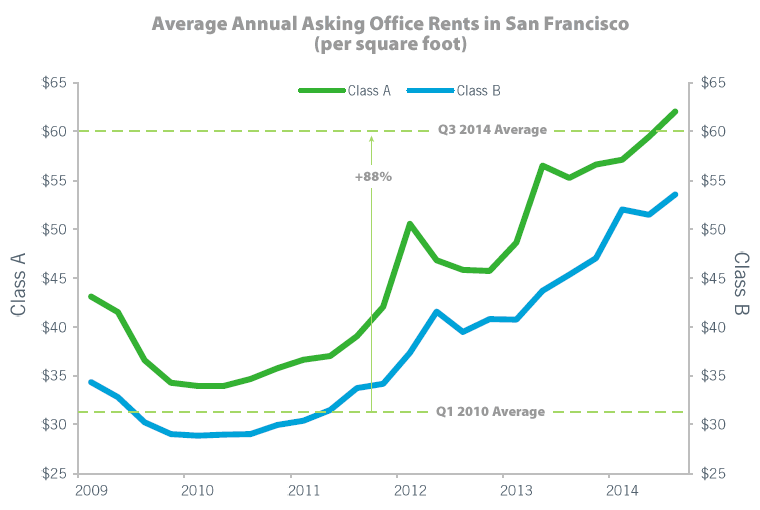

With demand for office space in San Francisco having reached an all-time high, the average asking rent for space in the city has increased 15 percent over the past year and nearly doubled since the first quarter of 2010, up 88 percent to just under $60 per square foot. That being said, rents remains around 15 percent lower than at the height of the dot-com boom.

According to Cassidy Turley, it’s not just the non-profits that are now being driven out of the city in search of cheaper space, but professional firms as well, with the surge in rental rates negatively affecting profitability for businesses that are worried about such things. And in the near term, it’s likely to get worse.

While there is currently over 4 million square feet of office space under development in San Francisco, the largest pipeline of commercial space in over thirty years, the majority of the pipeline won’t be ready for occupancy until post-2015, and over half the space has been speculatively pre-leased by companies such as Salesforce , Uber and LinkedIn.

For those looking for relative bargains, the areas around Showplace Square ($47.54) and Jackson Square ($50.19) are currently asking the least, while “creative space” and access to transportation continue to command a premium and the most expensive area in San Francisco remains around AT&T Park, with an average asking rent of $66.38 per square foot.

I have been a patient at the “top gun” ophthalmology practice on the West Coast for detached reinaes (my problem) and other critical eye diseases. The practice gets patients flying in from SOCAL, the mid-West and the Northwest.

Its a specialty practice – you get there by being referred by another ophthalmologist mostly. I assume it is very lucrative. It is an incredible practice and an incredible office.

Anyway. They have been SOMA for a decade and recently had to move to Van Ness. A less central location. They took a short term lease and who knows if they will remain in SF. It would be a huge loss. They have offices in Oakland, San Mateo and Marin and can easily expand those I assume and maybe open an office in the north Peninsula if they have to leave SF.

My question. Doesn’t Proposition M exclude office projects of 50,000 square feet or less from the cap count? It seems that developers might want to start building 50,000 square foot projects which are geared to professional offices and which the Ubers and SalesForces would not be interested in.

Van Ness is actually more centralized to more people, and not to mention there are far more outpatient/medical offices along that corridor and a whole new hospital under construction.

Also, the cap is for 50,000 SF per year for projects under something like 75,000 SF (so it’s a lopsided cap in favor of larger projects) and 800,000 SF per year for anything over that number. The cap applies to all office space, large and small, including medical office space.

The reason why you’re doctor’s office may have taken a shorter term lease is because there is a new medical office building about to be constructed as part of the CPMC deal, and maybe they want to be in there in order to claim “at the CPMC”, etc, and not to mention parking will be better if on-site at the CPMC.

Just my hunches.

Edit – it’s a cap of 75,000 SF for new projects of 50,000 SF or less, and 800,000 SF cap on projects larger. This is off of memory, but someone can correct me.

I believe each component of the cap is mutually exclusive, and cumulative. Meaning, if no larger projects get approved one year, then that leaves 1.6 million SF the next year, “in the bank” to be approved. Also, the larger projects can reach their Prop M cap without it affecting what’s in the bank for the cap on smaller projects.

I still think projects under 50K are excluded from the cap. Could be wrong. its crazy that the cap is supposedly 75K for such projects. If this is true. Like a total of one and one half such projects a year.

If this is right then an easy fix is to at least upgrade the 75K limit and designate it for small business and professional space.

I thought building under 50K were excluded from counting in the cap. Sure I’ve read that in the past.

I doubt the jobs boom continues in SF. I see it shifting to Oakland, Portland, Seattle and of course San Jose/Silicon Valley.

That said, the cap at this time, as long as job growth continues, seems to be a negative for non-profits and professional offices.

A modified cap might be in order. Allow maybe up to an additional 800000 feet per year if certain conditions are met. One has to be a pool of some sort (monetary, pay out of leases for a decade or so) for non-profits. Allowing them to continue to stay in SF. Maybe for each extra 200K in office space over the limit 10K of non-profit space has to be guaranteed for a decade.

Something similar with professional space. That is easier because that space can still be leased for lots more than what non-profits can pay.

The City and developers need to be smart on this and be proactive and engage the non-profits and others on a plan that both relieves the current office building constraints in a booming economy while providing a vehicle that at the same time ensures non-profit sustainability in the City. And a professional/small business office market solution too.

Cap applies to all office space. I looked it up for all of our records:

“A total of 950,000 gsf of office development potential becomes available for allocation in each approval period, which begins on October 17th every year. Of the total new available space, 75,000 gsf is reserved for Small Allocation projects (projects with between 25,000 and 49,999 gsf of office space), while the remaining 875,000 gsf is available for Large Allocation projects (projects with at least 50,000 gsf of office space). Office space not allocated in a given year is carried over to subsequent years.”

[Editor’s Note: “The Annual Limit Program governs the approval of all development projects that contain more than 25,000 gross square feet of office space.”]

All that chart tells me is that the bubble is about to burst.

What do we call the new zoning carve-out for historic dermatologist, opthamologist, and dentist locations?

Not having services here means more traffic = worse for everyone. Also, the less diverse the city’s economy, the more it will suffer in an inevitable downturn. Underbuilding commercial near transit across the region is a huge problem.