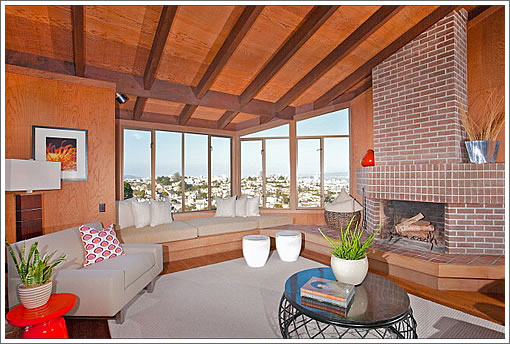

As plugged-in people know, the 1,810 square foot Albert Lanier designed Mid-Century Modern home at 4378 Cesar Chavez hit the market this past November priced at $1,100,000 or $608 per square foot for the designer Noe Valley home with views.

At the time of its listing, the average single-family Noe home was selling for well over $800 per square foot. Lo and behold, 4378 Cesar Chavez, the unidentified poster child of a recent Chronicle report, quickly sold for $1,540,000 ($851 per square) with 23 offers.

It’s funny how that happens.

According to the Chronicle’s Carolyn Said, the architecturally significant Mid-Century Modern home “looked like a 1980s Tahoe cabin,” one of the “flaws” that led Realtor Bernard Katzmann to price the property so far below market.

∙ Channeling Mid-Century Modern Flair At 4378 Cesar Chavez [SocketSite]

∙ It Would Have Been 50 Percent Over Had They Priced At A Million… [SocketSite]

∙ The SocketSite Reality Check For CBS’s Infamous “42 Offer” Home [SocketSite]

∙ Yes, yes, Noe Valley, say eager S.F. home buyers [SFGate]

This Chron article is a blatant ad for realtors diguised as a “journalism”. If the realtor thinks that property is a “flawed Tahoe cabin”, then he is in the wrong business. Actually, judging from his pricing and what it actually sold for- he is DEFINITELY in the wrong business. I can’t imagine what his clients must think when his listing price is that far off from selling in the other direction. Also, is he that far removed from architectural styles to call this “1980’s”? Really?

It never ceases to amaze me that most real estate agents know so little about residential architecture, but this story was a reminder of that fact. Just pathetic.

NoeNut wrote:

> This Chron article is a blatant ad for

> realtors diguised as a “journalism”.

Yesterday the Chron had another hard hitting piece of “journalism”: Want to buy on the Peninsula or nearby? Better have all cash.

“It never ceases to amaze me that most real estate agents know so little about residential architecture,”

You make so many incorrect snap judgment comments on here, based on nothing more than 1’s and 0’s, for all to see. Yet you still say that sort of stuff? Whatever. Most realtors who are any good would put your knowledge base to utter shame.

Noe Nut, the listing agent is a top producer and he always underlists his listings and does pretty well getting his sellers a high price. Whether he goofed or not on this one, he got his sellers an amazing price for essentially a 1 bedroom house that needs work.

anon.ed, Maybe so. But I wasn’t limiting my comment to “realtors who are any good.”

I think this reflects a very recent phenomenon. Last week the Guardian had a letter from a reader: http://www.sfbg.com/2012/02/14/were-trying-buy-condo-sf

Is it hype or is there something real there. All I can say is that inventory where I live is dismal and open houses are busy.

[Editor’s Note: Perhaps some data, versus anecdotes, can help shed some light: Recorded San Francisco Sales Fall 1.8% In January, Median Ticks Up. With respect to price per square foot trends: San Francisco Home Sales Slip In January And Not Simply Seasonally.]

I should have known when the Chron didn’t include the address or any pictures for the “Tahoe Cabin”, Said painted the picture of ramshackle cottage, not a mid-century gem.

The realtor played the buyers and the Chron like a fiddle. Did Said bother doing any research or just parrot what the realtor said?

Good job. Now take a giant swig of your Hater-ade and call it a day.

That place was really, really nice — it got an emotional response out of a lot of people (including me). It didn’t need any work at all. Not many places like that turn up in this part of town so they are real wildcards. The selling price of a more ‘standard’ house would clarify if tech money is really at work again….

“[Editor’s Note: Perhaps some data, versus anecdotes, can help shed some light: Recorded San Francisco Sales Fall 1.8% In January, Median Ticks Up. With respect to price per square foot trends: San Francisco Home Sales Slip In January And Not Simply Seasonally.]”

Not really. Data won’t shed light on micromarkets with any degree of usefulness. It’ll always appear as too small of a dataset, and it will always be a few months behind. So do not be so quick to dismiss anecdotes. At the end of the day the real estate market in SF is a few groups going after things in a neighborhood they want to live in. Those stats say nothing about that.

[Editor’s Note: Actual data points are great, which is why we like our apples. Anecdotes without any real data or context behind them, such as a property selling for “way over asking” without understanding it had been priced “way under market” in the first place, or the anecdotal frustrations of a buyer being outbid (see the previous clause), are much less valuable and all too open to (mis)interpretation and spin.]

You need to have your ears on the ground and right now I hear a bit of a tremor. Maybe it’s seasonal, maybe it’s not. But there’s something happening, maybe stronger than the usual seasonal move.

Zillow for 94114 shows a recent surge and I suspect it’s still going on.

All these overbids and high $ psf are exclusive to the real sf and on the right street. Obviously. Sucker buyers are overpaying after being played by the savvy real estate agent.

As I said in a previous thread, those guys in person were sheepish while admitting that they indeed botched the list price. It was a happy accident for the seller, IMO.

“All these overbids …”

Just a regular joe parroting the realty party line…

With hysterically low interest rates there’s never been a better time to lie!!!

“Were the 42 offers on 555 Edinburgh a sign of a “serious real estate rebound” in San Francisco? Once again we’ll say no, it was commentary on pricing. And it’s frightening that any industry expert would suggest otherwise.”

Read! Really!

anecdotes need to be taken with a grain of salt, of course, but they are indeed the most “immediate” indication, as stats tend to follow a couple months later. So the “ear to the ground” anecdotes are important, but so is how much you trust whoever is conveying the anecdotes.

And that chron article was truly a piece of crap.

And, yes, I think something is happening. From my point of view I hope it’s just a little spring surge (since I’m out of the market and hoping to get back in eventually)….but the limited inventory and the fact that so much of it seems to be going into contract very quickly sure suggest an uptick, even if it’s not clear in any statistics yet. We shall see…

there’s something going on in noe (or some parts of it). here’s another one that went for 37% over asking, recently: http://www.redfin.com/CA/San-Francisco/4332-Cesar-Chavez-St-94131/home/1994162

I would agree with Brahma on this one: most (not all) real estate agents really do know VERY little about residential architecture.

“anecdotes need to be taken with a grain of salt, of course, but they are indeed the most “immediate” indication, as stats tend to follow a couple months later. So the “ear to the ground” anecdotes are important, but so is how much you trust whoever is conveying the anecdotes.”

True, but from the ’09 thread…

“I’ve read so many comments over the years on this site pontificating how the prices in San Fran are going down. Well, in the 94117 zip code they are not down. Looking at depressing open houses this weekend and comparing it to fall 2006, every place we saw was more expensive than 2006. This is through the worst realestate meltdown in 70yrs.

Wake up – prices in San Fran are not down, at least not for interested buyers in good, not fancy areas. All the wishfull analysis and snarky comments doen’t change that.

Does make me think they will never go down, if this didn’t do it. Guess San Fran is special.”

Guys sent me this kind of “ear to the ground” stuff all the way down from the top. Datas wrong, blah blah blah. My Realtors actually the Human Torch he’s literally on fire all the time and so is the hood…

All bogus looking back at the data.

I’d be very curious to see how much this would sell for in 6 months or a year’s time if the sellers were forced to sell. To me, these multi-bid over asking sales are indicative of a marketing strategy, not the actual real estate market they’re in.

AT/RRR, I think you are getting confused here. The anecdote in your quote from 09 may well have been correct.

Now here’s where it gets tricky, so try and stay with me: Maybe the houses he looked at were all more expensive than in 2006. But then he jumped to the conclusion that “prices in San Fran” weren’t down and won’t go down. That’s not an anecdote, that’s a conclusion. Apples and oranges.

Understand the difference?

The selling price on 4378 Cesar Chavez is supply and demand at work – the very very limited supply of quality modern architecture homes in San Francisco. The new creative class, many of whom are designing the future at Apple or Google or Facebook or…are not afraid of modernity. And when they are looking for a home in San Francisco, they jump at the chance at scoring a modern gem like this one. As to the realtor, when I went to the open house he did not know who the architect was, much less that this was architecture. I suggested to him that it was Albert Lanier.

I posted a comment on the Chron website– something I rarely do. I pointed out that this was a biased and misleading piece and that in a minute on google, I found a number of other properties in Noe that had traded lower from their prior sale. (not saying that Noe isn’t doing well, just pointing out the “article” was not an article.) I also pointed “news stories” on sfgate was actually an advertisement for a house. While I was critical of the “journalism,” I was still polite and used no foul language etc. I’ve actually read the Chronicle’s terms and conditions. They removed my post– kind of funny…

-One of the top three stories/features on sfgate.com is frequently an ad for a house under the guise of being an article.

-This “article” chooses to focus on this

“AT/RRR, I think you are getting confused here. The anecdote in your quote from 09 may well have been correct.”

Maybe the guy confused the Realtors phone number with the home price… Maybe he went to invisible unicorn open houses that regular folk can’t see.

Doesn’t’ really matter why it was wrong.

curmudgeon was saying these anecdotes are more immediate than the stats. Could be true, but the stats went wee wee wee all the way down all the while people were putting out this ear on the ground stuff.

Demand folks. It exists. $1.5M clams is a lot of dough. 23 offers. = 22 remaining active buyers. Where is the inventory report? Plugged in readers want to know?

Here is the last one:

https://socketsite.com/archives/2011/07/san_francisco_listed_housing_inventory_update_july_5_20.html

“Were the 42 offers on 555 Edinburgh a sign of a “serious real estate rebound”

Guess with only 22 active buyers compared to 41 in 2009 we’ll only see prices do half as well going forward!

Read! Really!

It’s all local.

“It’s all local.”

Nope.

From 2009:

“BTW, how many were at 10% under the list price? How many at list? Without that sort of data, all we can say is that there are 42 potential knifecatchers, some portion of whom were smart enough to lowball.”

“Maybe the guy confused the Realtors phone number with the home price… Maybe he went to invisible unicorn open houses that regular folk can’t see. ”

Thanks for your helpful contributions to the discussion. Everyone appreciates it.

Demand is demand. 41 people don’t just put an offer on a house cause it seems like a good deal. They are called ‘buyers’. You put an offer out there because you have a sincere interest in buying a home.

Okay, so the realtor has a strategy of underpricing by a long shot and it always works out for his clients. However, then I would say his feigned “shock” at the overbids is awfully disingenous. I am also sticking to my guns that it is SAD that the realtor thought this was 1980s architecture. I just can’t get over that one.

BTW- I don’t think the selling price is shocking at all- this is a special house that was totally underpriced, apparently puposely.

22 remaining active buyers? Where do you get that? 22 remaining active lowballers is what you mean.

A few anecdotes and everyone misses the forest for the trees. A few upticks in Noe is NOT a sign to buy now IMO.

Fact- 95% of mortgages are subsidized by you the tax payer. Subsidies can prop up prices in the short term but long term problems remain. Write your grandkids a thank you note.

Fact- inventory is artificially low as banks hold onto inventory and “occupiers” live mortgage free courtesy of the tax payer. More market manipulation by the gov and more problems in the long run.

Fact- 25% of homeowners are underwater= more inventory

Fact-most of the people on this site cannot not compete with the Noe or Pac heights buyer so why get so upset?

tipster,

“22 active lowballers”.

Really? There’s nothing like active lowballing to make a price go up!

I am not sure 22 offers reflect 22 potential buyers. One person can offer/counter multiple times. The end buyer for instance could have submitted more than one offer.

Gyuppy,

Sure an uptick is not a sign to buy. The problem is that Noe for instance is a question of income vs cash market (often combined). Can people with a regular income and normal savings compete with (irrational?) people with a windfall? During the 2009-2010 trough income was sufficient because the cash market was too busy licking their chops. We could be in the uptick of a cash-fueled growth, or not. The expectation for some is that it is the case. It’s a bet.

Nethertheless, there will always be decent deals, the question is when the next trough will be.

What you are saying was very pertinent in 2009. We’re a bit past that curve I think. Despite obvious manipulations, the US RE market is one of the most efficient in the world. SF has its peculiarities, but prices reflect local realities more often than not.

Gyuppy,

Also: “Fact-most of the people on this site cannot not compete with the Noe or Pac heights buyer so why get so upset?”

Is that a fact?

And your first and last line, plus the topic of the post is NOE VALLEY. Are banks holding lots of NV houses? are 25% of NV home owner underwater?

22 $1M plus low ballers are out there. There are 16 houses not in-contract on the MLS in Noe.

I’m not in the market to buy a car, but if someone offers me one at 30% off, I’d take it.

22 is therefore a completely meaningless number with respect to the number of buyers, other than to say that 22 people recognized a severely underpriced property.

tipster, the concept of offers is one person at one price. You could theoretically have 22 offers with only 2 buyers. Just let them go back and forth with the seller. With electronic offers it’s pretty doable in a short amount of time. You could also have 10 low balls with no follow up and 3 serious buyers.

Wrong.^

Two things. Who got it right? The person who offered 1.54M?

Or the, let’s say 15 who made reasonable bids but are still in the marketplace? Not 22. So OK, throw out the top three and the bottom three, and the “winner.”

That’s a big, big problem with this site, the editor, you, and the rest of the toadies.

You keep on treating overbidding like it’s sensible. Or, “The market.” It isn’t.

Ninety percent of the properties that are ever dissected on here are overbids. Well, guess what? Plenty MORE people made sensible bids, missed out on the one they got caught up in competition on, and are living in their houses comfortably right now.

They make posts on here now and then. But you don’t pay attention to their words. They’re “anecdotes,” after all. Better to look at meta charts from three months ago rather than people in micro markets made up of (usually) three or four, not 22.

What’s what? be real once in a while.

“I’m not in the market to buy a car, but if someone offers me one at 30% off, I’d take it.”

No you wouldn’t. It wouldn’t be worth the risk or hassle. This is just a ridiculous analogy. The only thing more ridiculous would be to assume that there are people out there waiting in the shadows to pounce on underpriced real estate in this market.

And now we’re debating quantity offers versus actual potential people / buyers? Whatever, it’s not even worth the time spent. Anyone that puts an offer on a property is a serious potential buyer for that specific buyer; and would be viewed as an ‘active buyer’ in the market in general. To the extent that they re-bid — only serves to strengthen the fact of just how active and serious they are about buying any home.

If only buyers could obtain full transparency on offers, or at least have professionals be mandated to publicize post-sale.

Right now it’s offer/counter offer/approval/pure rejection with numbers going back and forth and only the seller sees all the numbers. It’s a bit too asymmetric, imho. A post-mortem would be educational and a great help for buyers to adjust their strategies to the market.

C’mon you guys, 80 realtors walked through that place on the tour and said to themselves “I could flip this thing easily for a $200K+ gain in about a week”.

One could just as easily assume 20 of those 22 were realtors and contractors who troll around looking for such things, leaving only 2 genuine potential buyers for all 16 of the currently active listings.

I’ve been involved with the seller in a multiple bid situation and it wasn’t even remotely close to what anon.ed described with 15 serious bids. More than half of the bids were UNDER the already too-low asking. Of the remaining ones, most were right around asking and only three were significantly above it. The second bid was $100K under the highest.

We’ll never know for sure, but one could just as easily assume there were probably only two or three serious bids here. The next highest bidder probably was nowhere near this price. The sellers of the other 16 houses can now compete for those lowball buyers. Lol!

The market dipped and corrected. Everyone agrees on that point. A $350k combined annual salary isn’t going to get your a super nice / prime SFH in SF. Ever. No one is on here saying we’re roaring back to those bubble prices (assuming you ignore, of course, all those turnkey dwell flips). Fact is that there are a lot of active buyers in the market and so long as there are active buyers out there it is hard to say with any confidence that we’re going to see another massive double dip.

“If only buyers could obtain full transparency on offers, or at least have professionals be mandated to publicize post-sale.”

Bingo!

But since there isn’t any real transparency or even verification that the offers were even real and not just eddy’s made up facebook friends, “Wow! Multiple Offers” means nothing and is just more Realtor Shilliness.

And it ain’t Noe or local or micro or even femto. The 2009 place was in the Excelsior.

Read! Really!

You’ve been involved with a seller in a multi-bid situation, have you? once? That doesn’t pass any sort of smell test any human being might imagine. And save, “troll,” guy. You’re nobody’s, nobody who does anything that is, SFRE peer. You’re a troll on a website who says crazy stuff. Stay in your lane.

With pure transparency, conspiracy theorists a-la-tipster would be debunked and would probably use their energy to something more productive than fighting a 5 year old battle.

“The sellers of the other 16 houses can now compete for those lowball buyers.”

6 of the 16 are priced under the list price of this place.

10 of the 16 are priced under the sale price.

So they might take the lowball offer of this place.

I do agree that some of the offers were builders who thought there was a deal to be had at asking or near it. Those buyers didn’t go away, they are still in the market for the next deal. Most of them would probably by a few Noe houses if they thought there was a project. I bet some builders have 3 or more D5 houses.

Also, I would bet this place has some permits pretty soon to do some work. And I bet the buyer ends up spending a lot more money than they thought they would spend. It’s not a total fixer, but I think most of the bidders had a plan to do some work. How much work needed to be done is where the listing agent missed the mark.

“If only buyers could obtain full transparency on offers, or at least have professionals be mandated to publicize post-sale.”

Why? What problem does this solve? I could’ve offered $50 for this place. Is that relevant?

“Why? What problem does this solve? I could’ve offered $50 for this place. Is that relevant?”

That’s exactly why the number of offers is irrelevant.

If the offers were known thats one solution. Or Realtors could just be honest about the relevance of “Multiple Offers”

Instead they immediately light their pants on fire, make their nose as long as a telephone wire and you get:

“No you wouldn’t. It wouldn’t be worth the risk or hassle”

What does whether or not there is full transparency on all offers have to do with questioning a poor analogy? You’re not making any sense again.

I also love how now everyone making an offer is not ‘irrational’. The only irrational people are the ones who fail to look at what is actually happening in the SFRE market and the broad markets as a whole.

http://blogs.wsj.com/marketbeat/2012/02/24/housing-market-trending-in-right-direction/?mod=yahoo_hs

^^Just another puff piece.

And then there is the whole over-hyped facebook effect, which of course is just a by product of a strong market. No one from FB will be buying a home, ever, post ipo. Especially not my make believe friends.

R,

RE your February 24, 2012 10:06 AM response,

We are in a data-centric market. It would function more efficiently with total openness.

Say you see a 1M house and want to make an offer. You’re told there’s already an offer by another buyer. The issue is for how much. Your total budget could be 1.2M, but if the other buyer’s total budget is 1.1M you could snap the place at 1.12 and save 80K compared to your max price.

But because you do not have all the information, you’re making a realtor-assisted move. Say 1.05M. The seller says he’s going back to the other buyer who does his own blind counter offer. You yourself have no visibility. You simply hear your realtor saying “the seller has rejected your bid due to a higher offer he hasn’t accepted yet”.

Say the other bidder has gone to his limit of 1.1M. You do not know it. You’re in the dark and you’re likely to shoot a bit too high at 1.15 or 1.2 compared to the other offer.

It’s an asymmetrical battle. It’s probably making you pay a bit too much.

Yawn. The commentary here is devolving into my strawman can beat up your strawman. If you can’t prove that nobody from Facebook will buy anything, then you’re obviously implying the null that everyone from Facebook will buy everything. Right? Because there’s apparently no middle ground in blogland, where most of you (including the “in the trenches” realtors) have had ZERO involvement in this sale, or any of the others you seem to obsses about and dissect.

Everyone seems to be saying the same thing: the market is active and people are buying houses. But prices aren’t expected to materially fall from a double-dip or surge from shortages driven by tech millionaires. Does anyone predict otherwise? A big drop or big jump? If not, then who are y’all arguing with?

@lol: So the problem is you don’t want the seller to get as much as possible for the place? They should make it easier for the buyer to get a better deal?

It’s pretty simple, you offer what you think it’s worth (based on real comps, not number of bidders, or asking price, or anything else). Either the seller accepts it or not, but if you get caught up in a bidding war, that’s your problem. Not the fault of the system.

“have had ZERO involvement in this sale, or any of the others you seem to obsses about and dissect”

No, I vetted it for a client and had a substantive convesation with the listing agent about its market.

“If you can’t prove that nobody from Facebook will buy anything, then you’re obviously implying the null that everyone from Facebook will buy everything. Right?”

No, that’s just a hyperbolic reach. If you actually look at the words used by the realtors in these various articles they’re a whole lot more measured than you and others would make them out to be. The realtors are actually in the middle, by and large. Where you say they should be! Your bias is simply not allowing you to read the words for what they are.

Some local people are going to make a lot of money from Facebook next summer. What will they do with it? Who knows? But get your head out of the sand already. There’s a dearth of inventory, and the market is better than it has been in recent years. Those are facts.

And the other issue is that, unless you know otherwise, 23 offers on a home 30% underpriced tells you very little. It doesn’t mean there are 22 other buyers at the selling price or even at a much lower price.

And if prices fall by 30%, those same buyers won’t necessarily buy: they may only buy if they can get something for 30% under the new, lower market price, so it does not necessarily even establish a floor. If the market price fell by 30% and this home was offered for the exact same price as it’s recent offer price, but that was then the market price, all the people who bid to make a quick flip this time would not do so then.

All you can really know is that people trying to hype a market and get you to buy today will use any fact available to do so. I saw a lot of hype like this around 2005/2006 and a lot of people lost a lot of money listening to the hypers.

Nobody is hyping more than this site, and you’re assisting Tipster. On and on and on with the 22 offers. The realtors aren’t publishing a thing. So congrats on being your own fake worst enemy in the fake eventuality that you ever become a SFRE actor.

“I vetted it for a client and had a substantive convesation with the listing agent about its market”

Great, so you looked at it. I bet a lot of other people who live in the neighborhood also looked at it. Were any of you actually directly involved with this transaction? Did any of you bid on it?

“No, that’s just a hyperbolic reach.”

Precisely. My FB comment was directed at eddy’s strawman at 10:27AM, which was probably in response to some other person’s strawman somewhere else.

And your last sentence, flujbot, is pretty much what I’ve said regarding FB before – that a few folks will get very rich, but the effects on the overall market remain to be seen. But I guess your personal realtor biases are not allowing you to read my words for what they are.

“overall market remain to be seen.”

But you fail to “see” that the tech buyers, and notice I didn’t say FB, are affecting the market right now. The 23rd st property, this one atop the tread, etc. Why? Because it looks minute to you. But at the end of the day it’s three or four buyers circling various properties that don’t even make up a dataset. SFRE exists in the margins and that’s why scoffing at anecdotes is foolish. It’s happening right now, man. (And sorry, but bot, for me? my voice on the interwebs? That’s beyond inaccurate. You would do well to leave that uber-rote voice behind every 10th post or so, so that people talk to you with words that have some meaning.)

“the market is active and people are buying houses. But prices aren’t expected to materially fall from a double-dip or surge from shortages driven by tech millionaires.”

Why you gotta go get all serious, make logical statements and ruin all the fun!

“and the market is better than it has been in recent years. Those are facts.”

Prestige index down 3% YoY.

21 Bids Hot Market uhhhh I meant Facebook!!! uhhhh I meant tech

Read! Really!

^Not sure why you’re getting away with this silly little pseudonym shtick, silly troll person. But it’s pretty played out and it makes the site look more biased than usual.

-3% yoy is actually better than what the prestige index showed in recent years (e.g., 07-09)

Read!

“I saw a lot of hype like this around 2005/2006 and a lot of people lost a lot of money listening to the hypers.”

“-3% yoy is actually better than what the prestige index showed in recent years (e.g., 07-09)”

Funny how Truthiness works!

I was an absolute bear on SFRE in 06/07 and my comments from those times support those comments. And I’m not now a bull.

Really!

A big grain of salt on the prestige index. It includes many areas that do not function the same way.

“I was an absolute bear on SFRE in 06/07 and my comments from those times support those comments. And I’m not now a bull.”

OK. But volume was higher in 06/07, more active buyers.

You think there were at least 21 buyers then?

And how’d that work out for prices? In any index?

The great thing about Truthiness is all the pieces fit together nicely!

Not saying $1.5M for this place is guns and canned food time, but if the market is so solidly mediocre why flog bad stats like Multiple Offers?

I will not repeat this enough:

21 OFFERS is NOT 21 BUYERS

Except if someone has real insight on the transaction, and there were 21 individual buyers making 21 separate offers, please let’s put this misreading to rest.

Seeing this repeated over and over again is very annoying.

Ha! AT is now claiming others are using truthiness! If that isn’t the pot calling the kettle fat. Hahahaha.

“The market dipped and corrected. Everyone agrees on that point. A $350k combined annual salary isn’t going to get your a super nice / prime SFH in SF. Ever. No one is on here saying we’re roaring back to those bubble prices (assuming you ignore, of course, all those turnkey dwell flips). Fact is that there are a lot of active buyers in the market and so long as there are active buyers out there it is hard to say with any confidence that we’re going to see another massive double dip.”

I don’t know that we all agree on this. I don’t know that we have corrected or not. To me, it’s all just noise and the truth will be told over a period of years. (and i’m not a big r/e bear.) It’s true that San Francisco is always going to have active buyers and latent potential buyers. But I think the flip side is true and there are latent sellers as well. I know two people who have had properties on and off the market, and a few more who are uncomfortable and would like to sell but keep holding out hope to sell in better conditions- thus the compressed inventories. Given, my sample set is small as I’m not in r/e, but it makes sense to me. They are people who bought during better times and now have an uncomfortable percentage of income going to their mortgages- and a percentage that is probably long-term unsustainable. But the difference between SF and other places– they still have jobs, income (that would be considered high in any other part of the U.S.), and are not forced sellers– just uncomfortable owners.

The net of it? You buy a house that you want to live in for 10+ years and shop for relative value and you’re probably fine. I still think we will have a ho-hum housing market for years– Bears wait for the 50% drop that never comes. Bulls wait for a return to the booming past. We’ll probably have quarters where one side or the other will have a lot to point to, but think it’s just noise for now . . . But who knows . . .

“21 OFFERS is NOT 21 BUYERS”

Yup!

And even if it were, there were more than 21 buyers in 06.

Detroit probably has more than 21 buyers.

“and are not forced sellers– just uncomfortable owners.”

Yup!

More buyers at 30% under. More sellers at 30% over.

Totally agreed with futures, especially on the inventory observation – a lot of trapped owners out there. Will be interesting to see if listings increase ahead of FB.

“trapped owners”

Buyers from 2005 to 2008 might be 20% down overall. Strong areas might be 5%. Weak areas might be 30% or more.

But if you consider volume, maybe 4-5% of current owners did effectively purchase between 2005 and the top of 2008. You have prop 13 and sticky owners to blame for the low turn-over. Some of the bubble-toppers have already sold.

Of these relatively few buyers, some have put 20% down or more and are therefore not very likely to be under water. Others bought for the long term and do not care too much about a 5-y span.

Therefore “a lot of trapped owners out there” might not be the best representation of what’s going on…

“I will not repeat this enough:

21 OFFERS is NOT 21 BUYERS

Except if someone has real insight on the transaction, and there were 21 individual buyers making 21 separate offers, please let’s put this misreading to rest.

Seeing this repeated over and over again is very annoying.”

I don’t follow you. Getting 23 offers (the actual number) does mean 23 offers from 23 different people? What do you think it means.

I guess I am confused about the industry lingo. For me an offer is when I propose a purchase price to a seller. If he refuses I can propose another price and this would be a different offer, right?

If it is not, and if there were 23 actual offerERs, then apologies. I’d like to have a pro confirm it.

I’ve always understood that “X” amount of offers meant that there were the same number of individuals making offers.

“If it is not, and if there were 23 actual offerERs, then apologies. ”

Not my point there.

My Yup was for “23 offeres isn’t necessarily 23 buyers at current market pricing”

Just like futures point about listed inventory vs potential sellers in a “better market”.

lol,

I think 23 offers mean 23 different people. The next step would be “multiple counter offers”. Where say 3 of the 23 are about the same and you send a new number back to those few. Then the best “counter offer #3” is who buys the house. These would not count in the description of the number of offers received.

Now Readingfor Realtors is talking some other non-sense. Any of the 23 people who wrote offers would have bought the house at the price they offered. So they are real buyers, not at $1.5M but somewhere around $1.1M. They will buy something soon if they don’t get priced out forever bwah ha ha ha ha

“Any of the 23 people who wrote offers would have bought the house at the price they offered.”

“Why? What problem does this solve? I could’ve offered $50 for this place. Is that relevant?

Posted by: R at February 24, 2012 10:06 AM”

Yup, And the price they offered could have been anything.

Redding! Really!

(Redding is a small town near Shasta with a pioneering DRE to GRE program that helps Realtors with the reading and the writing and the rithmatic!)

Offers and Counter Offers. What is the big deal? Aside from developers looking for deals, and they are out there, anyone that takes the time to put in an offer on a home is a serious buyer. Talk about truthiness. Unlike Tipsters statement that he would buy a car at a 30% discount; it is obviously much more probable that anyone would sell their asset for 30% more if you could replicate the same thing retail pricing. The other point is that the scamish lending and mortgage practices are no longer in place so these offerers (aka real potential buyers)are more genuine / qualified. I’ve not heard much in the way of rampant low-balling but maybe the agents can chime in with better data.

And what is the big deal with the industry reports from real estate agents being referenced and removed?

“Offers and Counter Offers. What is the big deal?”

Read the 09 thread to see the hype.

“offer on a home is a serious buyer. ”

Could be serious at 30% below market. Could be serious at 1% below market. Admit that and you’re in the clear!

“Redding! Really!

(Redding is a small town near Shasta with a pioneering DRE to GRE program that helps Realtors with the reading and the writing and the rithmatic!)

”

Now what are you talking about?

I totally agree with eddy. The offers could have been anything, but in reality these people did not go out of there way to see the house, write an offer and go with $50. Now they all know what they would have needed to write the offer at in order to buy the house. They will use this information on the next offer, and there will be a next offer.

You’re a silly hater joke, and bullish hater posters don’t get the same leeway. It is a very bad, bad look all around. Congrats on messing up your own hobby, dunce.

“So they are real buyers, not at $1.5M but somewhere around $1.1M.”

Looks about 30% under to me.

Maybe they’re in somewhere else at $1.5. Maybe they’re only in at $1.1

If they’re offering 30% under market they are buyers at 30% under market.

“You’re a silly hater joke”

I don’t think sparky-b is a silly hater joke. He just needs some help connecting the dots.

Look at what is going on over in Cole Valley, Right. This. Very. Moment.

785 Cole St, 1027 Cole, 121 & 137 Beulah, Belvedere. And this is not an exhaustive list. From another thread, “Cole Valley is on Fire”. All those homes are selling fast, over asking and multiple offers. Dollars to doughnuts says that the same crowd are all bidding on these same places. Make. Sense.

connect this dot if you will Reddherring:

$1.1M ( ) $50

My point is that they are probably in the market for a $1.1M house. They thought this would be one it wasn’t. They are still a buyer in that price range.

They aren’t 30% off the market by the way. They are 30% off what someone overpaid for an overhyped house, and they are better off for it.

P.s. You didn’t answer what you brought Redding and your GED into this discussion for.

“785 Cole St, 1027 Cole, 121 & 137 Beulah,”

Yeah Yeah, get caught. Change the subject. Facebook millionaires or something.

For Truthiness all but one of those places look to be in the $2-3M.

So no, it doesn’t seem reasonable that people who optimistically topped out at $1.1 are bidding on places in the $2-3M at market pricing.

You don’t like doing the time, so don’t do the crime!

Truthiness!

“My point is that they are probably in the market for a $1.1M house. They thought this would be one it wasn’t. They are still a buyer in that price range.”

Maybe. Or like you said, they could be pro’s or just have an eye on the investment/valuation aspect and would only be interested in under market pricing. Just like sellers waiting for a better market.

40% overbids must have a negative silver lining somewhere. RFR, please chime in with all your theories.

If they only want under market projects, they won’t buy something that hits the MLS. Becuase it will be bought at market.

I do think some of the offers were from pros. Those pros are still in the market for something and everyone will still have to compete against them on the next one.

I am somewhat surprised Cole Valley would do as well or better than NV. It’s around 10 minutes further from the 280 than NV. What gives? I know it’s a nice area, but is it the same crowd?

“If they only want under market projects, they won’t buy something that hits the MLS. Becuase it will be bought at market.”

I Lose a point for that one.

Should have said under current market.

If owning costs you an extra $1k/month vs renting at current market you’ll have less buyers than if the market drops to saving you $1k/month vs renting.

“40% overbids must have a negative silver lining somewhere. RFR, please chime in with all your theories.”

Never heard of negative silver or why you’d line something with it.

Here’s the theories:

1) Number of offers is useless unless you know the amounts.

2) More buyers at lower prices. More sellers at higher prices.

@ReadingForRealtors at February 24, 2012 4:47 PM

Your post. It. Makes. No. Sense. = Gibberish

I’m sorry if you don’t think those homes aren’t worth what the market commanded. Hang in there, I’m sure your sure they will all be burned back down to a price you think makes sense. Good luck.

“So no, it doesn’t seem reasonable that people who optimistically topped out at $1.1 are bidding on places in the $2-3M at market pricing.”

Read Again!

You’re starting to smell like 10 pounds of Realty in a 5 pound Sack!

Good Luck with that!

lol,

I think there is a NV pool and a CV pool and a pool who would take either hood.

The south bay commuter is looking mostly at NV, it’s a bigger pool but it’s also a bigger hood. Cole Valley + BV/Ashbury heights & Corona Heights only have 8 houses for sale.

“I don’t think sparky-b is a silly hater joke. He just needs some help connecting the dots”

Sparky is often the one connecting the line segments, actually. If he isn’t then it’s not geometry or ReadingforRealtors level remedial math and not for your eyes. It’s there if you want to learn. People are sharing. But if you can’t see the wood for the trees that’s on you, silly+hater+joker+we’re left to think the editor finds you amusing for some reason.

“Sparky is often the one connecting the line segments, actually.”

Line Segments?

Here’s me connecting the line segments.

See, I read not just the 09 thread but the ones linked from there too.

https://socketsite.com/archives/2009/03/socketsite_sees_seasonality_versus_a_rebound.html

Who’s going off on that one with the “You’re a joke” line?

This “anonn” guy that the other posters respond to as “fluj”

And here’s the money quote:

No, I am not an agent. I am a client of fluj. And so I have first hand knowledge that what you are saying in regards to him is false. Fake quotes when used the way you did make it sound like you are quoting him. I’m trying to clear the waters, claiming that all agents are alike is muddying the waters. Fluj is on this site and thefrontsteps saying he does not believe what this article is saying.

Posted by: sparky-c at March 13, 2009 3:02 PM

So I’m connecting these lines

anonn — anon.ed

sparky-c — sparky-b

So don’t get all Shillbo Baggins like you’re just a bunch of interested parties trying to keep things unbiased.

Truthiness!

eh? That thread where anonn shreds sfhawkguy for lying through his teeth and being a churlish irritant, such as yourself? What’s it got to do with the price of fish?

23 Offers $1.5M not bad as long as there’s Truthiness about what that means.

Wanna be in business with the Guy? No Problem unless you try and pretend to be the bias police.

So how’s about that Truthiness?

You and sparky-b in business together?

A Yes or No answer will be fine.

I wasn’t looking to fool anyone with the name change. The b and c come from an old discussion of “plan C neighborhood”. I changed to sparky-from a plan c hood for a bit, but then on the advise of anon.ed I bought in NV march of 09. Great advise and I changed my name (and shortened it) to sparky-b. Also I think it sounds more like a bad rap name, and I am a bad rapped (but a good break dancer) so I kept the name.

I like everything I said in the link you put up by the way.

Are we in business together, not really. I buy and sell real estate sometimes, he finds me places to look at, sometimes I buy them. Later he sells them. So we work together in that way. In the past we have invested together as well. So your answer is sometimes. I could use any agent I want to, and if a different agent brings me a good deal I’ll take it. He has other developer clients as well. So, I think you mean do we have a company we own together? No we don’t.

Perhaps you were talking about my award winning spirits company. If so the answer is No, anon.Ed is not involved in that.

Also “truthiness” is stupid.

Geeze, crowing about Noe because prices have only fallen to 2005 levels, 7 years ago, instead of 2002 or 2003 like just about everywhere else in the city? I guess if that’s the best you got, you crow about it! But what a joke.

Sparky D was a female MC of some note. I got one of her records: http://www.youtube.com/watch?v=z6N5X_SPkSE

There seems to be a bit of a perfect storm––nice weather making houses sparkle, low inventory, high rents pushing would-be renters to consider buying, and the hype about FB making some people panic. I suspect some tentative sellers will see what’s going on and put their places on the market, pushing inventory up over the next few months (as always happens in the spring anyhow). In my experience, February is a good month to sell, not to buy.

I looked at 4332 Cesar Chavez (not the home featured here) and seriously considered putting a bid in. It is a very ordinary, small Noe Valley home that needs some work. It was listed for $799k and sold for 1.1M. That one put me back firmly on the sidelines.

http://www.redfin.com/CA/San-Francisco/4332-Cesar-Chavez-St-94131/home/1994162

I think it’s a good strategy for selling agents to price low when inventory is low, but it’s no fun for buyers. I’ve been on all sides of that process–the lowest bidder, the highest bidder, and the seller with multiple offers in hand. In my experience, the sensible buyer that pays attention to comps never gets the home. I think it’s a terrible time to buy in Noe, but this too shall pass. I hope 🙂

As for trapped sellers, I think you have to go back earlier than 2005, because many folks who bought earlier refinanced and/or put money into their homes (remodels, retrofits) that still can’t be recouped at current prices. There are also those people who bought at pre-bubble prices and have equity, but can’t afford to move up to the next level of home. So there are home owners who actually want prices to drop so that they can afford a larger home or a better ‘hood.

It may be that I’m going to be priced out forever, but I’m not going to decide that based on the current mini frenzy.

“I am somewhat surprised Cole Valley would do as well or better than NV. It’s around 10 minutes further from the 280 than NV. What gives? I know it’s a nice area, but is it the same crowd?”

We were in the CV but not NV pool. We dislike Noe for multiple reasons. So we bought a SFH in Cole last year — and were prepared to pay more to live there vs. NV.

However, we commute south only occasionally, so freeway was not a major factor for us.

“There seems to be a bit of a perfect storm––nice weather making houses sparkle, low inventory, high rents pushing would-be renters to consider buying”

It’s not a perfect storm. Other than the weather, all the things mentioned are just the current market conditions. The high rents are something not discussed frequently and was a frequent argument many used as the basis for the double dip theory. GLWT.

“It may be that I’m going to be priced out forever, but I’m not going to decide that based on the current mini frenzy.”

Don’t take this the wrong way, but there are a lot of people that cannot afford to live here. San Francisco is not a first time buyer market for the average wage earner. I’m not exactly sure when the transition happened, but sometime in the early 90s the market here changed; so unless you owned before that time and rode the wave / bubble(s) up to current levels; or if you have the advantage of a windfall; or if you happen to be fortunate enough to have a recurring / stable high income — you are likely among those who are ‘priced out’. It’s OK.

“but sometime in the early 90s the market here changed; so unless you owned before that time and rode the wave / bubble(s) up to current levels; or if you have the advantage of a windfall; or if you happen to be fortunate enough to have a recurring / stable high income — you are likely among those who are ‘priced out’. It’s OK.”

Read up on prices all over the US!

Most everywhere went up. Then went down.

National bubble. Not the 90’s not Noe, it wasn’t different here.

Read around. Every lying sack of Realty all over was saying “It’s different here” Wasn’t and Isn’t

Truthiness!!

Why does this guy^ get to bait without content, ed? It reads like a Socketsite editorial departure because lots of better/funnier/smarter posters tried similar things previously only to get deleted. Is this a friend or family member posting? Odd looking stuff.

“Why does this guy^ get to bait without content, ed? ”

You guys started off with the full mental “Ackkk, tipster king of trolls” we’re just regular folk song and dance. Joke this and that and all…

I can play there too. Give ya the home court advantage and all.

If you want content, do you or do you not think there was a national housing bubble more recently then the 90’s?

I’m not interested in talking to you until you change this insulting routine. OK?

“You guys started off with the full mental “Ackkk, tipster king of trolls” we’re just regular folk song and dance.”

Tipsters first comment on this thread was,

“22 remaining active buyers? Where do you get that? 22 remaining active lowballers is what you mean.”

which came after you were already coming through with a “42 offers on 555 Edinburgh” line.

so if you “Read! Really!” you’ll find that is not how this went.

“so if you “Read! Really!” you’ll find that is not how this went.”

Accurate Again!

But I was talking about my first post a few weeks ago pointing out a few money quotes that some guys conveniently forgot to mention from links they put up.

https://socketsite.com/archives/2012/01/its_bazynga_as_the_pincus_pad_in_cole_valley_closes.html

And I got:

Insider Trading? Really? You are king of trolls and your falsification and purposefully misleading statements are crazy.

You are consciously confusing “shareholders” with “option” holders, and further confusing option holders with those in possession of wholly illiquid RSU grants. I personally know 5 FB employees hired in the past 18 months that stand to gain a significant windfall.

Nothing you fabricate will change the facts.

Posted by: eddy at February 8, 2012 9:53 AM

And even your beloved “Truthiness” was not me:

Truthiness!

Posted by: R at February 8, 2012 10:42 AM

Oh you were talking about your first post from weeks ago on a totally different post . How could I have missed that obvious connection.

And a bad catch phrase is one thing, but using somebody else’s bad catchphrase that is just pathetic.

BAM!

There’s nothing more entertaining than watching a bear partying like it’s 2009.

It’s like a guy I saw in 1983 making a fool of himself with disco moves on Duran Duran. Ouch. It’s still branded on my retina.

“Accurate Again!”

“”If they only want under market projects, they won’t buy something that hits the MLS. Becuase it will be bought at market.”

I Lose a point for that one. ”

Now I lose two points.

The “Accurate Again” was sincere. The Again a reference to my first bad wording.

ReadingForRealtors – Yes there was a national housing bubble more recently then the 90’s, so? Is the national housing bubble the reason that over 60% of SF’ers are renters while over 60% of the US are homeowners? Oh wait, that’s right those numbers must be wrong because SF wasn’t and isn’t different, its the same as the nation.

Funny that you seem to be disagreeing with Eddy’s comment that SF is not affordable to average wage earners and is not a good market for first time homebuyers. Unless you are trying to claim there is nothing unique about SF so therefore no where in the US is affordable for average wage earners or first time homebuyers. Interesting argument to try to make.

ReadingForRealtors, facts and logic aren’t going to work with this group. You’re debating a bunch of guys who are either realtors or recently bought in SF, and they are sure, just sure, that prices will only climb from here because “SF is different” or “the internet” or something. And if you disagree you are a “troll” and they will whine to the editor that your comments should not be allowed.

Remember, their ringleader famously predicted in mid-2008 that “It’s over. Sorry. Scare tactics are dead. San Francisco never really took a price hit and it won’t, either.” So you can see the track record of this bunch. But party on Wayne!

facts and logic, now. Can you find another word? You so love to misuse the word “logic.”

No, not facts and logic. Tipster, for example, has modified his stance like four times already. Why? Because all his fake facts were challanged successfully, with actual links to true facts and reputable sources, using logic.

I think “fact” and “logic” are appropriate words. 1422 douglass just closed today. Noe place down $150,000 in 5 years, and heck that’s not even figuring inflation into it. And that’s the hottest segment of SF, a Noe house.

Now, why don’t you whine to the editor to delete this inconvenient fact?

Why don’t you go “anti up up up” when people are actually saying up up up to begin with? You’re wading in sideways, trying to argue “facts and logic” using an example that isnt pertinent. For me, all I said was these guys got the list price wrong, and it worked out well for the seller. You’re so three years ago, dude. Wake up.

Three years ago? Dude, that place closed on Friday! 2012!

btw, see how I didn’t complain “Ma, he’s lookin’ at me funny” and demand that the editor remove your nothing post? I can refute any of your B.S. slinging pretty easily and don’t need to run to the ed. You should try it.

You are a little late to the party RFR. Your schtick would have been more appropriate 4 years ago and if you went back and read some of the posts from that era, you would know more where the rest of us are coming from.

We had about half the regular posters here predicting 50% declines in SF real estate. It turns out that they were wrong, though none of them will admit it.

Some people predicted more moderate declines and yes there were a few realtor types who never admitted the likelihood of a decline.

But the fact remains that San Francisco real estate market since 1980 has outperformed the overall housing market both on the way up and on the way back down.

Until you understand that you have no business making fun of people who say “it’s different here.” Because it has been and remains different.

Why are you talking about that Douglass property again? What about it makes it the avatar of everything you wish to communicate? Why not the 23rd street property? No, your whole “Anti the way bulls talked in 2007” shpiel — that’s what’s so 2009. Not cherrypicking individual properties. That was never anything at all.

The 23rd street place? Up 7% from EIGHT years ago? LOL. Inflation has been about 20% during that period. And this is another Noe house, “out-performing” the rest of SF by a mile. So much for SF being “different.” Hoo boy!

NoeValleyJim wrote, “We had about half the regular posters here predicting 50% declines in SF real estate.”

No Jim, we didn’t. Ever. Please either go back and find some links to where 50% of the posters predicted 50% drops, or stop making this idiotic claim over and over. Maybe 2-3 people predicted declines of this magnitude, and that was before the mother of all bailouts proved them wrong (anon.ed calls that “context”).

In any case, it seems the best rebuttal to a BS strawman is another BS strawman. Remember when you plus half the people here were saying that SF prices would never ever fall? Look how wrong you all were! Now those same pretend people are all claiming that the FB IPO will raise prices citywide by at least 20%! We’ll see how right they are…

See my comment on this thread:

https://socketsite.com/archives/2009/03/4214_26th_street_a_remodeled_noe_valley_apple_on_the_tr.html

There are at least seven different people I quote on there and I certainly did not catch all of them.

You are correct though that many people were over optimistic during the height of the bubble and many of them were posting here on Socketsite. Both my father and father-in-law got killed investing in real estate at that time. I did my best to warn them.

And as hard as it might be for you to believe, I was busy posting over on patrick.net agreeing with the group there that the bubble in real estate prices had gotten out of hand.

Hey anon, pick a real handle or I am not going to bother replying to your comments.

“60% of SF’ers are renters while ”

“You are a little late to the party RFR.”

Man! So many Straw Men I’m getting Hay Fever!

Renters? Wage Earners? First-Time Homebuyers? 4 years ago?

What?

So Realtors are more honest or accurate now compared with 4 years ago?

They’d be more honest if SF was 55% renters?

With more First-Time homebuyers?

Point was that denying the bubble at this point is a big shillbboleth of Realtors.

“Until you understand that you have no business making fun of people who say “it’s different here.” Because it has been and remains different.”

Like I said with facebook. If your version of “it’s different here” is cool with having the next four years of RE prices go like the last four, I don’t care. If your version of “it’s different here” is like your ringleaders ” San Francisco never really took a price hit and it won’t, either.” then the Truthiness comes back and ya gotta think if you guys were saying that 4 years ago and it didn’t happen, what’s different now?

Clearing up some loose straw. Not saying the next four years will be like the last. Just heard all the shilling last time and reality happened. So why is the shilling any different this time?

“We had about half the regular posters here predicting 50% declines in SF real estate. It turns out that they were wrong, though none of them will admit it.”

And Truthiness Man! I searched on that quote and anon was right, your ringleader dropped that bomb on the Ritz Carlton.

https://socketsite.com/archives/2008/06/a_concerning_comp_and_empty_shell_at_the_ritzcarlton_re.html

Actual result looks like it sold for $665k from 1.193

44% drop

Don’t know who these straw men were predicting 50% down, but if your guy called “San Francisco never really took a price hit and it won’t, either” and survey says -44%, I’m calling it for the other team.

“Both my father and father-in-law got killed investing in real estate at that time. I did my best to warn them.”

That’s my point!

I know exactly what happened the last 4-5 years.

So any sort of crystal ball that let that slip through isn’t doing me or anyone else any good!

@NVJ: ironic you linking to a thread where the editor called you out for making a similar strawman attack, as I just did – this a hobby of yours or something?

In any case, LMRiM and diemos are the two I was thinking of – they did indeed make such a prediction and disappear. Many other predictions of drops made, but nobody else was that specific or repeated the same prediction multiple times.

Plus most of those other people weren’t really “regular posters” as you wrote. LMRiM spawned a lot of fanboys/copycats who rarely posted original content. And there were/are more than 2 regular readers here, your penchant for exaggeration notwithstanding.

So half the regulars did not predict 50%, did they? So why do you keep repeating this? As I said above, I think this blog thing works better when we address the comments people actually make, in context, rather than exaggerating the ones they don’t make (or made 3-4 years ago in the wake of Fannie & Freddie failing, etc.). Just my opinion, though.

Story Time

A Guy says he can predict the stock market by looking at flocks of birds.

Makes no sense and his predictions have all been bogus.

Does this mean the market will go up? Provides no real information

Does this mean the market will go down? Provides no real information

But the real moral of the story is that if you spend all your time looking up at flocks of birds trying to predict the market all you’ll get is a face full of crap!

Predictions up based on Nothing are worth Nothing

Predictions down based on Nothing are worth Nothing

I also expected 50% drops based on pure rent-vs-buy metrics in 2008-2009.

Then I looked around while shopping for a place and noticed recognizable patterns of strength. Sellers were very rarely the distressed kind in SF, which meant they could wait out the cycle. Many buyers with sizable downpayments. Good property still selling very well at a minimal discount considering what was going on all around.

Also I had many friends on the sideline all waiting for the market to crash some more and all with very strong financials. I figured I was not the only one making that bet and I switched my position 2 years ago and acted on it.

“I figured I was not the only one making that bet and I switched my position 2 years ago and acted on it.”

And it wasn’t only your position you switched but your handle too. A while ago I wondered where regular SocketSite poster San FronziScheme had gone. Now with the help of my patented linguogrammatik text analyzer and soft serve yogurt machine which has been making bleeps and blurps over the last few months we know the truth.

lol the bull is San FronziScheme the bear.

Lets look at the similarities:

– knowledgeable about European markets, especially France.

– demonstrates experience with investment property

– usually writes in cogent good English

– uses the malapropism “bangs for the bucks”

The last one tipped the LTASSYM over the edge as it simultaneously invented a whole new flavor based on a fusion of Vietnamese jelly desserts and British tooth rotting fizzy candy.

Anyways glad you never left San Fronzilol. I’ve always enjoyed your input whether it smells of bovine or ursine sweat.

[If y’all recall LMRiM disappeared at the same time as San Fronzischeme. I’m confident that he hasn’t yet returned because he cannot resist dropping the H bomb in short order.]

Fronzischeme wasn’t a native English speaker, or as knowledgeable about some old school SF things the way lol is. So, no.

As to this? “Don’t know who these straw men were predicting 50% down, but if your guy called “San Francisco never really took a price hit and it won’t, either” and survey says -44%, I’m calling it for the other team”

Nobody’s ringleader, first offf. But never has one off the cuff blog comment from somebody who was fed up arguing with people who were off by a year or so — always talking throughout 2007 as if it was already late 2008 — gotten so much run. Markets don’t last forever. You don’t get to be wrong for a year and then, oh gee, I told you so. They made hundreds of incorrect price trade predictions, that crew. OK? So yeah. It was annoying. Anyway, ever hear of hyperbole? You know, the stuff that 50 percent of you San Francisco haters never really stopped lashing out with? hahah.

So let that be a lesson to you. It was to me. Don’t use one property to make a huge statement. Whether a Ritz condo or a house on Douglass in “Noe Valley” that’s 600 feet from the Diamond Heights Shopping Center. We can discuss whether “never” is more accurate than “50%” another time, in hindsight. I happen to think it is by quite a wide margin.

The LTASSYM is unable to determine a writer’s native tongue. He does use the language well. I never recall San FronziScheme stating that he wasn’t a native speaker either, just that he ran a property biz in Paris. But that might explain “bangs for the bucks”. I’ve never heard anyone, anywhere, at any time use that malapropism (usually a singular “bang”) except for these “two” posters.

I think this appropriate

http://www.youtube.com/watch?v=PSPtSEIlp8A

“Anyway, ever hear of hyperbole? ”

All I know is I heard a bunch of “It’s different here prices won’t drop because Blah Blah Blah” and never “It’s different here prices will drop less than 50% Blah Blah Blah”

“Case-Schiller below 110 and everything in the city 50% off peak prices by 2011.”

Posted by: diemos at December 20, 2008 5:49 PM

Give ya that this Guy biffed it.

And Double biffed it with the everything

“I’m guessing that the SF MSA will go under 100. Perhaps by not too much. 1999 pricing (on average). All in nominal terms of course.”

Posted by: LMRiM at December 30, 2008 10:33 AM

Peak at 220, half way to 100 is 160. Survey Says 130 right now

So I’m giving this one to him

@Eddy, back a dozen comments or so.

I’m not a first-time buyer. I’ve owned two homes, both in the East Bay. I sold the second in 2007 and have been renting since then. I can (comfortably) afford a D+ home in an B+ neighborhood or a C+ home in a B- neighborhood. (Per my own metrics––I have humble needs, unlike many SS posters.) But renting a B- apartment in an A- location seems to be the right choice for now. I’d rather make the mistake of not-buying than the mistake of buying.

I do think that the current high rents are pushing some people to buy, but it’s not clear to me that the high rents will sustain. Rents went up in late 2007/early 2008, but didn’t stay high.

Case Shiller is its own thing. Not interested.

Why lie. Good job, MoD.

@RA, fair points. And I 100% agree that now may not be the best time to buy anything. But I also don’t realistically see another major drop like we saw over these past few years and depending on your outlook / time horizon/ needs / risk sensitivity — you could make an argument to purchase a home. Every home that sells has a buyer that made that assessment.

Over on the quintessential Noe thread I joked about the supposed losses by holding from 08 to 12; but the fact is that owner probably had a fair amount of equity in their home over the 7/8 year hold and came out of the whole situation just fine. Some will do worse, some will do better.

Personally, I find it hard to believe that in 2020 we’re going to have a worse market (nominally) than we have today. So I’m pretty sure the buyer of 4245 23rd Street would fare just fine on an 2020 apple basis. And had the 2004 owner continued to live there for another 8 years they would be significantly above water.

I was about to post that the LTASSYM has NEVER been wrong. Then I read two posts above this one.

I was wondering when the first one of us would turncoat.

MoD: VERY outstanding work.

And isn’t it amazing how agreeable the realtor is to lol who agrees with him, when the guy hated SFS more than anyone hated anyone on this site. It’s going to be a horrible dilemma for anon.ed to have to agree with him now. But my guess is the prostitute in him (and realtors everywhere) will do so readily. Ha ha, anon.ed, you and SFS can now go after the rest of us, together, hand in hand, like brothers in century 21 gold jackets.

Naah that’s not the word. Easy with hate. I know that’s hard for someone like you to contemplate, given that you must feel the world has treated you very harshly indeed in order for you to behave as you do. But as to fronzi, I had a brief exchange with somebody about awkward language use, and how they must not be from the US. Thought it was fronzi. Guess not.

That was just the one-liner kind of low hanging fruit LD. I have plenty of other quotes from at least half a dozen others. And you know that SFS was one of them. So at least three “regular posters” by your legalistic definition of what a “regular” means. How many “regular posters” are there here anyway, by your narrow and specific definition?

Just as we had a bubble of optimism in 2006, we had a pessimism bubble in 2009.

RFR if you haven’t heard anyone say “It’s different here prices will drop less than 50% Blah Blah Blah” then you haven’t been paying attention. Because that is what I have been saying all along. I know you are kind of new around here though and I don’t post as much I used to, so I will give you a break.

“So half the regulars did not predict 50%, did they? So why do you keep repeating this? ”

Speaking of straw men….

A very large number of posters, certainly more than a dozen, predicted drops this large or larger. You can claim that they weren’t regular enough to be considered regular posters if you like, but you can’t deny that they existed.

And as I stated before, I certainly did not catch them all. I am not going to waste endless hours finding every last one of them, I think I have made my point.

I think it is ironic that you think it is perfectly fine to make a hyperbolic and fear mongering claim that San Francisco real estate is going to decline 50% in a few years, but to point it out later as an example of herd behavior and mania is a “Straw Man” in your book. I think you are missing a golden opportunity to learn something here.

Amazing work MoD. Now help me figure out who dub dub is. 🙂

I think the following is appropriate; and is, ironically, laugh out loud funny, in this context:

http://www.youtube.com/watch?v=PSPtSEIlp8A

The closest he ever got to giving himself away was this (which I thought was oddly out of character):

Are we witnessing the wintry moulting of the fluj handle?

Posted by: lol at February 1, 2012 9:33 AM

lol, you could have been verbally abusing him much more badly, and daily! and he NEVER would have done anything about it.

“Give ya that this Guy biffed it.”

Durn that Ben Bernanke and his quantitative easing! [shakes fist] And Uncle Hu for putting up with it! I assumed we’d be having our greece moment by now. Durn that flight to safety into the dollar!

Ah, well.

I’m not sure lol is a bull with all of his comments here and I don’t think there is any shame in anon.ed not having an issue with lol’s generally position. If anything, it seems it more a vindication of sorts that one of the perma bears turned coat. Nothing wrong with taking the ride down and getting off.

@lol, so did your purchase get a feature on SS?

Scratching my head over that one. The argument that somebody one used to argue and debate with a lot becoming convinced to switch over from a permabear to a measured bull, who actually purchases, is something to be embarrassed about? Makes no sense. Then again, it’s Tipster and he just says crazy stuff all day long.

“Because that is what I have been saying all along. I know you are kind of new around here though and I don’t post as much I used to, so I will give you a break.”

Yeah. I walked into to crazy Tribal stuff here

Hang on, go to channel 48 cause this is a Full Mexican Soap Opera!

The LoL Ranger, High-Ho Negative Silver and Away!!, is secretly the ex-arch-enemy of the prices take no hit wonder anon-ed-anonn-fluj who works with sparky-abc123?? But then there’s just plane anon, who’s on the other side?

Craziness!

Had to pull the guy’s card and check this out.

tipster is one of the sanest around here.

Posted by: San FronziScheme at April 17, 2008 6:09 PM

From that to Twister in four years???

Got a wee little splashback on that same thread on ya

Heres the money quote:

Isn’t SF median income somewhere about $75K ? So you’re saying that we can expect median home prices to adjust down to $375K ? Wow ! That’s quite a dire prediction.

I guess median income could also double. Is that what happens in a recession ?

I think a bit of both will happen. I expect that incomes will go up and home prices will go down, mostly due to inflation and eventually we will get back to 5-6X median income. I think it will take 10 years to work itself out though. I doubt if the recession will last that long.

It is entirely possible that the median will settle at a point slightly higher than that, since it is getting more desirable than ever to live near good jobs. I don’t except the current 12X to last forever.

Posted by: NoeValleyJim at April 19, 2008 4:37 PM

12x to 5-6x is 50% in my book

Yeah, you’re talking income adjusted.

But the whole Bubble thing was jacking up the X income then falling back down.

Don’t think incomes are up much since 08 anyway

Well as we say in French, only the fool never change their opinion.

tipster did fit into the reality of 2007-2009 with excellent arguments, but as the bottom was kind-of-reached for prime SF (good job for calling it Plan-B aka Plan-C), tipster never adjusted his tune. What’s valid nationwide might not apply everywhere. The market is a bit as if you were adding sine waves of different frequency and different amplitudes to each other. The nation is the 10-y wave. CA is its own wave, SF is another one. Mix the 3 and you can get some odd results.

The issue with ideas that do not apply to a new reality is that you have to defend them more force and less and less solid ground.

I have always said I was looking for investments. Therefore I am a long-term cautious bull, but short term bear when prices are out of range with reality. Now I am a cautious bull, back to my normal self.

Also, I did appreciate [anon.ed] determination even though our exchanges were a bit heated. His words were stronger than mine (one of his big forte), even though I knew I had something right at the time, having ridden the previous wave successfully. But he became less and less wrong as reality changed. He’s thinking long-term while still having an ear to the ground and it’s a very valuable quality even though he has a vested interest in the long term (nothing wrong with that).

tipster has his own qualities, but they need to be taken with a grain of salt.

@NoeValleyJim: so were you really asking a question, or just being petty? Taking a victory lap since your predictions were less wrong than those of others? I’ll take the high road and assume you were genuinely asking a question. In which case, let me take a crack at answering it so that you hopefully don’t feel compelled to ask it yet again:

Generally, the bears who predicted 50% declines did the same thing as the bulls who predicted zero declines: their predictions were wrong so they either stopped posting, changed their names, or just fessed up and moved on.

Now, If you’re specifically asking about LMRiM and diemos, the former moved to Florida and the latter still posts here – see above. Please direct your inquiries towards him directly instead of that strawman half.

Hopefully that answers your question. Please feel free to refer to this thread next time you’re inclined to ask it. You might consider it a golden opportunity to learn something.

Lastly, regarding fronzi = lol….no wonder fluj commented he was hearing French at open houses…you girls bury the hatchet at the housewarming? And tipster’s commment on the matching jackets…HA!

LMRiM= bought a house in SFW and is not man enough to fess up to it.

I don’t recall Satchel/Lmrim predicting 50% off SF prices. In fact, way back in January 08, Satchel was saying 30% off on average in SF proper, and that it would take 3 years or more.

“About SF proper – my prediction is down 30% on average, within 3 years. Nominal, not inflation adjusted…..

As for specific neighborhoods/types of houses. I expect that the best neighborhoods will show the least declines and there will be further segmentation of the SF marketplace. Maybe 5-20% declines. Many neighborhoods will be in the middle. Maybe 15-35% declines? Some neighborhoods will be annihilated, like down greater than 60-70%. We’re already seeing foreclosures in the Bayview at almost 50% last sales price, so no bold prediction here.”

Posted by: Satchel at January 30, 2008 11:03 AM

Doesn’t seem too far off, in hindsight. I think that later in 09 or 10 Satchel/Lmrim may have revised that 30% average to 40%, due to the bailouts and government policies stretching out the adjustments, but of course that poster always talked about average declines from absolute peaks for all neighborhoods and property types in SF, not cherrypicking in hindsight the few areas and property types that have fared relatively well.

The full Satchel/Lmrim quote referenced above explains the methodology for fleshing out how to measure the decline.

Was there ever a quote from Satchel/Lmrim saying that SF proper would see 50% declines?

“Lastly, regarding fronzi = lol….no wonder fluj commented he was hearing French at open houses…you girls bury the hatchet at the housewarming? And tipster’s commment on the matching jackets…HA!”

I can understand the constant sarcasm and sardonic little takes. I’d be bitter if I missed it, too.

eddy,

Nope, I do not have this luck.

LD,

I was the one mentioning hearing French at some open houses, among other languages…

And no I didn’t purchase through fluj.

4 days ago Gary Shilling, a famous housing bear said “Rental apartments should continue to be an interesting investment area for years, as rising rents provide attractive returns.” I believe he is correct, which is why I am looking for more stuff now, but out of state where the crash is still running its slow painful course.

No, LD if I wanted to do a victory lap, I would point out where I predicted that peak to trough price declines in The City would be about ~25%, which has turned out to be pretty much on the mark, at least so far.

The point is that even smart knowledgeable people are subject to the madness of crowds. Human being are sheeplike. And I don’t exclude myself from the general criticism of the human race.

Which is why Socketsite has been such an invaluable place to run reality checks on. This site probably saved me from what would have turned out to be a very financially painful move of buying a bigger house in 2008. Thanks everyone, especially Adam, for that.

—-