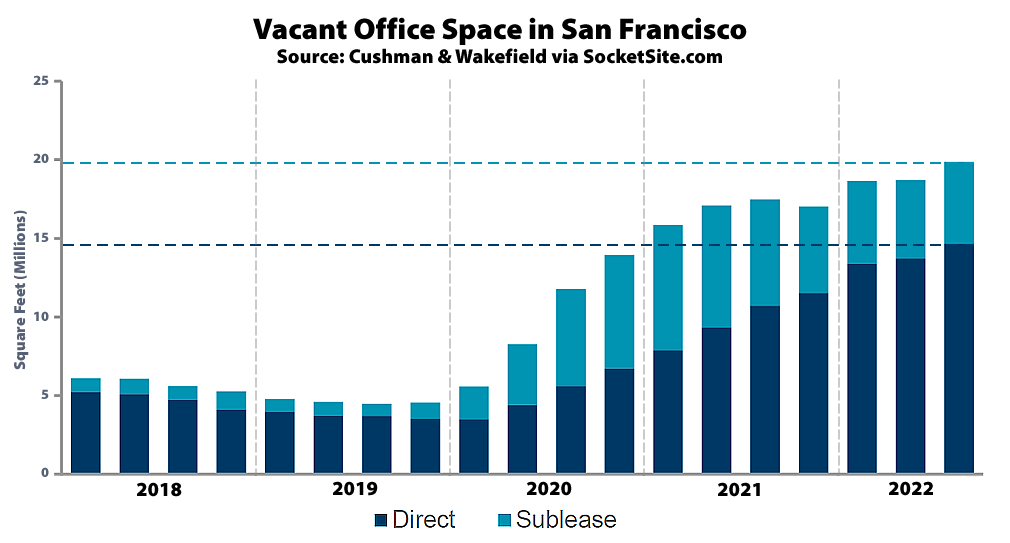

Having held at a pandemic high of 21.7 percent in the second quarter of this year, the effective office vacancy rate in San Francisco ticked up another 130 basis points in the third quarter to 23.0 percent, representing 19.9 million square feet of vacant office space in the city, with the amount of space which is technically leased but unused and being offered for sublet having increased for the first time in six quarters to 5.2 million square feet and the amount of un-leased space having increased from 13.7 to 14.7 million square feet, according to data from Cushman & Wakefield.

As we outlined at the end of the second quarter, “while the tally for the second quarter vacancy rate in San Francisco did include Google’s agreement to sublease 300,000 square feet of space at 510 Townsend, it did not include the 412,000 square feet of space that Salesforce is now offering for sublet in its tower at 50 Fremont Street, the inclusion of which would push the office vacancy rate in San Francisco to over 22 percent with over 19 million square feet of effectively vacant space,” and demand for space had sharply dropped.

As a point of comparison, there was less than 5 million square feet of vacant office space in San Francisco prior to the pandemic with a vacancy rate of 5.7 percent and the vacancy rate in San Francisco has averaged closer to 12 percent over the long term.

While the estimated active demand for office space in San Francisco did jump from 3.1 million square feet at the end of the second quarter to 4.8 million square feet at the end of last month, that’s compared to over 7 million square feet of demand prior to the pandemic with significantly more available space. And while the overall average asking rent for office space in San Francisco ticked down a little over 1 percent in the third quarter to $74.80 per square foot, and has dropped around 10 percent from its peak in 2020, the decrease is largely attributed to a shift in the mix, with “rents in top tier buildings hav[ing] held strong and, in some cases, climbed higher over the past few quarters.” We’ll keep you posted and plugged-in.

Why would anyone start a new residential or office project when faced with this sort of vacancy overhang?

A huge cap rate expansion is on the way.

Office developers won’t typically come out of hibernation until vacancy rate dips below 10% and stays there for a while.

Cushman Wakefield is as good a data source as any. But others are quoting 25% office vacancy, for direct + sublease space for SF.

Is there evidence of a residential vacancy overhang?

The death of the Bay Area exodus has been greatly exaggerated. The text-string match retrieval program of one’s choice should reveal numerous recent reports derived from various data sources.

I’m not aware that there is a big vacancy overhang in residential offerings, but I know the for-sale condo market has weakened substantially and we saw a big decrease in rents during Covid which has for the most part stabilized.

I have a hard time reconciling these reports of huge office vacancy with simultaneous reports of “8,000 new units coming on line in the next two years.” I know some projects get under way and are more expensive to stop rather than complete, but after Covid etc. I don’t imagine there are too many massive projects that will keep going despite headwinds.

So, rents are lower, input prices (labor + financing) are higher, and the offices to which the customers (housing consumers) were expected to go for income, are empty. To me it seems like we won’t wind up with 8,000 new units in 2 years or whatever the numbers are scheduled to be.

From a developer’s perspective, lower rents could be neutral. The difference comes out of the pocket of the person who wants to sell the land.

What do you think is the contribution of land to the overall costs of an average housing unit in the San Francisco housing pipeline?

$200-250K

It’s ok: WFH for symbol manipulators will end in 5,4,3,2….

Won’t someone think of the office managers?!

Some of these buildings ought to be returned to their former productive usage as contractor shops and art studios, and warehouses for building materials and consumer goods, instead of “warehouses” for banked office space that will never be needed. If your plumbers didn’t have to commute from Turlock, maybe you could even get them in time to stop the flooding from your bespoke roof pool?

Meanwhile, new inflation data means the Fed will hit the brakes even harder…

Candlestick Point, and the old schlage lock factory in Vis Valley, are two sites that come to mind that would be ideal for development for industrial business parks with hundreds of small scale units zoned light industrial. But SF politics is hell bent on residential.

“Some” as in “a very small percentage”: do you really think there’s 10M gsf of converted pluming supply warehouse space sitting around?

Yeah, sure, we ocasionally encounter an example – well a ‘sort-of’ example – but take note: the prior useage disappeared before the conversion idea came up.

Hmm. A lot of the disappeared prior usage occurred because LLs raised the rent too damned high, due to the gentrification effect of that fancy new luxury loft two blocks over. I’m not even talking about the see-through sky towers. There are many scores, maybe hundreds, of vacant or near-vacant two- or three-story converted former PDR spaces all over SOMA, the Mission, Potrero Hill, etc. Take a walk or ride around the eastern neighborhoods, it’s astounding how much vacancy there is. The most common use for those buildings these days seems to be for pot grows, but these buildings also do a good job of demonstrating the utility and variety of FOR LEASE signs in situ.

PDR can only flourish with reasonable and predictable leases. When conversion to Keurig foosball lounges for millennial style sheet coders was all the rage, property values and lease rates soared, so the contractors, suppliers, and artisans had to flee SF in like fashion to the symbol manipulators now. The difference is the former had no choice but to leave, while the latter are choosing to do so, in search of greener boba joints. One cohort made SF great; the other cohort made SF a great place to get rich quick, rend the prevailing social fabric, and leave soggy mattresses behind. (shakes fist at clouds)

Some did. A lot more did around the time Gavin Elster finally closed his shipyard.

I assume that most SF office leases are for either five or ten years. That means we will likely have new spaces coming available all the way through 2029. It’s going to be a rough decade for downtown.

With a few exceptions – the expansion of the Standard Oil HQ, the Equitable Bldg (Sutter/Montgomery) – there was almost no new downtown office construction in the three decades from 1930 to the 1960’s; those who cite (supposed) precedent to discount your pessimism may want to keep that in mind.

We did have a Great Depression and a World War during that period.

And we have a Pandemic and an aggressive nuclear power in this one. Are they the same thing? No. Might they be similar enough to warrant concern? That I can’t answer.

The bigger point tho – particularly for those who insist “SF always comes back” – is that there is a precedent for that process to take a very long time.

Lots of things are different then and now:

– China and Russia with new multipolar world

– decades of QE

– various deregulations

– opaque financial markets that rely on public gov interventions

– energy crisis (combined with a fumbled green transition)

– housing crisis

Wish us luck! Or pull up the sleeves …

For context: There’s Enough Empty Office Space for over 150,000 People in San Francisco.

Simple strategy for re-igniting demand: city should offer free parking downtown until momentum has shifted back toward offices.

SF politics are anti-car. They want to ram through congestion pricing. They regard city owned parking garages as future development sites for affordable housing. Office tenants understand that and would most likely regard free parking as short term gimick, if not a long term trap.

Well then SF politics will dig its own grave, as it may have already done. There’s no reason for a commute into the city unless there’s a critical mass of colleagues there.

If only there was some sector for which jobs required a physical presence, for which productive work was more, er, “essential” than brainstorming hover state functionality over kurig and donuts before foosball break. I’m sure there must be one, but I(P) just(D) can’t(R) figure it out!

Vacant: being without content or occupant.

Occupant: One that resides in or uses a physical space.

Deficit: Inadequacy or insufficiency.

The result of having 19%, 20% or 23% vacant office buildings is obvious. The handwriting on the wall for the city’s future should be as obvious as the Graffiti scaring the landscape across the city. The city is facing an enormous deficit it may not be able to handle well. Office buildings = People. People = tax revenue. People support small business. Vacant : being without content or occupant can’t support small business’s. Vacant business’s can’t support the city.

WFH= San Francisco dying a death by a thousand cuts. And the business leaders who can fix this and rescue the city are allowing San Francisco to die.

Gratuitous: free, but not useful.

How do you propose to “fix” a fundamental paradigm shift ??

As a business owner, I assure you that SF left the business owners to die first.

Breed is now going on record blaming benioff and musk for downtown’s problems.

Did Tesla ever have offices in downtown SF? Benioff has been nothing but good for the city. Maybe Breed is the problem? “Hey, look over there!!” works every time.

“He’s very supportive of the city, continues to contribute that support to schools and to other great causes, but the building is empty, and that’s a real problem,” Breed said of Benioff.

“Ultimately I can’t force or mandate, right? These companies are making the decisions that they believe that are in their best interests.”

What part do you disagree with ??

She should determine why it is in Salesforce’s best interest to leave their San Francisco building empty. I expect a hard look in the mirror would reveal the answer.

the downtown mess is definitely at the hands of city govt. But i also think Benioff is somwhat of a sleaze. his prop C backing was mainly to hurt his competitors and he knew it would hurt business in downtown. he also hasn’t put his company’s money where his mouth is in terms of helping downtown