While we’ve already debunked the CBS report that a recent uptick in home sales activity is a sign of a “serious real estate rebound” in San Francisco (we’ll call it seasonality and note that San Francisco sales activity continues to fall on a year-over-year basis), we now turn our attention to their infamous “42 offer” home.

Presented by CBS and their cast of “real estate experts” as another “hard fact” to back their report of a rebounding San Francisco real estate market (also touted as a “mini-boom”), we dug up some of our own facts on the Excelsior home. The address is 555 Edinburgh and it was listed for sale at $459,000.

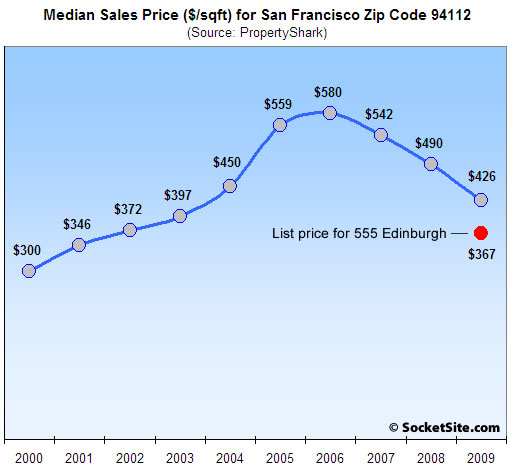

At a reported 1,250 square feet (plus a full basement “with room to expand”) that’s a list price of $367 per square foot. At the same time, according to PropertyShark the median price per square foot for 2009 home sales in 555 Edinburgh’s zip code (94112) currently weighs in at $426. In 2008 the median sales price per square foot was $490, in 2007 it was $542, and in 2006 it was $580.

In other words, 555 Edinburgh was listed at 14% under the 2009 median, 25% below the 2008 median, 32% below the 2007 median, and 37% below the 2006 median. In fact, it was priced right around the 2002 median ($372 per square foot). Even a sale at $100,000 over asking suggests a closing price around the 2004 median ($450 per square foot).

Were the 42 offers on 555 Edinburgh a sign of a “serious real estate rebound” in San Francisco? Once again we’ll say no, it was commentary on pricing. And it’s frightening that any industry expert would suggest otherwise.

∙ Listing: 555 Edinburgh (2/1) 1,250 sqft – $459,000 (pending) [MLS]

∙ SocketSite Sees Seasonality (Versus Signs Of A Rebound) [SocketSite]

∙ SocketSite’s San Francisco Listed Housing Update: 3/16/09 [SocketSite]

I looked at some places out there in 2006/2007 and I’m glad I decided to buy a smaller place for a lot less (probably less then this place ends up selling for). At the time it just seemed like a lot of money to be living so far away from the rest of SF.

Is that red stuff grafitti or a mural or something?

Hm. confusing

And it’s frightening that any industry experts said yes.

How else would they get CBS coverage?

If you don’t send this analysis to Hank Plante then I will. Cmon you guys need to put this sensationsal journalism in place and get SS some print.

Yep sounds about right. We are back to 2004 prices in that district, probably 2005 prices in a lot of the more traditional San Francisco neighborhoods. It still remains to see where the market bottoms out. For my money I’m seeing very few people actually willing to call a bottom.

Good thing, we’ll all have it on record Socketsite offically called ‘no bottom’ here.

Let’s all check back in Spring of next year and see how much further the real estate market has declined and see who’s actually correct – since hindsight will be the only truly unbiased commentator here.

I’m guessing there’s a seed of truth in the CBS story in so much as there are people looking. Not that I would be arrogant enough to call a bottom. Or for that matter, state for sure there isn’t one.

Where and when did anything say “prices up” ? LOL.

[Editor’s Note: Right. Year-over-year sales volume continues to decline along with values, and a listing priced at 2002 levels shocks the industry by generating multiple offers in 2009. Obviously signs of a “serious real estate rebound.”]

I’m calling bottom!

Wow. One news piece spawns a cottage industry!

You have the absolute best analysis of any SF RE site. Thanks!

Pretenders take note.

What about the 30 contracts in 30 days at the Infinity? Since you’re in the official ‘debunking’ game now how are you debunking that oh Socketsite? Even discounted sales over there average well over $1m/unit.

[Editor’s Note: It’s not a matter of debunking, it’s a matter of basic understanding: Infinity Sales Update: New Contracts Up But Driven By Discounts.]

About Infinity, we heard from poster “Outsider” recently that he contracted a unit at $500/sq ft., and that he had been waiting on the sidelines for a while while the sales office was at $1000/sq ft on T1. He didn’t say they were identical units, but he did imply that prices were down quite a bit (in excess of 30% apples to apples on psf basis – Outsider, if I am putting words in your mouth please correct me). Big price drops attract sales from a group of targeted customers (people who have been waiting for T2 to open up).

If those price drops are ballpark reality, 30 sales wouldn’t be very surprising, especially as they just started selling T2. Certainly no sign of huge strength in my book, especially as listings are up and sales are down yoy across SF.

The San Francisco realtor community is running with this story– facts be damned! Do a google search. Check out the number of realtors with blogs that are dutifully passing this [Removed by Editor] along. Here’s one such instance: http://www.lubasf.com/blog/did-san-francisco-real-estate-just-hit-the-bottom.php Some commentators here have also mentioned receiving e-mails cheering on Hank’s misleading “report”. Heck, some realtors have even come to post rah rah comments.

[Removed by Editor]

Clearly, the realtor community in San Francisco is standing four square behind deceptive practices.

Precisely what are the “facts” you’re questioning, SFHawkguy?

You’re mad that Luba is calling bottom? Why?

“A serious real estate rebound” — meaning a spike in volume, at the low end? yeah. That’s exactly what it is. And that’s what is said in the piece. Nobody said “prices up.”

What does a bottom look like? Does it look anything like a spike in volume at the low end?

Repeat. Nobody said “prices up.” So what’s the story with the median this year, and median that year angle? How does that fit into this story?

Now you all can see precisely what’s been effecting mix for about six months or so.

And LOL @ Socketsite will “call it seasonality.” funny. Seems like Socketsite questioned whether this year would see a spring bounce more than a few times.

[Editor’s Note: Without the context of how the property was priced (below current market), generating multiple offers is rather meaningless (and as is often the case, rather misleading).]

I think the editor needs to edit SFHawkguy.

“What does a bottom look like? Does it look anything like a spike in volume at the low end?”

No, actually, that’s what the beginning of capitulation looks like.

“No, actually, that’s what the beginning of capitulation looks like.”

OK, Mr. 50% Price Drop. You’ve spoken.

Not every real estate blogger in the land was toasting this news. In fact, we gave SS some credit where credit was due:

http://thefrontsteps.com/2009/03/12/42-offers-and-a-real-estate-rebound/#comment-8319

This is one scary industry. They provide highly misleading innuendo to their clients and expect their clients to rely on their advice in return for a five-figure commission.

Why the hell do we put up with this?

Isn’t the problem with deflation?

You’re always assuming that prices will be farther down tommorow, and the expectation that prices will fall more?

How many knife-catchers does it take to make a bottom exactly?

I bet that uncle sam thinks that fixing this problem, may rely somewhat on getting ahead of it.

Are you serious? You don’t “put up” with anything at all regarding the real estate industry, Tipster. You’re nowhere near it. You’re not even on the fence. You’re not even buried under the fence, like I thought before. You’re just a guy on the internet who likes to post disinformation as a hobby. Why does this site put up with your blatant fabrications all the time? That’s a more germane question IMO.

This story was about a resurgence in volume on the low end, not price. Sensationalist fluff and not worthy of the legs Socketsite has given it. And you know it. Nice fake indignation. Now how about a hot new conspiracy theory? It’s been a couple of days.

“[Editor’s Note: Without the context of how the property was priced (below current market), generating multiple offers is rather meaningless (and as is often the case, rather misleading).]”

The context exists in the story, plainly. It is Brendan DiSimone’s take. He says that these sort of buyers have been waiting for bottom. And then that’s followed by the Terradatum info, which puts prices as down 10% citywide. That 10 percent clearly fits into your median crusade.

It’s all in there, and all these guys, and you, know it. They chose to frame it sensationally because they are trying to sell commercial time.

Give it a rest.

[Editor’s Note: The CBS context is “prices are down 10 percent city-wide.” Our context is that 555 Edinburgh was not only priced 25% below last year’s median but 37% below the median in 2005.]

Anonn. These deceptions do great harm. Both on the way up and the way down. Your indifference to the harm seems consistent with a reckless disregard that the entire industry exudes. The industry doesn’t care about the facts in this case or if it’s misleading cheerleading will cause harm; it is throwing as much monkey shit at the wall as will stick in an effort to sale more homes.

Your industry doesn’t take its ethical obligations seriously. If it did it wouldn’t have mindlessly cheered this report on or planted it with Plante. Therefore, one would have to be seriously impaired to listen to a San Francisco realtor’s spin about “the bottom”. Indeed, your very response is a perfect example: you are parsing the meaning of “bottom” and how it was used by the industry (and encouraged by the SF association) in this case when the intent was pretty clear. You sound like Bill Clinton when you try to deny that the impression meant to be conveyed by this report.

You did better on Friday when you said you would never send this report to a client in a million years.

“What does a bottom look like?”

Well, I would look for a reduction in the “months of available inventory” number and a reduction in the “percentage of sales which are distressed” number before I’d even bother looking for a bottom.

Currently both of those numbers have been rising.

“No, actually, that’s what the beginning of capitulation looks like.”

OK, Mr. 50% Price Drop. You’ve spoken.

Bottoms in asset markets often look like this: rising volume for a sustained period of time, with flat to slightly decreasing price changes. Translating into the real estate world, I’d be looking for 6-12 months of increasing y-o-y volume (or at least seasonally adjusted m-o-m data) combined with roughly stable medians. There’s a lot of noise and heterogeneity in real estate data, so you’ll have to use some judgment in mean and mean $psf stats.

****************************

About 50% drops, take a look at some of the nearby “comps” identified in the redfin link for 555 Edinburgh:

http://www.redfin.com/CA/San-Francisco/555-Edinburgh-St-94112/home/1204573

For instance, 123 Paris:

http://www.redfin.com/CA/San-Francisco/123-Paris-St-94112/home/1720443

Last sold for $800K (!!) in July 2005, and now 126 DOM at $409K wishing price. I’d say that’s down 50%. LOL at the suckers who thought these places were ever worth that, and LOL at the “expert” appraisers and agents who signed off on those valuations. I’ll keep them in mind the next time an agent like anonn calls me a “fair value baloney salesman” 🙂

BTW, I’m not lol’ing at the guy who bought 123 Paris. 100% financed, not a dime at risk (according to prop shark). Who knows how long he lived there without making a payment or paying taxes? Well played.

I expect neighborhoods like this to fall 60%+ and for SFRs to regularly sell for less than $300K in another year or two.

That is so weird, how could you ever delude yourself into thinking a place like this was “worth” 800K?

My parents’ house in north central Phoenix is 500K and 5,000 sq ft. Relatively close to the center of town too. It’s probably down by half now.

[This is sort of what I asked in another thread, SFHs in San Francisco that do not enjoy 1) killer views or 2) proximity to literally everything and mass transit, what is the “premium” really besides psychology? They go for shockingly high values sometimes.]

Hawk Guy,

It might be instructive for you to actually listen to what is said in the CBS 5 piece. Just a thought. “Bottom” is in the piece, pal. It’s the whole point of the freaking story. I parsed nothing.

Now, the intention of the way the story was framed? That’s another story all together.

And you go ahead with your bad self on those predictions, LMRiM. Nearly every prediction you’ve made has been laughable but who cares? Have fun with it.

I suppose that 41 offers out of 42 with 20 percent down for a pedestrian home in a 10 percent or more down from peak blue collar neighborhood is nothing, right? Right LMRIM, Right diemos? Don’t pay any attention to that. It’s precisely nothing. Why it’s all seasonality!

anonn, with all due respect…

it’s probably much safer to be very skeptical regarding prices involving assets that require huge amount of leverage.

If this global financial meltdown has taught us anything, it’s that.

I don’t think that there’s anything wrong with that healthy amount of skepticism.

Jessep, the only premium I can figure is that for some of these “buyers”, they think having a San Francisco address is a badge of prestige, even if their property is no where near any area or atmosphere that comes close to being the “real” San Francicsco that attracts so many visitors and residents.

It reminds me of the designer label fad where if you could not afford an Armani suit, you could wear the Armani label on your 250 jeans instead.

“Right diemos? Don’t pay any attention to that.”

Why not pay attention to it? It let’s us know that there are at least 41 people out there ready, willing and able to purchase a house … at the right price. Where for these 41 people the right price is apparently around $367/sqft in this neighborhood.

From that we can conclude that the next seller in this neighborhood who is willing to lower their price to $367/sqft should be able to easily sell their house. (Assuming comparable quality in the property.)

I’m not sure what else we can conclude from that except that anything will sell at the right price(which we already knew).

There’s nothing wrong with skepticism. I don’t object to that at all. No. Here’s what it is. I mean, you have Socketsite never once commenting upon how remarkable the 41 out of 42 with 20% aspect is even once. Yet socketsite created, what, three or four posts on this topic? And two charts? I object to inappropriate language and fake outrage from the likes of Tipster and [SFHawkguy], intentional overlooks, willfull ignorance, a lack of reading/listening comprehension (again by [SFHawkguy]) etc. etc.

All of these characters are acting like the NAR told CBS5 how to frame the news story. Or that it wasn’t about buyers perceiving “bottom.” Look at the socketsite editor, wondering about context! It’s laughable. I’m enjoying this, actually. This story has by itself illuminated the bias of this website better than any one thing ever has before.

How do we know that 41 buyers had 20% down in cash? Is it because Plante the plant was told so by the REIC?

I wonder how many of those 42 “offers” were 3.5% FHA deals? How many of those were nonprofit dowmpayment assistance scams? Wouldn’t we expect some activity at the lowest end of the market with these government sponsored scams being touted daily? BTW, how many were at 10% under the list price? How many at list? Without that sort of data, all we can say is that there are 42 potential knifecatchers, some portion of whom were smart enough to lowball.

One thing is for sure: there seems to be a lot of price elasticity with respect to credit requirements. Looking at the 123 Paris property that I linked, 100% financing in 2005 resulted in an $800K price. Today, 3.5% downpayments require something under $409K. What happens when the USG takes the punchbowl away? (remember, folks, this was always about slowing down the decline in real estate values in order to trap people into paying on these assets; the game has always been to protect the banks as much as possible after this credit orgy, and I bet that as the problem gets more and more ringfenced, we’re going to hear more and more that there is nothing more that can be done to “help” housing)

“How do we know that 41 buyers had 20% down in cash? ”

Oh come on. How do you know about anything in any edited TV piece?

Can we at least all agree that the way the story was framed was different from its content?

Have any of you ever picked up anything by McLuhan, or Postman? It’s not a bad idea for anybody to read that stuff.

The implication is clearly that the realtor guy with the 42 offers in his hand told that to Plante. But what really transpired? One thing must be adhered to, however. And that is this. Assume realtor conspiracy and post it on Socketsite

Well, that proves it then 🙂 If you believe that oily snake oil salesman in the video, good on ya!

For my part, I’ll assume the worst, which I think is consistent with the laughably poor reportage of the piece generally.

Let’s get real. To think that 3.5% FHA downpayment scams are not being used by some significant portion of the “bids” on a sub-$729K place is silly. Didn’t we hear just recently that FHA loans are 25% of the SF MSA (don’t quote me, I’m just asking!).

anonfedup,

I think the city needs less of these type of houses and more middle class condos near mass transit, personally.

There’s nothing wrong with living in a condo, IMO, and I think we should be encouraging people who live here to really try to get SOMETHING San Francisco out of it.

“oily snake oil salesman in ”

Please, do regale us with your personal interactions with the realtor in the video. The real life interactions that have caused you to term him thusly?

Yeah. I thought not.

Nice one, jerk.

Lots of interesting commentary. First, nobody can predict a bottom. So anyone claiming to know for sure and/or telling buyers that we are at that bottom be damned. Is area 10 of SF down substantially from its peak in 2006 – yes for sure. Will it go down more – who knows?

What I can say is that there are a good number of ready, willing, and able buyers out there looking for a home. Either as investment only purpose, or to live in. And a good number are working class, “culturely oriented” income savers, immigrant families. Often live at home with the family until married or with children. Then buy a home and often pay cash or a large portion with cash.

Not being racist. Try visiting one of these “not real” San Francisco homes on a Sunday open house. Lots and lots of Asian and Latino buyers…who by the way are real San Francisco tax paying residents.

Sorry for the rant….I bet it sells for $558,888 Cash

[Editor’s Note: It’s not a matter of debunking, it’s a matter of basic understanding: Infinity Sales Update: New Contracts Up But Driven By Discounts.]

I don’t get it. That was clearly stated in the news piece, that the developer is dealing, which is why things are moving. How is that a sensationalized piece? Everyone knows prices are down, common wisdom is if they are going to continue down even with discounts, they shouldn’t be selling now. I don’t see how anyone has proven the basis of the story is false.

That there are 30 contracts in 30 days at the Infinity is NOT a sign of a recovery? A sign is just that, one little sign on who knows how long a road. Next sign might be more positive or less. I dont get all the drama and need to debunk the news story at this site. Sounds like sales are up – seasonally or not, so what, they are up. Didn’t say prices were up, just sales were.

As I recall the CBS news piece was titled SIGNS of a real estate recovery – not omg this is IT jump in now, or you’ll lose out! Where did anyone including poor Hank say that?

http://cbs5.com/local/real.estate.sales.2.956968.html

“That there are 30 contracts in 30 days at the Infinity is NOT a sign of a recovery?”

It is not, it is a sign of capitulation. Especially given our report of a unit going into contract for $500/sqft. Anything will sell if you price it low enough.

My goodness. These must be serious times indeed when the sentence “What does a bottom look like” gets printed in a San Francisco blog with nary a snicker.

I can tell you what a bottom looks like.

wow, this topic sure caused a sh!tstorm!

Just about everyone agrees it was a puff piece. Is it deceptive? Is it a sign of a bottom on the low end. Who knows, and really, who gives a damn. It’s one story out of many.

This country is a capitalist democracy (in case some forgot). CBS local news is largely kitch. Realtors will use info to their advantage- buyers always need to beware. The misguided masses create buying opportunities for those who are (sometimes) wiser.

Oh I’m sick of this tired ass topic…time to watch re runs of the real housewives of the OC. Next!

I’ve read so many comments over the years on this site pontificating how the prices in San Fran are going down. Well, in the 94117 zip code they are not down. Looking at depressing open houses this weekend and comparing it to fall 2006, every place we saw was more expensive than 2006. This is through the worst realestate meltdown in 70yrs.

Wake up – prices in San Fran are not down, at least not for interested buyers in good, not fancy areas. All the wishfull analysis and snarky comments doen’t change that.

Does make me think they will never go down, if this didn’t do it. Guess San Fran is special.

@45yohipster,

OC was ground zero for the sub-prime mortgage industry. I know you’ll be thinking of SS while you watch.

J

“I expect neighborhoods like this to fall 60%+ and for SFRs to regularly sell for less than $300K in another year or two.”

Yeah. All right. There’s a lot of opining going on here about “neighborhoods like this”. Most of you guys don’t have a clue about “neighborhoods like this” apart from your beloved MLS stats. Many of you quite openly look down upon “neighborhoods like this” anyway. Unbiased RE expertise? I think not.

Well, living just around the block from the “other” house in the report (the one on Naglee) that sold for $608k / 10 offers, I swung by the other day on my way home, walked up the stairs, peaked in the window, etc. It seems a decent enough house, even if it needs a new paint job (unless you like this color). But it does not stand out. I’m happy to see that so far, predictions such as the one above seem totally and ridiculously wrong. Yes, average and median prices are falling, not the least because there are quite a few foreclosures and short sales, but decent houses can be decently priced, and there are people willing to buy. Certainly we’re going downhill and this is a recession, but it’s nothing like a free fall at all. BTW if you all need proof that “neighborhoods like this” are in fact part of real SF, look no further. This is SF all right, and it’s more desirable than many other RE opportunities. Perhaps not to you, but many people actually like these neighborhoods and houses.

Why is it this story is deemed too insignificant for Socketsite to cover by anonn and yet not too insignificant for a realtor to email me with the subject heading: “San Francisco Housing Rebound”? The email refers to the news story and says that “the driving factors are historically low interest rates, more rational asking prices, the availability of credit and the effects of pent-up demand”. Funny, no mention of seasonal effects.

Fortunately I’m plugged in enough to know what’s really going on. Shame on realtors who try to mislead potential clients.

It isn’t too insignificant to cover. It’s rather noteworthy. But Socketsite has chosen to devote, what, three, posts to the subject?

How in keeping is that with typical editorial maneuverings?

Come on, matlaw. Shame on you.

Dunno if it was deceptive, but it definitely was a shabby piece of journalism at best. There is NO “mini boom” past two weeks. That’s been debunked here, twice now. Hank Plante simply passed on the stories realtors told him without doing his own homework.

Anyone who thinks that the real estate industry has anything other than their self interest in mind hasn’t been listening to Lawrence Yun for the past three years. I suspect Hank Plante is one of ’em.

Totally shabby journalism = yes.

Totally irrelevant that there were 42 bids on an Exelsior property, purportedly 41 with 20 % down each = no.

Anonn,

I don’t think anyone cares that some reported panders to the real estate industry. A lot of them do. They spend a lot of money. I stopped getting local papers years ago because they basically are cheeleaders for their advertisers. Can’t blame them, especially in an economy that is melting down: people are desperate for their jobs. I’ll now write CBS off my list of credible news sources. No big deal.

But it’s inexcusable for any Realtor to pass this type of story along to a client who is relying on them for advice. I hope the clients who received links to the “story” see their real estate salesperson for what they are: people who will do anything to get you to part with your money, including misleading you.

Those clients may want to investigate finding someone else or just doing without. It’s hard to imagine what someone like that is bringing to the table. Life is hard enough dodging Bernie Madoffs and the like without someone like that on your team.

It’s not so much the story as it is the what the industry DID with the story.

I learned this years ago in a different city when realtors kept taking my above asking offers and submitting them, knowing full well that all properties were priced so far under market that they would generate a ton of offers from suckers like me and my offers were woefully inadequate, in spite of being hundreds of thouseands of dollars over asking.

Why did they even bother? It was because myy offer served two purposes: 1) to allow the realtors to tell everyone “Can you BELIEVE that property!? 42 Offers!! (feigned surprise) and 2) to convince me to up the offer the next time.

The beans were spilled when a realtor called me to steal my business and said “I don’t think this one will go for the million over.” The million over? THE million over?

And I realized that they were identifying the comps, subtracting $1M and then pricing them like that. “My” realtor of course NEVER let on. Just feigned surprise at each one. And I realized I was being played. Played by an industry in which a lot of money is to be made when you do it right.

Get a clue people, you are being played. Can you BELIEVE that place had 42 offers? Um, yes. I knew it had been underpriced. I’ve seen this story before.

A realtor who knows me just sent me this story…she never sends me more than 1 newsletter a month except this…

fluj,

One of the reasons I created the REO Ratio* was to give you the benefit of the doubt in “real SF” regarding REO, foreclosure and other capitulation tides. The Excelsior is not in the “real SF”, it is in a disaster zone. Do you have any idea what the REO Ratio is in this are? Perhaps it’s a little over one (so not in the “real SF”). No. Two to one? No. Three to one. No. Try going to Trulia and searching on foreclosures. The REO ratio is four to one (those are Oakland type numbers). It is beyond my comprehension how someone could put in an offer on a home in this area when there are as many as four homes waiting in the wings to be sold off by the banks. ARMaggedon is upon us…

*REO Ratio = # of Foreclosures/(# of Resales+new construction) as shown on Trulia. Note that some of the “foreclosures” (NODs, NOTS and actual REOs) stand a chance of being cured before being put on the auction block.

Dang Fluj, watching you melt down over time is depressing. Socketsite is one of the few blogs around that uses real data and is transparent about their editorial line. You might not like it, but that CBS piece does nothing but discredit your “profession”.

@fluj

Would you rather have the press be unaccountable? It didn’t work out so well in the past. Sheesh…

You post as if the bloggers are after your pot of gold, when reality should be telling you to worry more about the fundamentals of SF real estate prices. A tuned in agent would be more concerned about getting prices down at this point. Loans would flow more easily and buyers would be more willing to jump in. Volume is more of a market killer right now than price for REIC professionals.

Anywho, feel free to perpetuate a myth that harms your own livelihood, I guess.?.?!?

>>Why is it this story is deemed too insignificant for Socketsite to cover by anonn and yet not too insignificant for a realtor to email me with the subject heading: “San Francisco Housing Rebound”? The email refers to the news story and says that “the driving factors are historically low interest rates, more rational asking prices, the availability of credit and the effects of pent-up demand”. Funny, no mention of seasonal effects.

Fortunately I’m plugged in enough to know what’s really going on. Shame on realtors who try to mislead potential clients.

“Paying these parasites 5% is an insult. I sincerely hope a day of reckoning is coming for this “profession” and industry. I won’t shed a tear when they’re asking me if I want to “supersize” my order.”

Don’t forget, after my office expenses, professional insurance, and consultants are paid, a realtor makes more on a house than I do as the architect.

If SS is going the way of imdb, can we at least use registered accounts and the ignore feature?

And…I remember when people were calling the bottom of the dot.com bubble.

SS, great job!

Hank…well, you will just be a laughing stock in a few months.

I don’t care what mortgage rates look like today. I really don’t. SF’s top housing market is about to crumble…and, the bottom will go with it…

BTW: Housing starts up this month.

Housing starts rose to a seasonally adjusted annual rate of 583,000 last month, up 22% from a revised 477,000 in January, according to the Commerce Department. It was the first time housing starts increased since June, when they rose 11%.

New construction of single-family homes, considered the core of the housing market, increased 1.1% to an annual rate of 357,000 versus 353,000 in January.

February’s increase was driven by a nearly 80% increase in construction of multi-family homes. New construction of buildings with 5 or more units increased surged 80% to 212,000 from 118,000 in January.

Applications for building permits, considered a reliable sign of future construction activity, rose 3% to a seasonally adjusted annual rate of 547,000 last month.

What do you think of this?

That’s a huge negative, jessep. There is a gigantic overhang of houses. The fact that construction companies are not going out of business and stopping construction entirely is a sign that prices are still too high (otherwise there would not be economic rents available). This is something that many people predicted would happen as a result of government meddling with interest rates, tax credits, etc. (In fact, I’m almost certain I predicted it as well on SS more than a year ago.)

Continued pace of construction will contribute to even lower prices in the furure and will crush existing homeowners even more. If the USG wanted to get prices of housing up, it would refrain from policies that help new home builders, but remember where the lobbying $$ come from 🙂

Nevertheless, for purposes of SF new home construction trends and outlook is not too important.

“What do you think of this?”

On it’s current trajectory housing starts would have hit zero this year so I suppose it was inevitable that we would see a bottom in the housing start rate this year.

jessep,

I see the positive in the numbers.

Let’s keep the bubbles in the bottles for now though. At these low levels it’s hard to call it a turn-around. Look at the historical graph with the new value:

http://4.bp.blogspot.com/_pMscxxELHEg/Sb-ZNOxm1AI/AAAAAAAAEzg/83lcmC-Bcy8/s1600-h/HousingStartsF2009.jpg

The trend is pretty much intact. But of course, it won’t go into negative which means the trend is bound to stop pretty soon. (Actually, if the builders ever decided to tear down houses, then it could go negative!)

Angry Joe,

I held the press accountable. Socketsite did as well. But Socketsite also chose to blast the real estate professionals quoted, and to frame it as a conspiracy. Did you read what I wrote? I called the piece fluff, sensationalist, poorly framed, etc. Clearly. Socketsite had three field days with this one. None of you folks read one thing into the act of running this three times huh? Ohhhhhkaaaaay thennnnnnn.

Socketsite fell all over itself on this one and pretty much ignored the meat of the story, which is D10 volume is up. Yeah, D10 prices are down too, and that’s reported in the story.

So, some realtors sent some of you folks this story. Go ahead and criticize that singular action. But keep it in perspective. Realtors are not all the same. This recurring notion — supported to no end by the editorial bias of this website, where, amazingly realtors actually advertise — is ridiculous. Are all sodas the same? All cars? All people? I got sued by a lawyer. I don’t want to hire a lawyer because he’s in league with the other lawyer. Whatever.

The real story? Price down? Socketsite to the rescue! Here are the TRUE MEDIAN VALUES! Well, no s**t Sherlock. That information is in the Hank Plante piece. So no, that’s only half of it. Volume up is the other half. Volume up, and that’s what the fluff piece was about. Since 10/1 there have been 217 SFRs in D10 sold (at 423 a foot). Over the same period last year? 173 (at 481 a foot).

But fluj, he never mentions D10 in the report. Here are the first few lines from the print version: “But there are now signs of a serious real estate rebound in San Francisco. The real estate tracing firm Terradatum ran some numbers for CBS 5, which show that more San Francisco properties have gone into escrow in the last two weeks than at anytime in the last six months. One reason is prices are down 10 percent city-wide, which has unleashed pent up demand”

See the references to “San Francisco” and “city-wide”? I agree that if the piece had stated that the 94112 zip code, which is down [37%] from the peak on a $/sf basis, has seen sales volume increase by about 25% YOY even while prices continue to plummet — that would have made a fair story. But that is not even close to the actual or implicit message. You’re pretty good at calling B.S. and that is helpful. But don’t defend complete B.S. like this story, which is being touted on many real estate web sites. Good realtors (and from what I can tell you are solidly in that category) would be far better served to condemn the sleaze within their field rather than reflexively defending it.

I’m not defending anything. But you really cannot expect a layman to drop “D 10” in a story. Also YOY since September’s market shift D10 prices appear to be down 12%, not 27%. Yeah, they framed it in a manner that indicates “HOT DIGGITY, THE MARKET IS BACK” and that was intended to provoke. I guess it worked.

tipster wrote:

> But it’s inexcusable for any Realtor to pass this type of

> story along to a client who is relying on them for advice.

It has been years since I sold commercial real estate for a living, but I’m still a licensed California real estate broker.

I laugh when people actually expect to ever get honest advice from a Realtor since if they want to make a living they need to lie to both the sellers (making it look like the market is about to drop like a rock) and lie to the buyers (telling them that the market has hit bottom and is about to take off).

If any realtor told the same story to a buyer and seller they would never make a sale (since buyers would wait to buy if prices were dropping and sellers would wait to sell of prices were going up)…

P.S. to anon/fluj I don’t have any problem with this just like I don’t fault a BMW salesman from telling me that the BMW 5 Series is better than the MBZ E Class…

Yeah, well, your binary view of the market is flawed, and your analogy to me wasn’t apt.

Real estate agents are not “advisors”. They are sales people paid with commissions (by the sellers). You want advice, get it from fee-for-service consultant/lawyers/doctors.

I just advised someone to pass on a property 15 minutes ago. His wife loved it, but even for 20% less than asking, it isn’t a good deal at all. I also advised him not to sell his current property, but to hold it. My payment for that advice? continued loyalty, hopefully solid recommendations among his peers, and the promise of a potential future deal at some point down the line. That’s how it’s done. So take all that “sell sell sell Socketsite TM” nonsense and shove it.

I just advised someone to pass on a property 15 minutes ago.

Bravo fluj. Keep an eye on the REO pipeline.

For anyone who doesn’t like real estate agents don’t use one. Ever heard of a For Sale By Owner? WAHHH ‘paying these parasites is an insult’. No one’s making you pay anyone anything Tony.

I have ZERO respect for someone who bitches about something and does nothing about it. L A M E.

Want to buy? Do your own research – there’s plenty of conflicting material all over the web for your perusal. Draw your own conclusions and go to Redfin. Tell them what you want to offer and shut up about bitching about the real estate agents.

Better yet, just keep renting, put your money in stocks and avoid the whole thing. I’m sure you will be much wealthier in the end… and the real estate community as a whole will thank you, trust me.

regarding agents, there are good ones, which work just like anonn above describes, and there are bad ones relying on hype and half truths to make sales. as a potential buyer, you need to not be lazy, and put some effort in finding a good agent. they are ultimately salespeople, and you always need to keep that in mind.

example- i usually buy property direct from the sellers agent, as i have some experience. but i remember a particular sale, were i actually benefitted from representation. in this case the property was way under market, but had a ridiculously late “accepting offer date” (this was in early 05, btw.) my agent was able to build a bond w/the other agent, and get her to convince the seller to take my early offer. i know the thing would have sold for more than i paid in an open bid.

turned out a great deal for me, btw. $800k for 2 units w/full basement on north slope bernal heights. developed basement into lower unit for a rather nice 4/2, and sold that early 07 for basically what i paid for the whole bldg. in essence i kept the top unit for my development & holding costs- a bit more than $400k for a 3/2, which is now a RC free rental condo. and yes, i sold the lower unit using the same agent that was instrumental in getting me the deal.

I’m sure there are helpful and decent sales people everywhere. But the payment structure and the inherent conflict of interest that goes with it is enough to discount their advice in general. At least till they reform the real estate industry to better align their interest with their clients’ in terms of real $$$.

JJ, anyone who offers any kind of service has an ulterior motive. Sales or no.

Lawyers make more money if the case goes on longer. Sure some will milk that, but there are many decent lawyers that give good counsel and are not trying to gouge their clients. Mechanics who offer service also benefit from fixing things – doesn’t mean all are trying to take advantage of their clients.

Therapists benefit from not having you get well. Doctor’s benefit from unnecessary procedures as well as more expensive testing. Doesn’t mean all are on the take to just get their money in the end.

Real Estate agents benefit from repeat customers. It is the #1 way we get clients. If we gave crappy advice, and the client loses money, you can be sure the clients blame the agents for it and will not refer, or use them again.

There is actually a financial incentive (other than sheer decency) for a real estate agent to do the right thing for their clients, as there are with a good financial advisor who makes a portion of their living thru trades.

It’s immature to paint any entire industry with the many people involved with one label – although it appears from this site there are plenty who are willing to do so.

@ Response to JJ-

The problem with your point is that 98% of realtors are not qualified to give any financial advice whatsoever. They lack the understanding of markets. Zero. It is so pathetically obvious….

Yeah, yeah, I’ve heard all that before. Repeat customers, referrals, blah, blah… And I’m sure most agents believe that. Would they choose $+10k in immediate commission over client’s interest if they can get away with it, either consciously or unconsciously? Who knows. The point is there is inherent conflict of interest built into the system, and that’s enough to make the whole industry a suspect. You don’t like that, you should work to reform NAR.

I’m forecasting a peach shaped bottom. 🙂

I think a fun occasional feature for SS will be where someone poses as a new client and does a fake initial interview (sorta like the canadian radio hosts prank calling Sarah Palin posing as Nicolas Sarkozy) with a randomly picked Real Estate Professional and posts the transcript or voice recording on here.

I guarantee the results would be hilarious!

LMRiM,

You said,”To think that 3.5% FHA downpayment scams are not being used by some significant portion of the “bids” on a sub-$729K place is silly.” I don’t understand how the scheme works. Were you able to stomach Bernankster Sunday?

I’ll say it again…. the list price has got nothing to do with market value the only thing that will tell the truth will be when we find out what it actually SOLD and CLOSED for

When will you people realize that the asking price means nothing? It’s the SOLD price that determines the market value.

Please stop being stupid pundits

[Editor’s Note: We’d be willing to bet that the vast majority of plugged-in people are well aware that it’s the contract price that matters with respect to determining value.

We are starting to wonder, however, what kind of people don’t understand it’s the asking price that’s the biggest factor in determining how many offers will be written and whether or not a property sells for over (or under) asking. And yes, even more so than “the market.”

Pricing a property at 25% under last year’s median (37% under 2006) tends to attract bidders. That’s the whole point.]

Too weird. I thought I recognized that picture. Actually grew up on that block many many years ago.

When we moved in the late 70s, area was strongly Italian (in fact 555 Edinburgh is probably being sold by the son of the, now deceased, Italian woman who lived there) yet deteriorated markedly in the early 80s. Was actually jumped in front of my house on that block. I fully suspect that the area has only gotten WORSE since then as when i checked the chronicle “crime pages”, there has been a murder or two within a block of the place within the last few years. Nice.

Crime notwithstanding (!), the actual area is not that appealing. There is park across the street that is lighted up at night, check meghan’s law databases and you will see locals listed on it, mission street (6 blocks away, down russia) is kind of run down + overrun late afternoon with high school kids from Balboa, and it takes 45 minutes on a crowded 14 mission to get downtown.

Once I moved to the east bay to go to Berkeley, never, ever desired to go back to this dumpy ‘hood.

@ Irwin Fletcher

First of all nice to see a name. Second no sh** real estate agents are not qualified to give financial advice. Nor should they, or legal advice for that matter. That’s not what they are hired, or licensed to do. You don’t ask a contractor to do an architect’s job not that both shouldn’t have an understanding of what the other does.

If you are looking for financial advice go to an accountant, financial/estate planner, or your dad.

(Not intending any personal attack on the last – dad’s just happen to be one of the three main financial planners most people turn to – for better or for worse).

The first paragraph here is comical in hindsight. “seasonality” and “continues to fall .,, year over year? Scorr one for mainstream media zilch for hatersite.

Never mind. 2009 was a different market. Why reference that? Very weird..