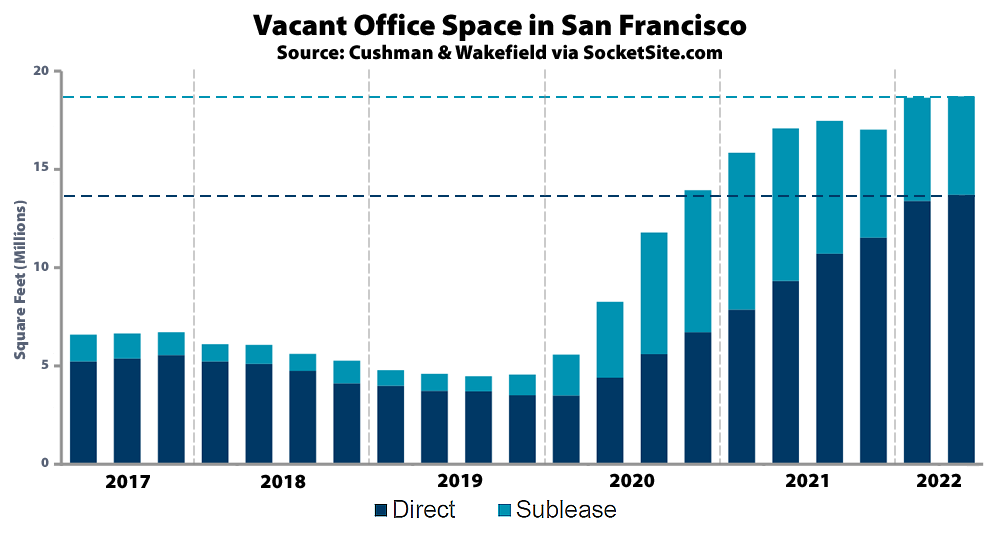

Having hit a pandemic high of 21.7 percent in the first quarter of 2022, the effective office vacancy rate in San Francisco was unchanged in the second quarter of this year, representing 18.7 million square feet of vacant office space in the city, with a slight decrease in the amount of space which is technically leased but sitting vacant and being offered as a sublet (which inched down from 5.3 million to 5.0 million square feet) having been offset by an increase in the amount of un-leased space, which increased from 13.4 million to 13.7 million square feet, according to data from Cushman & Wakefield.

As a point of comparison, there was less than 5 million square feet of vacant office space in San Francisco prior to the pandemic with a vacancy rate of 5.7 percent and the vacancy rate in San Francisco has averaged closer to 12 percent over the long term.

And once again, as we outlined at the end of last year:

“Despite the drop in the overall vacancy rate at the end of 2021, the amount of un-leased office space in San Francisco actually ticked up, both in the absolute and relatively, with 1.3 million square feet of space that was being offered for sublet in the third quarter having been leased, reoccupied or returned to the market as directly vacant space. And total leasing activity actually dropped from the third to fourth quarter of last year, with “a scarcity of large transactions,” a push back of return to office dates (yes, the surge in COVID cases is meaningful, beyond increasing hospitalizations and deaths), and under 1 million square feet of space having been leased, including sublets, for a negative net absorption.”

In addition, while the tally for the second quarter vacancy rate in San Francisco did include Google’s agreement to sublease 300,000 square feet of space at 510 Townsend, it did not include the 412,000 square feet of space that Salesforce is now offering for sublet in its tower at 50 Fremont Street, the inclusion of which would push the office vacancy rate in San Francisco to over 22 percent with over 19 million square feet of effectively vacant space.

At the same time, the estimated active demand for office space in San Francisco has dropped from over 7 million square feet in the first quarter of 2020, prior to the pandemic, to just over 3 million square feet at the end of last month, with a sharp drop from closer to 5 million square feet of demand at the end of the first quarter this year.

Isn’t CBRE quoting 24.5% vacancy, direct and sublease combined? Work from home trend is real. As leases expire, office tenants are renewing with smaller spaces. The less desirable buildings have 33% vacancy. There are office building with entire floor plates completely vacant. Maybe this blog doesn’t like negative news.

SF continues to be the worst-hit and slowest-to-recover city by COVID and Remote work.

Probably because its heavy tech presence lends itself to being amenable to and for the ability of remote work more than most other cities.

That, and the transportation/commute situation. Everybody raise their hands: Who’s going back to packing into buses and trains like sardines, with the occasional meltdown for extra joy.

and the fact that downtown, SOMA, mid-market is an absolute hellscape and not safe

It was a brilliant idea for the city to scuttle PDR and put all its economic eggs in one tech basket. MOAR twittr tax breaks, please! MOAR condo towers for flippers and foreign capital flight! How many empty Salesforce tower equivalents are we at now? #Corruption #Winning!

Sorry to see this site now is just post after post of endless graphs and uninteresting statistical data.

Don’t you have an empty open house to prepare for? Get that sandwich board up, stat!

Gosh, don’t you have a sister to marry or a misogynist support group meeting to attend?

How did the city do that? It was more or less tripling down on pushing tech out ever ever since Lee’s death. If anything, the industry the city actively solicits the most is biotech (but fails to SSF).

Well, you should clue in our fellow commenter “Dave (Seattle dude)”, who just last month wrote:

…because apparently he believe that The City hasn’t made any moves to kowtow to biotech.

Frankly, I think a multi-year “pause” in building office space would be good for the city overall, seeing as how there’s so much empty space. Maybe the all-singing, all-dancing, dynamic self-correcting free market will convert some of that vacant space to better, higher uses in the years ahead.

Well hindsight and all. Space available as a result of the biotech-forward development originally envisioned for Mission Bay would come in handy now, no? Instead they changed course and ran after all that funny money that was floating around. Now we got Uber HQ and the Chase Center and whatever they stick into Lot A right now. I can think of a few “leadership” names to throw some blame at. Truth be told, biotech looked rather lacking for quite some time, IIRC. (Shrugs). At any rate, by the time they’d get into gear chasing after biotech it’s going to be “over” anyhow.

At the moment, blood is in the water and the market appears to be tragically oversupplied. It is hard to project what might turn things around, but I wouldn’t bet a lot of money against it.

Following the Great Recession, the market bottomed around 2010-2011 with Class A vacancies in the mid-teens and average asking rents in the low-$30s. Even though there was still plenty of vacant space, tenants and landlords got it into their heads that the market was headed for a shortage of office space and it was off to the races.

Same thing happened at the previous 2002-2003 market bottom, following the dotcom collapse…Class A vacancies were around 20% and Class A rents in the $20s. San Francisco can be a very volatile market.

Speaking of Chase Center/the Warriors, they have put on indefinite hold plans for a 13 story hotel/condo project across from the arena.

no one in I know in biotech even considers SF when opening office space. expensive in small area where labs are viable, little network effect, biotech workers older than tech, and many families live outside of SF, more car centric

SF still faces a massive housing shortage of all types of housing, so I would certainly welcome as many more condo towers as we can fit into this city.

But… who would dare make a huge investment on a condo that’s dropping 10% YoY? My friend has a place on 2nd Street. She paid $950k in 2017. Guess what the price is today? 830k? Maybe?

Chinese or Russian kleptocrats who need a vehicle for laundering their corruption-generated wealth or moving it out of their home country.

The city “scuttled” PDR with laws that specifically protect it, prevent its demolition and in cases where it is allowed, require it to be rebuilt? One would think if there was such a hot demand for PDR, the rents for it would be through the roof and developers would be clamoring it to build it (because they do certainly build lots of it in markets where there is strong demand). And, the Twitter tax break, which covered a limited area of the city that had been economically depressed for many DECADES ended almost three years ago. As for condos, isn’t everyone always clamoring for more housing to be built in the city? And, aren’t we talking about office space and not condos. We get it. You hate SF and you come here to rant about how ruined the city is, but don’t you get tired just spewing the same nonsense over and over? Or, at least isn’t all this griping bad for your mental health? Say something new or at least say something interesting.

An impressive list of canards, h/t!

PDR rent for the dwindling spaces is too high for most PDR companies to operate. They don’t have the luxury of pump n dump VC backers hoping to score a quick buck on their bottomless pit of (formerly) free money to throw at the latest disruptive pizza delivery app.

The laws “protecting” PDR, like the NEMIZ plan way back when, were full of holes that that any developer could and did skirt.Due to the tech-fueled RE bubble, land acquisition costs are too high for developers to make a profit with the lower rents PDR can pay.

RE gangs were the ones clamoring for moar housing; affordable housing advocates advocate for affordable housing, not condo towers that raise adjacent property values, making moar towers the only thing that pencil out.

I hate what you and your ilk are doing to the city, but I don’t hate SF; I hate you.

I’m sorry if my words distress you, but shouldn’t you be prepping that empty open house for today?

Rubbish. Claiming that empty space would be magically filled with “PDR” is laughable and, like all fauxgressive cult mantras, gaslighting. We didn’t leave PDR, PDR left us. The entire “fight” was cover for land use wars, with non profit mobster builders using zoning to keep property values low in hopes of discounted real estate deals. The hot minute they get their hands on a PDR building, it’s resined for residential. 18th and Potrero, Mariposa and Bryant, 19th and Florida — and that just in Mission Creek. There were never plans for actual jobs.

Two beers, I am flattered you have such strong feelings for me, but I have been in this city for over 25 years and I will be here for at least 50 more (I was young when I arrived and in excellent health), so either decide you are going to cling to your bitterness until you come to a miserable end, or get a grip and do something productive with your energy aside from coming here and spewing nonsense. And, I say this with all my love because you are not worth my time or energy to hate.

“F” for reading comprehension and logic, thank you for the strawmen to knock down.

No one says PDR would swoop in to fill vacant Class A office space. The argument is that the “tech” bubble Ponzi mania drove property values so high, that PDR property was hoovered up to build towers, condo lofts, “creative” work space, and any number of other “tech”-oriented purposes that are now going the way of the dodo. PDR workspace disappeared, and the decent-paying working class jobs along with it. PDR didn’t “[leave] us’; it was brutally defenestrated.

But this, ” non profit mobster builders us[ed] zoning to keep property values low in hopes of discounted real estate deals” – wow, that’s some priceless tinfoil hat nuttery there. It’s almost as if the largest asset bubble in history didn’t occur (twice!) over the last two decades, but instead, it was those devious and all-powerful “non profit mobster builders” who designated a very properties in the Mission for affordable/senior/disabled housing. were behind the skyrocketing rates. Tell me, were this doing this on orders from George Soros, or from VV Putin? 😂

btw, l worked at 18th & Potrero long before it was demolished, and before that, I lived at 18th & Bryant long before the Madelongadingdong, so I probably know that area as well as you. The footprint of the buildings you cite is a small fraction of the Mission real estate that has been repurposed from PDR to tech office/tech housing.

That’s fine, Chris. Your time is better put to placing cold calls and replacing fallen signs. I’ll be in touch when the properties you rep throw in the towel on the tech bubble.

Two beers, for someone who is clearly quite passionate in your feelings about me, you don’t actually know much about me. As I’ve mentioned before, I am not a realtor, nor am I in anyway connected with the real estate industry. I work in financial and accounting services, as I have for most of my time in SF, aside from a year working for a social services nonprofit. Was your mom a realtor? Is this where all the animosity comes from?

Have a nice day, Chris.

in all honesty, they will probably need more twitter tax like incentives to get downtown going again.

Yes, this hits the nail on the head. The city should prepare to create serious incentives, and not just financial, if they hope to pull out of the current disaster. Anecdotally, I will never return to my mid-market office with street conditions as they are. SF has a huge challenge ahead and I’m not at all confident we have government competent enough to rise to it.

What is amazing is how San Francisco’s anti PDR policies have also resulted in the replacement of PDR space with technology companies in New York, Toronto, London, Amsterdam, and every other city on earth.

Because of Covid? Or do you mean because of our ridiculous and ineffective response to Covid?

It boomed too hard, thanks Ed Lee and Ron Conway.

Was holding ??? Isn’t this the most recent data ?? Granted, even ths most recent data is – technically speaking – somewhat out of date, but the head makes it sound like a story from last year or something.

Bottom line, vacancy will likely rise in the next 2 years. Mid-Market and Mission Bay could hit a 42% vacancy rate per Tom Egan. From the SFBT:

“San Francisco started the year with a 22% of its office inventory vacant — up from a single-digit rate pre-pandemic — but that number could more than double in some areas by 2024, the city’s chief economist Ted Egan said on Thursday.

The city’s downtown could see vacancy ranging from 35% to 50% in certain areas, assuming that current market conditions continue and office tenants decline to renew existing leases or sign new ones in a worst-case scenario.

“Even the space that is not yet vacant, much of it’s becoming vacant,” Egan told the city’s Planning Commission. “And if there isn’t a return to office and renewal of office demand, that’s going to create a problem in all of those submarkets.””

Block just announced it will not release its 450K feet of space in the Mid-Market area when the lease expires in 2023. Block no longer identifies SF as its HQ. Block will retain its 356K feet of space in Oakland which it leased several years ago. As it moves to a dispersed workforce it makes sense to place what Bay Area footprint it has in a more easily accessible location such as Oakland.

New housing proposals have dropped from 300 or so a month pre-Covid to 50 or so now. Housing production is expected to drop to 2800 units this year compared to over 4000 a few years ago. There is no way SF can meet the state mandated 82K new units by 2031,

Not only is Salesforce putting over 400K feet of space up for sublease, but it also backed out of leasing all the office space in the Parcel F tower last year. Setting that project back years and perhaps jeopardizing it outright.

Block, formerly known as Square. Same boat as Stripe. Jack Dorsey and Patrick Collison were very vocal in their opposition to Proposition C at time (2018). If I understand this correctly, Proposition C created an untenable situation for financial services firms like these two: They would have been taxed based on their customers’ revenues, not their own. Though it stands to reason they would have decamped San Francisco regardless.

And, here comes Cassandra with predictions of gloom.

SF’s post-pandemic recovery has been slow, mainly because of the lack of interest in supporting downtown either from the Mayor’s office or the Board of Supervisors and their insistence on making the city such an expensive place to do business, whether you run a small or big business. But, things will turn the corner, they always do. And, the recent city budget seems to show a growing sense of awareness that downtown and Mid-Market need more support. Google’s recent 300K lease in SOMA shows that there are still companies interested investing in the city, even companies like Google, which could certainly put office space or hire workers in almost any place in the world.

“[…] even companies like Google.”

Uh, how many companies are “like Google”? Even if there were more than one or two other similar companies interested in a coupla hundred k sq ft in SF, the goog itself is slowing down hiring. Layoffs might not be too far off. Even Apple, one of the few “tech” companies that is actually “tech” and not merely glorified pizza delivery app code, is slowing down. Hey, maybe crypto can save real estate! Can we get some tax breaks ova here?

RE has gone from ka-ching to ka-boom.

Google was in negotiations with the Pier 70 developer to take 1.75 million feet of office space there. Covid came and Google backed out. Pier 70’s developer recently declined to exercise an option on Phase 1 because of doubts about the viability of vertical construction there. Th Pier 70 project is now on hold and unless Brookfield can get a major commitment for most of the planned office space Pier 70 won’t move forward at this time.

That’s interesting. So what’s going on with the sinking problem — is it at pier 79, too? Basically at Mission Bay the ground around all the buildings is sinking. Is this dissuading builders from trying things at 70?

Good news. With no end in sight for the increasing office vacancy rates, only a committed lunatic would commit to a Pier 70 destined to be underwater (pun intended) before the end of the century.

Actually it would have to be an uncommitted one (pun intended, as well)

That having been said, the end-of-the-century is 78+ years away. That’s several eternities in real estate terms.

@Notcom – Brookfield has already been burned by the SF office market. Their 5M tower opened about a year ago and last I heard only one small lease had been signed for space in the tower.

I believe in musical chairs that’s known as being “the last one standing”

I was referring , tho, to the irrelevancy of the MSL in 2100 for people’s day-to-day leasing decisions

(or year-to-year…or even decade-to-decade)

If you want to throw your money into crypto be my guest. I gave always done well with stocks and bonds, even in a volatile market.

And, no, we don’t need tax breaks, we need a clean and safe downtown, less regulatory red tape, lower business fees, and more money invested into city infrastructure instead of into dubious nonprofits or city bureaucracy.

And, I mention Google because they are precisely the sort of company that could put offices anywhere and hire people anywhere, or have most of their employees work from home if they wanted, and they still chose to lease a very large amount of office space in SF. And, there are certainly other companies with similar circumstances such as Google.

What’s that under your skin? Oh, my, it seems to be me. 🙂 Ka-boom.

If I remember my Greek mythology correctly, Cassandra’s problem was that she issued accurate predictions, but was never believed when she spoke.

If it’s true that S.F. is “such an expensive place to do business”, it is due to, over and above the limited availability of buildable land, the regulations in place that themselves are a response to the preponderance of bad actors who have arrived here from elsewhere with dollar signs in their eyes, eager to exploit S.F. workers by jacking up the pricing of housing to maximize their income and therefore tend to ignore the rules. I’m thinking primarily of small business people that do things like illegally convert the basement of a laundromat into a warren of 20 unwarranted rental units or buying rent controlled buildings, turning out the tenants and then putting the units on AirBnB as quasi legal hotel rooms.

The regulations increase to respond the abuses perpetrated by the bad actors, and then more bad actors arrive, hell bent on ignoring the newly expanded set of rules and they get away with even more egregious bad acts, which triggers a response of more regulations. Later, rinse, repeat.

I wouldn’t blame the little guy. Everybody was simply chasing yield and trying to keep up.

Yes, and you missed that I was being sarcastic. The big Seattle Dud fancies himself to be an oracle of truth who unfortunately the ignorant masses refuse to believe. The reality is he is just a bitter person with apparently no other hobby but spending time coming to this forum year after year putting up post after post about how SF is in decline and lying in the shadow of impending doom, which is always just around the corner. One wonders why he doesn’t just enjoy Seattle and get a different pastime, but hey, to each their own, no matter how misguided they may be.

And, yes, limited developable land does increase costs, but SO do increased regulations, expensive labor, high taxes, etc. To pretend land costs are the sole factor that makes building in SF expensive is nonsense. Also, *every* regulation is a response to something, but that does not mean every regulation is either the *correct* response or correctly implemented. If existing city regulations were the best response to issues SF faces, then should have either solved or greatly mitigated these issues they purport to address. Also, nowhere either here or on any forum have I ever argued for getting rid of all, or even most, regulations. I do argue for carefully evaluating existing regulations and eliminating or scaling back those that drive up the cost of building new housing or opening new businesses in the city without providing a substantial benefit that outweighs the burden. So, please, look silly and post all the links you like to examples of illegal Airbnbs, but I have never argued the city should have zero controls on where housing gets built or what safety and other code standards it should meet. And, I think you know that, but it is easier to put up straw man arguments than to debate the issues.

Finally, instead of lathering and rinsing, the city needs to seriously focus on economic development, infrastructure improvement, and increasing the overall general livability.

Uh oh: “Twitter scraps downtown Oakland office, will chop San Francisco space.” And no this isn’t one of those Prodigal Returns stories: the City isn’t the ‘gain’ to the Town’s ‘pain’, they’re cutting back both. But of course that can be properly spun:

– Everyone’s suffering, but SF will suffer less than others

– Twitter: b-o-r-i-n-g

– It’s not a setback, it’s an opportunity.

But for now: thoughts and prayers, people…thought and prayers

This was predictable if you’ve even been remotely following what is happening around Elon Musk’s aborted attempt to buy Twitter. It’s an open secret that the company has been suffering employee attrition on a massive scale since the go-private transaction was announced, and the fact that the story Notcom provided a link to says “the move to reduce Twitter’s building footprints won’t result in layoffs in and of itself, the company stated” indirectly supports this.

The owners of the building in downtown Oakland that Twitter was going to create a new office in should have gone out in the open market and bought some put options on TWTR at the outset, to hedge their exposure, when the Musk troll rear its ugly head.

“Everyone’s suffering, but SF will suffer less than others”

You sure about that?

Office vacancy rate: 24% SF, 10% SM.