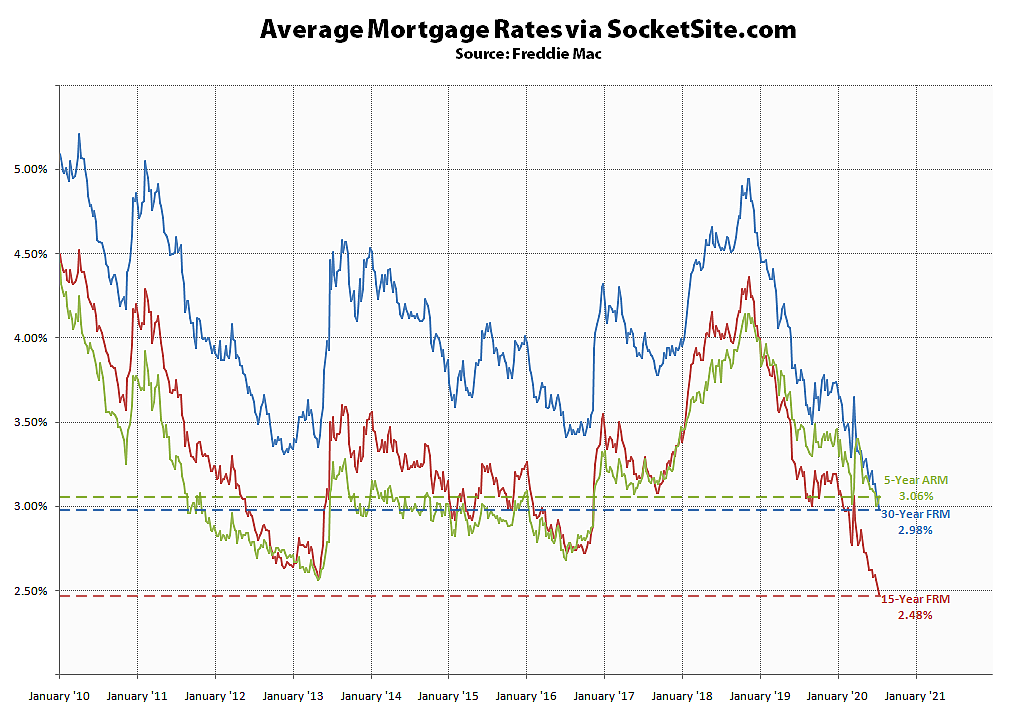

Having inched down another 5 basis points (0.05 percentage points) over the past week, the average rate for a benchmark 30-year mortgage now measures an unprecedented 2.98 percent, which is not only 83 basis points below its historically low mark at the same time last year but the first time the benchmark rate has averaged under 3 percent, according to Freddie Mac’s latest Mortgage Market Survey data (and which shouldn’t have caught any plugged-in readers by surprise).

At the same time, the average rate for a 15-year fixed mortgage has inched down another 3 basis points to 2.48 percent, which is 75 basis points below its mark at the same time last year and another all-time low, while the average rate for a 5-year adjustable inched up 4 basis points to an inverted 3.06 percent, which is 42 basis points below its mark at the same time last year but 50 basis points above its all-time low of 2.56 percent which it hit back in 2013.

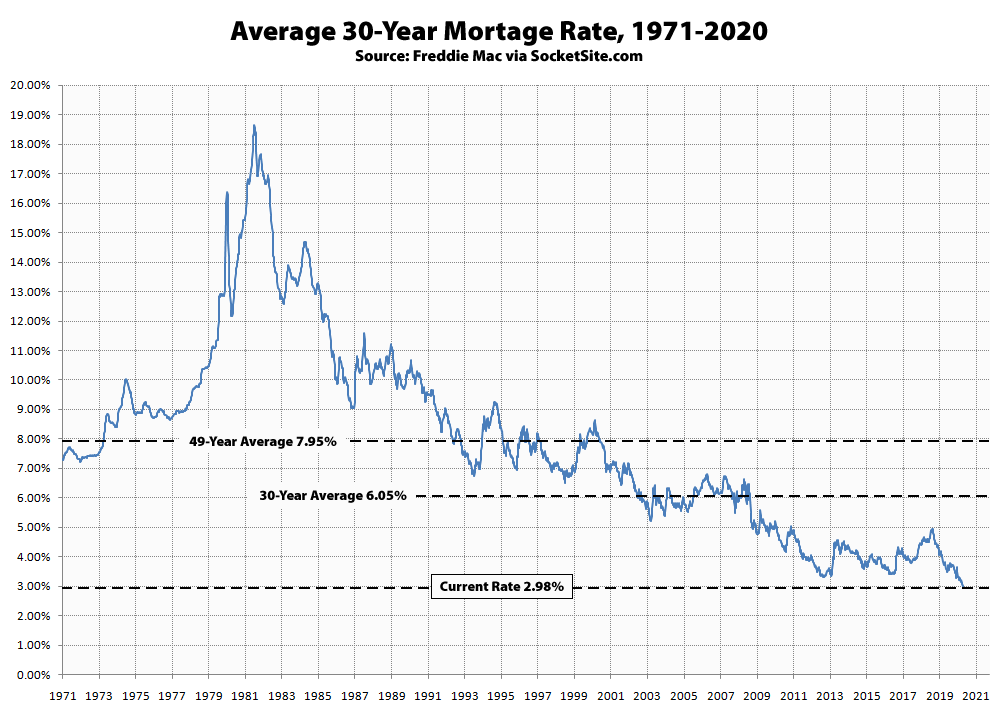

Keep in mind that the 30-year rate has averaged a little over 6 percent over the past 30 years and closer to 8 percent over the longer-term.

And while refinancing activity ticked up 12 percent over the past week and is running 107 percent higher versus the same time last year, purchase activity across the U.S. actually dropped 6 percent on a seasonally adjusted basis last week and is now only up 16 percent on a year-over-year basis, according to the Mortgage Bankers Association.

has anyone secured a re-fi below 3.2%

See: “Just closed on a 30 year refinance…” (along with others on the thread).

I got a 7/1 interest only ARM for 2.625% from SVB. I had to put some money in the bank with them.

15 year refi’s are around 2.5%, in line with the chart above. all other options I have seen are 2.6% – 3%

I am in a 30yr 5/1 at 2.75% that resets later this year…..waiting to see what they offer before I potentially switch.

Just refinanced two properties into 10/1 ARMs at 3.0% with .375 relationship credits.

Yes, but not recently. In 2013 we refi-ed 2 loans: A 10yr at 2.5% and a 15yr at 2.875% LTVs were ~25% and ~55% so ymmv. Also, didn’t at least one major (WF?) suspend all refi activity just last month?

It looks like roughly 50% to 75% price appreciation since 1997 is due to the declining cost of payments.

Shhh..you’ll frighten the rubes.