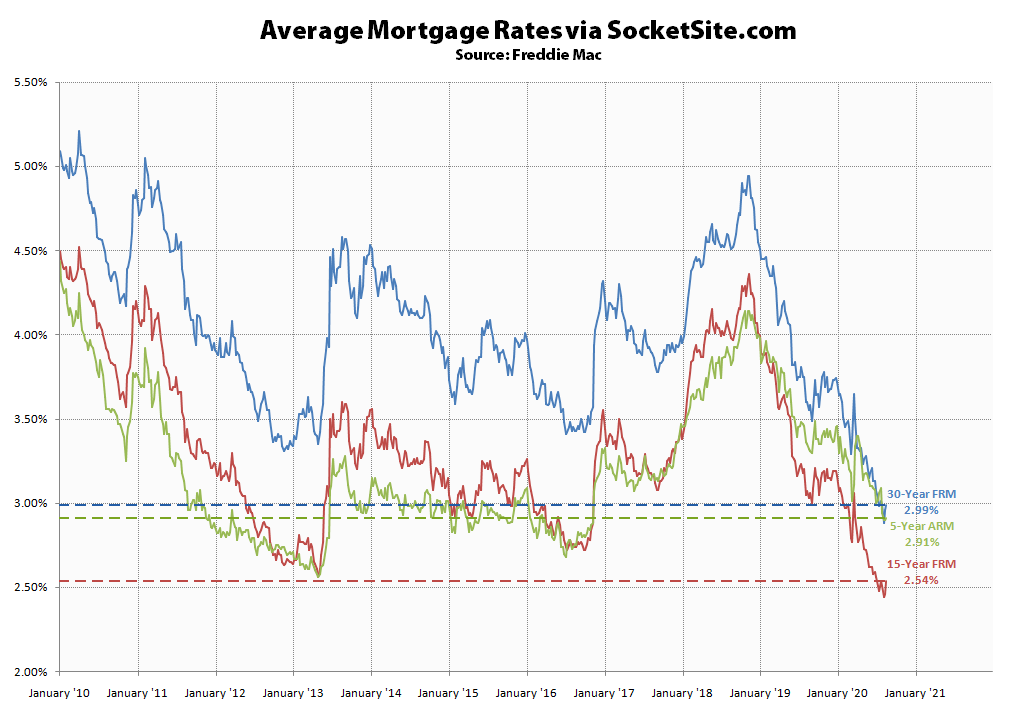

Having hit a new all-time low of 2.88 percent two weeks ago, the average rate for a benchmark 30-year mortgage has since inched up 11 basis points to 2.99 percent, which is now 56 basis points below its mark at the same time last year and still less than half its long-term average of over 6 percent, according to Freddie Mac’s latest Mortgage Market Survey data.

At the same time, the average rate for a 15-year fixed mortgage has ticked up 10 basis points from a new all-time low to 2.54 percent, which is 49 basis points below its mark at the same time last year, while the average rate for a 5-year adjustable has inched up 1 basis point for an inverted average rate of 2.91 percent, which is 41 basis points below its mark at the same time last year.

And in terms of mortgage market activity, applications to refinance dropped another 5 percent over the past week and are now running 38 percent higher on a year-over-year basis, versus over 100 percent higher four weeks ago, while purchase mortgage volumes slipped another percent but is still up by 27 percent on a year-over-year basis, according to the Mortgage Bankers Association.

From Home sales are soaring, but is it a good time to buy? Here’s what the experts say:

Time to get in while the getting is good. Of course, if you’re betting that selling prices will go meaningfully lower, a forty or even fifty basis point difference might not make you want to jump in for another several months.