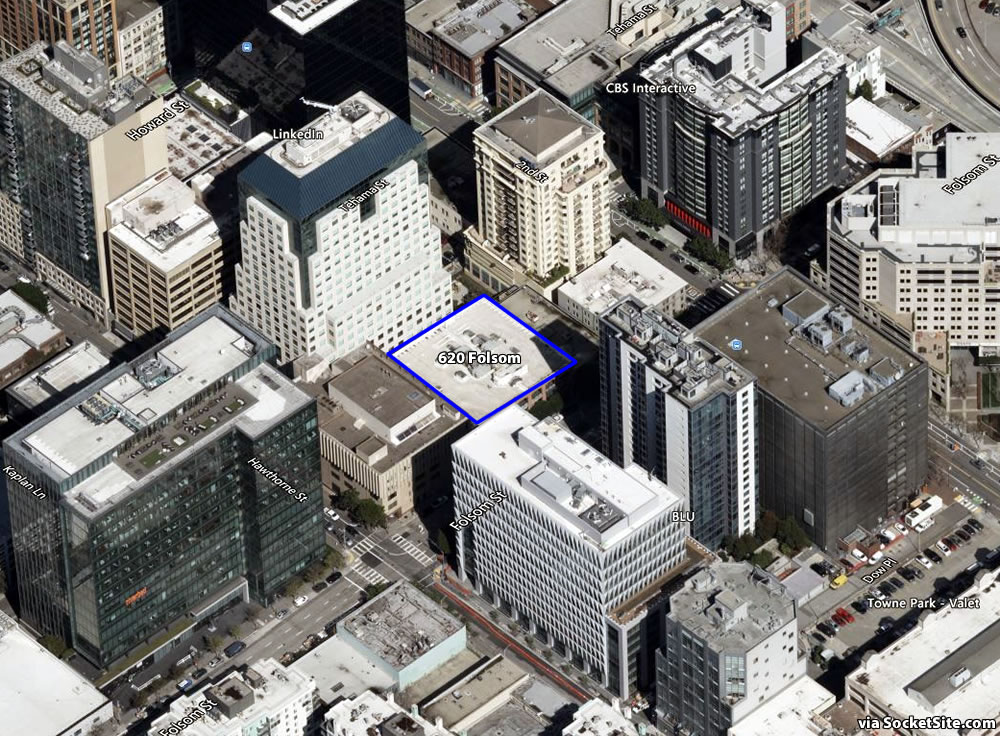

Plans for a 58-story tower to rise up to 575 feet in height on the South of Market parcel at 620 Folsom Street, upon which a three-story, 43-foot-tall office building currently sits, have been drafted and massed by SCB below, along with a placeholder for the approved 42-story development to rise up to 444 feet in height on the 95 Hawthorne Street site next door.

While the 620 Folsom Street parcel is only zoned for development up to 320 feet in height, the project team is planning to request a State Density Bonus for the additional 255 feet.

And if approved, permitted and built as conceived, the new tower would yield 623 apartments, 102 of which would need to be offered at below market rates (BMR), along with a below grade garage for 175 cars, a ground floor storage room for 280 bikes and a rooftop solarium and terraces. We’ll keep you posted and plugged-in.

since SF is being abandoned by everyone, who will this be built for? /sarc.

It’s actually a legitimate question; and if you mean to imply “they know something we don’t” or (this is) proof that things are quickly returning to normal, well, then, I think you’re presuming a lot. But I’ll return w/ a remark in kind: perhaps they’re counting on transfers [from a nearby sinking building].

You must be new to San Francisco. Welcome. San Francisco, like almost everything on Earth is cyclical. It has what we call, ups and downs. You have a Gold rush, you have a depression. You have over inflation, you have an adjustment period. You have an Earthquake, everyone leaves. Time passes, new people move back. Remember how NYC was “over” after 911? SF will thrive again, and probably sooner than later.

You must be relatively new to SF. Welcome. As you note, “new people move back.”[sic] The cohorts that drive each cycle are different. It’s as likely the next cycle will see the tens of millions of vacant sq ft of “creative” office space repurposed and filled with cannibalistic humanoid underground dwellers than see a sudden Restoration™ of avo toast kiddies paying $3000/mo for co-living covid “full-amenity” SROs.

And “thrive” is a very subjective concept. Not all of these cohorts drive the economic bubbles that the (18)49ers and recent boba brigade did. The beats, hippies, punks, artists, musicians, and other marginalized, actually “creative” cohorts came here because the rent wasn’t too damn high. What business model do you have that’s going to sacrifice any hope for profitablity by paying through the nose for open office space, and who are they going to hire and start at six figures for the opportunity to live in a tiny box with no oven, with actual C.H.U.D.s waiting for them outside the front door?

SF will thrive again, but “when” is another matter, and it could well be in a way that won’t do much for the real estate industrial complex. What will help SF thrive is the opposite of what enables the real estate industry as currently modeled to thrive.

Y’all killed your own golden goose.

Oh, the usual gloom and doom twins. Do yo two ever do anything aside from getting on this website to lament the decline of SF? Go outside once and awhile and get some fresh air.

Well-said as unsual, two beers.

P.S., build it in Tahoe where it’s actually needed.

“get some fresh air.”

That’s funny, I’ll give you that.

In case you weren’t being ironic:

Current Air Quality: 87 AQI Poor

The air has reached a high level of pollution and is unhealthy for sensitive groups. Reduce time spent outside if you are feeling symptoms such as difficulty breathing or throat irritation.

Given your antidevelopment sentiment that I’ve seen in the past, two beers, you would be the one who killed SF. SF could have been denser and more affordable, but instead, everybody gets to keep their views. Nice one!

“Density” and “affordability” are not synonyms, nor are they even necessarily compatible; in fact, they seem to be mutually exclusive. I’ve looked for evidence that clustered skyscrapers full of luxury condos and “creative” office space makes housing “affordable,” and I just can’t find it. Density can be affordable, if done in ways designed to provide affordable housing, but it is very rarely done, for the simple reason that it’s more profitable for the entire real estate sector (bankers, builders, landlords, property pitchers) to build high-end projects for speculators, money launderers, and short-term rental scammers, among other leeches on the productive sector.

You know what isn’t new here? Avocado toast.

Also, I can’t predict when things will “return to normal”, but anecdotally, my employer—about 80 employees downtown—just leased additional office space as the days of the open concept, shared desk, or “bullpen” style rooms rooms are over. A small amount of folks will continue to work from home but the majority of us are starting to come back in and need more sq ft per person than we realized pre-pandemic.

For context, there’s currently enough vacant office space in San Francisco to accommodate between 98,000 (based on an average, pre-Covid, density) and 131,000 (a la twitter) employees.

They will be back…. how many cycles have you been here for..

Damn, I work at 75 Hawthorne – would not have been blocked by the 95 Hawthorne’s building but this one will put me in the dark.

The city will bounce back… all great cities do. I have lived here since 2000 and have experienced 3 major down cycles (dot.com, financial crisis and now this)… 3 in 20 years. People love cities so there will be demand once this cycle passes.

Yes, the “tech” industry can go on forever and ever with only a few behemoths making any profit and all the others writing useless programs waiting to get bought up and have their programs permanently deleted. Boom and bust! It’s creative!

Yeah, Salesforce is definitely useless.

Just off the top of my head, I can remember when Salesforce acquired Mulesoft and Tableau, the latter of which was admittedly not a local company. And of course we can’t leave out the acquisition of Slack for over $27 billion which IIRC closed fairly recently. So I think anyone not trying to be uselessly snarky would have to count Salesforce as one of the “few behemoths” doing the buying up.

In any case, even if that weren’t true, one counterexample doesn’t make two beers’ general point less true. I’ve personally seen all manner of young people beavering away (pre-pandemic) in close quarters in S.F.’s We work-like “co working” centers, happily paying S.F.’s rentier class with money from Sand Hill Road VCs in the hopes that their completely pointless “app based” companies will be acquired, because they simply don’t make sense. And SFRealist probably has, too.

So are you saying therefore that Mulesoft and Slack are “writing useless programs waiting to get bought up and have their programs permanently deleted”? Because I see them being used really frequently.

Sure, some companies fail. Most new companies fail in every business. If that is his point, then bravo! If that’s not his point, then what is?

A quick glance at P/E ratios for the “tech” sector should clarify my “point.” Sure, there are some legit, useful, genuinely-profitable “tech” businesses. The vast majority of the sector exists solely to sponge up the excess liquidity the Fed deploys to inflate the assets of HNW leeches. Without twenty-plus years of corporate welfare, the “tech” and RE sectors would be living, together, in a box on a SOMA sidewalk.

The whole tech sector, eh? That’s certainly an interesting opinion.

I’m not saying that the Fed’s policy has been correct, but is there any reason that the tech sector is especially prone to absorbing the Fed’s excess liquidity? I mean, why the tech sector and not, for instance, retail? Or the oil companies? Or real estate? Or China?

You probably wrote that using your phone, to a cloud, to a website, etc etc. Oh but it’s 20 years of corporate welfare. What a load of hooey.

I love a good tu quoque in the morning!

growth companies are not valued, nor have they ever been valued, on P/E ratios. if they were the entire biotech sector would be valued near 0. and in that scenario, we never would’ve gotten Covid vaccines from moderna or Biontech (pfizer)

The fact that you wrote “tu quoque” regarding a factual response to your ridiculous troll which was,” the “tech” and RE sectors would be living, together, in a box on a SOMA sidewalk” is also absurd of course.

And besides, just how many horseless carriages can there be in one city? Mark my words, there will be a backlash as people flee the city so they can peaceably ride in their carriages.

I agree the City will bounce back, but 3 major down cycles in 20 years isn’t something for a great city to aspire to. SF is the most economically unequal city in America.

I can scarcely believe it, but this time you actually moved the needle. This time everyone listened to your griping and talking about how every worthwhile SF person got here before 1997 … and the world actually changed. Henceforth all SF flats where anyone who ever resided in them ever wrote a single article for the Guardian or the Weekly are going to be designated A-level historic resources from now until the end of time. Anyone Tim Redmond ever smiled or nodded at will be paying a maximum 400 dollars a month. And nobody will ever work in real estate development again either, the power of your words simply too overpowering They are all going to be quitting their day jobs and moving to places that they read other people are moving to. It worked. Your bellyaching on Socketsite actually turned into a thunderbolt of eldrich 1s and 0s that flew from high rise condo to luxury Sea Cliff manse to Rafael Mandelman’s hard drive where it tripled in size, and then zipped through the hearts and minds of everyone you ever thought wasn’t genuine or fair. Or just mean. Or else said something you accidentally misconstrued as somehow not altruistic but actually wasn’t because you were totally wrong and made a snap judgment and said something rote. (Sorry guys, collateral damage, greater good, etc do enjoy Austin we hear the weather is lovely in late August.) Excellent work.

I’ve lived at 1 Hawthorne for 10 years. The neighborhood has transformed from mostly downtown worker types but sleepy on weekends, to a stronger M-F tech work crowd, to a ghost town last year, but finally picking up again lately.

I feel like the rare non-NIMBY (though maybe because I’m not native, only lived in Bay Area since 1996) because I’m all for more BMR housing in SF and around here is the perfect location for high-density structures. The most pressing issues are doing a little more critical thinking about providing more off-street parking and feeding traffic to Bay Bridge more efficiently.

Agree 100% with this – live two blocks away and there are so many warehouses/surface lots that could provide housing in SoMa, with a short walk or bike ride to BART/Caltrain/Muni. Not sure why the Central SoMa and Western SoMa plans didn’t allow for this type of highrise growth, but it seems with the bonus densities we may (fingers crossed) finally get some more in the next cycle. My one complaint is the public services (schools, parks, libraries, community centers, etc.) are being planned/built way too late.

the downtown is dead due to Covid because there was never enough housing built dowtown to make it a neighborhood where residents could support business. thats why the “neighborhoods” in SF are doing fairly well with people on the streets and economic activity

No matter how dense downtown or SOMA is there’s no sense of neighborhood — anywhere. It’s monolithic & tedious. Wide traffic-y unnerving streets everywhere. There’s no fine-grained experience, surprise, or joy.

Rezone and Activate all the alleys & lanes throughout & watch what happens; that’s where the neighborhood magic will eventually be but it might be a while before that enormous untapped potential is realized.

Hello Melbourne, Amsterdam, even our own Hayes Valley.

UPDATE: Supersized Tower Raises Recommendations but No Red Flags