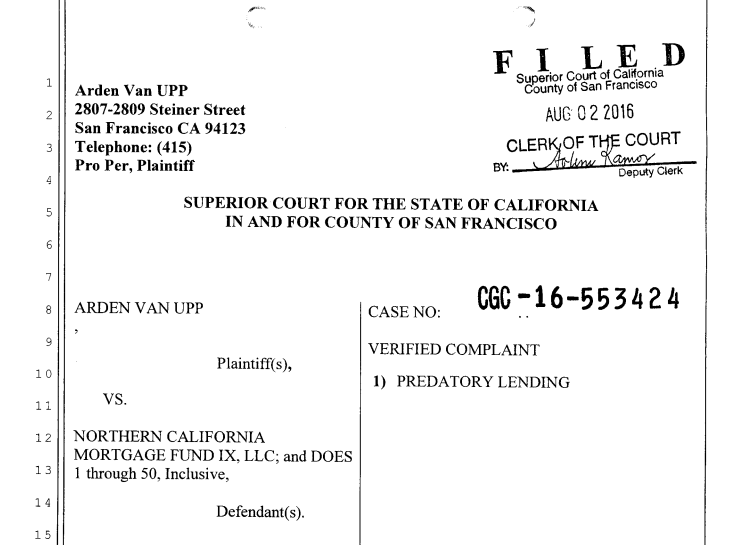

The infamous Arden Van Upp has filed suit to void the $5.5 million Mortgage which led to yesterday’s foreclosure of her Pacific Heights home on Steiner Street.

According to the complaint filed in Superior Court yesterday and forwarded by a plugged-in tipster, Ms. Van Upp was the victim of predatory lending practices, never signed “the purported mortgage and note,” and was improperly notified of any (purported?) default or right to cure.

As such, Ms. Van Upp is seeking a recession of the “illegal and void Mortgage and Note” provided by the Northern California Mortgage Fund IX LLC as well as damages, and has requested a temporary restraining order and preliminary injunction to halt any action to remove her or her tenants from the property at 2807-2809 Steiner Street until the suit is resolved.

I love how a story 30 years in the making, one that would seem like it’s a relic of the past, is still being written. I keep on saying, someone ought to make a movie of this.

Not sure how cinematic it all is, but it would make for a good chapter in a book on local characters, or a newspaper retrospective.

Writers and producers always take artistic license with stories like these. The 1990 movie Pacific Heights doesn’t look too cinematic on the surface, but was sufficient for a full-length movie.

If she is moving to rescind the loan, then she’d have to repay the $5.5 million. Can you link to the entire lawsuit? I can only see the facepage

Go to this site. After you get past the gatekeeper, enter the court number. Or search under her name if you really want to have fun.

A classic con artist move. When between a rock and a hard place file a frivolous lawsuit to delay the inevitable.

If she took the money and made some payments, I believe it doesn’t matter whether she signed it; she “performed” under the terms of the agreement, which is pretty good evidence that an agreement was in place.

Maybe, but if someone wants to foreclose there’s really nothing wrong with forcing them to bring a perfect claim.

A lawsuit is a kneejerk reaction for this sort of person. Good news for the lawyers, but a waste of time delaying the inevitable.

What a terrible person.

She’s certifiable. And a complete scammer, even of her own mother.

Some people have to go all the way, the shudders the rest of us feel help to keep us on the straighter-and-narrower.

I made the mistake of looking up the suit. Entertaining, but what a time sink. Clearly she used a boilerplate lawsuit she found somewhere, because it’s full of places where she forgot to fill-in-the-blank or remove the boilerplate text (lots of “INSERT NAME HERE” and the like.) She’s claiming that she’s a poor innocent old lady who doesn’t understand the financial world and that she was tricked into taking out a loan in order to steal her home. That’s the essence of it. I’m not an attorney, FWIW.

But it looks like it’s scheduled for an alternative settlement conference on Jan 4, 2017. So if she gets her injunction, she just bought herself five more months of squatter time. Outrageous.

But with this woman’s history, anybody that would lend her $5 million (even at 9%!) kind of deserves whatever they get.