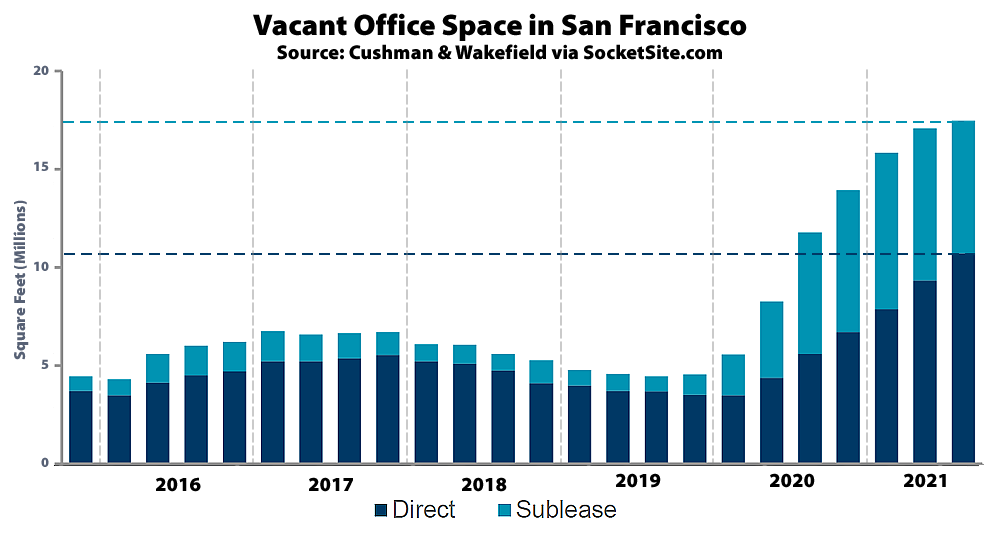

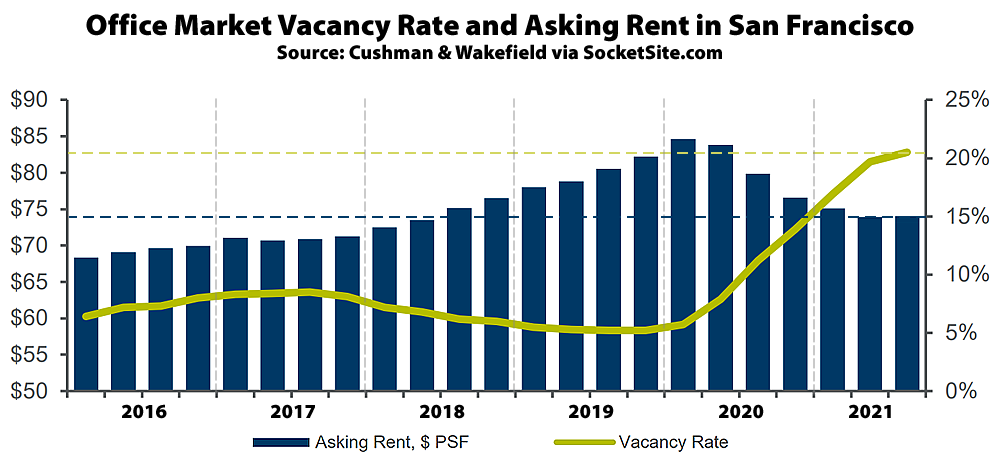

Having ticked over 20 percent in the second quarter of the year, the effective office vacancy rate in San Francisco has inched up another 40 basis points (0.4 percentage points) to 20.5 percent, which represents 17.5 million square feet of vacant office space in the city, with 6.8 million square feet of space which is technically leased but sitting vacant and actively being offered for sublet and 10.7 million square feet of un-leased space, according to Cushman & Wakefield. The office vacancy rate was 14.1 percent in San Francisco at the same time last year.

On a positive note, the book of sublettable space in San Francisco dropped by 900,000 square feet last quarter as space was subleased, reoccupied or converted to direct vacancy, and office leasing activity in the second quarter totaled nearly 1.8 million square feet, which was the highest total since the third quarter of 2019, but…net absorption was still a negative 534,000 square feet and the amount of directly vacancy space increased by 1.4 million square feet.

And while the average asking rent for office space in San Francisco inched up 0.3 percent last quarter to $73.46 per square foot, per year, it’s still down over 12 percent from a peak of $83.83 last year and the increase in the direct vacancy rate is expected to put pressure on landlords to reduce asking rents, as we noted last quarter.

S&D rules!: a casual inspection indicates an inverse relationship b/w rents and vacancy rates (that seemed to be noticeably missing from yesterdays Eastbay graphics)

A key line from yesterday’s overview of the East Bay office market: “While East Bay landlords appear to have held firm in terms of asking rents despite the increase in un-leased office space, with the average asking rent having inched up one cent ($0.01) over the previous quarter to $4.47 per square foot per month…landlords have been giving free rent and build out allowances rather than reduce [their asking] rents.”

Well, yes: I didn’t say it didn’t exist…only that wasn’t readily apparent. Which rather diminishes the neat value of a graphic…non ??

Its new era. WFH is real thing. Why wouldn’t office tenants reduce their footprint?

Does the 17.5M include all the vacant buildings in the SOMA and Mission? I think not. I also note that Loopnet is advertising vacant buildings in 94107 for $20 bucks a sqft.

Any of you real estate gurus want to take a guess on how long it’s going to take to absorb 18+ million square feet of vacant space in SF, especially with the “work from home” mindset being mandated by the likes of Twitter, FB, Google, SalesForce and alike.

minimally years, and now strong interest rate headwinds on horizon. clearly the self perpetuating bubble cycle has been broken. on top of everything this may be the worst urban planning debacle in some time!