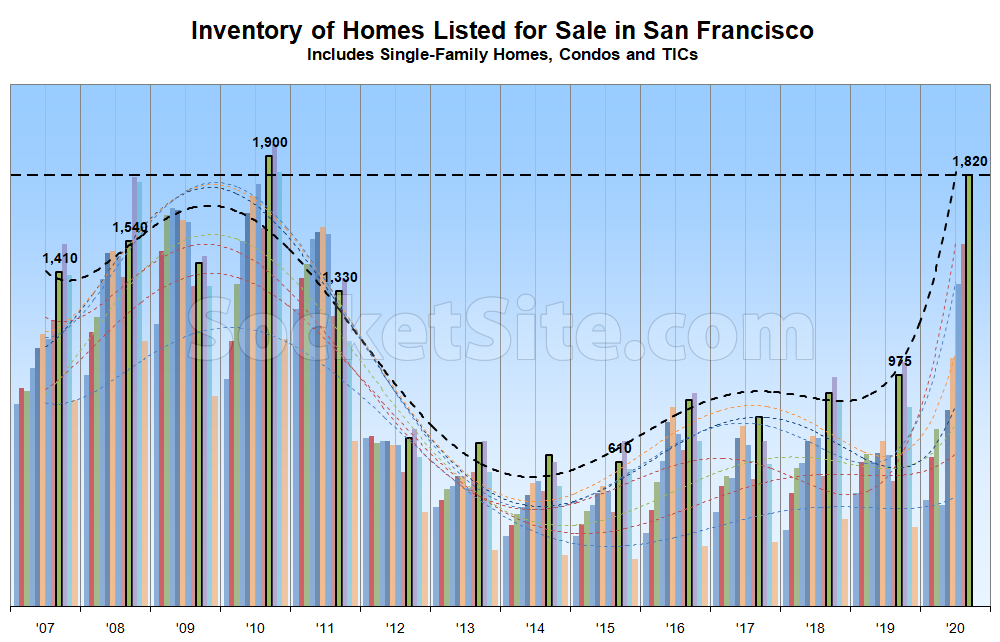

Having ticked up another 8 percent over the past week, the number of homes on the market in San Francisco, net of new sales and contract activity, has jumped over 15 percent since the end of August and crossed over the 1,800 mark for the first time in a decade, a jump which shouldn’t have caught any plugged-in readers by surprise.

As such, inventory levels are now running 90 percent higher on a year-over-year basis, 200 percent higher than in September of 2015, and roughly 20 percent higher than during the Great Recession, with the number of condos listed for sale (1,370) now up 108 percent on a year-over-year basis and single-family home inventory (450) up 42 percent (and climbing).

At the same time, with 30 percent of the homes on the market in San Francisco having been reduced at least once, which is 17 percentage points, or 130 percent, higher than at the same time last year, the number of reduced listings has increased 19 percent over the past month in the absolute to a new 9-year high, as we noted yesterday.

And with the pace of sales having slowed over the past week, while the pace of listings has increased, inventory levels should continue to tick up over the next few weeks, as would be typical for this time of the year.

This is a super interesting data point. My take away:

1. in the last cycle, volume peaked in 2010 and price hit bottom 2 years later. In other words, if you are buying to live, you might want to jump in before the bottom just to have more choice.

2. the volume increase in the last cycle was more gradual, took a few years. This time, it was a shot up. Curious to see where it goes from here.

How fast rents have dropped and how fast inventory has shot up should be a wake up call for people who think this time will be milder than 2008.

In the past, sharp recessions have had sharp recoveries. And we’ve never had a stimulus like this. Continued asset inflation is just as likely as the kind of crash you want. Your cash savings are down 10% of its value already. Somebody should dig up Satchel’s old “ka-BOOM” posts.

Everything depends on the Fed, the Fed doesn’t know what’s going to happen, if you think you know better than the Fed then you are a fool.

At least two [readers] expressed an opinion that this time would be milder than 2008.

“I don’t think we’ll see something similar to 2008 where the bottom absolutely fell out or 2001 where tech completely imploded (yet?).”

“2008 was unusually large and deep.”

I just see nothing to substantiate that opinion.

The drop in rents and rise in inventory has been sharp, but this crisis has been long and frankly still isn’t over. 2001 was a point in time loss of confidence in tech stocks and 2008 a similar moment for banks. This is a longer ongoing event. The Fed was around in 2008 and it didn’t prevent what happened post-2008.

And yes we’ve never had a stimulus like this. But if inventory is rising this sharply with such an unprecedented stimulus, what do you think happens post-stimulus?

Couldn’t disagree more. 2001 was an extreme tech bubble and economic disaster locally, and 2008 was a huge, global debt crisis. Those were structural issues with the economy that took years to sort out and restructure for growth. This is a virus that can turn around very quickly. If a proper vaccine comes out, or the death rate plateaus at a low level and people realize it’s overblown (not saying either of those will 100% happen), as what’s happening in Europe now, life can go back to normal very quickly.

I think vaccine progress, or even vaccine optimism and thus risk-taking, will be very real by Spring 2022 and prices.

Inventory rising doesn’t mean selling. People might sell if they can get it at 2019 prices or a 10% haircut. I don’t think many will be willing to sell at a 20% loss. Remember, most of these homeowners are the “Zoom class” who is doing fine financially, or they own it outright. They don’t *need* to sell.

With rents dropping, we’ll most certainly see people getting out of the rental business and selling. Anyone with tenants not paying rent are probably sitting on it until they can evict the tenant before selling since no one would buy a tenant occupied property right now.

With respect to not seeing signs of 2008 yet since I’m the first one that you quoted…the current crisis has disproportionately impacted people who can’t afford to buy homes in SF to begin with. Most people who can afford to buy homes prior to the crisis have not been impacted very much because they’re able to work remotely. We saw some tech layoffs in the beginning, but we haven’t seen much since. Most people who would be participants in the house buying market who were laid off were also able to find new roles relatively quickly.

I think until we see a shock on the demand side from people who are buying houses, we won’t see demand dry up. With that said, most companies had came out and stated early on there won’t be layoffs through their fiscal years, etc., but we’re starting to come to an end of that. If there are any massive layoffs, we’ll probably see them in the next few months and its impact to housing demand.

In addition to increasing supply as landlords exit the business, either by choice or circumstances, any thoughts on how a 20 percent drop in the pro forma income a property produces might impact the valuations of the properties being sold and the resultant comps? Or how a 20 percent drop in rents might impact a typical rent versus buy calculation and the resultant impact on demand?

“…the current crisis has disproportionately impacted people who can’t afford to buy homes in SF to begin with. Most people who can afford to buy homes prior to the crisis have not been impacted very much because they’re able to work remotely.”

As I said here. We haven’t seen the need to move out component yet, just the want to move out. Which makes the rent drop/inventory rise so striking. We’ve already almost surpassed the peak inventory from the 2008 cycle and the group most impacted isn’t even in play yet because of the stimulus and eviction/foreclosure moratoriums. I agree that many of the most impacted weren’t in play to become SF owners. But some most likely were. And as you point out, more renters leaving drops rents which also adds selling pressure to the market.

Panhandle Pro-

“[…] 2008 was a huge, global debt crisis. Those were structural issues with the economy […]”

Or, more succinctly, a giant real estate bubble to date popped.

“[…] that took years to sort out and restructure for growth.[…]”

Or. more accurately, “growth” here means a reinflation of the real estate bubble, with an epic stock market bubble piled on: the “everything bubble.”

This time it’s different, right? Upton Sinclair to the white courtesy telephone, please!

At this point, everything has been zombified. We can’t even tell the living from the dead.

Prices are rising in many cities. The leading story on this site says that home sales are in a 14 year high. Set of the above comments or rationalizing San Francisco’s current situation with past downturn’s. In the past San Francisco was mildly affected; ie the financial crisis of 2008. This time, the decrease in prices are reflecting the bubble-like real estate prices prior to virus. Couple that with exodus from the cities, remote working, business relocation, a lack of confidence in SF government, lack of affordability and disaffection with CA and you have an explanation that is specific to the city. This is not a trend that will be easily reversed. This is part national and a larger part local.

[Editor’s Note: While up Nationally, Index for Bay Area Home Values Slips]

I lived in SF for over 30 years. I sold my house in 2013 a little before peak prices but did ok. Tech ruined our city and it just wasn’t the same quirky SF.

I bought property after the markets cratered in 1990, 2001 and 2008. Did very well on all of them. What is happening now is no different than the previous declines. But values are going to decline much more than many of you expect.

When I left in 2013, I began to purchase rental properties in Montana and now have a tremendous number of tenants that are COVID refugees from the west coast. 100% occupancy though keeping units full was never a problem pre COVID. Outward migration from the cities is what is happening. But that being said, I intend to buy a home in the city next year.

After this period of chaos, things will reset and the market will stabilize though not get a crazy as the last couple years.

The number of homes on the market in San Francisco, net of new sales and contract activity, has ticked up another 3 percent over the past week to 1,860 and is closing in on a two-decade high.