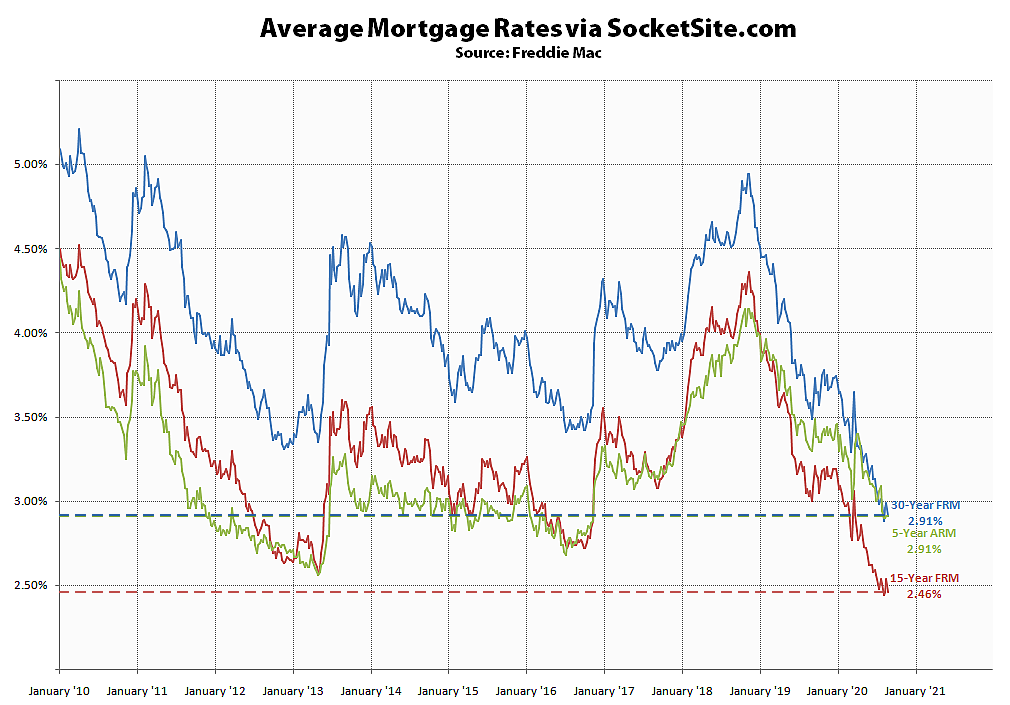

Having ticked up last week, the average rate for a benchmark 30-year mortgage has since dropped 8 basis points (0.08 percentage points) to 2.91 percent, which is 67 basis points below its mark at the same time last year and within 3 basis points of the all-time low it hit earlier this month, according to Freddie Mac’s latest Mortgage Market Survey data.

At the same time, the average rate for a 15-year fixed mortgage dropped 8 basis points to 2.46 percent, which is 60 basis points below its mark at the same time last year, while the average rate for a 5-year adjustable held at 2.91 percent, which is 41 basis points below its mark at the same time last year.

And mortgage application volumes continued to drop, with application volumes to refinance dropping 10 percent over the past week and purchase mortgage volumes slipped another 2 percent, according to the Mortgage Bankers Association.

That being said, application volumes to refinance are still running 34 percent higher on a year-over-year basis (versus over 100 percent higher five weeks ago) while purchase mortgage volumes are currently up by 33 percent on a year-over-year basis.

Logjam has been broken. Couldn’t get a lender to respond 4 weeks ago, locked at 2.8 this week and everyone is returning my calls/emails.

Thanks for the datapoint. Make sense.

Too bad I have no nice income to refi. 🙁

Can I get a POV from the experts here?

I’m 8 yrs into a 30 fixed at 3.2, and doing the math I can’t see how a refi at 2.8 would pencil out. Might only make sense if I continue to make the same payments as I do now? Don’t plan to stay in the house long term but would keep as a rental.

What is your Loan amount? From current 3.2% to possible 2.8% is less than 1/2 % and you would pay to refi, so as you say may not pencil out.

506K left, monthly payment is 2,660 with it being just about 1/2 interest 1/2 principle

0.4% (Difference in rates) for 500k is $2000 a year saved in mortgage interest. Not a small amount. Refi cant cost more than 5-7k, I would think?

Hi may I know how it is $2000/ yr? Since he has 22 yrs left, shouldn’t it be $909/ yr? Thanks!

I locked a no fee no point refi at 2.75% on a jumbo loan. So it’s possible to pay nothing out of pocket for a refi. Everything, even the appraisal fee, was credited back.

I’m not a home owner, and I have always been puzzled by reasons to refinance. Have not most of the interest already paid off after 8 years and you mostly pay off the principal? I assume you start from scratch after a refinance and delay paying off the principal again. Also, don’t you extend the end of the loan by 8 more years by doing a refinance? Just wondering how it works, not trolling.

After 8 years, you’re paying just about 50/50 on the interest vs principal scale. But yes, you would start from zero if you refinance. That said, you can always get a 20yr mortgage for possibly a slightly better rate than the 30yr.

steve, which bank?

Steve – I’d also like to know what bank that was. I’m preferred platinum w/ BofA and they recently did a rate modification on my jumbo (w/ strong loan to equity %) down to 3.375% and kept the same loan and duration for a flat fee of about $900, no paperwork other than a signature. But that was about 4 months ago and I’d like to go back if there’s a 2.75% option.

First Republic has rates under 3% for a jumbo refi but you need to have a significant amount of cash (15%+ of loan balance) in a checking account.

@Betty: I think mine was 250K in the account for two years for a .25% reduction, in hindsight not worth it when considering the opportunity cost

I’ve got a 3.75 rate and wanted to refi, but now with added 5% government bank fee where does that leave me? Is it even worth refinancing?

To be clear, the Federal Housing Finance Agency’s “adverse market fee,” which was slated to go into effect on September 1 but has since been rolled back to December 1, is a one-time 0.5 percent surcharge on the loan amount, based on when the loan is funded/closed, not an ongoing increase in the rate.

QuickenLoans is quoting me 2.99% rate and 15K closing costs. Should I bite and go through with it?

If you’re in California you could try Owning. I got 2.99% with them and no closing costs.

Thanks Dan! Yes in California. I’ll look into it. 15K was what I was expecting with my loan being a jumbo loan….but if I can get down to no closing costs, even better!

UPDATE: The average 30-year and 5-year rates both inched up 2 basis points over the past week to 2.93 percent while the average 15-year rate ticked down 4 basis points to 2.42 percent.