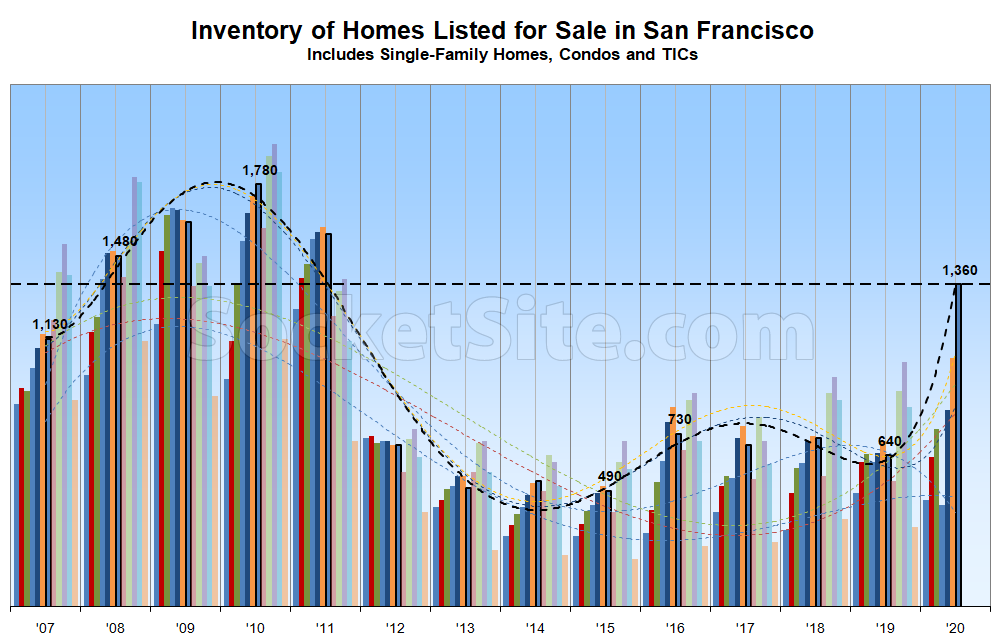

Continuing a trend which shouldn’t catch any plugged-in readers by surprise, the number of homes on the market in San Francisco, net of new sales and contract signings, ticked up another 6 percent over the past week to 1,360, which is now over twice as much inventory as there was at the same last year, a new 9-year high, and within 8 percent of its mark in July of 2008.

At a more granular level, while the number of single-family homes currently listed for sale in San Francisco (350) is only running 48 percent higher than at the same time last year, the number of condos (1,010), which tends to be a leading indicator for the market as a whole, is up by over 130 percent and tallied over a thousand for the first time since the fourth quarter of 2010.

With nearly 30 percent of the homes now on the market in San Francisco having been listed for under a million dollars, there are now over twice as many sub-million dollar listings on the MLS than there were at the same time last year.

And as we highlighted last week, there are now over 150 percent more reduced listings on the MLS than there were at the same time last year, over six times (6x) more than there were in July of 2015, and the most reduced listings since the fourth quarter of 2011.

Keep in mind that inventory levels should be ticking down, based on typical seasonality patterns, before jumping again in September. We’ll keep you posted and plugged-in.

338 Main Street #14C, sold in 2016 for $2.5M, then sold again last October for $2.7M. Reduced yesterday to $1.995M. This is just heating up, and they’re already down $820K including commissions and transfer tax, in less than a year of ownership. No loan that I can see, the owner is going to eat every dime of this loss.

I wonder if you’ll be as enthusiastic when all the paycheck-to-paycheck renters who haven’t paid rent in 3 months (and whose legal protections will eventually time out) start facing eviction.

Hmmm, let’s try to figure out what happens to rents when another 30% of the rental units come on the market at the same time when those legal protections expire.

Rents drop like a rock, and now even more small landlords can’t rent their properties profitably and sell, all at the same time. Home prices will accelerate their decline, which will then cause even more sellers to sell.

Those legal protections are holding back the real estate sales market from falling further and faster.

While I think it would be intellectually interesting to see this “doom loop” scenario play out, I don’t expect it to actually happen.

If rents drop dramatically, landlords will be able to go to their lender(s) and ask for for forbearance on their mortgage, arguing that the fundamentals of their business hasn’t changed, and that the reduced income is a temporary consequence of the coronavirus-induced national emergency. Lenders don’t want to foreclose, and they know, ahead of time, that forced selling of properties will negatively impact their own balance sheets on a mark-to-market basis, so they have every motivation to extend loans on terms favorable to borrowers.

Once they have runway from mortgage servicers, the proverbial small-time landlords can just stop making their loan payments, keep collecting rents from tenants who are still willing and able to pay and hold out until the sales market recovers. Once it does, they can sell and pay back all the back mortgage payments with interest or what have you. Meanwhile they are writing off all of that lost rent on their taxes and reducing their tax liability from their other income streams.

This is hilariously optimistic. We are at the beginning of a prolonged economic crises. Lenders will not offer forbearance in perpetuity. Even historically low interest rates cannot prop up this grossly overvalued market anymore. Again, this is just the beginning.

Lenders don’t need to offer forbearance in perpetuity, they just need to do so long enough to outlast the pandemic-related economic downturn. That downturn will end shortly after a vaccine or an effective treatment appears.

Even if a vaccine takes years to develop and get propagated out into the population, if the Federal and State governments decide in a shorter time period that “well, this has gone on long enough, let’s re-open everything, let the virus rip wild and we’ll pin our hopes on herd immunity”, people who manage to hold onto their properties and not sell into a downturn will be better off than those that do. Lenders know this.

Brahma, indefinite forbearance might play well to the Bernie Sanders crowd, but that is not how banks or businesses work. Mortgage lending counts on the fact that most people pay their mortgage most of the time. There just isn’t that much allowance for widespread defaults and delinquencies. Based on the results of the Fed’s recent bank stress test, the Fed has already ordered banks to cease their share buybacks and cap their dividend payments. And as Anonoly said, this is just the beginning.

And if people can simply stop paying their mortgage with little or no consequence, then many more people will chose that option. Also, what happens at the end when all the back mortgage payments with taxes and interest come due? You say that people could simply sell and pay that off, but if everyone is selling 2-3 years from now you’ll have the same glut of sales that you’d have if they all sold today.

And if people can simply cease mortgage payments for an indefinite period of time, what is that going to do to lending during that time period? Anecdotally, banks have already increased their scrutiny of prospective borrowers even with the current level of forbearance.

FYI if you want a timeline, the conventional wisdom is that right now there is rare bi-partisan alignment on the stimulus. The Repubs want stimulus because a good economy will help them for the November election. The Dems are just generally in favor of stimulus. Unless there is a Dem sweep (Pres, Senate, House) in November the alignment around the stimulus goes away after the election.

Per Redfin, after it was sold last October, it was listed for sale again, one month later on 11-13-19 and then delisted 3-21-20. What do you make of that?

I instinctively reached for “money laundering” except their asking was slightly above the previous purchase price. Maybe just a real bad case of buyer’s remorse?

Reads like a failed flip, attempted hold for a stronger spring, now chasing the market down.

Gag on those Gaggenau appliances with that loss. Lumina was a sign of the top. Marginal hood with over priced amenities/hoa. How does a valet safely park your car in Covid? Hows that climbing wall? The $160 steak at Angler was all you needed to know.

Oh, so true.

“Keep in mind that inventory levels should be ticking down, based on typical seasonality patterns, before jumping again in September.” — like 2020 is “typical”

There is no denying these statistics, but for the amateur, reading the Sunday Chronicle and the Nob Hill Gazette, it would appear that prices are unaffected. How can that be?

Pretty easy, I think – asking prices just haven’t changed that much, yet. In the price range I’m looking (<1.5M), single family homes are selling briskly (backyards, and space, is more valuable now than it was before, I assume) but condos are piling up and almost nothing is selling. Sellers haven't lowered their asking prices much. I don't expect this to last.

“…for the amateur, reading the Sunday Chronicle and the Nob Hill Gazette, it would appear that prices are unaffected.”

Based on what metric?

Hopefully you’re not quoting changes in “median/average” sales prices as an uneven drop in sale volumes over the past quarter are skewing those reports. And while movements in the median and average sale prices are a great measure of what’s selling, they’re not a great measure of actual changes in value, especially when sales volumes are down.

But on an apples-to-apples or price per square foot basis, values are down and price reductions are on the rise.

In related news: Rebound in S.F. Home Sales and “Pent Up Demand” Plateau

Just wait six months before even thinking of buying … There will be plenty of available inventory.

So far no posts have been conversant with what’s actually taking place wrt covid-19 mortgage forbearance. As of this month deferral has been added to forbearance.

UPDATE: Number of Homes for Sale in S.F. Just Hit a 10-Year High