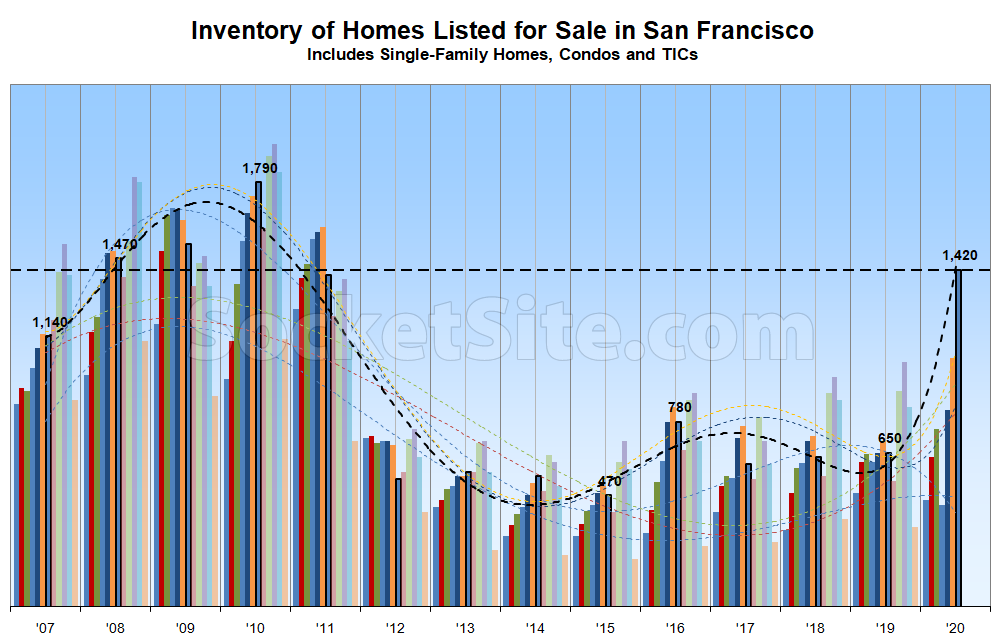

The number of homes on the market in San Francisco, net of new sales and contract activity, ticked up another 4 percent over the past week to 1,420, representing 120 percent more inventory than there was at the same last year and a 10-year seasonal high.

At a more granular level, the number of single-family homes on the market in San Francisco (370) is now running 68 percent higher than at the same time last year while the number of condos (1,050), which tends to be a leading indicator for the market as a whole, is now up by nearly 150 percent having tallied over a thousand for the first time since the fourth quarter of 2010 last week.

With nearly 30 percent of the homes on the market in San Francisco listed for under a million dollars, there are now nearly 130 percent more sub-million dollar listings on the MLS than there were at the same time last year.

And there are now over 200 percent more listings on the MLS with an asking price that has been reduced at least once than at the same time last year, over seven times (7x) more reduced listings than there were in July of 2015, and the most reduced listings in the absolute since the fourth quarter of 2011.

Keep in mind that inventory levels should be ticking down, based on typical seasonality patterns, before jumping again in September. We’ll keep you posted and plugged-in.

What is the blue bar in this graph? Sales are clearly at a high, but it looks like they’re mostly being driven by a single category of the market based on this graph.

The blue bar is “July.” Meaning that “the present” is the category driving the market inventory higher.

That would be “the number of homes on the market in San Francisco, net of new sales and contract activity,” both currently and for the same week in July back to 2007.

The other eleven (11) bars represent normalized point in time inventory counts, typically mid-month, for each of the other eleven (11) months of the year.

And the dashed trend lines are year-over-year.

What *is* the driver? I don’t buy the narrative that everyone in SF is leaving. IMO, the short term rental market is unloading inventory because it isn’t able to sustain cash flow that pays the mortgage. But I do wish I had more evidence to support that theory.

I think a ton of people lost their jobs or have sudden financial insecurity, some are looking to move from cities to suburbia, and many other people are wary of making long-term decisions during a pandemic. Listings pile up; far fewer buyers to go around.

It isn’t clear to me that these are the same people that own homes. The service industry got wrecked, but I think this group of folks may be more likely to rent. Tech has been affected, but it’s a drop in the bucket. Would be nice to find data to prove/disprove this.

Every industry has been affected, even if service is just the most visible. Healthcare, tourism, real estate, finance—all are cutting jobs. You can google to find more specific stats, but here are the general numbers from May.

I know several tech execs who had to sell and move after their cash flow dried up and they couldn’t find new jobs. It’s happening to everyone, even if you’re not hearing about it.

I put most of it down to economic caution – in my case (not to make the anecdotal evidence) I’m a white-collar professional able to work from home, and with a sufficient salary to buy an average S.F. home — but there’s no way I’m going to commit to a 30 year mortgage of S.F.-sized mortgage payments when the economy could crater even more any week now …

In other words, even those who could, aren’t, because they’re concerned about what the future could bring.

It only take one or two percent to begin moving the market. A mass movement is not necessary

The Wall St Journal had an article a bit back that used cell phone tracking data to show that people are indeed leaving urban areas. I think that SF topped the list for urban exodus. This data intrigued me so I looked into it and there are a number of companies that collect cellphone location data. They sell this mostly for marketing purposes, but many of them either have free previews or have lowered their paywalls for some of their data during the pandemic. So if you have a little time on your hands you can get some more detail and convince yourself that this isn’t just some narrative.

Cell phone data can tell you that people have left and stayed away for some length of time, but it does not tell you if they intend to leave permanently or eventually return. For NYC, the New York Times has also looked at census response rate, amount of garbage collected and mail forwarding data. The last item, mail forwarding, shows more of an intent to be gone for a while if not permanently. I think they also found that wealthier zip codes had a disproportionate amount of people leaving the city.

You can’t look into people’s heads to see what is driving them to leave and/or if/when they will come back, but there is plenty of data out there to show that people are leaving. The decline in rents is another data point on this.

Indeed the question is are the moves out of SF temporary or permanent. Developers’ are halting residential construction in SF for the by and by. Ross Edwards, president of Build Group says there is likely to be a long pause before market-rate apartment or condo complexes get going again.

From today’s Chronicle. “Projects that had financing before COVID are still proceeding, but anything new is on hold, unless it’s a pure affordable play,” he said, referring to affordable housing projects. Build Inc has postponed indefinitely..

“They have not been canceled but they have moved over to next year. There is not a set date,” Edwards said. “They are evaluating and watching what happens. There is so much uncertainty about what the future holds.”

“I don’t buy the narrative that everyone in SF is leaving.”

Uhaul 15′ truck from SF to Phoenix on 8/4: $1250. FROM Phoenix to SF on 8/4: $209.

They price the trucks based on demand. You’re wrong and the “narrative” is correct.

That’s a pretty big reach to base your conclusion on that data alone. Prior to the pandemic, rental cars of any kind were notoriously expensive in SF relative to other places. It’s not like there is a big parking lot full of trucks here.

” It’s not like there is a big parking lot full of trucks here.”

So what you’re saying is they have a bigger need to get rid of them from here because they have no place to store them here, and would want to price them to send as many as possible to Phoenix, where they can store them.

You’re making even better arguments for my position.

Feel good VC story of the year: Zoox investors don’t lose their shirts. Love to hear your calculations for ROI on this one. If they’re lucky, they should at least keeps pace with inflation (plus some interest?). One billion dollars can’t be wrong — right?

BTW, thanks for the heads up on Uhaul rates. Gig economy arbitrage opportunity for wanna be truckers…

No. He’s saying there are less of them here, labor costs more here, storage costs more here, so UHauls cost more here.

I wonder how many times people have countered your “U-Haul Indicator, drops mic” take previously. Probably that has happened many, many times. But you still kept saying the same thing anyway. “U-Haul indicator 2009, drops mic.” “U-Haul Indicator, 2012, drops mic.” “U-Haul Indicator, 2018, drops mic.” Never mind there were population gains all interspersed between those years. And I got those years by Googling “U-Haul Indicator” and looking at the various pieces in the press over the years. They keep going back to it too. Do they ever run, “Gee, our U-Haul Indicator piece didn’t pan out” type follow up pieces? I didn’t see any.

“there are less of them here, labor costs more here, storage costs more here,”

Isn’t that the point? There are less of them here because people are taking them on one way moves out of here. Trucks moving *to* here are the ones that need to be stored here. If people were flooding *into* SF then trucks would be piling up and expensive to store here so U-Haul would increase prices *into* SF and decrease prices *out* of SF. But what is happening is the opposite.

Regardless of whether it’s a supply/demand issue in SF, rates in other CA metros are basically the same. So Tipster is right. WE ARE ALL FLEEING TO PHOENIX!!

The point is that local rental costs remain constant ~$40 / day for a 20′ truck in both Phoenix and SF. It costs more to run a business in SF for the reasons I said. The point is also that it’s always been expensive to rent intrastate U-Hauls from SF. Population gain, population loss, U-Haul makes money that way. Another point is that these articles are not effectively predictive.

“interstate,” that was …

“Another point is that these articles are not effectively predictive.”

Actually they are.

Actually, they’re not. Feel free to go back in time and to look at the various net gains interspersed between “U-haul indicator” articles over the past decade plus. You’ll see. Secondly, I will point out that you’re hanging your hat on an article that purports a net loss of a mere 88 souls. Do you really think a “U-Haul Indicator” is precise enough to gauge 88 human beings? Or that it isn’t within a margin of error in the first place? come on now.

The narrative fits what I’m seeing in Hayes Valley. In the course of walking along Buchanan from Grove to Haight to pick up food this past Saturday I saw no fewer than 4 separate uhauls getting loaded up within 40 minutes of each other. Went for a walk along Valencia the next day and the uhaul lot under the freeway was around 2/3 empty. A friend spotted 3 uhauls on Guerrero between 16th and 19th a few weekends back within one afternoon. Maybe I’m just noticing more, but if it isn’t just attention bias there is clearly an observable uptick in moves out of the central rental heavy neighborhoods.

Perhaps as folks who are more recently arrived here mostly for job opportunities watch rents start to fall it is causing rent vs buy calculation hesitation among those who were considering purchasing but not intending to stay in SF forever?

People could also be moving out of those areas to nicer, less-central parts of the city (Russian Hill, Marina, Richmod, Seacliff). If you don’t have a commute, why be close to work?

It’s likely not a mass exdous, but rather a combination of a somewhat-higher-than-normal number of people leaving the city for the many reasons already discussed, and lower-than-normal number of people moving in. People moving here is driven by jobs, university, etc. Since the area is so expensive and those activities are now remote for a while, people who would normally be moving here from outside the area for those opportunities are likely choosing to delay moving until they physically need to be here.

as with anything its a combination of factors. 1. Hiring freezes. 2. Layoffs 3. Workers being able to work remote full time. 4. Corona virus unemployment. 5. Uncertainty about the future. 6. Probably almost no one moving here for a job. If you are a home buyer, all of which can help lead to feeling less anxious about being outbid for a house and if you can, sit on the fence and wait to see if prices drop.

How much of the drive up in prices in the recent year is from FOMO. This may be the the drive down as the FOMO resides based on factors listed above, among others.

September/October is going to bring some large price cuts

I’ve been in San Francisco for 20+ years. I’ve never seen as many moving trucks being loaded as I have over the past two weeks.

I’ve been in SF over 25 years. While I agree there are plenty of moving trucks around, I’d say there are nowhere near as many as say summer 2001 or winter 2009. I mean, not even close.