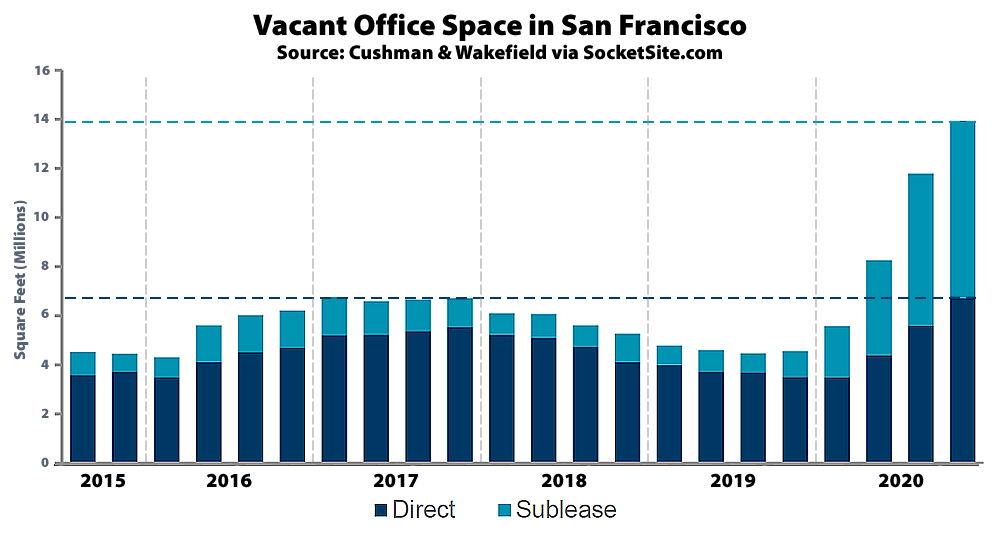

In addition to 6.7 million square feet of un-leased office space now spread across San Francisco, which is up from 5.6 million square feet of un-leased space just three months ago, there is now another 7.2 million square feet of office space which has been leased but is sitting vacant and being offered for sublet, which is up from 6.2 million square feet of sublettable space three months ago, according to Cushman & Wakefield. And yes, that’s net of Vir Biotechnology’s sub-lease of 134,000 square feet of space from Dropbox at the Exchange.

As such, there is now 13.9 million square feet of vacant office space spread across San Francisco for a citywide vacancy rate of 16.7 percent, which is up from an office vacancy rate of 14.1 percent three months ago and versus a vacancy rate of 5.7 percent at the end of 2019.

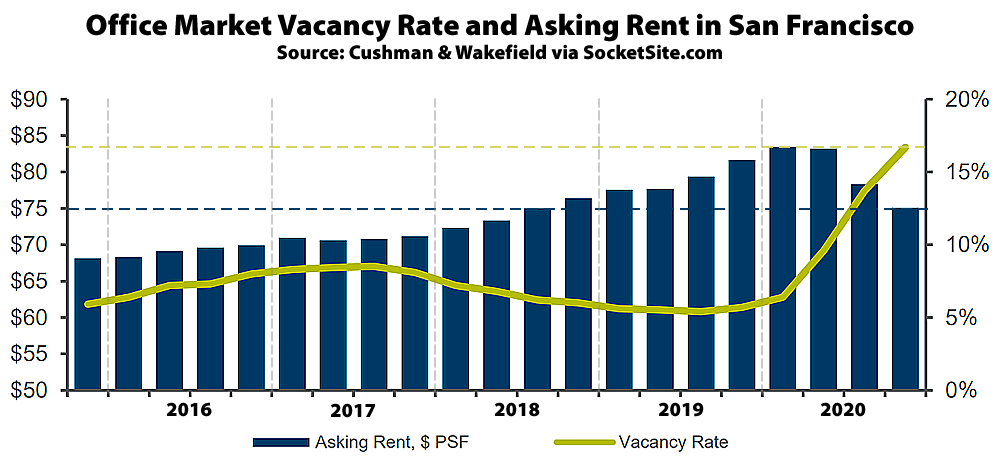

At the same time, leasing activity hit a 30-year (plus) low in the fourth quarter of 2020, with only 295,000 square feet of space leased. That’s versus a post DotCom-era low of 933,000 square feet of space in the second quarter of 2001. And while landlords had held firm through the second quarter of last year, asking rents for office space in San Francisco have since dropped nearly 10 percent to $75.11 per square foot (per year), which is down 8.0 percent on a year-over-year basis and back to mid-2018 pricing (when the vacancy rate was running closer to 6 percent).

Rents are still too high. It has to drop by 20% per quarter at these vacancy levels if they have any hope of filling them up.

I think lower rent and then flat rent (office/residential/commercial rents) for next couple years is a good thing longer term for SF and Bay Area. It has gotten way too effing expensive over the last 3-5 years. Give some time for people and companies to catch up…

agree that it will need to drop to at least $60/sq ft to start filling this back up

The average asking rent for office space in San Francisco hasn’t been under $60 per square foot since late 2014, at which point the vacancy rate was around 8 percent.

The enhanced unemployment check of $400/week will likely going to slow down the re-open, as some people will simply choose to stay home and collect that check. Back in June 2020, my mail got stuck in a Fedex hub for 7 weeks in Michigan because Fedex could not find workers, the hub manager told me everyone chose to stay home to collect unemployment checks.

Silicon Valley’s share of venture capital expected to drop below 20% for the first time this year

As it was SV’s/the BA’s dominance as the tech center was going to decline over time as other metros captured more of a share of the tech industry – including fin-tech. This was a macro trend some of us pointed out a while back. What has changed is that Covid has accelerated that trend. Significantly so. SF is likely to be especially hard hit in part given it’s tech was really a spillover from the SV. .

Where is Austin on the Top Regional Market for Venture Capital list?

Does the San Antonio-New Braunfels-Pearsall MSA include Austin?

Thought Austin is the future.

Well, Austin is included in the Austin–Round Rock–San Marcos MSA.

It’s not out of the question that the vacancy rate could approach 25%. But even at 16.7% the rents are way too high given there is little demand for SF office space. A much more significant drop than 10% is needed to help alleviate the situation. Even so, with 14 million feet of empty space and counting (PG&E will free up a big chunk of additional space this year) it’s hard to see how that space gets filled. During the boom years of 2014 – 2018 about 1.6 million feet of office space was absorbed each year and that kind of demand for SF office space won’t come back for a long, long time. If ever.

Large companies are not relocating to SF or setting up employee heavy office hubs in the City. Many mega-leases like the one DropBox signed a few years back are needed to fill up some of the 14 million feet but those days are over. The 5M project had the unfortunate luck of breaking ground 2 years ago during the boom. Now that tower is almost complete with no takers for its 650K feet of space. Oceanwide was a bit luckier. They stopped construction a few months back with a very expensive foundation completed but nothing else. With office rents set for a significant drop the [Oceanwide office tower] may no longer be financially feasible. The Tennis Club has pushed ground breaking back more than a year on its 2 million foot office project. It’s unlikely that project moves forward.

San Francisco faces a precarious future as its job base gets hollowed out. The massive amount of empty office space with near zero net absorption should have City Hall very worried.

Net absorption was running closer to a million square feet per quarter in 2018 (with an average of over 2 million square feet of leasing activity per quarter in 2017, 2018 and into 2019 as well).

Given the vacancy rate differences (16.7 now vs. 5.7 a year ago, assuming the latter is an equilibrium rate) and the total footage on the market (14.1M), the excess supply is ~10M. Even if you project using the boom year absorption rate of 4M sqft / annum, that would take 2.5 years to absorb after the bleeding has stopped (and we’re still seeing sublease supply hit the market, with 1 year leases to expire in March). @SocketSite – do you have data on the distribution of lease lengths (% of total at 1 year, 5 years, and so on)?

I agree with you. And yet somehow I don’t think enough of the people who matter are all that concerned. The fortunes of the SV/SF/BA have been trending upward for so long now, with some notable temporary blips, I don’t think most people in the area (and on this site) can conceive of that truly changing.

Disclosure: After 18 years at a large tech firm in the BA starting as a lead engineer and working my way up in management, I took early retirement a few years ago still in my (barely haha) early 50s and we left the area. From the time we arrived in 1998 it took all of 3-4 years for RE prices to double where we were. And it just never looked back. I remember thinking during my commute over the years that if SF and the BA really wanted to optimize their chances for a durable future, they should have been starting to look a little more, residentially, like Manhattan. Well we all know that’s never gonna happen and so, I believe, the roots for the current situation go way back.

I remember posting here some time ago that my company had stopped hiring graduating engineers from top tier schools in the mid-2000s. We had such a hard time attracting many of them, due to the cost of living, even at more than competitive salaries and benefits. Instead we opened campuses in 2 other smaller yet desirable cities in the US, one in Singapore and one in Europe. In terms of SW development, all these locations must work together, though most maintenance functions are focused in only 2 locations. These campuses are thriving and in terms of the business itself, as opposed to technical development, have served the company strategically even better than expected. My point is that for years before the pandemic, an exodus was already in progress and ‘remote’ workers had been the norm for many companies already. And believe me, there were no HR/salary/benefit challenges to operating campuses in multiple US and worldwide locations, as some here have suggested would be a deterrent. We already had a worldwide presence – just not for development

Obviously I’m not in RE or an economist but I believe the BA is in the early stages of what will be a significant and lingering downturn. Yeah I know – we’ve heard it all before. I keep thinking that the area may see an office building foreclosure wave similar to what the housing market went through back in the 2000s. Is that possible? And if so, I’m thinking it might play out more slowly. I think it may be 5-10 years before things bottom out and 20+ years before recovering. And I doubt a lot of people (myself included) can appreciate the ripple effects of that and how deep the tentacles might go. All just IMHO of course.

I do not dislike the BA, though I have grown much less fond of SF. On the contrary, we both have family in SF, on the peninsula, in the East Bay and out in Sac. I hope I am wrong in my thinking and do not wish misfortune on anyone. Maybe, if the powers that be react quickly in a way that is very favorable toward businesses small and large, some of this can be averted. Based on what I’ve heard from family about recent regulations and propositions, I’m not sure how realistic that might be.

Let me also say, I’ve also really enjoyed this site since the beginning when I was a much younger man and once upon a time would post with some frequency. I still like to check in a few times a month. And btw, Dave (Seattle dude), I enjoy your thoughtful posts.

City Hall should be worried, but every indication is that the BoS progressives view jobs leaving and tax base cratering as a *good* thing, because…*mumble* *mumble*…equity.

I was referencing the period from 2014 through 2018. Absorption was negative in 2017 and around 500K in 2016. Essentially flat for those two years per SS 10/22/19 post.

That’s correct, driven by the delivery/absorption of new buildings/space that was coming online. But our report on 10/22/19 was actually re: the office market in Oakland. The overview for San Francisco was on 10/9/19.

14 million. It’s a big number…how big? With normal spacing it’s about the same as the entire CBD of San Diego, Milwaukee or St Louis …in fact all but 33 U.S. Cities (34 if you include Oakland …egregiously omitted in this survey).

Thank God for Prop M, Preservationists and NIMDT’s in general or it might well be a lot worse.

What number are you using for normal spacing?

4000 people/1 million gsf (or IOW 250gsf/employee) It is, obviously, just a ballpark number, so you can go thru the list w/ different figures and decide whether/not it corresponds to ~56,000 (the effective cutoff for the 33/34 number)

Thanks. I have no reason to disagree, just curious.

That’s six Empire State Buildings worth of floor space, and counting…

Or in local terms, over ten Salesforce Towers.