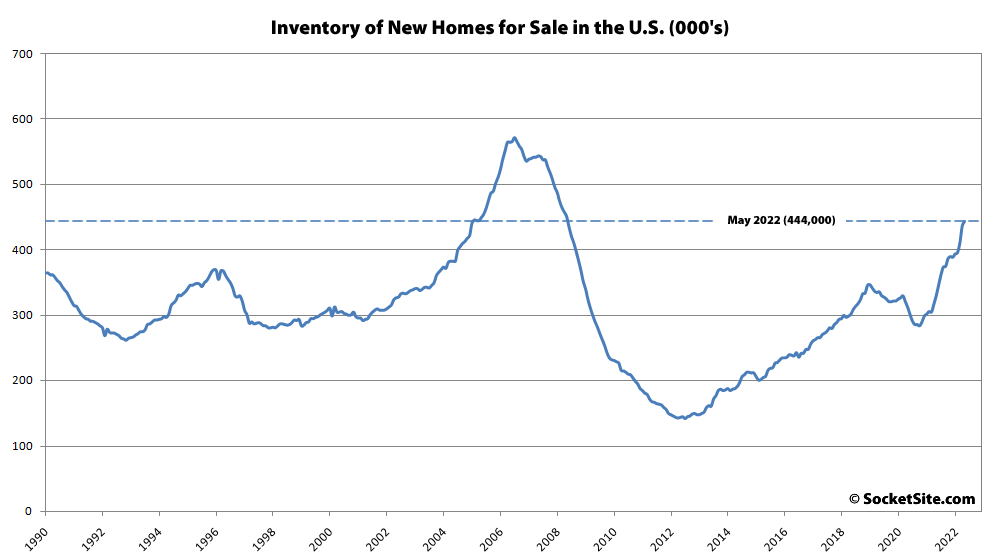

Despite the fact that the number of new homes on the market across the U.S. is up nearly 35 percent on a year-over-year basis to a 14-year high, mortgage loan application volume to purchase one of said new homes dropped 10 percent from May to June, is down 12 percent versus the same time last year and at its lowest level since April of 2020, according to Builder Application Survey data from the Mortgage Bankers Association.

Crazy that we may see inventory similar to that during the real estate crash, but without the corresponding change to prices.

Oh don’t worry, the prices will follow, these prices won’t be seen for decades. if ever.

Real or nominal prices?

It’s actually pretty typical for inflation to do the heavy lifting of dropping prices in RE downturns. The 2008 crash was an exception where people let go of their tendency to cling to nominal prices and thus make them sticky. We’ll probably find out shortly if that was a one off event or if that represented a general attitudinal change.

Not yet.

Remember, RE prices are “sticky” on the way down. RE isn’t a commodity or consumer good that responds quickly to consumer sentiment. RE is a highly illiquid, often non-fungible asset. Information is not shared symmetrically. Buyers can have different motivations (end use, rental, investment, long-term hold, flip, $$ laundering, capital flight, ego, change in investment strategy, etc). Sellers likewise can have different motivations (job move, retirement, bankruptcy, change in investment strategy, cold feet, panic, sudden need for cash, sudden need to flee country due to impending prison term for accounting fraud, etc). These, and many other factors, can make price movements slow but relentless, like an ocean liner changing direction.

Buy now or be priced out forever. RE never goes down. Except when it does.

Oh don’t worry, the prices will follow, these prices won’t be seen for decades. if ever.

SF currently has 244 MLS-listed single-family homes between $998,000 and $4,000,000. There are 150 in contract. So the market has moved away from a seller’s market and is now more balanced to buyer favorable. Rarely is a market totally evenly balanced between buyers and sellers with an even supply of property and supply of buyers to buy them. Condos are in a buyer’s market for sure. Especially big building condos and not neighborhood flats. My crystal ball suggests there will ultimately be a wash out of sellers and inventory level will drop as they are not able to achieve the prices they want. And/or their mortgage at existing house is so low that it does not make economic sense to move to another property with a higher mortgage rate. So long as there are not significant losses of Bay Area jobs. Buyers: I think once mortgage rates have stabilized and motivated sellers have come to reality of 2022/2023 values, there will be a pick up in transactions. A best case scenario. Should there be a number of owners who need to sell, and mortgage rates go considerably higher from here…we will have more market pain. We will see. Real estate does go through cycles and we have been in an up cycle for approximately 10 years. They don’t last forever.