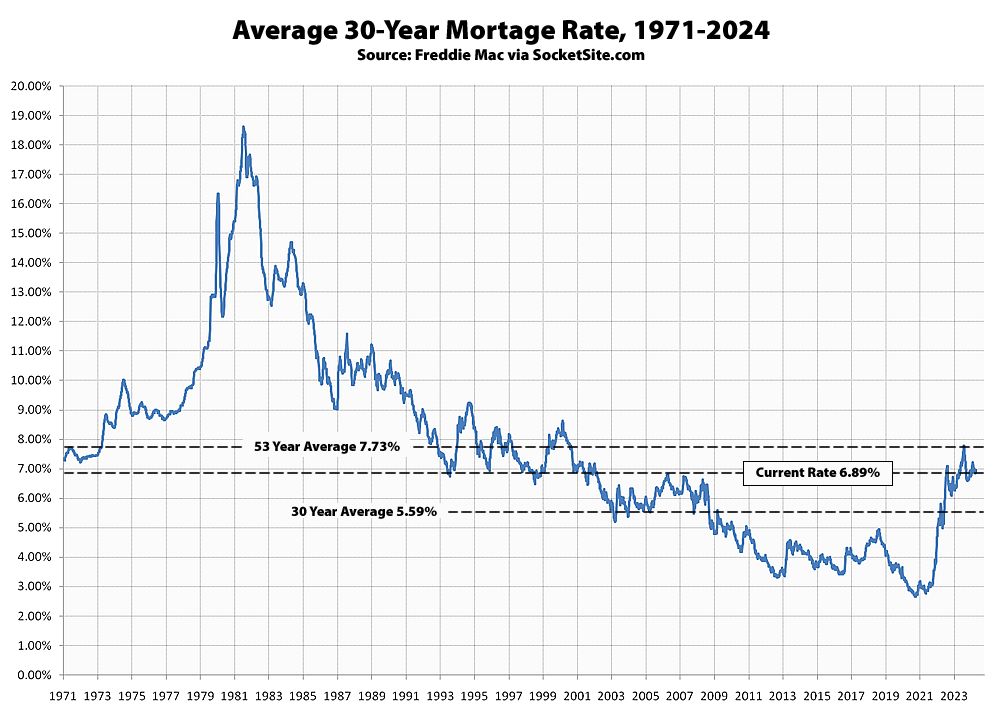

The average rate for a benchmark 30-year mortgage inched down 6 basis points (0.06 percentage points) over the past week to 6.89 percent, which is 7 basis points lower than at the same time last year, representing the first year-over-year drop in the 30-year rate in nearly 3 years, according to Freddie Mac’s mortgage rate survey data.

At the same time, the yield on the 10-year Treasury, which drives the 30-year mortgage rate, has inched down another 8 basis points since Freddie Mac’s latest survey, which should translate into slightly lower mortgage rates over the next week or two.

All that being said, while the current 30-year rate is now 84 basis points below its long-term average it remains 130 basis points higher than average over the past 30 years. We’ll keep you posted and plugged-in.

The Fed is literally throwing us crumbs at this point.

After years of gorging on cake others made and brought to the party, the revelers are now griping about the crumbs. The Fed is being somewhat mildly-restrained and moderately-responsible for the first time in several decades. Subject to change, of course, with Wall St’s next regularly-recurring crisis.

You know nothing about me and you come across as an arrogant ignorant fool (exactly like those you deride)

I’m a 40 something “old millennial” that has been screwed over since the day I graduated high school, first with the dot com boom and bust, then the 2008 crash, then the covid crash, all of this combined with student loan debt and a “starter home” at $500k in America ( and not even possible in the Bay Area ) has taken out the rug from under my generation, the result of older generations doing the rug pulling ensuring they got theirs and no one else is allowed to the party.

Please accept my apologies on behalf of America’s old farts for your being unable to buy a house the day you graduated high school. Grams and gramps aren’t your enemy, sonny; the rich are your enemy, and the rich are young, middle aged, and old. Virtually all the wealth of the old rich is passed on to their descendants, who become the young rich. It’s class war, not age war.

The reason housing is unaffordable isn’t because of a conspiracy of old farts to screw the kiddies out of their birthright. Instead, it’s the many years of ZIRP and QE that blew historic asset bubbles in real estate and stocks. The Fed now seems to be trying to undo the decades of damage it caused doing Wall St’s bidding, without blowing up the economy or destroying the ungrateful, voracious, parasitical 1% upper class it still serves nonetheless.

If your object is downward pressure on real estate, you have less reason to be angry with the Fed now than at any time so far this century.