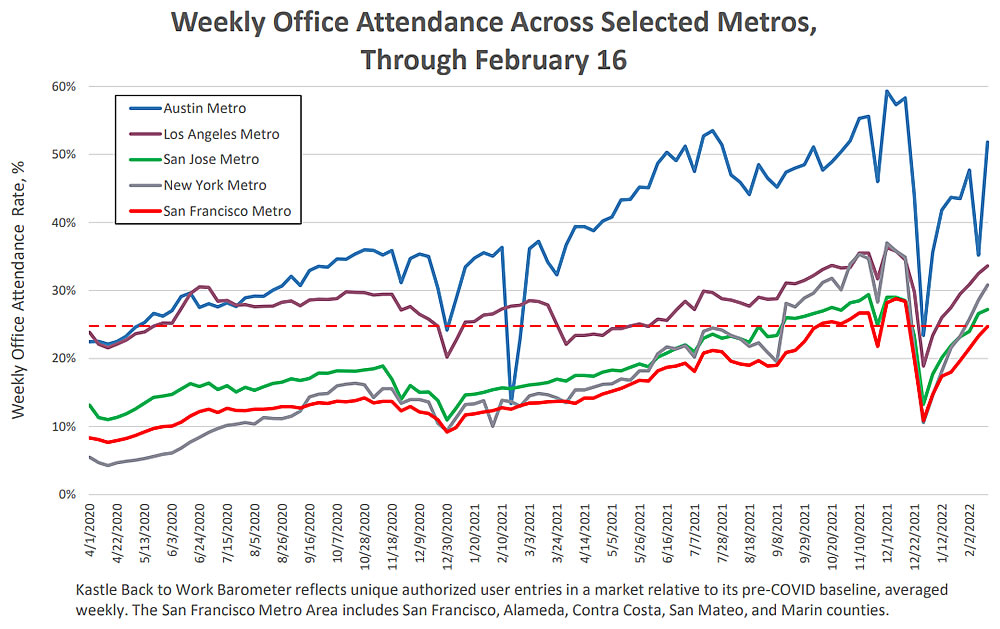

Having dropped back under 20 percent in January, driven by the Omicron surge, the weekly attendance rate for office workers in San Francisco, which was nearing 30 percent in mid-December, has since ticked back up to around 25 percent, according to the City’s latest Re-Opening report.

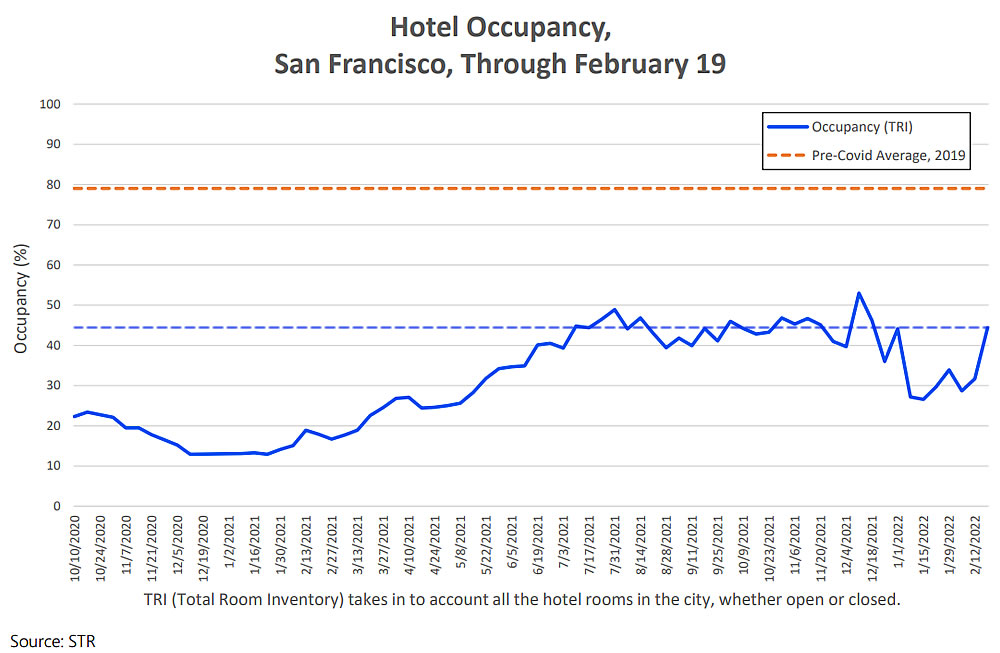

At the same time, the hotel occupancy rate in San Francisco, which dropped back under 30 percent last month, having briefly hit 50 percent in December and averaged closer to 80 percent prior to the pandemic, has ticked back up to around 45 percent.

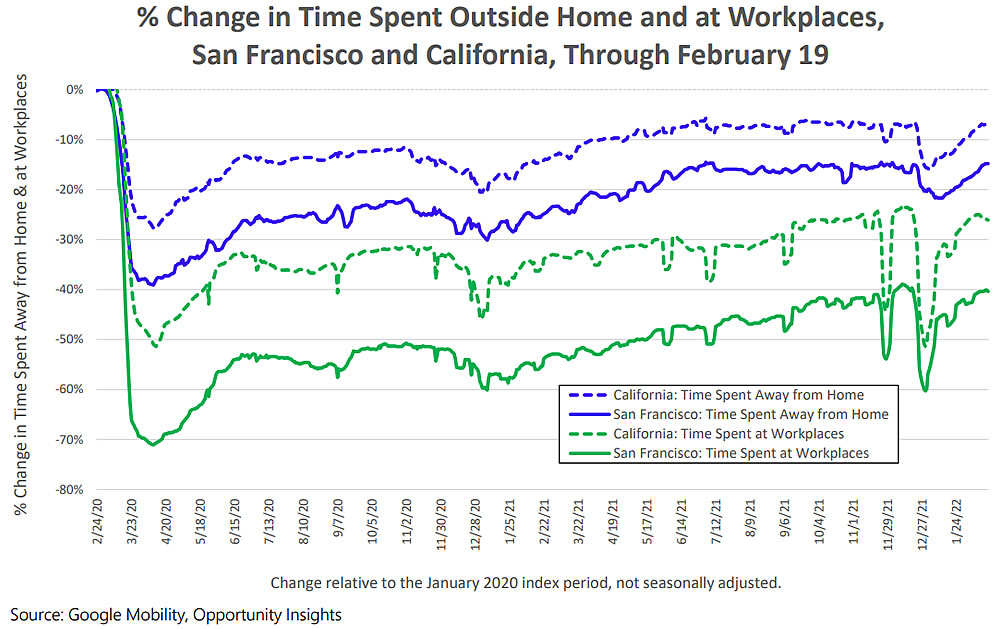

And having dropped at the end of last year, San Francisco residents are spending around 5 percent more time outside of their homes than they were last month but still 15 percent less time than two years ago.

A few thoughts:

– OMG! 🙁

– a curious peer group: LA and NY make sense but…Austin ?? as opposed to, say Seattle, Chicago or Denver.

– I wonder how different – as in maybe even worse – it would look just looking at DTSF, w/o adding in all the rest of the (Non SJ) Bay Area. Because the mass transit ridership, which would seem to be key to the former remains bad, shockingly bad.

Austin is included as a tech-centric comparison point (and also relatively wealthy and liberal, and least comparatively). In other words, those who might say “yeah but SF is different because of tech” have to explain why Austin doesn’t follow the same curve.

This will be fascinating to see play out. Up to this point it’s been theories and conjecture. The big one, of course, is office attendance. If data was normalized at 100 before the pandemic, it’s hard to believe we will get back to even 80. My guess is closer to 60.

Regarding hotels, the only way we don’t get back to 100 is if the extensive media coverage of SF’s homeless and crime problems impact tourism. I expect we will get back to 100…eventually.

Time spent out of home…there are definitely the hypochondriacs out there who are terrified of the concept of a virus and will become permament homebodys, but that strikes me as a small group. I expect we will return to 100.

I agree with where you’re head is at, but I don’t see how we get to 100 in time outside the house while remaining near 60 in office attendance.

San Francisco is lagging among other metros in terms of a recovery post-Covid. By many metrics. SF sits at the bottom in office occupancy. Note that San Jose performs better than the SF metro area. DTSF is dragging the number down for the whole region even as SJ, the Peninsula and Oakland/the East Bay are outperforming SF proper. Since Covid millions of feet of new office and bio-tech space has been proposed for the Peninsula. Oakland has new proposals for office towers. SF? 3 weeks ago, Slack and Merrill Lynch gave up their SF footprints. More than 300K feet of space.

The SF Times reports office vacancy at 22.4% in the 4th quarter with the amount of sublease space available increasing. Telling that the Boston Properties CFO said they will not be building in SF for the foreseeable future. Even as they move forward with bio-tech and office projects on the Peninsula and in other parts of the BA. That apparently means their massive Bryant Street project will not go forward.

The hotel situation mirrors that of office space. The CEOs of Pebblebrook Hotel Trust and Park Hotels and Resorts recently visited Mayor Breed regarding the crime and the dirty streets. The Park Hotel REIT has seen their RevPar down 43% from a year ago and that is largely attributed to SF’s numbers. The CEOs were asked if SF could be “red lined” in the tourist industry. Their reply – you can be expensive and safe, but you can’t be expensive and unsafe.

The Supes had SF’s chief economist testify on the situation, Bottom line is that SF is where it was a year ago. There weren’t many practical answers to what can be done to bring workers back. Several supervisors asked about converting downtown office space to residential use. The reply was there was not enough demand for that. Which makes sense – if the job base does not come back to its pre-pandemic levels (which it won’t) what is the reason for living downtown? Especially given the streets of San Francisco.

San Francisco is in for a rough ride this decade and the City PTB are finally realizing that.

More accurately, as we outlined last month:

“Having hit a pandemic high of 20.5 percent in the third quarter of last year, the effective office vacancy rate in San Francisco inched down to 19.9 percent at the end of 2021, which represents 17.0 million square feet of vacant office space in the city, including 5.5 million square feet of space which is technically leased but sitting vacant and 11.5 million square feet of un-leased space.”

And in fact, the net amount of sublettable space on the market in San Francisco has actually dropped, not increased, “with 1.3 million square feet of space that was being offered for sublet in the third quarter having been leased, reoccupied or returned to the market as directly vacant space.”

Plenty of people want to live downtown. First of all, plenty of jobs will still be there so the whole “close to the office” thing will still stand. Second, it’s a very central location with access to North Beach, South Beach/Mission Bay, access to the East Bay etc. There are urban people who like living in tall buildings in dense area.

It’s probably the equivalent of living in Mid-Town Manhattan. Is it our cup of tea? No. But plenty of people live there…

The conversion of existing office space to residential use currently makes no economic sense for the vast majority of downtown San Francisco buildings. Zip. Zero. Zilch. And it’s not a matter of “demand,” per se, it’s a matter of the relative value of each use and conversion costs.

But it makes sense to leave literally millions of ft.² of office space sitting there, empty for years on end like the situation we have now and have had for several years with retail space? While landlords collect the tax benefits of depreciation for offices that are not in use and not generating taxable income?

100 Van Ness seems to be a notable exception here. Yeah, I know it’s not downtown downtown, but it is a pretty prominent office -> residential conversion. Were there specific dynamics at play for that one that are no longer feasible?

The cost basis of the building/site (which was acquired for under $200 per existing square foot back in 2008, including the adjacent building at 150 Van Ness which was then demolished to yield a “bonus” 429 units of housing).

A lot of the office space will be empty for an indefinite period. At some point owners may not be able to service the loans. Bankruptcy could come for some of the office towers and, if it does and the towers are sold at a steep discount, then conversion to residential use will become more viable.

Have you been inside 100 Van Ness? All of the units have very awkward hallways because the habitable space needs to be moved to the perimeter of the building. It forces a lot of compromises onto the architect.

I have not been inside 100 Van Ness, but that cost basis definitely reveals why this one’s different.

*currently* and *vast majority* are key words here. There will be some obsolescent buildings unable to attract tenants that will make sense for residential conversion. Covid is accelerating obsolescence.

Key words which we included for a reason. But there’s still a large gap between the current value of office space and the point at which a residential conversion makes economic sense, even with the current vacancy rates and decline in leasing activity.

Agreed. The three Z’s take seemed remarkably negative: couldn’t one also take the “glass half filled” approach and say conversion might make sense for some properties ?? Which is, I would think, vague enough – and supported by such conversions all over the world – that it really isn’t much to dispute. The main issue, then, is “relative values” (which I take to mean value as office space): logic would suggest that as space becomes unrentable, the sale price of such buildings would tend to zero; wouldn’t ever reach that, of course, – we hope !! 🙁 – but low enough that it’s cheaper than developing “underutilized” sites.

Actually, Merrill consolidated into some space that B of A leases at 555 California Street. And Slack is keeping their HQ at 500 Howard and putting 200,000 square feet at 45 Howard up for sublease.

Office construction in San Francisco may be on hold but institutional investors still think the office market in San Francisco has a good future (e.g. Hines purchase of the vacant PG&E complex). The sale of the two buildings on Howard and Townsend Street (leased to Pinterest and Stripe) to the REIT from Singapore in late-2020 demonstrates investor appetite for buildings with long-term leases backed by good credit.

Also, Hines is planning to build a huge luxury residential tower on the former PG&E site, which seems to contradict your theory that nobody wants to live downtown.

Merrill gave up more than 100K feet of space. Its workers are being folded into existing BofA space. BofA owns Merrill (apparently no longer called Merrill Lynch) so another 100K feet added to the sublease market.

Slack is going to a digital work model. It’ll keep a small existing footprint as headquarters, but its workers will no longer be domiciled in SF. Slack CEO and co-founder Stewart Butterfield called requiring workers to return to the physical office a “doomed approach.” Additionally, he said “Work is no longer a place you go. It’s something you do.” Also, given all the residential towers not moving forward in the downtown, I wouldn’t hold my breath on the Hines proposal.

Slack is owned by Salesforce so I’m pretty sure they will continue to have employees “domiciled” here. Also, note that their business provides a product that enables remote work.

Nobody here is saying that the office market isn’t in a world of hurt, but your comments aren’t even-handed. If your prediction is correct that working in offices is dead then NYC, Chicago, Seattle, and other places with large CBDs will be affected as well. Tellingly, the downtown San Jose office market is holding up pretty well. There are reasons for that but they don’t align with your theory that big tech is all-in on permanent WFH.

It’s not all downhill for CBD’s and it’s not all remote work. It is, however, a shift from CBDs to regional hubs. SJ and Oakland are both doing better than SF as they have strengths as regional hubs that SF does not. The Ellis group just announced a large spec office tower for Oakland that it hopes to start construction on ASAP. Ellis believes in Oakland as a jobs center going forward given its proximity to a third of the BA’s population and the relative ease of access compared to SF. SF being on the tip of a peninsula will hampered going forward in this new work environment. NYC will also underperform as a CBD. BTW, the San Jose metro area came in 16th in job growth compared to SF’s 18th last year.

Beyond the above, only 3 West Coast cities made the top 10 in job growth last year. Spokane, Portland and LA. So, the Bay Area as a whole will underperform many other metros in coming years – a trend that was in place prior to the pandemic.

As far as Return to the Office is concerned: That horse is out the barn, commuters are not going to return in the numbers of the past any time soon. I visit the Financial District on and off, and I don’t see much change in terms of the street scene / perceived public safety. I figure however that the thought of squeezing on public transit or sitting in traffic pre-pandemic style just to get in and out will be a non-starter for a lot of people.

Is there data to support the assertion that return to office is higher on the peninsula? Anecdotally, I’ve heard the Google campus is at 5% capacity, not even close to 20%.

Most amazing is that San Franciscans stayed home more than the rest of California. It’s so odd how in some ways progressives can be in favor of enacting and following draconian rules.

Places like Orange County have ignored the virus during the last 2 years. I’ve visited many times and it’s like an alternate universe where the pandemic doesn’t exist.

Yes, Orange County is like an alternative universe, one in which you are twice as likely to die from covid compared to San Francisco.

The Covid-19 death rate to date is actually 2.3 times higher for Orange County (2.0 deaths per 100K people) than San Francisco (0.9 deaths per 100K). And now back to ongoing economic impact and market at hand…

Plus Orange County has 3.1 million people compared to 850 k in SF.

Both populations are actually a little higher in the State’s database (over 3.2 million people in Orange County and 890K in San Francisco), with 6,605 Covid deaths to date in Orange versus 791 in San Francisco, which yield the rates we provided. And now back to the ongoing economic impact and market at hand…

San Francisco’s population decreased 1.7%, from 889,783 on Jan. 1, 2020, to 875,010 on Jan. 1, 2021. Since then a UC Berkeley study reported a continuing exodus from SF from 07/21 through 09/21 of another 9365 people. New estimates won’t be out until summer, but it looks like the population will drop from 875K to around 865K.

We used the State’s denominator for both counties in order to be consistent with the State’s Covid-19 dashboard. That being said, the State’s population metrics, for the purposes of the dashboard and relative rates, are static from 2020.

I haven’t seen direct morbidity and mortality comparisons between the two counties, but what Milkshake wrote is certainly possible.

What Another anon probably doesn’t have in mind is that Orange County likely has many fewer untreated persons with severe schizophrenia and hard drug addictions living on the street and riding the public transit, and since it’s likely that population is less likely to be fully vaccinated and boosted — which increases the risk to other San Franciscans — San Franciscans shape their personal behavior to take that increased risk into account.

Probably the first time I’ve agreed w Brahma in a decade/ever 🙂 People I know are going to the office in their car, Uber’ing or on foot/bike. Who can deal w the shenanigans one encounters on SF’s public transport.

Still the commute is so much quicker now that street are empty and work schedules are more flexible. Orange County is probably much safer to take public transport.

My job is pushing very hard to return to office (2 to 3 days weekly) starting today. They’ve even offered to reimburse parking for those that are not comfortable “yet” with public transit. Everyone I’ve talked to is still super mad they have to go into the office. This is DTSF btw.

How did my comment violate community guidelines? It was removed, with no context. Socketsite is by far my favorite website being a loyal visitor for over a decade and yet my comments are removed on what basis?

While we sincerely appreciated your comment (“I appreciate the editor offering various data points.”), we didn’t see it advancing a discussion of said data points or trends. Regardless, thank you for the accolade (and continuing to plug in)! And now back to the various data points and trends at hand…

The best thing the City can do is to understand that office presence is no longer attached to economic activity as it used to be, for many industries. So many “office jobs” are “work from home” first, and in many cases, a return to the office on anything other than individual employees’ terms will just cause folks to quit and sign on with a company that allows it, in this labor market.

The City needs to start planning for a world where downtown does not require an influx of commuters to function. That also means not paying as much attention to “office occupancy” metrics, because economic activity is not as tied to that. There’s also an opportunity – at some point, SF can benefit from workers who want to live here but work remotely for an “office job” at a company with an HQ somewhere else. We can have a recovery without office presence.

workers who want to live here but work remotely for an “office job” at a company with an HQ somewhere else.

I believe what you’re describing has traditionally been described as a “suburb”. So, in short: a world where SF isn’t as important any more.

Right… “access to jobs” no longer becomes an advantage, so SF will need to learn further into advantages it already has (walkability, weather, culture, acceptance of minority groups are ones that matter to me), as well as developing new ones.

What a shame they just blew several $Billion on a bus station that will likely get even less use than it already did. But hey, only some of it was SF’s anyway…right ??

Another shame is the money squandered on the Central Subway. It was more a political payoff than a needed infrastructure improvement.

Nobody knew this pandemic was coming when the terminal was funded, planned, and built, so I’m not sure what your point is.

Well, if you think these were vanity projects that never made sense even in pre-covid times, and never should – can never would – have been built if the people who proposed them actually had to pay for them, then it was a particularly galling waste of resources.

But if you don’t think that, then I guess it’s just one of those I-just-washed-my-car-and-a bird-flew-over moments…a damn shame!

I still don’t get the hate for the Central Subway. Have any of you ever ridden the 30 or 45 between Union Square and Sacramento Street? Or the 8… anywhere? Chinatown is a major trip generator.

@ Kyle S. – I agree. I’ve taken both the 30 and the 45 from the Marina or Cow Hollow all the way to the CalTrain station. The stretch between Chinatown and Union Square is by far the biggest time suck of the trip. I’ll probably never live to see the Central Subway go further north than Chinatown, but I’m looking forward to using it.

I would argue SF has minimal advantages right now, which is confirmed by the numbers of individuals moving out of the area.

Walkability: homeless and crime

Culture: many people still staying home as the data above shows

Acceptance: SF does not stand out in this regard to other major metropolitan areas

Disagree. These are broad strokes you are painting.

Walkability: Still the most walkable city in the US after NYC. Homeless and crime are not major issues outside of the Tenderloin + Soma. Tons of people, families etc. out and about. You are being influenced by social media clips and anecdotes, not daily life.

Culture: Still the most nightlife culture on the West Coast as the others are sleepier. Concerts are clubs are full. I’ve been in them in the last week+.

Acceptance: Not sure what you mean by this.

Uh… I thought the primary reason to live in a suburb was to be close to jobs without dealing with the downsides of city living (i.e., witnessing poverty)? Why pay $3M to live on the peninsula when you can move to a much cheaper place with lower taxes and more space?

SF has been a wealthy city in significant part due to its the high-tech and VC jobs presence. That base will decline going forward and that has huge financial implications. SF has a bloated city budget and a very inefficient government. Infrastructure maintenance is and has been sorely lacking for years. Something will have to give and raising taxes and fees will not cut it.

San Francisco should be going after bio-tech jobs. There is a huge spillover from SSF/the Peninsula. Oakland, Emeryville, Berkley and Hayward are actively wooing bio-tech. There is talk of turning all the office space at the A’s massive Oakland development to bio-tech space. Hayward is aggressively redeveloping its industrial space into bio-tech/life science uses.

It’s a “no-brainer” for SF to try to capture some of the bio-tech golden goose. Bio-tech/life science space has a vacancy rate of around 2%. Bio-tech jobs are generally not conducive to a remote work model. The jobs are high paying as are tech jobs. SF seems oblivious to this. Clint Reilly said in an interview that the way to bring SF back is to fill up the downtown office space. Really? That is old school thinking and it will not turn things around.

most people i know in biotech are still working from home. the only exception are lab workers

Suppose I am a hiring manager, and I have a smart coder who costs $500K per year and chooses not to come into the office and I have to create a distributed workforce paradigm for her/him/them.

Once I have established that distributed workforce paradigm, why shouldn’t I hire a smart kid in Brazil, or Colombia, or Vietnam who can do the same work, on a distributed basis, for $40k per year? I am under the impression that smart ambitious people are widely distributed throughout the world.

Is there not a risk of pricing oneself out of the market for employees who won’t play ball and come in to work?

I had a long conversation with a late-40’s software entrepreneur who was sure that the next wave of software startups will be distriibuted, cost much less, and avoid the people costs of SF Bay coders. If I wanted my career to continue, I think I would show up at work…

Language barriers, time zone barriers, weaker technical skills, difficulty in finding people and legal complexity of hiring/compensating are some of the reasons it’s harder than you think to hire in places like Brazil, Colombia or Vietnam.

85K in Indiana, yes.

Every country in the world has a population where at least 5% of the people are capable of learning English, coding, and are willing to work much harder and at odd hours for much less than our local tech bros. All the other problems with finding and connecting to that 5% are rapidly dissolving. Google works most places. All of MIT’s courses are on line. Being able to work from anywhere means virtually anyone can do your work.

All of those things are true. However, I’ll tell you, having outsourced software development numerous times, in numerous places, it’s harder than you make it out to be.

The supposition is that it’s different this time (!) because of Covid. Have you outsourced software development in the last 24 months?

Managers HAD to develop zoom meeting formats that worked (or worked pretty well). People HAD to find a way to engage with a team remotely. So now, most tech people who have worked remotely can conceive of doing a normal job in this remote manner.

In this regard, everyone’s pre-Covid experience of hiring a coder from a big outsource firm in India, or Eastern Europe is a less useful comparison.

What is the difference between remote hiring remote software developers in Miami or “outsourcing consultants” from Medellin? Both scenarios involve a defined scope of work and finding someone to do it.

I’ve got to agree with Panhandle Pro on this one. I’ve also had plenty of experience with the outsourcing/offshoring wave of times past and the results were significantly worse then what seems to be happening with WFH now. It’s been far more than 24 months since I’ve been ‘in the game’, but If WFH was performing as poorly as at lot of the offshoring that I saw did then we would have seen the effects of this underperformance. We’d probably all be suffering through digital infrastructure outages and still using our pre-pandemic iPhone X’s. Instead, despite years of near complete WFH our tech infrastructure is chugging along, new product development has continued, profits have kept rolling in and until the recent Ukraine/Taper Tantrum issues tech stock prices were flying high.

People can, and have, analyzed and written about this extensively but it boils down to high end tech development being significantly different than other forms of “production”. If you’re making widgets then workers who are half as fast, but 1/10th the cost can profitably replace workers with unit cost & productivity. But high end tech development just doesn’t seem to work that way, adding more lower skilled workers often just ends up a mess or at best is just economically useless. Maybe you could get a team to develop a iPhone 8 class phone for 1/10th the cost of a team making a iPhone 15 class phone. But if you tried to market a iPhone 8 class phone now you’d undoubtedly lose a pile of money, whereas whoever (probably Apple) comes out with the iPhone 15 class phone will be making a mint.

This dynamic of more and more of the economic value being concentrated in the very upper end of skills has if anything gotten stronger over the years. Market sizes have gotten larger and capital has gotten cheap and abundant so if you really don’t need to be the best at something, there’s probably someone out there selling a product or service that’s good enough. You’re not replacing a $500k engineer with a $50k engineer from a body shop. You’re replacing them with a $30k/year software license. And the company you’re licensing the software from can afford their own $500k engineers because they can monetize his or her work product across a wide range of customers.

The improvements in intra-team communication (Zoom, slack, Dropbox,…) that are enabling WFH now doesn’t really change that fundamental dynamic above. By and large companies didn’t try to outsource single team members, but whole groups and divisions. It wasn’t and isn’t a lack of good video conferencing that stood in the way of these projects being successful.

“If I wanted my career to continue, I think I would show up at work…”

If people in the RE sector want their careers to continue, they better pray that other people show up at work…

I don’t see how that conclusion follows. Real estate will continue to be bought sold and leased even if prices go up or down.

From Slack to sublease 200,000 ft² of office space in move to ‘digital-first’ work, early last month:

I can tell you as someone who works for a tech firm that attempted to sublease it’s Grade A downtown S.F. offices (still on the market, vacant) that this is entirely consistent with my personal experience.

Look, I get it. The developers, penny ante mom-and-pop landlords, real estate agents and other hangers-on in the real estate “game” need everyone to believe that their careers depend on being back in the office and everything going back to the way it was pre-pandemic, so that commutes are terrible, and people can be forced to pay a premium for housing to reduce the time of that commute by living close to the office. So they are out in force, posting FUD like the “Is there not a risk of pricing oneself out of the market for employees who won’t play ball and come in to work” gambit.

This, of course, is to distract your attention from the fact that it’s S.F. real estate that has priced itself out of the market, in large part because there are simply too many people running around here trying to make their rips from running up the price of real estate so they can take their “winnings” and retire early to Texas or Florida.

your repeated mantras both make an appearance: “hangers-on in the real estate ‘game'” and “take their ‘winnings’ and retire early to Texas or Florida”

I will ask as I ask every time; who are these hangers on?

Yes the city is in a sorry state but fears about DTSF are so overblown…it is already coming back…it’s just a matter of time before people fully venture out of their home base & re-engage in-person with their work & social lives. Will it be the same as pre-pandemic, where peak hour often resulted in temporarily shutting down Embarcadero & Montgomery stations due to overcrowded platforms? Probably not this year or next but it’s not going to be the waste land many think.

Retail activity on the other hand is more problematic & is not helped by the homeless, crime, drug problem & dirty streets. City Hall leadership from the Mayor to DA & BOS is an ineffectual mess. Hopefully, the city voters are ready for moderate candidates who are going to focus on the basics. And yes, that does include attracting more businesses.

As to retail, Crate and Barrell announced the closing of its downtown store last week. After mor tan 40 years in the City.

Yes, retailers across the Bay Area have closed up shop. This is not unique to downtown SF. Do you have data to support differences in retail closures around the Bay Area?

I believe the issue is really more the the primacy retail has to tourism in SF (and implicitly the primacy tourism has to SF’s well being). The closure of Neiman Marcus in Walnut Creek a couple years ago, or of Saks in Blackhawk several years before that were closings too, but guess which is most most important? (You’ll get one try)

This post was going to include a link to the macy*s page touting their Union Square flagship but I discovered the lackadaisical treatment seemed to only buttress the idea of the cause already being over, rather than being urgent.

Can’t find article but the SF Business Times had a piece last year saying Walnut Creek and Oakland had been the strongest retail areas in the Bay Area during the pandemic and up to that time. It was based IIRC on new retail leases and existing retail re-leases.

The overall vacancy rate for San Francisco retail space was 5.4 percent at the end of 2021 with a direct vacancy rate of 14.0 percent in Union Square, down from 14.5 percent in the third quarter, according to data from Cushman & Wakefield. The direct retail vacancy rate for Oakland was 14.7 percent at the end of last year, 6.7 percent for the East Bay overall.

And while the rental rate for premier ground floor retail space in Union Square did tick down a percent to $495 per square foot per year, and is down from closer to $700 per foot in 2017, that’s versus an average of $28.28 for Oakland.

I don’t think anyone is going to take seriously any list that puts Oakland – traditionally one of the most underserved retail markets in the area – on the overachiever roll. Forget the lists, and all the legerdemain involved w/ defining “-est” : just driving down one of the major avenues radiating out of DTO – or DTO itself – will tell you

allmore than you want to know.Thanks, Socketsite. Dave, you need to stop doom-scrolling and start reviewing data. You have this tendency to declare that SF is doomed while the rest of the Bay is booming. It’s just not true. SF certainly has it’s problems, but so do other areas. I assume you’ve read about the Walnut Creek “looting” and the recent window smashing in Palo Alto?

I like to think of it as “balance” (to some of the more hyper-optimistic pleadings); but whatever…

If Dave – or anyone – does want to “doomscroll”, as you put it, they needn’t move far down the street…only next door, in fact: according to…we’ll just say “competing site”, 39 Stockton recently changed hands for a startling 60% discount on what it fetched five years ago. I’ve few doubts there’s more to the story, and even if there isn’t it’s kind of a one-off – right ?? – but still, it seems a hint that “currently” and “vast majority” (see above) may be changing.

39 Stockton, which currently sits vacant, was fully leased to The Walt Disney Company when it sold in 2017. Regardless, the re-sale at “a startling 60% discount” still equates to a cost basis of $959 per square foot for the 11,469 square foot building or around $1,700 per square foot for the building area that’s above ground. But sure, if it dropped another 90 percent it might pencil for a conversion!

Every avalanche starts with a single snow flake…right?

This property would never be a candidate for conversion I imagine – even the “above ground” part as you put it ; I was …yes, cherry picking it (I admit it….proudly!!) as an example of declining R/E value. The older, smaller Class B and C (office) space which would be candidates, go for under $1700 I believe.

There are always exceptions. But that is a great example of how a conversion wouldn’t pencil for the vast majority of vacant commercial buildings in San Francisco, despite an eye-popping decline in value as retail/office space.