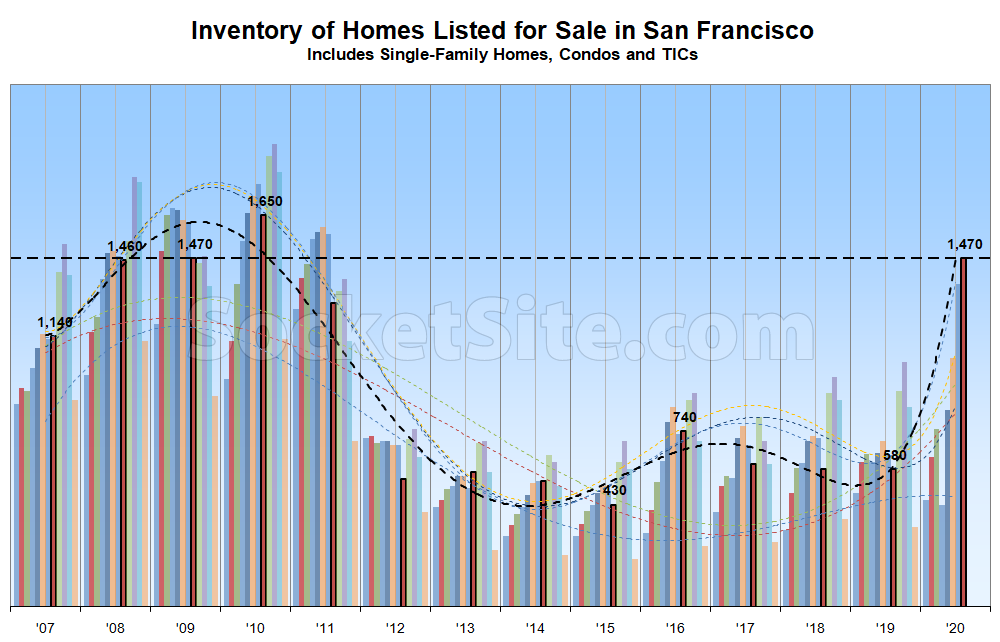

Having hit a 10-year seasonal high last week, the number of homes on the market in San Francisco, net of new sales and contract activity, has ticked up another 3 percent to 1,470, representing 150 percent more homes on the market than at the same last year (580) and equaling the recession-era inventory levels which were driving the market in early August of 2008 and 2009.

At a more granular level, the number of single-family homes on the market in San Francisco (370) is now running 90 percent higher than at the same time last year while the number of condos (1,100), which tends to be a leading indicator for the market as a whole, is now up by over 180 percent, year-over-year.

Keep in mind that inventory levels should be ticking down, based on typical seasonality patterns, before jumping again in September. And that listing activity for apartments in San Francisco has spiked as well and is continuing to drive rents down.

We’ll keep you posted and plugged-in.

There are big obstacles to a price collapse:

– if there’s a big pool of people who pray for prices to drop because they are eager to buy, this pool prevents a collapse almost by definition.

– for decades, we geezers have predicted a currency devaluation. Just because [an old] person predicts something doesn’t mean it can’t happen. Perhaps it has been happening, just at a rate of a 3-6% a year. The govt has been printing vast oceans of cash. Gold has been rising dramatically. A declining dollar is a powerful headwind to a real estate price collapse.

– Frisco politicians, though as crazy as human beings can get, have been shockingly conservative recently. There’s been very little mayhem in comparison to Portland, Seattle, Chicago, NYC, DC, etc. Portland and Seattle are getting nasty and those are the places to which whiners have always threatened to relocate.

If people were waiting on the sidelines to get in we would not be seeing the rents collapse or the inventory spike. A few months ago people would say it was only service workers but many of the places with steep rent drops and concessions now are the places techies used to rent.

Uh, the problems in Portland are confined to about three city blocks, at most.

Last week was a frenzy of moving vans and U-Hauls unlike anything I’ve ever seen. Three flats vacated off my own block over two days. The whole central city has been swarming with move-outs. Even on the 1st and 2nd of the month, when you’d expect the activity would be mostly moving in, almost all the moves were outbound. I asked the one move-in I saw what his deal was, and he said he was moving cross town for $300/mo cheaper rent.

Btw, if anyone is looking for a used mattress, there are literally hundreds on the streets right now, probably one on your own corner, abandoned by poorly-socialized koder kidz who see no problem dumping their trash on the city they are now fleeing like rats. Don’t let the door &etc.

I counted six moving trucks parked outside 100 Van Ness last Saturday evening. According to a friend who lives there, they are beginning to offer 12 weeks free rent as an enticement to renew.

We live in a nearby building, and our neighbors moved out when management told them their best offer was to waive the fee for moving to a lower-priced unit. Corporate is apparently ignorant of the economic reality in the surrounding neighborhood.

Ha! Are you at Etta?

These people are insane. Corporate would rather have 10%+ vacancy than cut a good tenant a break.

Avoid that place at all costs, having lived there for seven years. What a joke.

I know of a friend at Etta… I think their vacancy is like 25% now, or something in that range

I don’t think it’s quite that high. Peaked around 17%. Maybe 12-15% now.

Management will not reduce rent or even allow primary tenants on a lease to quote monthly rent to a new roommate. It’s disgusting and unprofessional.

Oh, and one of the elevators is off line about 25% of the time. They are liars, unfortunately, and unprofessional

“or even allow primary tenants on a lease to quote monthly rent to a new roommate”

hstfan – what exactly does that mean?

Eh, San Franciscans have been dumping their move out trash on the sidewalks for decades before the first dotcom scene. Don’t blame the tech bros for starting that.

And an update to the tipster U-Haul Index: 26 Foot Truck edition

San Francisco to Phoenix: $2,500

Phoenix to San Francisco: $261

Oakland to Phoenix: 2460

Are your renters sitting tight these days?

Probably not the thread to talk rentals, but yes. They have all been there for a while.

I was just pointing out with my previous post that the U-haul index isn’t the greatest. Maybe this is a better one;

Hillsborough to Phoenix: $2475. Is everyone leaving Hillsborough?

Not as far as we know. But we’re guessing U-Haul understands that most people would drive an extra 20 miles to pick up a truck for a 750-mile move if the area pricing was significantly different.

And now back the recession-era inventory levels at hand…

Now do San Diego. Now do Reading. The “U-Haul rental as Indicator” has a lot of problems.

What is the inventory / total housing stock? Inventory / Total Population? The real story is in the ratios, not a linear value

Both those denominators changed drastically over ten years. You could compare current inventory to 1955 and see a massive spike as well…

As real estate is priced at the margin, the ratio of inventory to total housing stock and/or “population” is effectively meaningless. Inventory levels, which reflects both listing activity (supply) and sales (demand), and not simply “the number of homes that were listed,” is the metric that matters in terms of pricing, values and directionality.

I moved into the new Fifteen Fifty building on Mission and Van Ness in June. For about a month and a half there were only a hand full of residents in the entire building with no one moving in. Now, almost everyday, im seeing people moving in…sometimes two households at once. I know they are offering some good concessions right now, so that may have something to do with it. Some of the tech tenants that have moved in have all said that majority of their friends/ co-workers intend to move back to the city in 2021 once things (hopefully) somewhat return back to normal and the city and offices reopen.

Where are these people moving from and why? I know no one moving here. Hiring is frozen and there are many layoffs. Everything is closed.

They are getting two months free rent as a move in incentive and after two months they can’t be evicted because of non payment because of the eviction moratorium. I bet the landlord isn’t getting much security deposit as a incentive too. Let’s see where this lands in three or four months for the landlords.

Funny, I thought all of the penny ante landlords were aware of the basic economic principle that “there is no such thing as a free lunch”.

If a landlord is offering “two months free rent”, it’s because in those circumstances where it is offered, it obligates the tenant to pay a full year of rent, no? So the incentive is really just a reduction in the overall rent liability for the year.

And nothing about the temporary moratoriums for the pandemic prevents landlords from enhanced vetting of newly-leasing tenants, so I am sure to the extent some people are moving in, they are the kind of people who either don’t need jobs because they have substantial personal wealth or they have jobs with companies that are doing well during the pandemic and aren’t too worried about being laid off and therefore having to avail themselves of the pandemic-related moratorium on evictions because they can’t pay rent. Otherwise the poor, poor, put-upon landlords, who are well aware of the current, temporary constraints on their ability to evict, probably wouldn’t be letting them move in.

All the places that banked on people getting a bunch of roommates to afford the unit are screwed in eternal WFH situations.

Over here in Southern Marin, there is very little inventory for sale at the lower end of the market range (condos sub-$1 million). Inventory was low last year and even lower now.

that makes sense. most of the people i know who are looking to leave SF are looking in Marin. I personally dont know anyone moving out of the area, but Im 45. My guess is most of the out of area fleers are in their 20s

I wouldn’t be so sure about that. One of the things the New York Times found when they crunched the data is that the richest areas emptied out the most and the fastest:

“But, on average, income is a strong simple predictor of a neighborhood’s change: The higher-earning a neighborhood is, the more likely it is to have emptied out.”

This dovetails with my anecdotal/social circle experience in SF. The younger lower end workers may have been hit harder, but the stimulus checks, eviction/foreclosure moratorium has largely prevented that from hitting the market so far. Not much incentive to leave if you get money coming in and need not pay your rent. Moving would involve money for moving expenses, getting a lease without income and paying first months rent and security deposit. All that vs stay and not pay. I think what we are seeing now is largely voluntary departures and investors getting ahead of the distress wave.

If the high end moved out, why are Russian Hill and the Marina still popping like a spring street festival? Activity there has picked up if anything, not down.

Streets feel crowded/busy because bars and indoor dining rooms are closed and empty and people aren’t at work.

Anecdotally I know of two couples who already had second homes in Sonoma. They put their SF places on the market in May and made the move north permanent.

I am definitely hoping to be able to buy a small something before a vaccine comes out…I am looking at $600K range for a large studio or small 1/1, in a desirable location…..

I was just looking at this. Tough place to be. The market has not shifted so that studios and 1 Brs are especially attractive south of 700K.

I doubt you will be able to get a 1 bedroom for south of 650k anywhere in SF. I think that price is not coming back.

What are you talking about, there are 84 1 bedrooms on the market with an asking price for under $700K, in nearly every neighborhood. 49 of them aren’t even asking as much as $650K

Give me 1 in pac height or noe, that is under $700K with at least 500 sq ft please….

Increase your budget or become more flexible in your neighborhoods. What about Cole Valley, Inner sunset, Inner Richmond?

725 square feet 1 bedroom sold for $675K. Just across the Noe border.

510 Square feet studio with a private deck in Pac Heights for $610K.

And twice as many properties come on every week as get sold. Prices will only get lower.

Those two sales aren’t anything noteworthy or indicative of change, Tipster. You don’t know what you’re talking about as usual.

@OC: Isn’t that exactly what ST asked for? 600k-700k range >500sqft. Good hood?

Not really, as the second sentence would have it that they are indicative of some sort of change. They are not. Those Gough and Franklin and California and Broadway where it meets Gough or Franklin addresses have always been where less expensive studios and 1 brs could be found in “Pacific Heights.” Also, positing a condo on up on Portola in response to a Noe Valley question is not. Those units on the side of Twin Peaks on Portola are their own thing and always have been.

How about Telegraph Hill? Here’s a 580 square foot one bedroom that you could probably get for $550K (name link), as it’s been sitting for 2 months at $599K and they just dropped it to $575K. The seller bought in 2005 for $489K and redid the kitchen and bath and that would net the seller an insane 10% return over a 15 year hold after selling expenses. I mean, you just can’t beat that return, that’s about 0.5% per year compounded!

tipster – that Telegraph Hill condo is nice but, the HOA Dues are $945 per month!

Plus – “Additional storage in the building avail at a very reasonable $325/year.”

Includes both homeowners insurance and earthquake insurance. Seems more than reasonable.

a lot of new condo listings are, in a futile and time-wasting effort, asking pre-covid prices and predictably not selling. then they end up reducing the price one or several times and it’s still not selling, which just highlights how out of touch their original price was. what makes this even more dumb is one can already see that there are similar units in their building or neighborhood that have failed to sell in the same price range for several months.

I’ve been patiently waiting to buy a condo for a while now — there is a lot of unimpressive inventory coming online at delusional pricing. Looking forward to seeing what the next 6-18 months bring.

I am waiting to see the next 6 months as well?

18 months? Vaccine might be out and market might be up again

WIll be interesting to see if prices follow down. I predicted they would when sheltering in place began in March, but so far I’ve been wrong as we’ve hit one record high index level after another.

By the way, contrary to many posts on this site, listings do not equal “supply” nor do sales equal “demand.” Both supply and demand are on a curve. On the supply side, a seller is willing to sell a place at a certain price and no less. Thus, if nobody offers that price, he may simply not sell. There are situations where a seller has no choice but to take the highest offer no matter how low that is, but that is uncommon — it was far more common in the foreclosure days of 2008-13. On the demand side, a buyer is willing to buy certain places at certain prices. If a place does not sell, it does not mean there was zero demand but just that the supply and demand curves did not intersect. So high inventory should lead to lower prices, but in a small, non-fungible product market like SF real estate, it is very complicated and not inevitable. We’ll see.

This is hilarious.

Sales have fallen while inventory has risen. There are only ~100 sales each week, so only 1 out of 15 sellers has to want to sell badly enough to meet the buyer’s demand, and that’s pretty much a given. Last week, a Cow Hollow SFR sold for *below* its 2014 price.

Even the best of the best is collapsing. Full floor flats in top Pac Heights co-ops are being reduced $500K at a time. Last year the owner of 1960 Broadway #5 refused to let it go for less than $4.5M. A few reductions and it got pulled from the market. Today, relisted for $3.5M. Funny how the new reality will do that. They’ve owned it forever, and can easily undercut any other seller without losing a dime.

3065 Clay #101, also in Pac Heights, was an Q2 2014 buy and they just lowered it by 5%. If it sells at asking, they just about break even — on their 2014 buy.

And every week, more than 2X as many come on as come off. As long as that pattern holds, next week only 1 out of 16 sellers needs to meet the market, and the week after 1 out of 17. And the panic buying of people who were desperate to get out of a too small living situation they had been stuck in for months seems to have been satiated by the sellers who were realistic about pricing early on. The buyers will only get more picky as the weeks go on. And the sellers will have more competition.

Yes, price is definitely dropping in SF… There is nothing to debate on that….

Speaking of which: Apples-to-Apples for a Contemporary Cow Hollow Home

I am in a rent controlled mid century modern 1BR with a heated pool in the building in Lower Pacific Heights since 2003 with a rent of $1,595. Lock in a rent controlled unit with a reduced price and stay there until they carry you out in a pine box. LOL. The money you save can allow you to buy a cheap cottage in Russian River.

Your landlord must not be increasing rent by the allowed rent control limit or passing through maintenance costs. If they were you would be paying more but still under market rate.

At a 2003 rent of $1595, with banked increases alone it would be $2086.49 in 2020. Or, $1595 in 2020 was $1150 in 2003 with yearly increases. Some maintenance costs can be passed through and often are by savvy landlords.

I have always looked at long term renters as the biggest victims of the rent control laws in SF, because you get content with your low rent, and miss out on the huge price appreciation over the years…

Had you bought something small in 2003, you would be sitting on a lot of equity now…. I bought something in 2012 for $360K now worth $890K…. No amount of rent saved can match that

It’s all timing. Buying only makes sense on the uptrend. Rents have collapsed and prices have just started to fall. Buying now would mean taking a huge loss as prices fall further. Lock in RC now, if rents keep dropping you can ratchet lower by moving to a new place. It won’t be a V bottom. Plenty of time to buy in when prices bottom.

Everyone’s situation is different. My wife and I have rent control on our Marina 1/1 going back to 1994. There’s no way we would have been able to buy here when we were younger and making less income, and a comparable 1/1 condo would probably cost us a million bucks right now.

it is easy to think you could not have afforded anything, but the matter of fact is, yes, likely you would have been able to buy if you wanted to do that bad enough…. And with a rent controlled, it is easy to NOT want to try that hard….

if you invested that rent in segments of the market, you would be doing much better than from the RE

UPDATE: Number of Homes for Sale in S.F. Has Likely Peaked, for Now