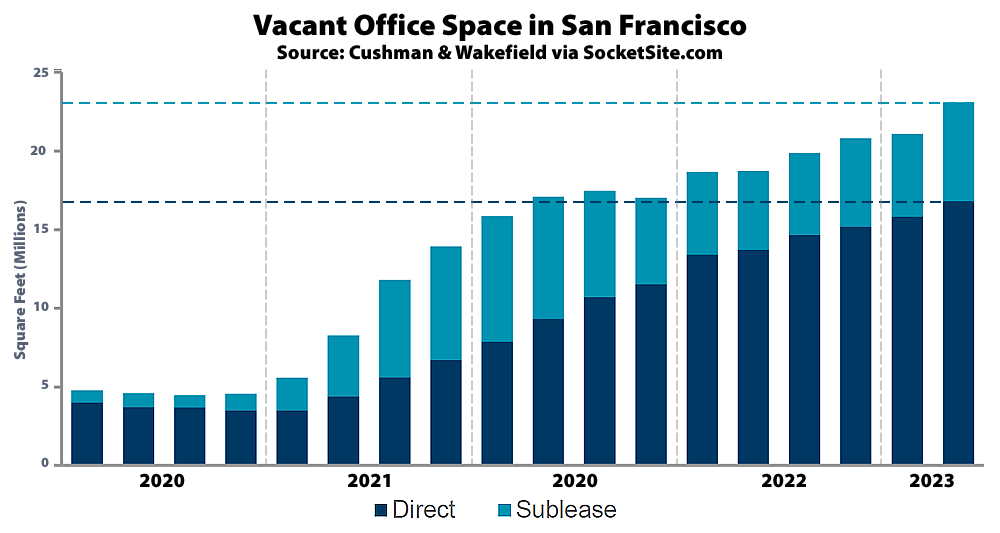

The effective office vacancy rate in San Francisco ticked over 27 percent in the second quarter of this year, representing over 23 million square feet of vacant office space spread across the city, which is up from 21 million square feet of vacant space at the end of the first quarter, including 16.8 million square feet of un-leased and non-revenue producing space, which is up from 13.7 million square feet of non-revenue producing space at the same time last year, and 6.3 million square feet of space which is leased but unused and being offered for sublet, according to data from Cushman & Wakefield.

As a point of comparison, there was less than 5 million square feet of vacant office space in San Francisco prior to the pandemic and the office vacancy rate in San Francisco has averaged closer to 12 percent over the long term, with a much smaller base of buildings.

At the same time, while the estimated active demand for office space in San Francisco ticked up by 9 percent over the past quarter to 4.9 million square feet of space, which includes 800,000 square feet of space for AI company growth, that’s compared to over 7 million square feet of active demand in the market prior to the pandemic, at which point there was nearly 80 percent less vacant space as today. And there’s another 4 million square feet of leased space in San Francisco that’s slated to come off lease by the end of this year.

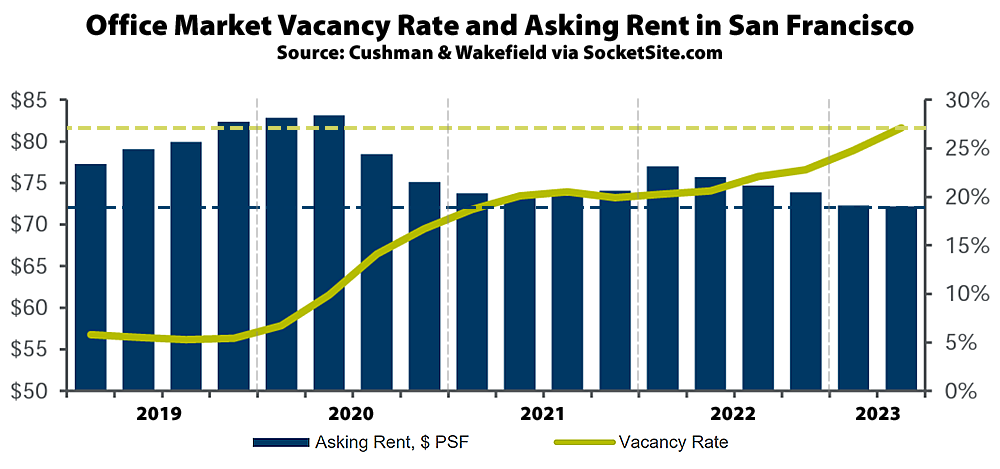

While the vacancy rate continues to climb, the overall average asking rent for office space in San Francisco only inched down 14 basis points over the past quarter to $72.16 per square foot, which is only 4.6 percent lower than at the same time last year and roughly 13 percent below its 2020-era peak, as landlords’ fight to keep asking rents up, with the cost of capital having jumped and another shoe poised to drop.

Once again, “while it’s tempting to see, promote or editorialize an opportunity to convert all the vacant office space in San Francisco into housing, the conversion of existing office space to residential use still makes absolutely no economic sense for the vast majority of San Francisco buildings, due to the relative value of each use and the costs of conversion,” as we’ve outlined for over a year and others have finally started to figure out. And yes, there are higher vacancy rate numbers making the rounds, but it’s the consistency of the data set and context going back over a couple of decades, as our numbers do, that matters and there’s a lot of poor reporting and cross analysis, between data sets, making the rounds.

Nice bar graph. A visual of the trajectory and the 30M milestone might even penetrate the skulls of the geniuses at City Hall.

It is quite clear to me that “the geniuses at City Hall” are quite aware of the problem with vacant office space, and more importantly, the fiscal impact on The City. From How San Francisco can tackle two of its biggest issues: office vacancies and housing, in December of last year:

Of course, the situation has worsened since then, and the Board has passed legislation recently to make it easier to convert vacant office space to other uses. It’s not clear to me how The Mayor can force owners of these properties to take action, mark their assets to market and lower asking rents to a level in line with current demand so the market clears.

I would be interested in hearing how the real estate geniuses would improve things at this point.

I cannot claim to be a real estate genius, but perhaps a commercial vacancy tax would force the hands to act–either lowering rents or finding new uses.

Rents are already dirt cheap. Commercial buildings are going bankrupt and suffering at a loss. Do you expect the private sector to subsidize the public? They’ll just declare bankruptcy.

Dirt cheap according to whom? In case you missed it on this very website last week, Another 2 Million Square Feet of Vacant Office Space in San Francisco, second-to-final ‘graph:

Emphasis mine.

$72 per ft.² does not count as “already dirt cheap”. If you believe, as the folks in the S.F. real estate “game” claim to, in Supply and Demand as taught in Econ 101, then rents need to fall and keep falling until the market clears most of that 23 million square feet of vacant office space.

Oh. My bad. There is one obvious public policy change that is within the power of “the geniuses at City Hall” to make that would improve things at this point. They could pass a moratorium on new projects and retail conversions that would put more office space on the market. Because we all agree that real estate is a commodity like any other and obeys the iron laws of supply and demand we all learned in Econ 101, slowing or even stopping the inflow of newly-constructed office space onto the market will marginally slow the decline in commercial rents and the knock-on effects on The City’s budget.

That would be low-hanging fruit, but I don’t expect that the players in the commercial real estate “game” would be in favor of it, were it to penetrate their skulls.

at what price would conversions start to make sense? this is clearly headed for $50/sq ft once reality sets in

To get a sense of what would be involved, I’d point anyone interested to a pretty informative video that the WSJ published a few weeks back, How to Convert a Manhattan Office Into Luxury Housing. They quote the developer of a current office building conversion project, 160 Water Street in New York City, as saying that it costs between $300 and $500 per ft.² of converted space, so you can use that to calculate the necessary discount to the cost of property acquisition.

Once again and despite plenty of misreporting, pleas to the contrary and symbolic acts, the conversion of existing office space to residential use still makes absolutely no economic sense for the vast majority of San Francisco buildings, due to the relative value of each use and the costs of conversion.

At some point, especially for low-rise/low-FAR buildings, the existing improvements add no value to the land for a potential residential use. At $200-$250 per square foot we might be getting close. 550 California Street sold for about $150 per square foot.

We’d put the inflection point at under $200 per foot. And so far, 550 California has been the exception, with more recent sales running closer to $500 per foot.

180 Howard in escrow $255/sf. 60 Spear @ $285/SF. 350 California Street isn’t that exceptional.

These prices might not be low enough to scrape but they’re getting closer.

1) How are the first two graphs different ?? (I usually do tolerably well in that ‘Spot the Differences’ game, but never get all six)

2) While I can appreciate tenacity, it might be helpful to articulate some number other than “the vast majority”, particulaly as I’ve never seen anyone say all or even the vast majority (of vacant CRE) should be converted. The operative phrases are “some” and “start (at the margins)”

Yes. This. Folks advocating for conversion of office space to residential are almost always careful to say that conversions of some Class C and perhaps Class B office space should be converted initially, under the assumption that remaining relatively cost-insensitive tenants will prefer to relocate into vacant Class A office space when their leases expire.

The former Golden Gate Theater Office Building at 25 Taylor St., a Class B building with a FAR of 2.11 that has been sitting around overwhelmingly vacant for years and currently sitting on the market, seems to be a candidate. I’m not a CRE broker, but it could be had for < $110 per ft.² if it just returns to its purchase price a little over a decade ago. The current owner just needs to adjust their expectations to the current reality, or perhaps be forced to when they have to refinance.

I miss the Salesforce tower representation of vacant office space. We’re over 16 towers (including sublease), aren’t we?

[Editor’s Note: Wait for it…]

Enough Empty Office Space for Nearly 180,000 People in S.F.

Not to worry! AI will save the day as the koder kiddies come scuttling back to SF to do chores that can be done much cheaper elsewhere, and that will in any case soon be obviated by AI itself as it displaces thousands (or millions) of information and tech sector positions. However, we’re going to need lots of cloud server space to host our robot overlords’ data training sets and hallucinatory output. Maybe all those half- (or fully-) empty residential buildings up and down Market St can be converted into warehouses for wayward terabytes? But again, that can be done much cheaper elsewhere.

The city government isn’t to blame for cratering CRE, and there’s little it can do to prop up collapsing values. However, the city is to blame for enabling the banker/builder/landlord/property salesman faction in waging class war on workers in the PDR sector, turning land that had long supported a strong light industrial base into yet another speculative gold rush, in the process spawning successively larger RE bubbles that have left us with these millions of square feet of vacant and useless property.

C’mon…given em a break: they promise to do better next time!

🙂

Totally deserves a third beer. Bravo.

Office vacancy in SF is well north of 27% by other sources not used here.

Other sources that I’ve read that publish similar figures are only counting a certain type of office space for the total, or they are only reporting figures for a certain geographical area (downtown, rather than city-wide, for example).

As we noted above, “yes, there are higher vacancy rate numbers making the rounds, but it’s the consistency of the data set and context going back over a couple of decades, as our numbers do, that matters and there’s a lot of poor reporting and cross analysis, between data sets, making the rounds.” And the dataset we use is citywide.