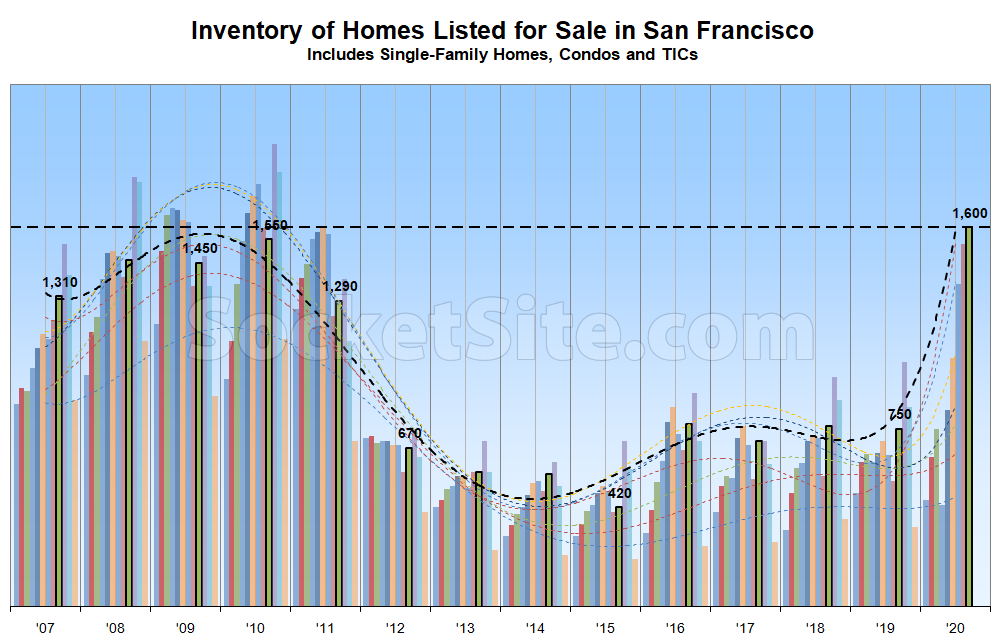

Having effectively plateaued over the past couple of weeks at above recession-era levels, the number of homes on the market in San Francisco, net of all new sales and contract activity, has ticked up to 1,600, which is twice as many homes on the market than there were at the same last year (750) and the most homes on the market at the start of September in the over 15 years, a trend which shouldn’t catch any plugged-in readers by surprise.

The number of condos on the market, which tends to be a leading indicator for the market as a whole, currently totals 1,210, representing 150 percent more inventory than at the same time last year, while the number of single-family homes on the market totals 390, which is currently 46 percent higher on a year-over-year basis and poised to jump as listings which failed to sell in the spring, and were subsequently withdrawn from the MLS in the summer months, return anew.

At the same time, with the list price for 29 percent of the homes on the market having been reduced at least once, which is 18 percentage points higher than at the same time last year, there are 450 percent more reduced homes on the market in the absolute, a number which is poised to rise as well.

We’ll keep you posted and plugged-in.

We currently have the highest inventory we have seen in over a decade while interest rates are at all time lows and tech stocks are at all time highs. Let that sink in. That’s how bad the RE market is doing in SF.

The San Francisco single family homes market is not down year over year, August over Augus. It is up. August 2019 saw 168 SFRs trade at $989.69/ft. August 20 saw 214 sales at $1026/ft. Surprising, isn’t it ?

Only if you you haven’t been paying attention or don’t understand the broader trend at hand. As we noted last month:

But as we noted back in July, at which point pending sales activity was up closer to 40 percent on a year-over-year basis but the rebound in “pent up” sales activity appeared to have already plateaued, “with “pent up” supply continuing to outpace “pent up” demand, listed inventory remains at – or above – recession-era levels in San Francisco.”

And in terms of the price per square foot bump in August, you might want to adjust for the mix of what has sold.

Why did you respond to me and not the poster who is talking about how bad the RE market is doing in SF?

Perhaps it’s because “we currently have the highest inventory we have seen in over a decade while interest rates are at all time lows and tech stocks are at all time highs.”

And the August bump in sales, which deserves some context, shouldn’t have come as a surprise to anyone who’s actually plugged-in.

There’s a lot of inventory it is true. It’s also true that amenity oriented condo buildings cannot offer the same things as they could prior to the pandemic. Per the MLS and aggregators there are currently only 382 SFRs for sale. There are 1176 condos for sale.

Or as we outlined above: “The number of condos on the market, which tends to be a leading indicator for the market as a whole, currently totals 1,210, representing 150 percent more inventory than at the same time last year, while the number of single-family homes on the market totals 390, which is currently 46 percent higher on a year-over-year basis and poised to jump as listings which failed to sell in the spring, and were subsequently withdrawn from the MLS in the summer months, return anew.”

Yes I know you’re still talking about condos being a leading indicator even though the pandemic has clearly changed the nature of many condo buildings. Meanwhile the SFR volume and absorption and price are all quite healthy.

And for additional context, there are now 120 percent more single-family homes on the market in San Francisco than there were in 2015 and the most, in the absolute, since the fourth quarter of 2011. That’s net of the “healthy” sales/absorption/demand.

OK. And this year’s August had 16 more sales than 2015 and homes only averaged $796/ft in August ’15. Was 2015 a bad year for SF real estate?

You know it was pretty entertaining reading all the 3 year old posts that were populating on here recently. So many posters were going on about the market certainly tanking in 2017. It didn’t.

Once again, the un-surprising bump in August closings was driven by a shift in sales which would have normally occurred in the spring. And if you’re somehow still “surprised,” or don’t understand what’s going on, you might want to compare April-August sales volumes, 2015-2020 (hint: they’re down).

Of course spring 2020 saw weak sales volume. The entire industry was shut down for months.

Which shifted closings into August. And again, which shouldn’t have come as a “surprise.”

But sales were down last year, both year-over-year and versus 2015, and despite some rather vocal “just wait, you’ll see” protestations to the contrary, as well.

No, not into August. Why would Mid-March to May shutdown kick on all the way to August? June is when the market started coming back tentatively at first. And July saw the same amount of sales year over year, 213, which is a decent amount of sales for SF July wise.

Actually, “having bottomed out at the end of April, at which point they were down nearly 50 percent on a year-over-year basis, the number of homes in contract to be sold started to rebound in May; turned positive, on a year-over-year basis, back in June; and were [then] up sharply in July,” setting the stage for the forecast bump in August closings.

There is NO doubt that listing is up and sale price is down, period. maybe small exceptions such as SFH in Noe and Pac Height, from what I have observed. The bigger question, for me, is how much lower will price go? At what point, should I jump in and pull the trigger. As of now, of all the listings, rarely anything is attractive and makes financial sense, even thought they are cheaper than before.

How’d TSLA do today? AAPL? MSFT? Watch the fed and watch stocks. No money from stocks, no houses purchased at these prices.

While Tesla stock dropped 21 percent today, it’s still up 300 percent since the start of the year (and up 600 percent, year-over-year). While Apple dropped 7 percent, it’s still up 50 percent for the year. And while Microsoft dropped 5 percent, it’s still up 25 percent YTD.

Rents and employment are down in San Francisco, however, and vacancies are up.

One can’t call the bottom but SFH prices are likely to drop significantly from here if the trend continues. Pinterest not only backing out of it’s lease but hinting it will move some of its workforce out of SF. Other companies hinting the same such as Twitter. Stripe had already announced its departure. Tech workers pushed home prices out of reach and now many are/will be leaving. The things that make a city appealing such as great restaurant were in decline in SF before Covid and, with techies leaving, many such restaurants will not reopen. . The Chronicle did a story that Covid culminated a mounting series of negative trends in SF. Homelessness, crime, unprosecuted crime, filthy streets and inept government. And now? City PTB want to raise taxes and fees. That is crazy as small/medium sized businesses were struggling in SF to begin with. If it gets worse small startups will not start up – in SF anyway. Can the city government successfully address these issues? IMO no – given their track record. All that said, my educated guess is a drop of 10% – 20% in prices from where they are now. Should you jump in? If prices reach a point you can afford without stretching you’re budget and if you plan on living in SF for 6 or 7 more years then maybe. But there are other options in the Bay Area that make more sense for home ownership.

“Can the city government successfully address these issues?”

No. We’re screwed.

It’s amazing SF’s mayor makes more than any other mayor in the country. Especially as SF is a small city compared to NYC, Chicago, Dallas, Houston and LA. That about 40% of city employees have compensation packages exceeding 150k is a scandal. Especially as many city employees are milking it. DPW workers hanging out for hours at Lake Merced for instance. As high paying jobs are leaving the city and major projects (SF Bay Tennis Club) are delayed or abandoned the flow of taxes/fees coming from such will fall off sharply. Endangering among other things the City’s BMR housing program. And still city employee unions are balking at any effort to rein in their very, very generous salaries.

you’d think with that pay she would be able to get her car fixed on her own.

I would add that trends are, by their nature, over longer periods of time. How long this trend of inept government, business destruction, social chaos, mobile workforce and lower home prices will continue, is anyone’s guess. Seeing it all spelled out though I would have to guess it will be a period of years not months.

A rare incidence of Socketsite engaging in the discussion. I love Socketsite

I come for the real estate news and stay for the saucy comment section (one of the few that remains readable in the cybersphere)!

I prefer to go straight to the comments.

UPDATE: Number of Homes for Sale in San Francisco Jumps