As we outlined yesterday, there is now nearly 14 million square feet of vacant office space spread across San Francisco, which is up from around 12 million square feet of vacant space just three months ago and as compared to under 5 million square feet of vacant space at the start of last year.

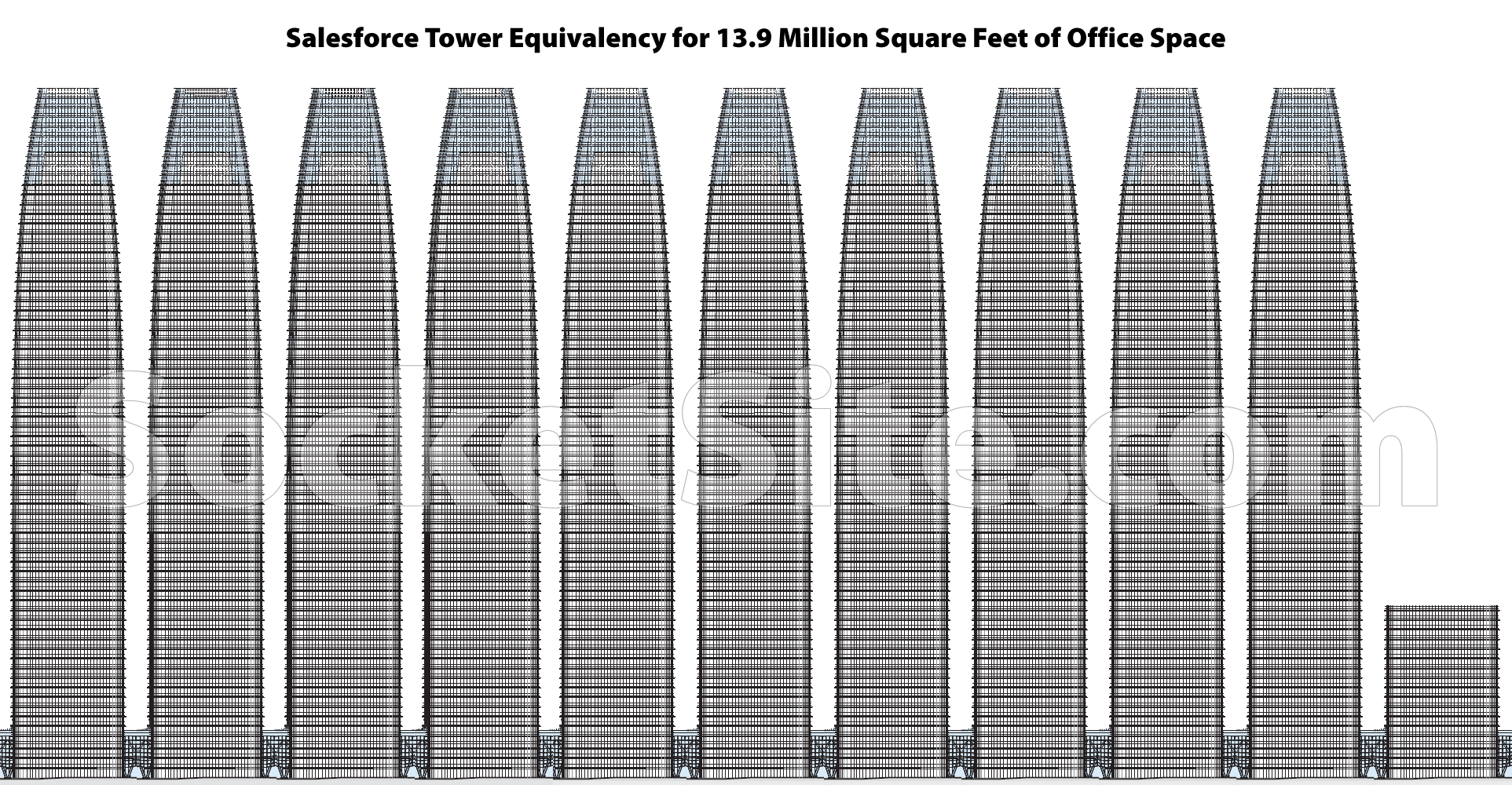

For context, the 1,070-foot-tall Salesforce/Transbay tower at First and Mission, which is the tallest building in San Francisco, contains 1.35 million square feet of office space spread across 59 floors.

And employing the framework we introduced last year, there is now 10.3 Salesforce Towers, or 607 Salesforce Tower floors, worth of empty office space in San Francisco, which is roughly enough space to accommodate between 79,000 (based on an average, pre-Covid, density) and 107,000 (a la twitter) worker bees.

I’m sure SF will get back to normal but it is going to take a long time to refill those vacant buildings.

And what will fill those vacant buildings, and what will “normal” look like? For most of its history, SF had a vibrant mix of professional-managerial, blue collar, and service workers that made the city one of the most interesting places on earth. Twenty-five years of adding mainly professional-managerial jobs (IT coders) while kicking the others to the curb has made SF one of the dullest places on earth. Maybe the objective shouldn’t be to fill up all the vacant office space with 22-y.o. pinterest coders?

The real estate mob made their bed, and those of us who have neither fled nor been defenestrated get to lie in it. ¯_(ツ)_/¯

Agreed.

The city long ago made a deal with the devil. Who do you think pays for the $13.6 billion dollars budget?

The city is projecting a 2-year deficit of at least $650 million, and growing. Where will the money come from as businesses and residents continue to leave the city? You cannot tax what is already gone.

SF better figure out how to fill up those empty buildings with something, and sooner, rather than later.

I do not think you really meant for the city to figure out how to fill those empty office buildings? You have seen how the city has filled up the empty hotels, right?

I mean the city needs to have a plan how to retain existing businesses and attract new ones. And, so does the State of California. Neither the city nor the state can function without a robust tax base. The empty office buildings need to be filled with users who will contribute to the city’s tax base.

The anticipated $13.6 billion budget shortfall is a money demand problem, not a supply supply problem. Hopefully the City will figure out a way to waste less and run better. I am not an anti-government/tax guy, but at a certain point a small city, both in terms of population and size, should be in better condition with a $13.6B budget.

It is a money demand problem when the city refuses to cut the budget and keeps an unsustainable payroll, and also do not forget all these city employees are entitled to very generous pension benefits that will continue long for many years to come. Also, the budget is $13.6 billion, not the shortfall (at least not yet). You’re blasé attitude does not offer any solutions, and just saying the city is better off being smaller is not an answer–hard decisions need to be made.

God forbid young people exist and have different jobs than the previous generation.

SF was vibrant when it was hookers and gold miners, everything since is “dull” by comparison.

let me guess you were one of the interesting people!

Well, that depends on how many beers you’ve had! 😛

Thank you, agree 100%

Fenestrated by the cruel blow of economics, I can feel the pain, something similar is happening to us.

All the empty Class A space will finally take the pressure off of historically less expensive building stock, I am looking forward to the return of art galleries (remember those?), non-profits, artist studios, interesting startups that aren’t solely intended to be unicorns, makers, and hopefully a bunch of other uses that some interesting person is thinking of right now. Thanks to all of the mega-developers for guaranteeing reasonable rent for the next economic cycle.

I soooo hope you are right.

Let this city diversify again economically and culturally

Let it become more interesting again, racially, economically, ethnically, musically, politically, etc.

Let it thrive again. I hope mass immigrants of all colors, geo origins outside the US, shapes and sizes of people are allowed to come here again ( read afford it) and the rich white techie boring crowd and stale old money fades back again for a while to allow less snobbery and more true culture to emerge again.

Fill with what? The tech industry is doing to local tech what it’s done to brick & mortar for years…

Going remote.

Yes, but probably not as long as some of the doom-and-gloomers commenting here think. San Francisco came-back after the last 2 crashes. I don’t believe that “this time is different.”

Agreed. SF will come back. It’s got location on its side. There have been half a dozen big crashes since the gold rush and it always bounces back eventually. I give it 2-3 years.

Lol, that’s realtor desperation talking right there.

Realtors are likely doing incredibly well right now

Not commercial realtors, they aren’t.

It is different. There’s zero need for tech to ever congregate in person, in one specific city thanks to tech-dtivrn online collaboration advances.

Those last two crashes were never because of a fundamental shift in the modern workplace overall, but only mere market corrections.

This is seismic.

From where I sit, I can see IT industry shrinking owing to maturity, automation and consolidation, not growing in terms of human personnel required. Of course new technologies, emergence of new and different business models are always a possibility — I just don’t see how IT can consume all this space.

The social media companies are going to have to fill it with people “moderating” member posts now that they’ve voluntarily become “publishers” responsible for content and not simple conduits of content for which the individual posters are responsible.

Incorrect. Publisher distinction is meaningless under the law.

Yet you can count the number of art studio/fabrication/workshop complexes on your fingers, and private studios on one hand. Seems like there is a bit of demand there, and hardly any supply. Maybe some clever developers will repurpose their “creative office spaces” (that were likely “repurposed” from former workspace to begin with..) to meet this demand?

Nah, who am I kidding. They couldn’t gouge productive businesses for what they charged useless VC-funded apps that alert your phone when your toast is ready. They’d rather sit on empty space. Supply & demand is a farce.

What are some anecdotes or even hard data that suggests art studio/fabrication/workshop complexes are in high demand? Not being snarky.

Hard data? C’mon, man, you’re the proud pro.

Anecdotes? Look at the prices and descriptions on CL to describe the few remaining smallish warehouses in SOMA that haven’t been turned into “creative” office space: “rarely available!” “hard to find!” “unique!” “classic!” “original!” (all code words for raw or “unimproved” spaces without foosball tables and hot pink Jacobsen chairs).

Search for “creative office” (which by def. means not creative) on CL and you get hundreds of hits. Search for “workshop” and you get bupkis, or maybe one of the two hobbyist complexes that aren’t really suitable for a small business, serious artist, cabinet maker, etc.

You are asking this the wrong way: What are some anecdotes or even hard data that suggests that art studio/fabrication/workshop complexes can afford the current prices given supply?

There’s very little evidence that art studio/fabrication/workshop complexes can afford the current prices. But given the current oversupply of office space, lenders are going to have to begin leaning on owners of these properties to lower prices to the point where the market clears.

Given what has happened (or really what has failed to happen) with ground-floor retail all over The City over the past decade, I am not holding my breath for that to happen. The most likely scenario is that all that empty space will sit there, unused, for years on end and commercial property owners will take years upon years of tax write offs for their loses instead of lowering prices or repurposing it for other uses.

B-b-but supply & demand! All that surplus space means prices will quickly drop to equilibrium, right? That’s what I learned in Econ 1, and it must be true, just like the Laffler Curve!

I took Math 101, so I’m an engineer.

Hope you don’t mind me stealing that zinger, sparky-b!

I am a woodworker and have been looking in SF for years for a decent workshop close to my home in the sunset.

It is extremely difficult and unaffordable to find workspace anywhere in SF from both my experience and the experience of others in my field. There are a few well known art studio buildings but the line for tenancy is years long.

So much industrial land has been repurposed as hip office space for tech [workers] or leveled for apartments. The last few woodworkers in the mission are being pushed out of their buildings because the buildings they occupy are owned by developers who want to turn the buildings into housing. Same goes for art galleries near potrero hill.

CellSpace turned from a massive vibrant studio space/art gallery/music venue 4-5 years ago into techie housing. The only hardwood lumber supplier in san francisco was leveled 2-3 years ago to make room for an amazon distribution center. There is no longer a hardwood lumber yard on the entire peninsula from SF to SJ. The amount of art spaces and material suppliers in SF has only gone down exponentially for the last decade.

There is your anecdote!

Seems like a consequence of concentrating housing development in the formerly industrial areas of the city. If the only place where housing is allowed is former workshops, that is where they will have to build housing. A better plan would have been to concentrate the housing in the areas that are already just housing, like the Sunset where there is nothing interesting to destroy. Replacing housing with different housing is greatly preferable to extirpating all the workshops.

Is that what happened to McBeath?? Amazon distribution? Damn shame.

I’m curious if this affects the City’s revenue in any way? I am assuming yes, but not sure how exactly.

Well for one thing the city…excuse me, the City is losing out on all the revenue activity generates:

– Sales tax

– Farebox revenue (offset, somehwhat by reduced service)

– Payroll tax…I’m sure there will be a ‘battle royal’ when companies begin to claim that WFH employees aren’t subject to it anymore.

Also, as bad as 14M gsf, may sound, the problem is actually a lot worse: that’s the AVAILABLE space; the VACANT space – i.e. the amount of space with no one working in it – must be vastly greater (at least at present)

Notcom is correct; the large increase in office vacancy impacts The City’s revenue, because the people who would ordinarily work in those offices spend money here even if they don’t live here which is reflected in sales tax receipts.

From a report released mid-January by the city’s fiscal analysts, in which San Francisco projected a $411 million gap in the next fiscal year:

Emphasis mine.

I also agree that the vacancy rate is greater than it appears, because the majority of companies who have decided to leave S.F. are still paying their leases, and it’s only until those leases are up that the true rate will become apparent.

Thanks Brahma for giving numbers to my general remarks; the report makes for interesting – albeit depressing reading:

“The lack of online sales tax growth in San Francisco is difficult to explain without some loss of population….Even more dramatic evidence of out-migration can be found in indicators of the city’s real estate market, especially apartment rentals” (pp12)

“COVID-19 is the worst crisis to hit the city’s tourism industry since 1906, so its severity is not in any doubt”

(pp15)

“Even before the pandemic, the city’s neighborhood commercial corridors were facing increased vacancy, weak employment growth, and a 15% decline in the number of retailers in the city over the past 20 years. The structural challenge is that if the city cannot grow its neighborhood small business sector when times are good, what will the growth strategy be in the early stages of recovery from a severe recession?” (pp16)

I guess we now now Dave’s occupation: ghostwriter for the Budget Office.

IT can’t fill this space. IT was already backing off on SF prior to Covid. Stripe and Square leaving the City to name two. Now Pinterest will not be hiring new workers into SF. DropBox the same. Twitter – with permanent telework they’ve basically decamped as well. The exodus of tech from SF will continue (and from the BA) and there is no one else left to fill that space. Banking, finance, insurance are not retuning to SF in terms of shifting force here. Commercial bankruptcies – likely inevitable. See through towers – yes, a new feature of SF’s downtown.

Beyond that, the tax revenue SF was banking on from projects like Oceanwide, HP/CP’s office component (once projected as 3.5 million feet plus), the Tennis Club and such will not happen as these projects are likely DOA. The upscale residential projects planned to house the 10’s of thousands of new workers are no longer financially feasible. Their market niche – upscale high paid techies – is and will be a vanishing breed in SF.

The exodus from the City is far worse than most metros are experiencing. I follow Seattle as well as BA real estate and Puget Sound was one of the most robust markets in 2020. Ranking among the top in terms of sales, new deliveries, construction and vacancy. 7.5 million square feet of office space is under construction and the vacancy rate has ticked up to just 9%.

Seattle stands in stark contrast to San Francisco and the difference can’t be explained solely by Covid. If anything the Puget Sound area has been harder hit. No, there was and is a more fundamental problem that explains it. An ineptly run city, a city with no strategic plan, a city that assumed the golden goose would be around forever. The current City PTB are, IMO, incapable of addressing the coming fiscal crisis short of more taxes on local businesses and residents.. .

The difference between Seattle and San Francisco isn’t Covid, it’s not the existence of a strategic plan, nor does it have anything to do with how well they’re run. The difference is Amazon.

And Microsoft, Costco, Starbucks to name a few others. But the big difference is: lack of state income tax. Washington State has one of the least tax burdens while also allowing for better quality of life and housing affordability.

Well, the Seattle–Tacoma–Bellevue MSA accounts for over half of Washington State’s population and the number is still almost a million people less than the San Francisco–San Jose–Oakland MSA. It’s not hard to have a higher quality of life, lower taxation and more affordable housing when you just have fewer people competing for housing.

“It’s not hard to have a higher quality of life, lower taxation and more affordable housing when you just have fewer people competing for housing.”

Exactly. Of course, this runs counter to the RE bull infinite recursion narrative loop that to run the city, we need more people to pay more taxes to pay for more services for more people to pay more taxes to pay for…

My name is Jon Jonson…

And therein lies the rub doesn’t it. Seattle has been significantly outbuilding SF in new housing for a long time. Their regional metro system is expanding more rapidly than BART with several new lines planned for the next 5 years or so. The metro area having a million less residents is not the explanation for the better quality of life.

Seattle’s public transportation is nowhere near as good as San Francisco’s, or the Bay Area’s. And Seattle is essentially Marin County in terms of how the roads work.

@Ohlone Californio

SF better public transit than Seattle? Have you ever lived in Seattle and depended on public transit to get around? And in SF? Having done both in the last few decades and lived and driven in both cities too I can tell you from experience that getting around Seattle (and the East Side) on public transit is an absolute joy compared with MUNI and the other Bay Area equivalents.

Comfortable buses, well thought out routes, some great drivers and almost never the freak show passengers that is a daily occurrence on MUNI routes like the 6 or the 22 or on BART.

In fact Metro Transit in Seattle is the only public transit system in the US that even starts to get close to what is taken for granted in most European counties. A fantastic system.

As for why Seattle works (at least until recently) and San Francisco does not. It was not full of NIMBY’s who moved in from elsewhere and shutdown all up-density residential building in the city. For almost two decades Seattle, a much smaller city, built far more housing units every year than SF. I’ve seen block after block in places like Capitol Hill and the U District go from low to medium density over the last few decades. Sure I miss some of the old vibe but I also appreciate that it does not have stupid rents like SF.

It seems too many people in SF dont understand a very basic principal, if you dont allow up-density residential building in high popularity neighborhoods then rents and property prices will go up far faster than median income. Which is what has happen since the 1960’s when the NIMBY’s first moved to the City.

No, I’ve never lived in Seattle. But I’ve been a very frequent visitor, I’ve taken public transportation a lot there, and I have friends who are journalists there who have reported on the subject. Any Google search will yield pieces by names I know personally. Suffice it to say the very aspect you hold up as proof positive, buses, are the problem as Seattle traffic was only worsening pre-pandemic.

Seattle has been adding large amounts of new housing stock over the past 5 plus years which is the key to the more affordable housing. Not that housing is cheap but it is certainly more affordable and especially given the rapid population growth there. Several times faster than the BA.

The NY Times did an extensive piece on this yesterday entitled They Can’t Leave The Bay Area Fast Enough. As the era ends what comes next? The article didn’t answer the what comes next question but focused instead on comments from a lot of techies who have left SF. The big beneficiaries of the exodus per the article will be Austin, Seattle, NTC and Chicago.

Former Mayor Ram Emmanuel said at a Commonwealth Club event several years ago that the problem with the Bay Area in terms of quality of life and affordability was that it did not have a truly diverse economy. He was right.

Florida doesn’t have state income tax. Nor does it have any tech companies. That’s a red herring.

Amazon is huge and the pandemic has only made it stronger.

that is not completely correct – there are a number of onshore outsourcing delivery centers in Florida.

Typical Tech Companies may not be HQ’d there but the lower cost of living has attracted many vendor providers and service delivery centers.

If Florida’s strongest tech companies are delivery centers, then it’s a fine demonstration that there are no tech companies in Florida.

The point is that having no income tax is not a factor in Amazon’s success. If it was, then Florida, with 3x Washington’s population, would surely have something. It does not.

Yeah, I’d be cautious about throwing around the “ineptly run” moniker: on everything from the 1-99 replacement tunnel to the ‘Capitol Hill Autonomous Zone’ fiasco https://www.seattletimes.com/seattle-news/welcome-to-the-capitol-hill-autonomous-zone-where-seattle-protesters-gather-without-police/ our northern neighbor has shown an unerring…well maybe TOTALLY erring ability to play in the big leagues (when it comes to playing in the sandbox)

If Square is leaving, so its CEO can’t walk down the street to his other empire, how’s he going to keep running both Square and Twitter? Well, he thought he could do it while living in Africa (until his Board of Directors said, “Wait a minute!”) so maybe.

Neither is Twitter, a fact I’ve seen misstated here and elsewhere

Are there specific business reasons as to why Square must be located in San Francisco? What is the advantage that Square derives in San Francisco vs say South San Francisco or say Phoenix? Can Square exist out side of San Francisco and still maintain itself in terms of growth and profitability?

Cave Dweller, Square finds it advantageous to have their headquarters in San Francisco for a number of reasons, including that it’s easier for the company to find employees who have the skills that the company needs to operate here.

Now, I now you think that workers at companies like Square are easily replaceable with people elsewhere in the country or world, but it looks as if the management at Square doesn’t agree. So, according to the econ text books, current management is not maximizing shareholder value and thus someone should be starting up a company right now, with a completely remote workforce located elsewhere in the country or world, which will enter Square’s business segment ultimately use that competitive advantage to overtake Square in the marketplace and eventually run them out of business.

Knowing this, as you seem to, why are you wasting time posting questions like the above here and not shorting the stock aggressively? It’s publicly traded on the NYSE.

On the contrary the management appears to agree with me. I believe SQ already announced permanent work from home .

Further, the facts of other companies offering similar solutions that have been entirely developed outside of SF/Bay Area and have been successful should also indicate these people “skills” are transferable and not unique to SF. I am going to guess SQ already has not-insignificant amount of off-shore development outside of SF

Not sure what you are on about shorting and what not. Wage expense isn’t the only factor in determining the share price (or net profitability) in an inflated market.

Absolute nonsense that SF has this ridiculous lock on all top tech talent. This isn’t 2011-2015 anymore.

Austin, Portland, Atlanta, Seattle, NYC, LA, all have premium tech talent and top arts/cultural scenes there to keep them happy.

“So, according to the econ text books, current management is not maximizing shareholder value and thus someone should be starting up a company right now, with a completely remote workforce”

A dirty little not-so secret is that many tech companies were in SV/SF because that story played well with investors. Square has a PE ratio of 345 and twiter has a negative PE. So its less about running the business at maximum efficiency and more about selling the stock at a maximal price.

And there is no need for someone to “starting up a company right now, with a completely remote workforce” when COVID has forced an experiment whereby nearly all tech companies are currently running with a nearly completely remote workforce. (And as Cave Dweller pointed out Twitter & Square among others have announced that they will continue widespread WFH post-COVID) And by and large those tech company stocks are doing well with many at or near all time highs. Investors and top management are seeing this and reconsidering why they were paying SF/SV prices for compensation and other costs.

I don’t think that all companies will go 100% remote post COVID, but a while back locating in SF/SV was the default choice and remote or secondary locations required justification. I think you’ll see the staffing equivalent of “Zero base budgeting”. Where things are working remotely now, managers/founders will need to make active arguments to justify bringing headcount to the SF/SV area vs more cost effective options.

There’s a saying in business that its better to fail conventionally than to succeed unconventionally. Before, if you wanted to move a team or start a company remotely or in an unconventional location you risked having any setback blamed on that decision. Now that WFH has been forced upon us remote work is no longer the unconventional choice.

wilson, i think its more about growth vs. profit margins at this point. young companies focus on growth and market share, with presumably profits to fall in line later.

jimbo, but growth is an expectation about the future. I agree that VC’s & management created a growth story to entice investors to buy in at higher valuations. And part of that growth story used to be that companies were based in SF/SV. But COVID has currently forced near total remote work and some companies such as Twitter/Square have announced post-COVID permanent remote work. And they are still trading at high multiples showing that investors still believe the growth story even with near total remote work.

Brahma posited a though experiment to Cave Dweller that someone should start a completely remote company and see how investors react. And my point is that there is no need for a thought experiment because that is exactly what is happening right now.

If investors really believed that remote work was a growth killer, these companies that trade at high multiples because of expected growth should have tanked. But they didn’t.

Hilarious, but spot-on. The greatest minds of a generation were focused on making people click on ads.

CRIME SOARS !!!

Headlines are misleading. So what if vacancies are over 14,000,000 sqft. What does that actually represent? Is that 20% of the market or available space? 2%? 0.2%

As previously outlined and handily linked above, that’s 16.7 percent of all the office space in the city and three times as much vacant space than there was at the same time last year. That’s also more vacant space than there was at the height of the Great Recession and the most vacant space in over 30 years. But sure, it’s probably just an issue with the headline.

I knew I was vacating my office space by April, but I held it to the end of the lease late last year. The sublease market is completely dead and I’d just be wasting my time by listing it. So I paid to the end of the lease and bailed. It was only listed for rent at that point. The other business owners I know who bailed did exactly the same thing.

If most business owners are like me, the amount of actual vacant space is probably 3-5X what’s listed.

How is debt on most BA office space structured? Even if some of the trusts/companies/individuals that own these buildings have deep pockets, what happens if they can’t make or stop making payments? I’ve read that Trump owns 30% of the BofA building at 555 California with approx $162M in debt coming due sometime this year. Is any of the SF office building debt sliced and diced into funds? Are any financial institutions or major funds at risk from an over exposure to office space? Could we see a wave of office building foreclosures over time and might this have ripple effects throughout the US and world economies? I honestly have no idea what the risks are but if the BA is in for an extended leasing downturn, it makes me wonder what the ramifications might be.

If they are overleveraged and there is no cash flow there is always the Fed bailout. But that machine, I am afraid has been way too busy in the last 12 years for the rest of the world to remain comfortable about it.

Really, at this point, I am no longer sure why anyone pays taxes anymore. Its pointless other than as a means of general harassment.

There was doom and gloom in this comment section in 2009 and 2010. The dot-com slump lasted about 2-3 years. The Great Recession bottomed around 1.5 years after it began. There is way too much pessimism about San Francisco here. We have had “quality of life” issues and relatively high taxes for years yet people still came to San Francisco. Same with NYC and London. We won’t be locked down forever. There was a global pandemic about 102 years ago, which led to the Roaring 20s. This doom-saying is way overdone.

None of this is meant to minimize the pain felt by people whose livelihoods have been affected by COVID-19.

The Great Recession era downturn actually started in mid-2006, which is when the southern neighborhoods peaked and the “doom and gloom” / “bubblehead” barbs started ramping up. The middle-tier neighborhoods then peaked in early 2007, followed by the top-tier areas in the first half of 2008.

The downturn then lasted through early 2012, at least for the residential market and at which point property values in San Francisco had dropped around 20 percent on average, with drops ranging from nearly 50 percent in Bayview to around 10 percent in Pacific Heights and greater volatility for condos – which tend to be a leading indicator for the market overall – across the board.

But the local office market did bottom, and started to recover, in mid-2010, following a sharp drop in rents.

I am well-aware that the peak of the residential market was in mid-2006. This thread is focused on the office market, which began its crash in 2008. Also, the office market bottomed around 2010 and went straight-up for 10 years.

If you’re in San Francisco for a quick trade, maybe its time to sell or maybe its too late. For anybody who intends to spend their life here, or much of it, the doomsaying is way overdone.

I’ve been here for more than 60 years. This city has come back from an earthquake/fire, a pandemic 100 years ago, a Great Depression, a dot-com crash, and a Great Recession. It will come back from this.

I would not be betting against where San Francisco will be 5 or 10 years from now.

I think San Francisco the geographical city will continue to exist in some form. But will it be able to sustain the level of revenues required for its maintenance and growth? Will the existing problems to be solved or will they become something else? Can San Francisco remain the leading destination for business and investment it was for the past 20 years? If yes, why?

What are the factors that contributed to resiliency of SF and are those factors still intact? What are the conditions for prior failures and recovery? Do these conditions and recovery match with the situation today in a manner to suggest a robust recovery?

People can live for 100 yrs and cities/nations can survive for a very long time — but not forever. An old world proverb: A vulture that ravaged 1000 carcasses may be felled by one thunderstorm.

Aphorisms aside exactly what do you think are the advantages (geographical, cultural, economic, climatic and others) that SF possess that will aid its recovery and economic stabilization? I am genuinely interested to understands these factors.

“[…] will it be able to sustain the level of revenues required for its maintenance and growth?”

Somehow, SF had sufficient revenue before the innernetz. As I barked in this forum for years, it was foolhardy to put all our economic eggs in one digital basket. A diverse economy is a stable, durable, and resilient economy; a rapidly-growing economic monoculture is fragile and doomed. Looks like this shmoe was right.

@Cave Dweller–I have already said why I think San Francisco will endure as a vibrant city where people want to live and do business. I will leave it to you to provide the answers to your own questions in support of why you think it won’t.

I’m not suggesting that the pandemic and the exodus by several major employers isn’t a big setback. I just think it’s no more than that. In 2010, Class A office space was leasing at less than $30/SF and everyone thought the world had ended. By late-2019, rents were 2.5x their 2010 levels.

None of us will be here forever. My horizon is 30-40 years max. I have no opinion on the survivability of San Francisco in terms of glacial time.

“Nobody goes there anymore. It’s too crowded.”

@Cave Dweller – in terms of geography SF is a small city at the tip of a peninsula. Before the pandemic the BB and BART into the City were at near peak capacity at rush hour. And frankly San Francisco had exceeded its jobs and population capacity. .

Despite the above, another 15 million feet of office space (that figure may be on the low side) had been approved or was going through the process. That would have meant 10s of thousands of additional jobs. With no imminent improvement of public transport into SF. The excess of jobs and population has contributed to the deteriorating quality of life over the past decade. Given the new paradigm most of the approved/proposed office projects won’t get built. It’s telling the Oceanwide project has been abandoned even though its very expensive foundation was just recently completed.

The future IMO will see a big drop in the number of jobs in and the population of San Francis. I expect easily a 10% drop in population short term and ultimately a further decline with San Francisco returning to a more historic population level.

“I’ve been here for more than 60 years.”

But how many people can expect a 60 year hold? Or even 30 or 40 year?

Maybe a long time ago blue collar workers could buy a home right out of high school and get a stable job with a pension. But in the SF of today the housing market is really only accessible to the professional class. Sure, there is the odd anecdote of the precocious coder plucked out of high school into a tech giant. But most of these jobs are filled by people with at least a college and often post-college degrees and all the debt that entails. And how many 70-80 year olds do you see in tech (or even 60 year olds)? So people are starting here later and ending early. A poster the other day mentioned that they had a 18 year career in tech. That sounds about typical. Subtract out some years of paying down student debt and building up a down payment and you don’t have all that much time in the housing market.

Getting in at the start of a good 10 year stretch in the housing market vs a bad 10 year stretch makes a pretty big difference for most people these days.

@wilson — But in the SF of today the housing market is really only accessible to the professional class .. only if its a coupled double income professional class either with a single child or none (perhaps a pet). Those people who can afford with a single income are very few and very very far between.

Falling disposable incomes is THE major reason why people remain single or when coupled opt for a single child or a pet. The working brave chance it with a single kid. Only the very rich or very poor can afford more than 1 kid because of state support.

The reason why you don’t find many children in SF has almost everything to do with economics rather than lifestyle choice.

@Wilson and Cave Dweller – the market today is indeed nothing like the market in the 60s. I have a neighbor who is 90. She worked at Woolworth’s on Market Street in the day. Her husband was a tailor. Yet they were able to purchase a home in the Mt. Davidson area. For $12,000. They had two kids to boot. That home today is worth 1.8 million. There is no way two service industry workers could afford it today. The housing market in SF has left the middle class behind. And Mt. Davidson is not even considered an especially desirable area.

And the ‘Roaring 20’s” was followed by the “(Insert term of choice here)’s 30’s”: DTSF saw one major private building project (the Standard Oil Bldg expansion) in the quarter century b/w 1930 and the mid 50’s…doom really can show up – and camp out – at your doorstep.

Not that will happen this time…of course. 🙂

The first time I moved to SF was 1991 and all I heard was that I would never survive it. How expensive it was. “You’ll never find an apartment, you’ll always have roommates. You’ll never find a job.” Maybe my friends were just really negative. But, I survived. I remember that Muni was terrible, especially the underground and I remember the homeless population was startling.

I remember going to parties at artist communes in old macaroni factories. Lots of artist shared old factory spaces when SOMA was dangerous and gritty. And even then people used to say, this isn’t San Francisco, you should have been here when. Everyone thinks their favorite time in the city was when it was at its best.

It’s interesting reading these comments as it’s the same diatribe that gets told decade after decade about the city that was. The city thrives and then it crashes, thrives then crashes.

These buildings will fill up again and whomever fills them will influence the next incarnation of the city. These times of crashing feel like karmic comeuppance to some for taking away the city they once loved.

One key difference is that vacant macaroni factories can be repurposed in many ways. Economies that have not been subjected to the development pressures of speculative bubbles can evolve naturally. But during an artificially-induced development bubble, scarce resources are quickly turned into their highest immediate advantage, with no concern for the future. Once the macaroni factory has been purchased and “improved” for several million – with “plug & play” wiring, marble bathrooms, exotic hardwood floors, bespoke cafeterias, and yoga rooms – there will be hurdles to repurposing that building away from the use the speculator intended it for (e.g. self-driving skateboard start-ups).

What you describe are not hurdles. If a building cannot be used for its original intended purpose, it will eventually undergo a change of use. Money spent in the past to build/convert buildings for a use that is no longer demanded is just a sunk cost. Rational actors do not let sunk costs affect future decisions.

And you can wait a very long time, a substantial portion of a human lifetime, in fact, for this change of use to “eventually” happen.

And as I wrote above, anyone rational who has seen what’s happened with ground-floor retail in S.F. over the last decade would dispute the dogma that you have apparently had pounded into your head in Econ 101 that commercial landowners (and their lenders) will “not let sunk costs affect future decisions”.

You are incorrect about what is going on with ground-level retail. Building owners would love to put some other tenant type in there. The City won’t let them. They want to see pedestrian friendly sidewalks.

I have had some professional exposure to commercial lenders and property owners in downtown San Francisco. They tend to be on-top of market are do not waste time in making appropriate adjustments.

This is true. The City has been insisting on ground floor retail, even though for many years it’s been clear that there aren’t enough people to populate the retail stores that the City wants to exist.

Online shopping (Amazon) is destroying retail in San Francisco and everywhere else.

“Building owners would love to put some other tenant type in there.”

Then they should lower the rent so that small businesses can afford the space. 20% off the western hemisphere’s historic highest rent is not reasonable; 20% off absurd bubble rents is not a “renter’s market.” Commercial rents need to be more in line with the growth rate in rents in other cities that didn’t see the real estate bubble that happened in the Bay Area.

Upton Sinclair notwithstanding, why is this so hard to understand?

SFRealist is 100% correct. Lowering the rent to some “market clearing” level is not the answer (for the record, rents for your basic ground-level food space haven’t gone up nearly as much as office rents). Local retail is withering everywhere. Downtown can only support a certain number of coffee shops and chain drug stores.

Also, owners of Class A buildings don’t want Dollar Store tenants on the ground level of their buildings.

Maybe it’s time for San Francisco to accept that tastes has changed and ground floor retail is never coming back. Stop insisting that buildings include space for ground floor retail.

Ground flor retail’s footprint is shrinking and will continue to do so. That the SF PTB/Planning have refused to recognize this is inexplicable. Much of SOMA’s ground floor space was empty even before Covid. On weekends the area was pretty much a ghost town.

Going forward and given that there likely will be less new housing produces in SF one option is to encourage the conversion of some of this space to housing. It won’t work everywhere e but it will in many places. Potentially thousands of new housing units over time.

For instance, why not encourage empty retail space along transit served corridors such as Taraval to be returned to residential use. Ironically some of the older buildings were totally residential initially and had their ground floor space converted to retail. Now much of that space is empty.

This is an excellent idea, if it’s possible for the individual building (need to have proper water hookups). Reclassify existing empty retail spaces as residential and let the building owner figure out how to make it work. Also, stop requiring or encouraging ground floor retail.

If we’re going to turn retail into luxury condos (a glutted market), why not turn them into “creative” office space (another glutted market), or coliving covid dorms (yet another glutted market)?

Since the PTB decided it was wise to eliminate the vast majority of PDR workspace that provided jobs for people who don’t code useless apps for a paycheck, it turns out that now there is a huge under-supply of that kind of PDR workspace. Who knew? If you really, really, really don’t want to lower your rent enough for small, independent retail to survive, you could find ways to convert the space to PDR uses. Of course, you’d still have to lower your rent to enable PDR-based businesses to make it, because those businesses don’t have access to bottomless venture capital to pay expenses until the IPO cash-out. So, if you really think you have to pivot away from retail, it’s up to you: would you prefer to fill your spaces at lower rent, or convert to them into more unwanted luxury condo/coder dorm/”creative” office space that will never fill?

We already know the answer: it’s more appealing to sit on empty, high-valued space than to provide lower rent.

#Supply&DemandFail

#CommericalWastelands

#VacancyTax

@two beers – it’s not about turning residential space into luxury condos .The conversion of space on Taraval would be to more market rate housing as the market for luxury condos on Taraval does not exist. It is not about just converting to residential either – it’s not either/or but both/and. The pressing need is housing but conversion to PDR space should be encouraged too. Especially as not all the retail fronts are conducive to being converted to housing. .

Beyond that the problem remains regarding all the empty towers. They can’t be converted to PDR and also not to housing given structural issues. Older office space could be converted but these new towers will sit empty for years and SF may become known for its see through office towers.

@two beers, this is not a supply and demand question. This is a zoning question. Building owners have known for many years that there is little demand for ground floor retail, but the city has interfered with the market to keep pushing it.

If the building owner wants to put in a PDR workshop on the ground floor, then let them do it! If they want to put in housing (obviously the likelihood of luxury housing along Taraval is zero percent), let them do that. Just don’t insist on retail.

My comment isn’t that I am in favor of saving abandoned factories. As charming as they could be once repurposed, it’s that the city will continue to evolve. The factories served a purpose and as industries changed they were no longer needed and closed creating a neglected area of the city where rents fell drastically. Artists took advantage of those lower rates, filling the spaces and eventually raising the value of the area which at some point pushed them back out. That ebb and flow continues.

So there is now a lot of cheaper office space and cheaper housing in a city with great climate and infrastructure for start-ups. I wonder if anyone will take advantage?

Somebody will definitely take advantage. This is a chance to reshape the city and some people are thinking big.

I don’t know what it will look like except that (1) money will be made and (2) the new residents will irritate the old residents.

From the early 1970s to 2017 I lived in the Bay Area. Over those decades there was a clear and steady degradation in quality of life accelerated by an increasing out of touch radical liberal govt takeover. For years the high tech boom managed to offset a number of growing negatives, but it has finally gotten to the point where even a high paid techie isn’t willing to put up with the filth, crime, corruption and taxes. This is no temporary recession, but likely beginning of a decades long decline of a once dynamic city.

The early 70s? SF was at a violent crime high then, was it not?

The whole country had higher violent crime then. But SF was not coated in feces during those times. Nor was it an outdoor insane asylum.

SF is not coated in feces now, nor is it an outdoor insane asylum, and I wonder how much nihilistic heroin-related human behavior there was in the good ole 70s versus now. I actually remember certain parts of town, such as 16th and Mission and surrounding, being worse in the mid to late 90s than they are now relative to the societal problems the heroin trade causes.

No chance was the heroin epidemic worse in the 90s. Mexican cartel took advantage of demand for opioids and lax drug enforcement in the early 2000s. Before that the heroin came from Columbia and was very difficult to find outside of NYC.

Many parts of SF indeed can be compared to a feces covered insane asylum. Huge swaths of it sadly. Thankfully I don’t live in those areas anymore but I feel for those that do.

That’s simply not true. Black tar heroin use was rampant, and a huge problem in the mid to late 90s in SF, and it was Mexican-American gangs distributed.

I’m not even kidding you when I say that I used to go to work via the 16th st BART every day. Later on we moved and I commuted from the 24th st BART. And drug dealing was so prevalent that dealers would say “1 and 1” and “outfit” to me all the time just walking on the sidewalk at like 8:30 in the morning. I was a white guy like with wet hair just out of the shower with like semi-nice work clothes on, and I had zero interest in what they had on offer. But they’d still offer ! The Mission was flooded with the stuff in the 90s. Flooded.

Then why are the tent cities a more recent occurrence? They were absent in the 90s.

@KOBking: Dollar purchasing power was a lot higher in the 1970s. Its been decimated in the decades since. Seems a lot of people purposely want to ignore the fact of depleted disposable incomes and lack of sustainable employment opportunities — which I think is an artifact of a failing economic system.

There weren’t tent cities in the 90s? Oh, yes there were. Also in the 80s!

TIMELINE: The Frustrating Political History of Homelessness in San Francisco

Sfrealist: Art Agnos lost his mayoral race to Frank Jordan because of the tents across from City Hall.

Now we have a tent city. Why can’t they just outlaw tents as Agnos eventually did. Since the need for privacy is universal they’d likely go elsewhere.

I’m well aware of the history. I’m pointing out that KOBking is factually incorrect in saying that there weren’t tents in the 90s. (I lived here in the 90s. There were tents.)

KOBking, we can’t go back to a time when making living on the street illegal would work to reduce visible homelessness, because the U.S. Supreme Court failed to overturn a 2017 ruling by the Ninth Circuit, in San Francisco that forbade prosecution of those sleeping outdoors. This created “a de facto constitutional right to live on sidewalks and in parks”.

Office space for what? Why would anyone need it, in a city with a muni system that does not function, no affordable housing, a city administration that is both corrupt and inept, an insane population of homeless. The location is beautiful, but that alone does not make it a viable place to do business.

Muni is key to a successful return. No one wants downtown space they can’t get too. Our City administration is both corrupt and inept.

Hopefully the real estate barons figure out they need to start demanding some accountability from City Hall in getting Muni to function in order to protect their investments.

Doom and gloom is a normal part of the cycles of up and down. San Francisco is an amazing place and has seen many ups and downs since the Forty-Niners Gold Rush.

I managed thousands of apartment units in SF and vacancies have soared. But the very good news is that people from outside SF are already starting to fill those vacancies. Rents are down and people are still coming to live here. Our residential vacancies are dropping dramatically. So, it’s not all doomsday.

There is light at the end of this tunnel, and San Francisco has a lot to offer.

Absolute nonsense.

Dropping dramatically? Figures please.

Factually speaking, while aggressive discounting and incentives to sign a new lease by the end of the year did help drop the average vacancy rate for large apartment buildings in San Francisco by a couple of points, listing activity for apartments citywide has continued to tick up with three times as many apartments listed for rent in San Francisco at the end of 2020 than there were at the end of 2019.

“But the very good news is that people from outside SF are already starting to fill those vacancies”

Not according to U;Haul.

So why are we paying $8k/mo for the homeless to live in luxury hotels?

Because we’re in the middle of a pandemic; that’s cheap compared to $4k/day in a hospital bed or $8k/day in an ICU; it helps keep hotel workers employed; and people can’t legally live in office space.

taco would prefer they just die, I imagine. It would reduce the surplus population.

or just let them use the vacant space

Curious to see how this pandemic will have changed office culture in the coming years. It’s possible the open-concept layout popular in tech and the classic “bull pen” setups you find in IB and consulting may become a thing of the past and companies will be looking for a lot more sq. ft. per employee. If prices come down due to this massive overstock of office space, we could see employers spreading their folks out a bit more. Assuming, that is, enough of them come back to work in the office. Only time will tell.

Convert office towers to residential.

This is a tectonic event. A convergent array of forces are acting in unison against the status quo and any notions borrowed from past experience. These forces are:

technologic — cloud computing & high speed networking enabling remote commuting and unprecedented availability of services enabling remote lifestyle

politic — anti-business environment bordering on abuse dis-incentivizing entrepreneurship and creativity driving away business and investments to elsewhere

geo-strategic — rise of China and other technological centers around the world which offer better labor/wage economics

pandemic — public health crisis which has clearly highlighted the dangers of close co-existence in cities

climatic — re-current wildfires creating pollution and driving power cuts. Also drought like patterns over the past several years creating shortage of water resources and fostering a belligerent situation between upper and lower riparian corridors.

socio-economic — wage and income disparity with high tax burden with falling disposable incomes and low affordability for housing

In addition, there is the situation of outdated infrastructure (roads, public-transport, healthcare, services), impractical housing permit system (taking several months to years), high cost of labor owing to government induced artificial shortages of housing and imbalanced and stunted economic development, growing homeless, public health and crime problems, falling school standards etc.,

I fear the rot has set within. This stat related to vacant office space is, I think, simply an outwardly visible symptom.

I challenge anyone to prove me wrong on the above points and explain to me how and why SF will bounce back to a relatively better situation that it currently is in now. No, rising housing prices is a not indicator of a healthy city.

Wait, you actually think that China is a competitor to San Francisco because of San Francisco’s environmental issues? China???

Cave Dweller is not here to talk about SF real estate. Don’t feed the trolls.

My mistake.

No, that is not what I said. But I also did not share the entirety of my thinking to show case the geo-strategic effect. As Chinese companies become more competitive they will impart pressure on American businesses.

Sure.

technologic — At this stage, knowledgeable posts wrt the negatives of remote work are legion.

politic — this is a real problem, agreed. However SF was never a one industry town and many of the big players are going nowhere. Nor is startup culture going away.

geo-strategic — I don’t see how China affects SF more than other places. And the second clause seems redundant.

pandemic — the vaccines, and people being people will be eager for human interaction when the time comes.

climatic — serious climactic concerns exist for every 21st century municipality.

socio-economic — wage disparity is not unique to San Francisco, what are the falling disposable incomes you speak of? and low affordability is also not a new thing.

To the other points, I largely agree. SF needs a local gov and local bureaucracy reset. The time has come.

technologic — Distributed work force has been in the making for the last 50 years. It has been practical for at least the last 20 years. 2020 is an epoch event in that highly specialized, highly skilled technical jobs in large numbers are being transitioned off to remote working model. I do not think 100% remote is the way forward. But I also think 100% centralized labor model is past its due date. I really think (and the data bears this out) hybrid model is the way forward. As to the exact split between on-site vs off-site labor is industry and company dependent. My view is that this transition is going to create a population vacuum and expose symptoms such as above vacancies.

geo-strategic — China is proving to be a real competition at fostering startups and product alternatives. Success of SV/SF Tech is also contingent on their success world wide. In fact, the success of RE in SF is, in a large part, directly dependent on world-wide success of local businesses (FB, GOOG, AAPL for ex.) . As China proves to be a viable competitor to American products in Latin America, Europe, Middle East/Africa and Asia, it also threatens the total addressable market for startups here. This could limit the upside for startups — which are then forced to search for efficiencies in wage and expenses or worse capitulate.

politic — See above. Rise of China is a real threat in no uncertain terms. If the local politics doesn’t do its part to help businesses remain competitive, companies are going to pursue alternatives that best align with their interests.

socio-economic — Disposable income is income after income taxes but before expense on necessities. In the context of SF, wages in relation to costs of necessities (rent+food) have either stagnated or fallen (because of inflation). Not everyone owns stock in mega rich corporations with exploding PE ratios. It’s a really bad situation. Because both workers and business are left economically starved. A large part of this can be attributed to high (unaffordable) housing costs. Which ironically (in my opinion) feeds the housing inflation loopback since it has now come to represent a store of value and major source of wealth which then (I think) feeds the expense/carrying cost suppression cycle (Prop 13 status quo).

climatic — yes, these concerns exist everywhere. But the relative economic risk for San Francisco is a lot higher than say a municipality in Lassen county. SF cannot fix the problem for everyone. But given the risk, I would think any capable city management would consider for air pollution risks as a result of mis-managed forestry.

SF is in a precarious position. The city needs to get its act together. The attitude of “it will all work because it did in the past” without any real effort towards fixing the fundamental and structural issues is a false hope.