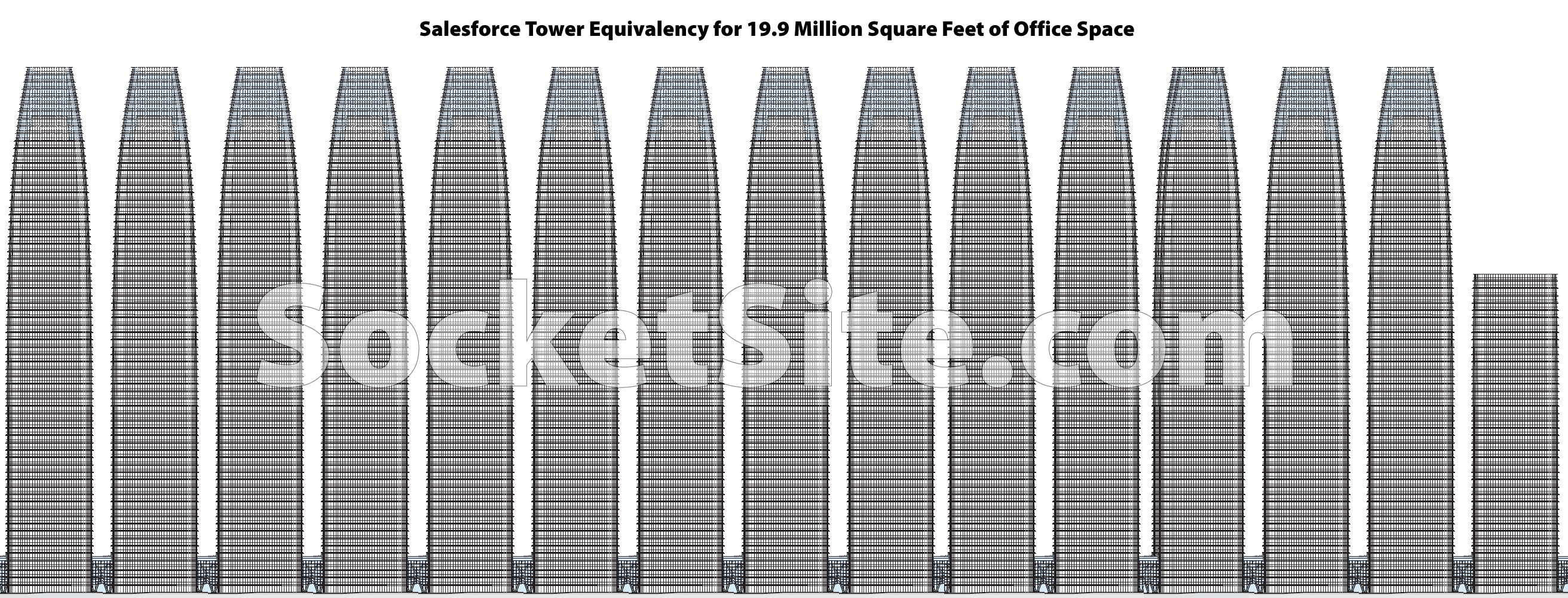

As we outlined earlier this week, the amount of vacant office space in San Francisco has just hit a new pandemic high of 19.9 million square feet.

For context, the 1,070-foot-tall Salesforce/Transbay tower at First and Mission, which is the tallest building in San Francisco, contains 1.35 million square feet of office space spread across 59 floors. And employing the framework we introduced back in 2020, there is now 14.7 Salesforce Towers or 869 Salesforce Tower floors worth of empty office space spread across San Francisco, which is roughly enough space to accommodate between 114,000 employees, based on an average, pre-Covid density or 153,000 (a la twitter) worker bees.

And once again, while tempting to see or promote an opportunity to convert all the vacant office space into housing in a response to San Francisco’s housing woes, the conversion of existing office space to residential use currently makes no economic sense for the vast majority of downtown San Francisco buildings, due to the relative value of each use and the cost of conversion.

yeah, it’s more like 80-85K office workers, not 153,000. Still not a small number by any means, but it’s a big difference. That Twitter metric of 125 sf/worker is pretty extreme and not the average actual pattern of office usage across the office market in SF even at its peak occupancy in 2019. Once you average actual space usage trends across all industries that occupy office space and real world patterns, the average across SF peaked at about 240sf per office worker, as referenced in a 2017 study of office space that the City did with consultants to support an update to the affordable housing impact fee on new office space. You have to account not just for various industries across the entire SF office market, but also a reasonably healthy long-term average vacancy rate, since never is there ever 100% occupancy even in the most robust office markets. In sum, if that 19.9m sf of office space were to be re-occupied at pre-pandemic “full occupancy” rates with a similar industry mix as SF had at the time, it would be refilled with 80-90K workers, not 150K+. Of course you can find individual tenants who actually pack in workers at the rate advertised by Twitter, but in practice across the market that doesn’t hold (if it ever even did at Twitter in practice rather than on paper). If SF office space was occupied at the rates suggested by the Twitter number alone, there would have been almost 650,000 office workers in SF’s 80m sf of space, but the number of office workers peaked under 400,000 office jobs and the the city peaked at something like 725,000 jobs before covid.

Prior to Covid, the industry average was actually running under 200 square feet per employee, despite what a 2017 study might have suggested and why we provided a range of “between 114,000 employees, based on an average, pre-Covid density or 153,000 (a la twitter) worker bees.”

Dang, <200 sq ft per employee seems tight. I'm not disagreeing with the stats, but at our peak we had roughly 80 people on a 20k sq ft floor (~250 sqft per) and we were on top of each other. Here's to hoping a post-Covid world revises that industry standard.

One might think that the “real” number is reflected by the decline in employment, which does, indeed seem to be less than that a six digit figure; of course that’s highly imperfect, since the two data sets – employed persons in SF and employment in SF – are not entirely the same; and not to mention that “office” is but a subset of all employment. Nevertheless it might be a good place to start.

All that having been said, the official vacancy rate doesn’t reflect the actual occupancy rates (i.e. how many people are actually coming in to work each day) Although not terribly important to the RE industry, at least in the short term, I think it’s crucial to everyone in the long term….and the numbers are probably a lot worse than the numbers we’re discussing here.

The Twitter amount was not extreme! When Twitter was trying to unload that space, my colleagues at Google SF were appalled that they got so much space. The local trade press underestimates how densely Google and Facebook crammed workers into offices, before COVID-19.

whatever “industry” you’re citing was not the average across the whole SF office market, which includes finance, legal, real estate, government/institutions/non-profits, and a host of other office users And again, the 200 sf/employee does not account for any vacancy at all, which is totally unrealistic. The 2017 was not government conservatism, it was based on the best available actual data from very reputable real estate consultants, with the results triangulated from original surveys on individual tenants across all office users, brokerage marketing materials with sample floorpans for buildings in the market at the time, and citywide data from various sources.

Yeah, even those <200 sqft best laid tech company microspace plans of yesteryear are not so relevant in the begging employees to go back to the coughffice era.

For example, LinkedIn's new Sunnyvale office was originally planned to stuff 1.5k employees into a 239k sq ft building (~160 sqft per employee), but the reality is their since redesigned 'hybrid' workplace that got rid of nearly half the desk space remains most empty.

Is there a reason why we can’t have residential more mixed in with business spaces, like in London or Tokyo?

Zoning … but, it’s (slowly) happening too – e.g., Hine’s proposed supertall residential at 50 Main (which so far seems to be getting support from Planning).

who controls zoning and are he/she/they voted into this position (serious question)?

Curious how neighboring san mateo county only has 10% office vacancy rate. Could SF’s problems be self inflicted?

Almost all of SF’s problems are self-inflicted, that’s what makes it so frustrating.

Lots of biotech where the vacancy rate is very low. Lots of demand as a number of large projects are moving forward including transformation of Tanforan into a massive office complex. In part designed to draw jobs from SF.

Biotech is its own separate property category. Biotech buildings are special purpose buildings. It is usually not possible to covert general office space into biotech, although there are some exceptions, and more recently some buildings some are designed for either use. Biotech vacancy rate is calculated separately from office vacancy rate.

Juul which purchased its building for 397 million a few years ago put it on the market last year for 450 million. No takers. It is expected to put the building on the market again and for a “massive loss” per one RE insider.

This from the SFBT on the wobbly state of SF commercial office buildings:

“Some predict that the next big wave of commodity office building deals will come next year, and that there will be some “distress.” That could be characterized in some cases as keys being handed back to lenders or building owners cutting their losses and selling at a discount, according to sources.”

The ongoing issue is the exodus of jobs from SF. Wells Fargo is rumored to be moving its headquarters to the Texas mega-campus it’s developing. It’s a safe bet that the core downtown area will never attain the number of jobs it had prior to Covid. The residential RE market will be hugely impacted as well. Many projects in the pipeline will be delayed for years and some will be abandoned outright.

SF chron editorial today, require taxpayers to subsidize office to residential conversions.

But no detail about who would pay those taxes. Would that be owners of other types (non-office) properties? Or SF residents who never worked in an office building? Or california residents of other counties?

People can editorialize all they want, but once again, “while tempting to see or promote an opportunity to convert all the vacant office space into housing in a response to San Francisco’s housing woes, the conversion of existing office space to residential use currently makes no economic sense for the vast majority of downtown San Francisco buildings, due to the relative value of each use and the cost of conversion,” as we’ve outlined, time and time again. And in order for most conversions to make economic sense, the subsidy would need to be outrageously large.

Haney and Mahogany have both made recent statements that residential conversions are the key to reviving downtown and increasing affordable housing supply. I don’t know if it’s magical thinking or they are being disingenuous, but the idea has gained a great deal of traction on housing Twitter when basically numerous developers (including the developer of 100 Van Ness) are on record stating it’s presently impossible. It’s a terrible distraction.

I can’t find the comment, but it was explained quite well why 100 Van Ness was a bit of a unicorn and how unlikely it is to be repeated in the foreseeable future.

As we actually outlined 7 months ago, the cost basis of 100 Van Ness was under $200 per existing square foot back in 2008, including the adjacent building at 150 Van Ness which was then demolished to yield a “bonus” 429 units of housing. That’s all anyone should need to know and why calling this wildly popular but completely ignorant idea a “distraction” is not only an understatement but terribly kind. It’s not a matter of ideology or will, it’s a matter of economics.