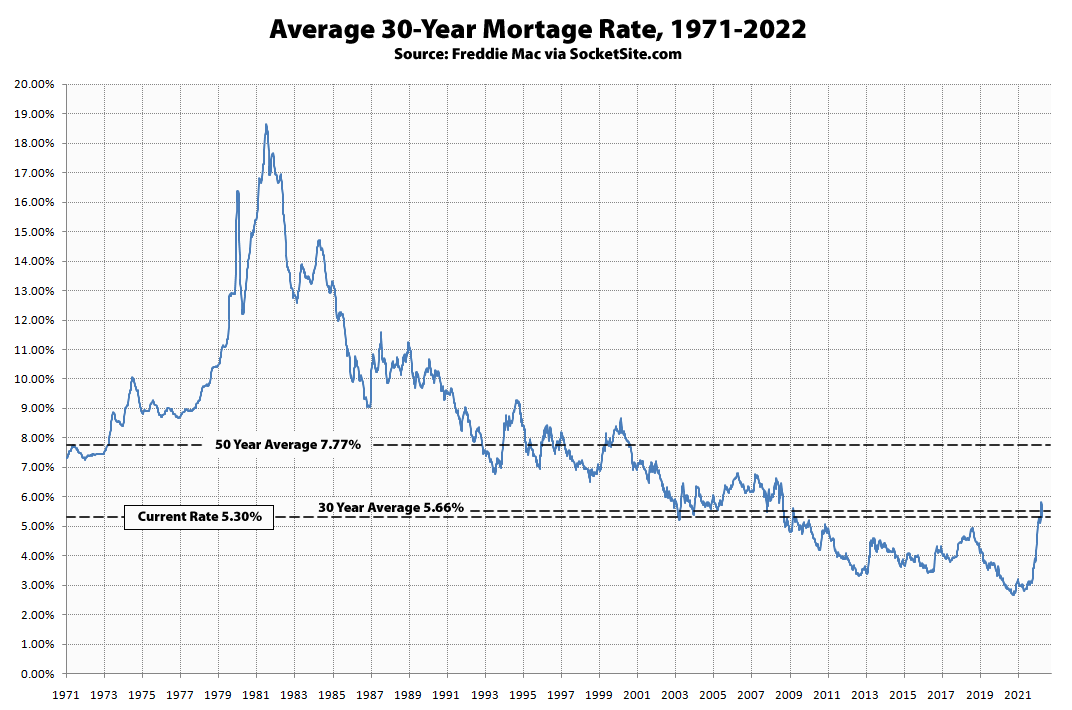

Having hit 5.81 percent two weeks ago, which was the highest average rate since November of 2008 and above-average over the past 30 years, the average rate for a benchmark 30-year mortgage has since dropped 51 basis points (0.51 percentage points) to 5.30 percent with a 40 basis point drop over the past week alone, driven by increasing concerns of a recession and hard landing.

Despite the drop, the current 30-year mortgage rate is still 240 basis points and 83 percent higher than at the same time last year with the average rate for a 5-year adjustable rate mortgage (ARM) having dropped to 4.19 percent but still 66 percent or 167 basis points higher than at the same time last year and pending sales still down nationally and locally as well.