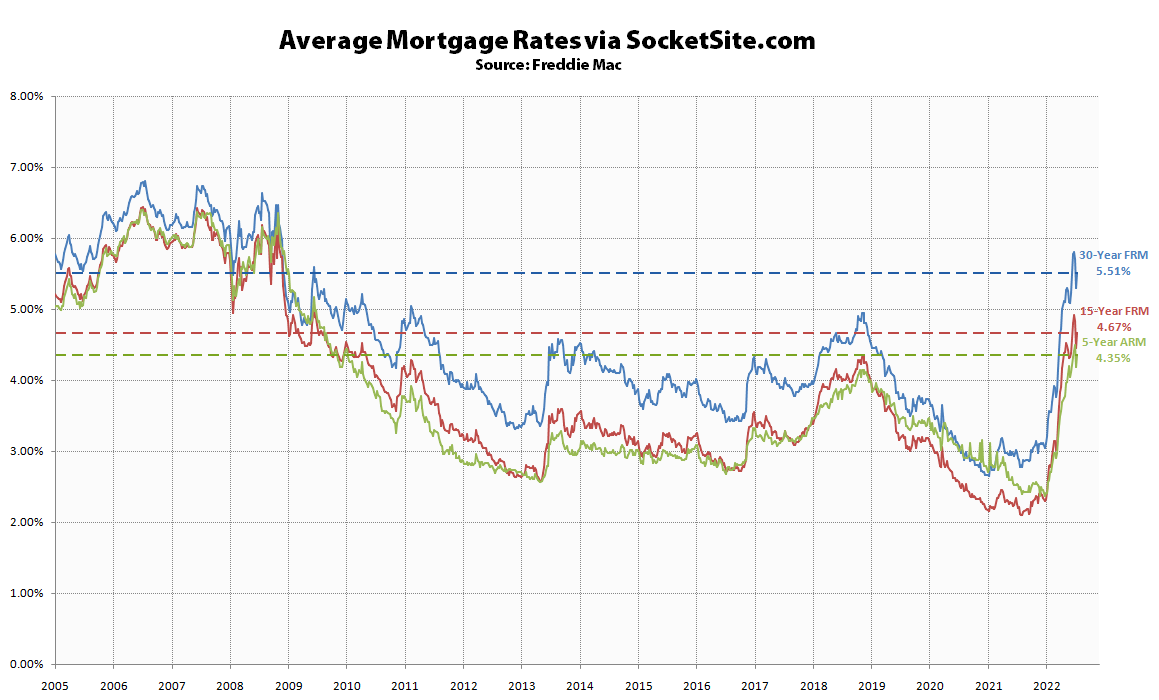

Having dropped half a percentage point from its 13-year high of 5.81 percent last month, driven by increasing concerns of a recession and hard landing, the average rate for a benchmark 30-year mortgage has since ticked back up 21 basis points (0.21 percentage points) to 5.51 percent, which is 263 basis points and 91 percent higher than at the same time last year with the average rate for a 5-year adjustable rate mortgage (ARM) having ticked up to 4.35 percent which is 76 percent higher than at the same time last year.

At the same time, the probability of the Fed adopting a higher than previously projected 75 basis point rate hike late this month has effectively jumped to 100 percent based on an analysis of the futures market with the probability of a nearly unprecedented full percentage point (100 basis point) hike currently hovering around 30 percent, neither of which appear to have been fully priced-in to the current mortgage rates and would translate into even less purchasing power for buyers and more downward pressure on home values, the median sale price of which is poised to drop.

More buyers will be dropping out. Real estate agents who got their listings in the past by stimulating sellers greed impulse need to work on new listing presentation. The SF address and painting the kitchen cabinets white won’t guarantee multiple offers.

I used to own in SF. Starting to think I might buy back in again at the bottom. I don’t think we’re there yet, though.

Let us know when you know “the bottom” has arrived..

Hahahaha, exactly two beers.

We’re not even close to “the bottom” (of home prices), the slope of the curve is just starting to increase. According to a certain web site whose name rhymes with pillow, the typical home price in San Francisco has decreased slightly from May to June, but remains up 10.6% year over year.

“we must kill the economy to save the economy”

Mortgage rates have indeed baked in expected fed moves. Mortgage rates, which reflect 15-30 year rates, have fallen because inflation expectations have fallen. 5 year projections now at about 2.5%, down more than 1% from a few months ago. Indicators show inflation starting to fall fast (gasoline, freight, chips, many others), and the markets are reflecting that.