to adjust for changes in income) – it’s nonetheless true that factoring in inflation does give you relative prices; as such, given that there’ve been considerable price increases over the past three plus years, there’s been a reduction…of sorts.

Of course all this is just noise: DTSF’s full recovery is just around the corner….multiple independent experts here on SS have assured me/us as much (and they’re experienced: as with the rental data, they have consistency…going back decades… in (always) doing so.)

No worries, office space demand for AI – software intended to obviate office work (you know, like writing software) – will save downtown and SOMA. Moreover, the accompanying downward pressure on white collar income will surely lead to insatiable new demand for local housing. Laissez les bons temps rouler.

White collars workers, welcome to the class wars. I’m sure the working class you stood with so valiantly during the neo-liberal dispensation will come to your aid…

I attended the Business Times Structures Summit last wk, some very upbeat but cautious developers if the City can make necessary changes to aid DTSF recovery, (including demolition of existing Class B/C buildings for residential use).

SF will always be valuable because of its geography, climate, and other stable industries, I’m just wondering if it’s so bad if the DT rots if demo’s to Res just doesn’t pencil out to revive DT.

Is there an economist on here that’s knows what kind of shape SF will be in if we don’t try to breathe new life into DT resources? What does that mean for residents? Are future pensions and a 30k person government going to bankrupt us, or can this city run w/out the DT revenue? The rest of the City is kinda nice.

I think ss readers understand that at this point, demolishing existing buildings for replacement with residential doesn’t pencil out. Existing building acquisition costs would have to come down significantly from where they are. You don’t even need a complicated spreadsheet model: the existing building acquisition, demolition and subsequent construction costs would be more than developers could expect to earn on the completed residential units, assuming even rosy projections for residential unit sales.

Perhaps what the attendees at the conference you attended are calling “necessary changes to aid downtown recovery” means getting someone else to pay for existing building acquisition and necessary demolition. If that’s the case, I can see why developers would be upbeat, if they see a practical path to that happening. I don’t, but I am not a property developer.

Curiously I had much the same thought. A downbeat developer must be a rare and depressing sight. But as for how “practical” it is, I would point out that the

cityCity, the state and the country in general already have quite a bit of experience in this process: it’s called “urban renewal”, and here in SF, where it was practiced – Yerba Buena and (more particularly) the Western Addition – it has become a source for recriminations and calls for reparations. But practice makes perfect…right ?? What could possibly go wrong??Speaking of which, I got a glimpse – apparently it at least made it to the rendering stage – of the one idea that received quite a bit of attention: replacing San Francisco Centre with a soccer stadium. For those who were curious how a 15 AAA of a stadium was going to be fitted into the 6EEE of a site, the plan was to also demo the 5th/Mission Garage and close/reroute/underground Mission St itself. What could could go wrong?

As for the OP’s query about SF’s budget challenges, I’ll refer her/him to the info I posted in the Oakland Rents thread…the one discussing what a great future SF has. Hopefully.

“urban renewal” is a tool, and every tool can be used for good or ill. It’s up to an engaged citizenry (yes, the same folks that get derided as NIMBYs in the comment threads on this site) to ensure that such efforts be put toward socially useful, equitable and justified ends. As you probably are aware, The original World Trade Center in the Financial District of Lower Manhattan in New York City was built between 1966 and 1975 to help stimulate urban renewal in Lower Manhattan.

I think the times where we just trusted that developers (the same ones that overbuilt Class A office space in this city over the past twenty years or so) to produce what society needs are over.

Some – not just Randites – would say Urban Renewal is inherently wrong, since it usurps the role of the marketplace, and the evils it purports to correct – like “blight” – can and should should be handled under existing health and safety regulations (on a case-bycase basis, not en masse)

I’m not really going to take a position on that philosophy, but will note that for a long time cities in the U.S. (more or less) continuously grew (in wealth and population) and so it seemed blight and obsolesence would always be self correcting. Now that we have almost a century of evidence that isn’t true, and the possibility of more and more cities ending up like Detroit looms ever-present, tinkering seems unlikely to go away; the fact that it ultimately did little to help (placees like Detroit) not withstanding.

“I think the times where we just trusted that developers (the same ones that overbuilt Class A office space in this city over the past twenty years or so) to produce what society needs are over.”

Hmm, maybe, but that leaves a huge void: who would that leave to grease palms in city hall? Won’t anyone think of the politicians, commissioners, and administrators?!

“SF will always be valuable because of its geography, climate, and other stable industries,”

I guess the geography and climate changed, because San Francisco was very affordable during the beatnik, hippie, and punk eras, which is why so many artists and musicians lived here. As for “other stable industries,” do you mean all the blue collar ones (e.g. food production, clothing mfg, printing, construction services, maritime services) that were defenestrated so the land could be repurposed for office and condo/apartment space for software coders?

Even if DT res conversion “penciled out,” it won’t revive DT, because there just isn’t (and never actually was) enough organic demand for “market rate” condos and apartments for swells. The city has a glut of “market rate” housing (hellooooo, NEMA!). If/when the rental inventory is fully implemented and published, we will learn that res vacancy rates are much higher than we have been led to believe.

Reiterating my battle cry on here for well over a decade, turning SF into a monocrop economy (actually duocrop, counting tourism) was bound to fail because monopolistic economies are inherently not resilient (they not only can’t handle economic crises, they are the root of those crises). Cities that maintain a diversity of industries, along with housing within the means of a blue collar workforce to run those industries, will prevail, while sterilized Disneylands for twenty-something boba-app stylesheet coders, like SF, will wither unless they are hospitable to industries and housing for the blue collar workers who actually make cities run.

Good luck reviving DT with the same ol’ same ol’.

Isn’t healthcare another significant industry? I guess finance is one that used to be significant before it was displaced by tech?

As far as beatnik affordability goes, was SF actually cheaper relative to other cities? I have the impression that other cities were cheaper still — it was an era where cities were being hollowed out and abandoned in favor of suburbs, and that the beatniks didn’t live here because it was cheaper than Cleveland; they lived here because they weren’t interested in living in Cleveland at any cost.

While I agree in general with the above sentiment regarding S.F.’s surplus of (overpriced, when compared to the incomes of most of the people who live here) “market rate” condos and apartments, I don’t think that NEMA is an example of a building sitting there empty, and we should be cheering that it isn’t, if prices are actively being lowered.

From San Francisco high-rise apartment building NEMA loses half its value – $264 MILLION – in the last five years:

I would say that if the building was 30 percent or more vacant, that would be evidence of a glut. I don’t call a building that is currently 92 percent occupied as contributing to a glut.

I guess that Crescent Heights got themselves into a situation where their 754-unit apartment building went from a value of $543.6 million to $279 million in the past five years by aggressive price cutting just to get and keep units leased. If so, that is a market signal that says to investors that real estate isn’t a risk-free opportunity.

there is no glut of market rate condos. we are in a price discovery phase. at some point, prices will drop to the proper levels to meet demand, particularly in downtown, SOMA, Mission. there is still a lot of pent up demand from renters to buy and for people moving here. People dont really want to buy in unsafe areas but they will once price gets there. then you will all be cheering that the production of market rate housing led to lower prices.

“Sterilized Disneyland?” San Francisco is a vagrant-filled cess pool hellscape right now. People like you should be thrilled about that.

I think it’s fairly obvious that the “Sterilized Disneyland” comment was a shorthand for what investors, developers, penny ante landlords and such want S.F. to be, an easy environment to make money off of newly-arrived workers — largely in a single industry — that can afford the housing costs people like you are making it their business to run up.

SS uses the more conservative numbers for vacancy rate from CushWake. Other sources quoting 4-5% higher. I’m not optimistic there.

As we noted above, “yes, there are higher vacancy rate numbers still making the rounds, but it’s the consistency of the data set and context going back over a couple of decades, as our numbers do, that matters, with an escalation of poor reporting and cross analysis between data sets in the press and splattered across X.”

Understood. There are different reports using different methodologies for calculating office vacancy rate. In san mateo county market for example, CushWake lumps Office and R&D together in their report which some question. One report doesn’t necessarily invalidate the other report, they can be equally valid for different reasons.

Curious what that last chart would look like plotted for the past 20 years instead of just 4.

I’m guessing that asking office rents in, say, 2006-2007 were well below today’s “plummeting” numbers on this chart. I tend to view anything 2014-onward as reality distortion from our most recent, and most awful, tech boom.

This site right here has you covered, pretty far back.

Back to 2012 [and] from 2009-2014.

Just think how much worse off we’d be, in terms of vacant office space for white collar companies, if Prop. M hadn’t passed in 1986, well before our current crop of fast buck artists arrived in San Francisco with their gold rush mentality. The Board of Supervisors should nominate Sue Hestor to be given the key to The City.

In their latest Form 8-K filed with the SEC, Dropbox dot com indicated it plans to hand over 25 percent of it’s San Francisco HQ back to the landlord. From Fri, Oct 20th :

The subject of this transaction, if you can call it that, is the one Dropbox leased at 1800 Owens St. (Exchange) in 2017, in a property that private-equity firm KKR purchased from its original developer for over $1 billion in 2021.

Members of the local real estate cabal should taking their hats off to Kilroy Realty Corp. for selling this bag of odorous excrement at the top of the market. The folks still at Kilroy who worked on that deal were probably at pebble beach this weekend, still laughing about the money they extracted from KKR’s LP’s all the way up the back nine.