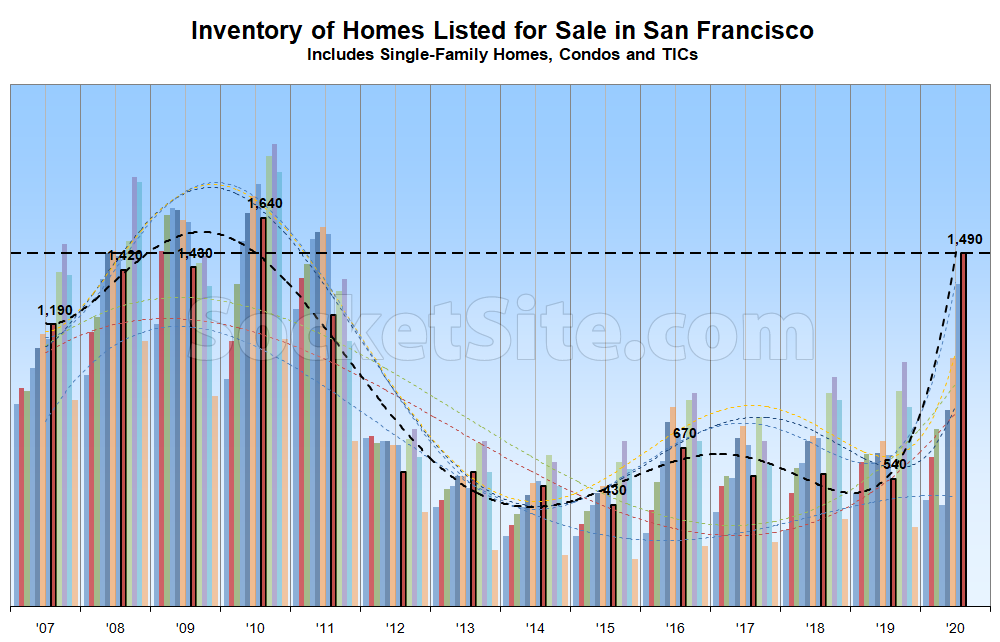

Having reached recession-era levels last week, the number of homes on the market in San Francisco, net of new sales and contract activity, has since ticked up another one (1) percent to 1,490, representing nearly three times as many homes on the market than there were at the same last year and surpassing the recession-era inventory levels which were driving the market in August of 2008 and 2009.

And while the number of condos on the market (1,110), which tends to be a leading indicator for the market as a whole, is now up by over 220 percent on a year-over-year basis, the number of single-family homes on the market (380) is running 95 percent higher as well.

That being said, inventory levels appear to have reached a seasonal peak and will likely start ticking down through the end of August, at least in the absolute, before jumping again in September. At the same time, vacancy rates continue to tick up in the city and rents are on the decline, none of which should catch any plugged-in readers by surprised.

We’ll keep you posted and plugged-in.

This isn’t the only recession level issue with which we’re flirting. Check out (name link) the 28% drop in the velocity of M2 money and compare it to the 15% drop in 2009.

A “seasonal peak”? Are you joking? The worst pandemic in a century, the worst jobs situation since the Great Depression, millions just lost their extended unemployment benefits and you’re citing “seasonal peak” like this is normal? Good lord, take a look around.