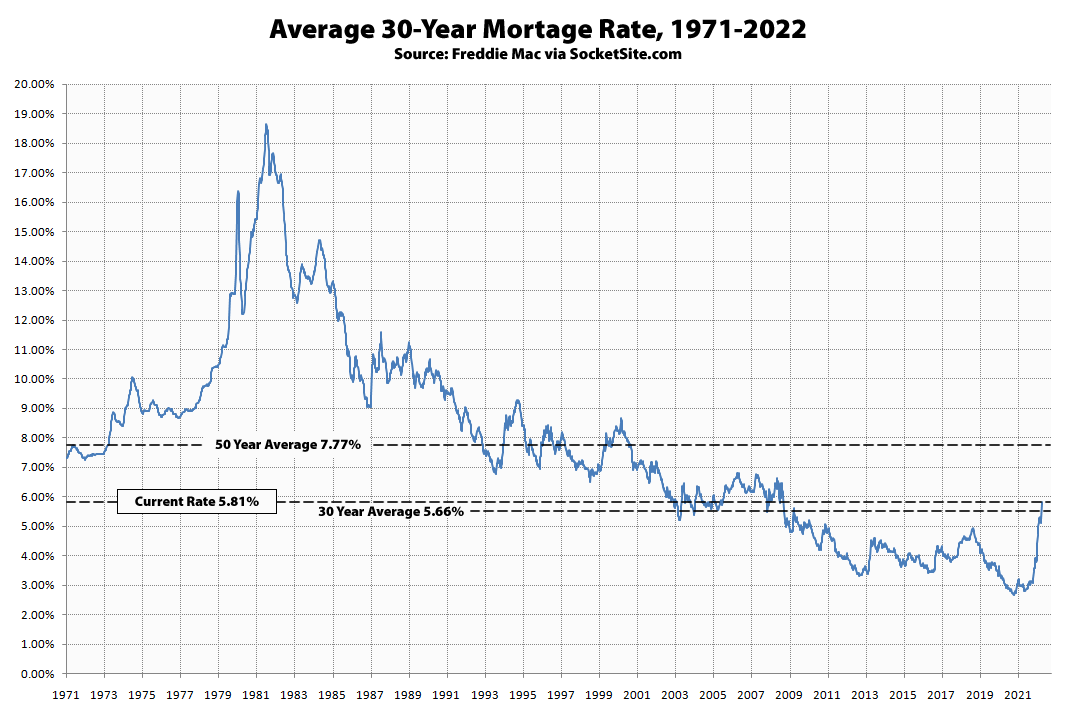

Having inched up another 3 basis points (0.03 percentage points) over the past week to 5.81 percent, which is the highest average 30-year mortgage rate since November of 2008, the benchmark mortgage rate is now above its 30 year average for the first time in over two decades and poised to climb.

At 5.81 percent, the current 30-year mortgage rate is now 92 percent higher than at the same time last year with the average rate for a 5-year adjustable rate mortgage (ARM) having jumped to 4.41 percent, which is nearly 75 percent higher than at the same time last year and 66 percent higher than the average 30-year rate in January of last year.

Once again, with the rise in rates, mortgage application volume in the U.S. has already dropped to a 22-year low, with purchase volume down over 20 percent, year-over-year. And as we outlined at the end of last year, when the average 30-year rate was closer to 3 percent, the projected rate hikes, which have since materialized, would translate into “higher mortgage rates, less purchasing power for buyers and downward pressure on home values.”

Crazy market. Just when you thought 30yr fixed rates would continue to climb they reverse. The 30yr fixed is set to close at 5.75% today as demand for home mortgage’s fall. Yesterday JP Morgan announced a 1000 person reshuffle in their home mortgage division, 500 layoffs and 500 moved into other divisions. WFB and Citi did similar with their home mortgage divisions.