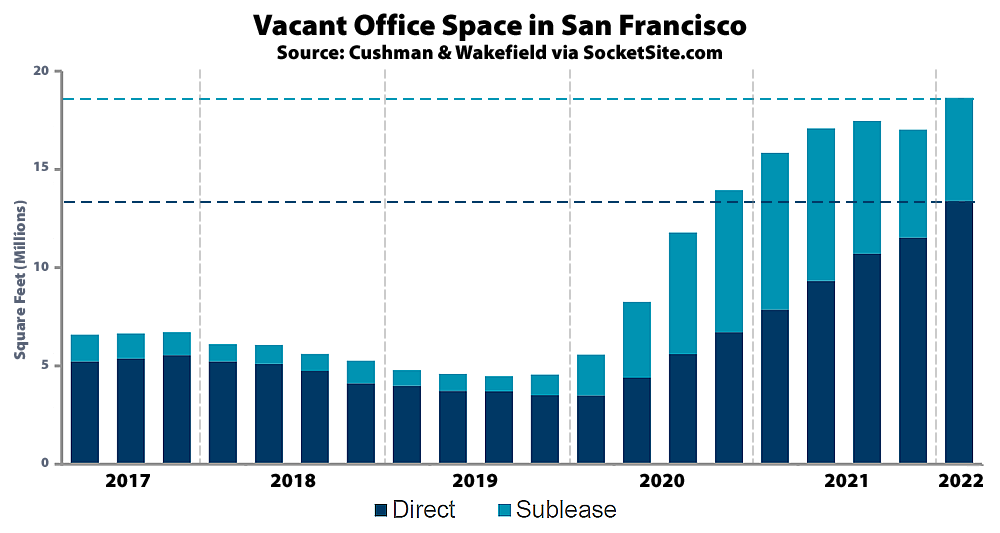

Having inched down to just under 20 percent at the end of last year, the effective office vacancy rate in San Francisco ticked back up to a pandemic high of 21.7 percent in the first quarter of 2022, representing 18.7 million square feet of vacant office space in the city, including 5.3 million square feet of space which is technically leased but sitting vacant and 13.4 million square feet of un-leased space, according to data from Cushman & Wakefield.

As a point of comparison, there was under 5 million square feet of vacant office space in San Francisco prior to the pandemic with a vacancy rate of 5.7 percent, versus a long-term average of around 12 percent. And as we outlined last quarter, foreshadowing the first quarter rise:

“Despite the drop in the overall vacancy rate at the end of 2021, the amount of un-leased office space in San Francisco actually ticked up, both in the absolute and relatively, with 1.3 million square feet of space that was being offered for sublet in the third quarter having been leased, reoccupied or returned to the market as directly vacant space. And total leasing activity actually dropped from the third to fourth quarter of last year, with “a scarcity of large transactions,” a push back of return to office dates (yes, the surge in COVID cases is meaningful, beyond increasing hospitalizations and deaths), and under 1 million square feet of space having been leased, including sublets, for a negative net absorption.”

And in terms of active demand for the 18.7 million square feet of vacant space, Cushman & Wakefield is currently tracking active requirements for 4.9 million square feet, which was down from the fourth quarter of last year and 33.8 percent below the pre-pandemic demand.

SS’s vacancy numbers and those of the SFBT are finally coming together. This week the SFBT listed the vacancy rate at 21.9%. And rising. The juxtaposition to the East Bay’s office vacancy rate dropping tells a tale. Oakland is seeing proposals for new office buildings at a time when projects like 88 Bluxome are being abandoned in SF. Also, at a time when millions of feet of office space (in addition to bio-tech space) are being proposed in SSF, San Bruno and other north Peninsula cities.

Just today Wells announced it is giving up its space at 45 Fremont – 146K feet. In March Slack gave up all its SF space – again at 45 Fremont – 208K feet, Too, Sendoso just announced it is moving its HQ from SF to Phoeniz bringing almost a thousand jobs to the desert city. If Musk manages to take control of Twitter that company’s HQ leaves SF.

As office space remains vacant or is only partially used due hybrid work small downtown businesses will be further hammered. The Embarcadero Center is 1/3 vacant with several large spaces now occupied being advertised as available soon.

Employers are not moving jobs to SF even as the exodus continues. SF is at an economically perilous point. Most of the office space is not able to be converted to residential or bio-tech use. SF may have millions and millions of empty office space for years to come.

The solution is clearly to tear down what’s left of PDR/light industrial and build more office space and condolofts.

There won’t be major new office developments in SF for a long, long time so you need not fret. Even approved projects will not go forward. 88 Bluxome, 725 Harrison (almost 1 million feet of office space) and other projects are now in limbo. The Flower Mart development timeline has been pushed back a number of years and the vaunted Parcel F tower recently sought to reduce penalties for not being under construction by 2023. Wanting to shift that date to 2027. My bet is that Parcel F does not end up getting built.

SF has lost its mojo. Unless there is fundamental reform with regards to quality of life issues: crime, public safety, homelessness, hygiene, sanitation, traffic, public transport – it isn’t really desirable anymore.

If the “22.5% vacancy [rate] per SFBT” that it appears that you quoted last month was correct, wouldn’t that mean that the vacancy rate in San Francisco is actually dropping? Or perhaps the SFBT is finally closing in on the accurate number…

Slack is a bit of a bad example. They were acquired by Salesforce, so of course their office space would get merged into SalesForce’s existing holdings across the street. Google is still looking to make some moves in SF (they are still using wework space) so it’s not all doom and gloom, but I do agree the recovery will take a while.

It’s not so much Slack taking empty space in SalesF’s SF footprint as it is Slack going to a mostly remote work model, Slack’s CEO said that return to the office is “doomed”.

SalesForce itself is reducing its SF footprint. It had pre-leased the office component of Parcel F (275K feet) for future expansion a while ago. Last year it backed out of the lease (think Pinterest). Tha’s one reason the Parcel F project is on shaky grounds.

“an office vacancy rate of nearly 32 percent in Oakland’s City Center”

10% higher vacancies and proposals for new offices is a good thing?

This vacancy rate is misleading. Oakland and the East Bay have vastly more antiquated office buildings which will likely never be put back into service in their current form. The flight to quality is real, and its creating a dichotomy in the market. Look at vacancy rates both in SF and in EB in Class A built 10-years ago or less and the vacancy tells a very different story.

Embarcadero center is over 90% leased.

Musk, Musk, Musk! Twitter employees haven’t come back to their office in numbers which means that Twitter has effectively already moved out of SF. As usual it doesn’t matter what Musk says, just as with the San Leandro manufacturing plant and all the Tesla and Space X employees that are still working in California.

Mid Market was always an optimistic bet so it isn’t really surprising to see companies giving up on that location.

Some thoughts (feel free to borrow):

(1) Why does SF get a breakdown b/w the ‘direct’ and ‘sublese’ sectors while the Eastbay – a region that includes the city of Oakland (but apparently not Walnut Creek) doesn’t?

(2) SF continues to go up while the EB is going down; this will set off excited comments from the I told you so crowd that the center of Bay Area life has now crossed said bay…never to return.

(3) #2 notwithstanding, the difference is pretty darn small, so the crowd’s observations are probably wrong;

(4) or maybe not: BART ridership is still sicker than a frat bro on a Saturday morning….and I believe CALTrain is even worse.

$8/ day bridge toll. Or $8+ / day average Bart fare. Works out to $2,000 per year per employee plus extra commute time to SF. There is definitely a small but noticable reason for employees to favor Oakland.

The largest flow of BART commuters (pre-COVID) is/was Dublin to Embarcadero, which is $13.20/day plus parking/taxi/uber since Dublin BART is the most auto-dependent station in the whole system.

Are these tax-deductible empty buildings losses?

It’s time for a moratorium on all office space construction.

I’m curious as to why we need a moratorium? If a private developer wishes to waste his or her money on building unwanted office space, what’s the problem? Ultimately, the end result will be an across the board lowering of asking rents although this may take some time.

We do not live in a country with a command economy much as that seems to be a problem with both the right and the left.

There is a moratorium and it is enforced by lenders.

Depending on banks to guide our social policies (deciding what, when, where, and how to build _is_ a social policy) based on their own profit expectations is a recipe for continued historically-high levels of wealth inequality and civic deterioration. “Let the market decide,” lol.

FALSE. You need a rush on demolition permits to take antiquated buildings out of service to make way for more usable space.

To me the obvious solution is to convert these spaces to residential, given the still extremely high rents we see in San Francisco. This article says they can’t be converted. But why? If it’s zoning, couldn’t that easily be changed?

Zoning changes are never easy. It is a multi-layered endeavor and take a lot of time. It is also the costs to bring these units to code during conversion as there are different building codes for residential.

It isn’t zoning. Most of these properties are zoned C-3-O, which permits residential. Conversions will happen when and if it makes financial sense.

A big part of the issue is the cost of retrofitting for residential. Not just the walls, but the systems and plumbing is particularly difficult. In most modern office buildings, all of the plumbing is concentrated in the center core. That’s were the restrooms and coffee stations are located. Locating kitchens and bathrooms in the core won”t work for a residential retrofit, it would lead to really awkward floorplans.

You can extend the pipes outward which is not too hard for fresh water piping. But waste pipes need to be slanted for gravity flow. That slant will eat up 12-18″ of vertical space.

So though retrofit is possible, the costs in both construction dollars and lower ceilings make it a hard sell.

The logical choices for conversion are older, smaller spaces: something like the Mills Tower or Shell Building

(hypothetically, of course, since they may well be still viable as office space)

Why no count of the blood bath in associated vacant retail space associated with the vacant office sector? The SF financial district is a ghost town. Most if not all the ground floor supporting retail is vacant. Who’s keeping track of the amount of vacant space? Like office supplies, food service, drug stores, flower shops, delivery service, shoe stores, etc.

Also, I’m told that many tenant’s leases have expired in several downtown buildings over the last three years. I’m told that some tenants only extended their lease for one year to see how things would shake out. I’m now told that tenants are looking to renegotiate their $80 dollar per sq foot lease down to $55 or may not renew. WFH impacts are making tenants rethink their office needs. Many office workers are balking at coming back to the office. I’m also told that there is a wave of property tax appeals heading to the SF appraiser this year by downtown office building owners. This potential loss of tax revenue does not bode well for the city as a whole.

Stay tuned as I believe this next year is going to be a rough ride for the city and the office sector. Wake up and smell the recession.

Post script….I owned buildings in the SoMa. I monitored the number of vacant buildings around me. Three years ago vacancies began appearing. Many of those vacant buildings are still vacant today and sadly the number of vacant building in the vicinity is growing.

You are spot on and, sadly, the City PTB don’t seem to realize this.

The much-ballyhooed March return to work was a dud. Workers coming into the office in San Francisco stood at 31.2% of the pre-pandemic level for the week that ended March 23, up 1.1 percentage point from the prior week, according to the occupancy report from Kastle, which provides workplace security systems. That is far behind Austin at 52.9%, and even New York at 36.1%

Downtown will not be the jobs hub it was. If it gets back to 70% in terms of daytime workers, the City can count itself lucky. But that means many small downtown businesses dependent on weekday office workers won’t come back or will go out of business.

Not only property taxes but business and payroll taxes will decline. Not good given the bloated City budget. 88 Bluxome, the Flower Mart and Parcel F projects are likely bot to be built. The anticipated tax revenue and funding for BMR housing will vanish.

SF could make a play for biotech but it is not. If anything obstacles are being put up when biotech companies want assurance that space will expeditiously be built. This at a time when Oakland and Hayward/Fremont are aggressively courting biotech and especially given the over flow from SSF.

Agree the next year will be rough. The office vacancy rate will climb more before leveling off. Even then all the empty space will mostly remain empty for the foreseeable future.

> Most if not all the ground floor supporting retail is vacant.

That’s just patently false. Are there shuttered retail spaces? Sure. But as I walk around 101 Cal and Embarcadero Center, the majority of storefronts are open for business… by no means are “most” – let alone “if not all” (!!) – retail spaces vacant.

If you want to engage in reasoned debate, that’d be great – but hyperbole and unsubstantiated “I’m told…” allegations are meaningless.

There’s our housing, let the conversions begin!

It should be our housing. We could do it with a office space vacancy tax.

Ballot proposition?

Easier said than done. Many, perhaps most of the newer hi-rise towers do not lend themselves to residential conversion. The City could tax empty office buildings but the owners probably could pay that tax for decades rather than retrofit to residential and still be ahead dollarwise.

That begs the question – as downtown SF sees its share of jobs decline relative to DTO, the north Peninsula, Fremont/Hayward and SJ who is going to want to live in converted downtown towers? SF’s population dropped to 815K in July 2021 from 870K the year before. As it is there is a question as to whether the almost 70K units in the housing pipeline are really needed giving the new dynamic.

Sort of tongue in cheek but maybe the day will come when owners decide not to pay the property taxes and maintenance costs on long empty office buildings and tear them down. Would that will come to pass with the eyesore Salesforce tower.

One can hope.

Conversion to resi is extremely hard. Floor plates, cores and parking of office buildings are all not condusive to residential (think window line to square footage of the foorplate). Office buildings are often too deep to support residential. Plus, the additional utility (water, sewer, gas/electric) load is siginificantly higher which many older office buildigns cannnot support.

As we previously wrote, and was subsequently debated, the conversion of existing office space to residential use currently makes no economic sense for the vast majority of downtown San Francisco buildings. Zip. Zero. Zilch. And it’s not a matter of “demand,” per se, it’s a matter of the relative value of each use and the cost of conversion.

my wife works in a mid sized tech company (10K) and is located in mid-market. when surveyed about coming back to office 2 days a week, the #1 issue cited was a safety concern about violence, #2 safety concern about open drug dealing (worded differently) #3 taking public transit due to safety concerns #4 commute #5 productivity at home #6 COVID.

when asked what was the #1 thing the company could do to encourage returning to the office, it was overwhelming an ask to move the office to a safer location.

Where does your wife work? I’d love to help them find a safer space!

10K means

the number of employees??

the revenue??

it’s big enough to file a 10K ??

Same question. Most downtown buildings host about ~70-120 workers per floor max. Salesforce doesn’t even have 10k employees working in San Francisco.

The actual current vacancy of the San Francisco office market is 24.7%. My firm tracks 87M square feet of inventory, and CoStar currently shows 21,474,926 square feet as vacant. Unlike large firms, we do not exclude buildings under 10k SF nor ground floor spaces that can be used as office.

[Editor’s Note: As a point of reference, Cushman & Wakefield’s base is 86,138,540 square feet of space.]

So has your metric peaked, or not ??

Time for office building landlords to reduce asking rent, and properly incentivize office leasing agents. Those buildings aren’t going to lease themselves. SF office building landlords need to face the reality that office tenants have options. Or they can stay in denial and let their space sit vacant for another 12 months, and lose 12 months of rental income.

Commercial landlords are unlikely to reduce asking rent of their own volition because many of them are locked into agreements with their lenders to not reduce rents below an agreed upon floor. So only landlords who own their buildings outright are even able to respond to market conditions by significantly lowering asking rents.

As far as potentially “losing twelve months of rental income”, well, the first paragraph in the editor’s post above estimating vacant office space in the city includes “5.3 million square feet of space which is technically leased but sitting vacant”. Well, that means about 28 percent of the ostensibly vacant space is still generating rent, no? If the space is technically leased, then the fact that the space isn’t being used is the tenant’s problem. On top of that, commercial leases are typically multi-year.

Landlords probably don’t care if people are actually coming into their buildings on a daily basis, as long as tenants are paying the rent and they are generating revenue. Hell, commercial landlords probably like it better to have offices that are “technically leased but sitting vacant” because that reduces their costs of upkeep in the long term while not doing anything to diminish the depreciation they can claim.

Office vacancy rates are mostly taken from Costar nowadays. The space doesn’t get input into Costar unless it is actually vacant with no tenant paying rent, or there is tenent with lease expiring in next few months and not renewing, or tenant is on month-to-month terms. Costar expends significant resources to maintain its site data integrity. Its the industry standard which gets used as baseline figure by all brokers, even though some brokers include different buildings, and “shadow” space which may or may not be actually available for lease.

> Costar expends significant resources to maintain its site data integrity.

Ha, they flubbed facts on a large (9-figure) transaction with which I was recently involved – *and* refused to make changes when errors were brought to their attention. May be just one anecdote in a sea of facts, but I personally will always question the quality of their data.

Pure greed. All they were interested in was office space. It is not like San Francisco is/was alone in this, just look at the 2mio sq ft of office space, zero housing, that Brisbane set out to build ten years ago. You develop a place like that, and all you get is commuters on ever longer, crowded MO-FR schlogs. Now they’re all waving their buh-buys with a smile. You got to say, good for them. For the City and County? Not so much. DC Covid money and transfer taxes helped prop up the budget – needless to say, that will evaporate.

SF talks a good sustainability game – but there is nothing environmental about a 3 to 1 jobs/ housing balance, people living in Concord (and further)commuting downtown. More housing closer to jobs. A lot more….

More housing closer to (office) jobs? Done! As in: The walking distance from the bedroom to the home office.

That is definitely going to be the competition to the CBD in the future. 🙂

People are social animals. I expect many will want to live downtown if there were decent affordable opportunities to do so.

But isn’t one of the most tired tropes in socketsite’s comment threads the one in which a flipper, mom-and-pop penny ante landlord or some other hanger-on in the real estate “game” glibly says “All housing is affordable to someone”?

In order for the “many” to live downtown, at least in the case of market rate housing, we’d have to see a pretty substantial decrease in housing costs. Perhaps if large numbers of highly-paid professionals — like the staff at Twitter who aren’t coming into the office now — continue to work from home and/or move away from S.F., the local market will be deprived of the outsized effects of that one segment of the population and then capitalists who purchased real estate here in hopes of exploiting that population will sell their assets at a loss, and thus make homes available at lower prices to the people who want to live downtown but can’t currently afford to.

You’ll understand if I don’t hold my breath waiting for that to happen.

Real estate is such an open, efficient, and responsive market, it can take mere decades for price discovery mechanisms to play out! 😊

WFH is very real for certain kinds of tech companies. It doesn’t mean that all employees will work from home all the time. But all workers don’t need to be in the office all the time either. This rings especially true for tech sector. SF might be office market with chronic high vacancy rates for few years. Because office landlords scared away old economy office tenants by raising rents during the last tech boom, and replaced them with tech companies.

Meanwhile san mateo county office vacancy rate is below 10%. Office tenants are shunning SF. SF office building landlords can’t pick up their building and move it to san mateo county where there is abundant free parking for all employees, and no homeless junkies at the front door. SF office building landlords need to compete some other way. What could that be… hmmm… stop playing poker with deal.