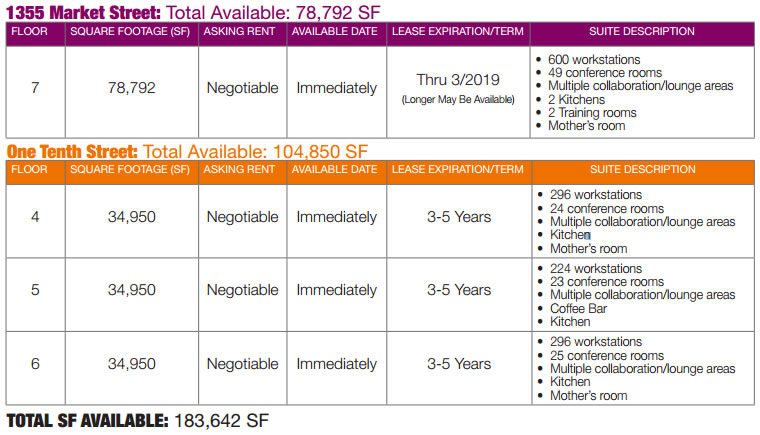

Twitter is seeking to “immediately” sublease the entire seventh floor of its Mid-Market headquarters at 1355 Market Street, along with the entire fourth, fifth and sixth floors in the adjacent One 10th Street building. The four Market Square floors total over 180,000 square feet of space and represent nearly a third of Twitter’s footprint in San Francisco.

As reported by the Business times, the four floors are currently configured with a total of 1,416 workstations, along with over 120 conference rooms, 5 kitchens and a good-sized coffee bar.

As we first reported last month, the office vacancy rate in San Francisco jumped 1.6 percent in the second quarter of 2016, the largest quarterly increase since the first quarter of 2009.

And in addition to 4.1 million square feet of truly vacant space, the amount of rented office space available for sublease had roughly doubled over the past quarter to 1.5 million square feet, now 1.7 million square feet, with tech firms accounting for 48 percent of those offering their excess space for rent.

Twitter is the second-largest tech employer in San Francisco and directly accounted for around 5 percent of the job growth in the city over the past three years.

I don’t get it, are they actually laying off 1400 employees or just some extra space they thought they were going to expand into – but aren’t? Sounds like the latter – but SS is trying to make it sound otherwise….

We’re trying to make it sound like they’re putting enough space to accommodate 1,400 employees on the market, while you’re trying to make it sound like we’re trying to make it sound otherwise…

“Twitter Shedding Space for 1400 Employees” the headline sounds pretty dramatic

Agree – the headline implies they are laying off staff. Why not “Twitter is shedding 180,00 square feet”? I guess, not as dramatic!

Quite simply, because “Space for 1,400 Employees” is more intuitive and telling than “180,000 square feet.”

If it is more intuitive, then why do articles such as: European Co-Working Operator Leases 37,000 Feet on Mission

list the space in square feet rather than the number of employee.

Number of employees is not a good way of measuring space. There’s a wide spectrum of possible density in an office building depending on the type of work as well as corporate preference.

There’s a wide spectrum of possible density in an office building depending on the type of work as well as corporate preference.

And there’s the rub. For in this case, we know exactly how the space is configured and how many employees Twitter was planning to have on the floors it’s giving up.

Actually 1,416 employees. That number isn’t listed, but 183,642 square feet is. Because square footage is intuitive when talking real estate!

I don’t see anything in the SS piece that states or implies any reason for the sublease. You are reading words that aren’t written.

But I can tell you why, and I can do it in less than 140 characters: They are massively unprofitable, with little prospect that will change soon.

To follow up with Neighborhood Activist stated, a discussion we could probably spend countless hours giving opinions on is if Twitter can survive as a public company? They are losing money every day and as a public company it is a whole different ball game.

Heck, could see Jack Dorsey moving a chunk of Twitter’s operation to St Louis where he grew up. He would probably get big savings on labor, get some nice incentives from MO, and probably make a profit putting more square footage up for sublease while paying St. Louis dirt cheap rents. Keep HQ in San Fran with execs, and core development group.

Dorsey should just turn over the CEO job to someone who’ll do it full time. The idea of one guy leading 2 companies, especially when one has the problems Twitter had, has always been ridiculous. Frankly, I think the Board is negligent for permitting this.

You have to understand that he is competing with Elon.

Jack Dorsey tried opening a St Louis office for Square and shut it down after one year.

The space would have been sparsely populated with people… imagine vast areas with nobody in them for a while, followed by consolidation onto 6, 8, and 9.

Well I am looking for 180,000 square feet of office space, but when you say “good-sized” coffee bar what exactly are we talking about? I like to stretch waaay out when I have my coffee.

In that case, this could be the space for you! For as currently configured, the “Coffee Bar” covers roughly an eighth of the fifth floor at One Tenth Street, which is why there’s room for 72 fewer workstations on that 35,000-square-foot floor, as you might have noticed in that handy little table we included above.

Ah! but that doesn’t include info on the size of the “Mothers Rooms(s)” (it seems you get one or the other)

But back to “coffee bars”: I thought one of the big excuse…er, justifications for the tax breaks given to Twitter (and their ilk) was that it would help “revitalize” Mid_Market. I would take that to mean – or at least include – bringing in new businesses; but if they’re going to have a food court in-house, doesn’t that reduce the likelihood of such happening?

Wasn’t Yammer in the same building or is that next door?

One Kings Lane was also in the same building. It was sold in June for close to a tenth of their 2014 valuation.

Yammer was on 4

Sounds to me like the building should be rebranded as a reverse incubator for failing startups. Ouch, was that too mean?

A failed startup museum! Too soon?

That location is terrible. No Bart or Caltrain access limits employment pool to sf techies. The area also lacks that happening ‘feel’; it feels like the middle of a transit corridor due to van ness and market.

It is less than two blocks from BART. It is a great location for commuting purposes. I agree that it is less than optimal as a walking around neighborhood (although much improved from 10 years ago), but most employees come to the office, work there, and go home. So it is a great business location overall.

The location is not at all terrible. BART stop at Civic center. It has 83X access to Caltrain. I would say its access to Caltrain is as good as anything on Market. Driving is actually possible compares to FiDi.

SF’s tech base was always a spillover from the Silicon Valley. An outpost of sorts. With LinkedIn acquired by Microsoft and the possibility that over time its SF staff, and Bay Area staff, is shifted to the NW, the Twitter news is another potential red flag for SF’s tech future. if Twitter is acquired, there is the chance its SF staff will be relocated.

Schwab freed up a lot of space at the One Fremont building recently as they left the City. Does anyone know how efforts are going to sublease that space?

As to the future, the rising vacancy rate and the freeing up of space by tech companies here, who have absorbed a lot of the space in the last 5 years, brings into question the viability of large office projects proposed but not yet set to go. Like the Flower Mart and the Mission Rock office component.

Do all these proposed projects still pencil out? Especially if the vacancy rate in SF continues to rise?

Dave, you are addicted to this interpretation of SF as simply the “spillover” of Silicon Valley, as if firms moved here reluctatntly only because SV was full up. I believe you are quite wrong. It is not the spillover, it is the enlargement of Silicon Valley. As tech went from manufacturing to software to apps, SF developed its own strengths in the tech universe, and many companies have been born and have grown to maturity here and have no intention of leaving. Those aren’t going away even if Twitter completely implodes.

Either way, the post notes that 48% of sublease space is coming from tech firms. It would be interesting to see the comparable sublease percentage for the SV.

There are millions of square feet of space in the office development pipeline. With large firms not relocating here or shifting large groups of workers here and tech pulling back and freeing up space for sublease, who will lease all this space? Legal and marketing firms can pay top dollar for office space but they are, by their nature, not users of huge blocks of office space.

I’ll agree with you there. Tech has certainly driven office demand, and as tech retrenches office demand will therefore drop. Not really much to replace it with….some of the traditional FIRE (Finance, Insurance, Real Estate) has downsized (as you correctly note Schwab), and none of the traditional office users will grow in the same kind of way as tech. It seems that every time Prop M limits threatens a supply crisis for office, an employment recession cures the overhang. In any case, the truth is we are not vastly over-supplied with office space, and we could use a (slight) downtown in employment growth to calm our overheated economy.

If things are frozen where they are now re: office space there may not be a vast oversupply – though clearly an oversupply of sorts. But with projects like Oceanside, 5M, Lennar HP, Mission Rock, the Flower Mart and two or 3 proposed large office projects in the FM area – not to mention lot F, there would be a vast oversupply. Especially as there is no indication that, aside from retrenching tech, there will be the need for new supplies of office space in SF for the medium term future next 10 plus years..

Each developer will make their own decision on whether to start construction. If things really turn south, you can bet that all of the permitted office space will not get built right away but will be metered out as demand requires. There is always a lot more permitted on the books than gets built. Look at the housing pipeline!

Why are we worrying about an office “oversupply” when our rents are the highest in the country? I WISH we would actually get into an oversupply situation where we’d see our rents drop to “only” downtown Boston prices. lol.

According to CRE firm Savillis Studley, vacant availability in Q2 rose to 8.3% (up from 7.7% in Q1), and Class A availability hit 9.2% (up from 8.4% in Q1). In the Financial District, it “spiked” to 9.8% (up from 8.6%). Despite “a flurry of large subleases and these direct deals” in Q2, with Fitbit, Lyft, and Stripe signing the largest deals, leasing activity over the past four quarters plunged 31% from the five-year average to 5.9 million square feet. “Caution prevailed,” the report said, as “more firms coped with funding shortfalls by cutting back or considering relocations to other markets.”

[Editor’s Note: Or as we reported last month, Office Vacancy Rate in San Francisco Jumps the Most since 2009.]

If Technology companies like Twitter are acquired, there is no doubt the new owner will still keep the name and employees in San Francisco. This is where the engineers and tech people want to live and companies know that. Look at Facebook. They are adamant on keeping their headquarters and employees in Mountain View. With more than 20% of their employees living in SF, they are considering to open a large office in the future Mid-Market Hub.

A detailed analysis of Microsoft suggested the possibility of moving the company to SF because of the difficulty of finding staff in the NW.

Schwab is not a good example. They are a traditional finance company that does not even register as a financial powerhouse. No loss on their move as they certainly don’t pay their staff well and Texas fits in with their lower cost model.

“A detailed analysis of Microsoft suggested the possibility of moving the company to SF because of the difficulty of finding staff in the NW.”

What? Source? Seattle is basically the #2 spot for tech talent in the world, which is why every Silicon Valley company of note has an engineering office there. Microsoft certainly has offices in SF and Silicon Valley (~8000 employees now), but the likelihood of them moving their HQ from the Seattle area is very, very, very small.

UPDATE: Twitter, which remains unprofitable with slowing sales, is planning to cut another 300 jobs as early as this week.