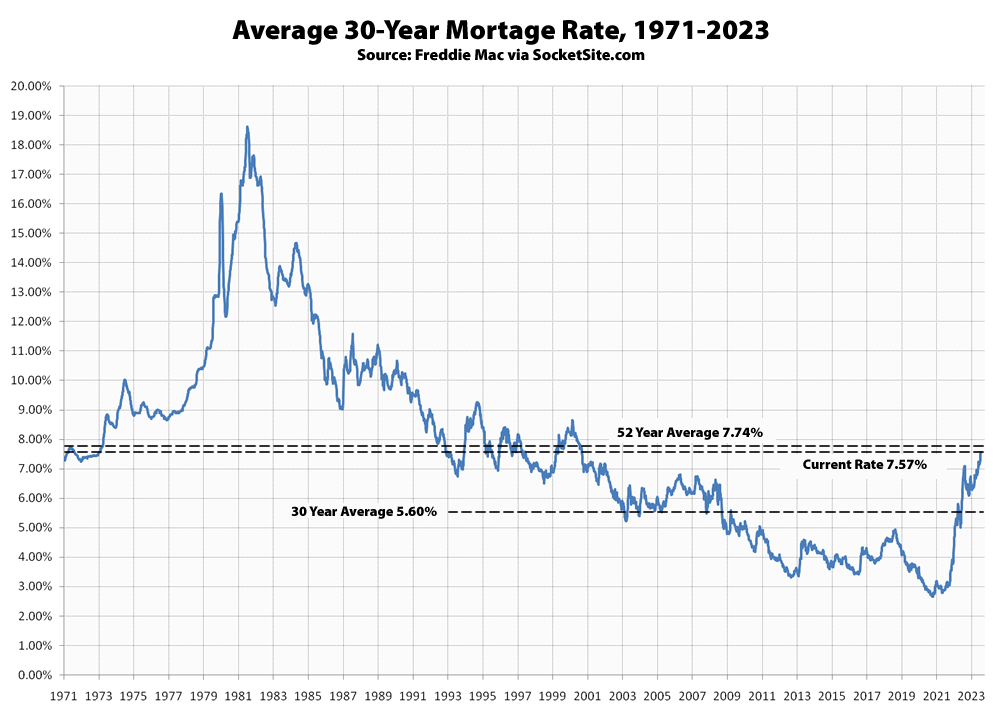

Having jumped 18 basis points (0.18 percentage points) last week to 7.49 percent, the average rate for a benchmark 30-year mortgage has since ticked up another 8 basis points to 7.57 percent, which is 65 basis points higher than at the same time last year, 492 basis points, or 186 percent, higher than its all-time low of 2.65 percent two years ago, and the highest average rate since December 2000, according to Freddie Mac.

That being said, the current 30-year rate is still below its long-term average of 7.74 percent and not historically “high,” with the probability of an easing by the Fed by the end of this year holding at 0 percent and the futures market currently predicting that the Fed isn’t likely to start cutting rates until mid-2024, at the earliest.

At the same time, the average rate for a 30-year fixed jumbo loan has jumped to 7.51 percent, which is the highest average rate in over 12 years, according to the Mortgage Bankers Association. And as we first outlined back in the fourth quarter of 2021, when the average 30-year rate was under 4 percent, expect mortgage rates to continue to put downward pressure on home values, none of which should catch any plugged-in readers, other than the most obstinate or easily mislead by others into thinking that rates “would soon be back into the fours,” by surprise.

Bank of America 30 Yr Mortgage is 8% as it is with other major lenders.

4% Boom crashing into Wall of 8% Rates

I see some of the same old folks are saying the same old stuff within this crummy new format. Heh. More power to ya. You won’t be seeing me around much. What a terrible website design this is. Yuck.

Ohlone Californio: You should at least know that “this crummy new format” was/is supposed to be temporary. See Limp Mode Engaged. I don’t think what you are calling “a terrible website design” is supposed to be the way things are going to be going forward.

That Limp Mode notice was three months ago. Brahma – are you sure this is temporary?

I agree with Ohlone California. I miss the warmth and charm of the old site.

Well, I thought I read a post from the editor in another thread around that time indicating that this layout was temporary, but I looked around and can’t find anything like that. So no, I am not sure.

I agree with you, I think the previous iteration of the site was much, much better, which is another thing that lead me to believe this was a temporary placeholder. It’s kinda hard to believe that someone would chose this over the last one deliberately, unless the previous site design was somehow the intellectual property of a spurned hosting provider.

The current UI and limp mode remains a temporary measure, to allow commenting, at our expense, until we can get the site stabilized and restored. Think of it as a gift to those whining and whining about the UI in an effort to avoid acknowledging the actual state of the market and accuracy of our forecasting and analysis.

“Here’s an ominous indicator for the Housing Market. The 10-year government bond now yields a higher return than the Cap Rate, or profit from operating a rental property. “

^^^This. The effect is lagged by about 6 months to a year. But its inevitable.

UPDATE: The average rate for a benchmark 30-year mortgage inched up another 6 basis points over the past week to 7.63 percent, which is nearly three times as high as its all-time low of 2.65 percent two years ago, with the probability of an easing by the Fed by the end of this year holding at 0 percent, the impacts of which shouldn’t catch any plugged-in readers by surprise.