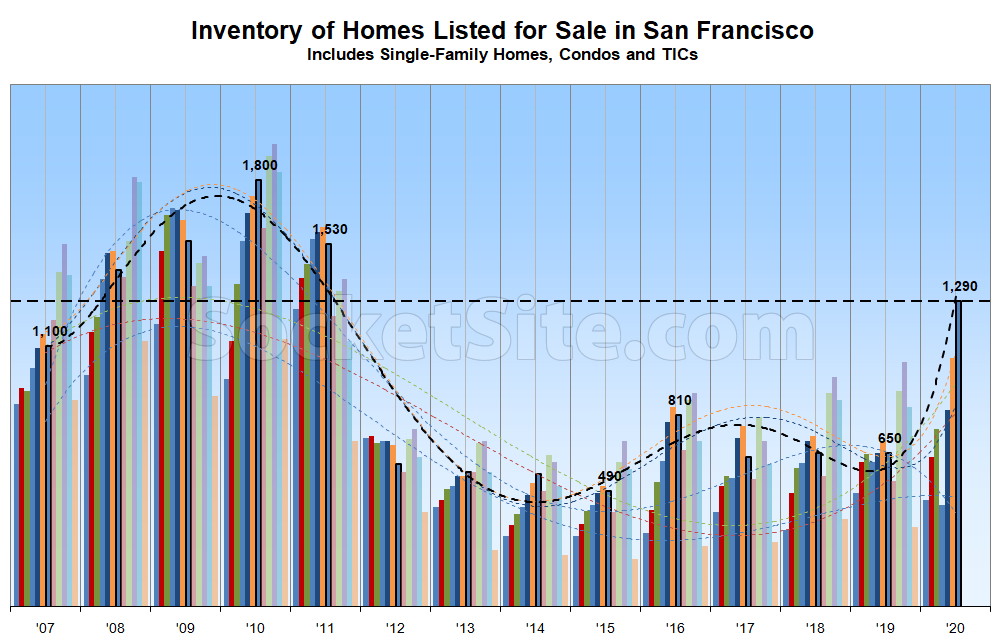

Following a trend which shouldn’t catch any plugged-in readers by surprise, the number of homes on the market in San Francisco, net of new sales and contract signings, has jumped another 10 percent over the past week to 1,290, which is 98 percent more inventory on the market as there was at the same last year a new 9-year high.

At a more granular level, the number of single-family homes currently listed for sale in San Francisco (360) is now running 55 percent higher than at the same time last year while the number of condos (930), which tends to be a leading indicator for the market as a whole, is up by over 120 percent.

At the same time, the percentage of homes on the market in San Francisco which have undergone at least one official price cut has ticked up to 23 percent. And as such, there are now 130 percent more reduced listings on the MLS than there were at the same time last year, and five times (5x) the number of reduced listings than there were in July of 2015, for the most reduced listings, in the absolute, since the fourth quarter of 2011, as we noted last week.

And with nearly 30 percent of the homes on the market in San Francisco having been listed for under a million dollars, there are now 80 percent more sub-million dollar listings on the MLS than there were at the same time last year and the most, in the absolute, since the fourth quarter of 2016.

All that being said, if typical seasonality patterns hold, inventory levels should start ticking down over the next month, at least in the absolute, before jumping again in September.

No broad price capitulation yet, though. Perhaps in 6-12 months we get back to the low prices + low rates scenario of 2010-13. For buyers, a good time to wait. For sellers, good time to take any reasonable offer. YMMV

This is probably one of those times when you shouldn’t sell unless you have no other choice. But some people are scrambling to leave the city for less dense environs, for multiple reasons. If the reason is Covid, though, it may not be a great choice; there have been some studies that show that there’s no connection between infection rates and population density (maybe because people in urban areas are smarter about complying with health mandates.)

I don’t expect huge price drops, except perhaps in neighborhoods which were not that attractive to begin with — areas where “proximity to employment” was really the only thing going for them. Why would you want to live in SoMa if you don’t need to go into the office any more? But my crystal ball is often on the fritz, so I’ll wait and see.

Well, saying “the reason is Covid” can mean a few different things, only one of which is the perceived marginal increase of exposure to the virus in S.F. proper risk. It can also mean that since the amenities which made The City so attractive are either greatly reduced or completely unavailable, there’s no good reason to pay for the (much) higher cost of living over the suburbs. If one’s favorite restaurants, theaters, nightclubs and so on are unavailable or so greatly restricted that the experience has fundamentally changed for the worse, why would you want to live in S.F. if you don’t need to go into the office any more or your office is already located outside of The City?

Exactly. A Chronicle article today mentioned these amenities as regards the Mira tower. The streets below have empty storefronts and closed restaurants. A street vibe that potential buyers at Mira and other SOMA towers looked for is not there. Now not only are those amenities gone, but open space/larger residences are the new amenity of choice. If workers can telework from the edges of the Bay Area or further out, a large chunk will choose to do so.

for those i know who are considering or are leaving, it has to do with getting more indoor space, and personal outdoor space (yard) as opposed to infection risk. the 2nd biggest reason is the rampant/homeless drug problem; 3) increase in crime; 4) city’s continual war against children; 5) terrible state of politics, especially from board of supervisors. many of those were pre-covid issues but have been intensified and have moved up their timeline

+1 on #1 and #2. What’s the details on #4?

spending more money to support homeless than children. terrible state of the public schools. lack of clean facilities for children. war on cars proxy for war on having more than 1 child. would you take a child downtown right now and allow them to see people shooting up, defecating, attacking, dying in street,etc?

I am not religious but this is the sentiment I try to teach my child living in the city, “there but for the grace of God go I”

re #4, SFUSD was planning budget cuts even before covid19. That’s with coffers flush with record tax revenues (at the time). As others have pointed out, homeless spending up combined with school spending cuts = war against children.

The city is amazing right now imo. Weather is nice and cool and there is no traffic. Lots of solid restaurants are open. The closed bars/nightclubs keep the bridge and tunnel away. I mean if you can stay here now, you are seeing the glory days!

And that no traffic means no tourists…so Abe, Andy and Ben aren’t showing up either. Glory days indeed….it’s the best it’s been since 1775 !!

There’s another sector that underperforms when the market is in decline: areas/properties that were bid up on account of being relatively inexpensive compared to more desirable parts of the city.

Good to make that distinction. If they were relatively cheap and had other merits, then they dipped less or even increased. Take the Mission, which only dropped 7% or Oakland which is up 4.5%.

You are doing some real cherry picking with that study’s findings.

“We find metropolitan population to be one of the most significant predictors of infection rates; larger metropolitan areas have higher infection and higher mortality rates. We also find that after controlling for metropolitan population, county density is not significantly related to the infection rate, possibly due to more adherence to social distancing guidelines. However, counties with higher densities have significantly lower virus-related mortality rates than do counties with lower densities, possibly due to superior health care systems.”

“Large metropolitan areas with a higher number of counties tightly linked together through economic, social, and commuting relationships are the most vulnerable to the pandemic outbreaks. They are more likely to exchange tourists and businesspeople within themselves and with other parts, thus increasing the risk of cross-border infections.”

“We also find that counties with a higher percentage of the population over age 60 have higher mortality rates. Indeed, this variable is the most significant predictor of the mortality rate other than the infection rate itself.”

Metro areas are much much worse for COVID, but within those metro areas they didn’t see much correlation with density. Moving from SOMA to the Richmond or Noe might not change your risk much, but moving out of the BA to someplace smaller does. There is some benefit to being close to better healthcare systems, but that is dwarfed by the risks of age and comorbidity. No matter where you live your age and your health are not changing.

Number sold last week, Number Listed week : Number sold last month, number listed last month

Marina 94123: 6, 13 : 23, 41

PacHts 94115: 6, 14 : 20, 27

PresHts 94118: 7, 8: 27, 28

Soma 94105: 1, 16 : 7, 57

From last week’s Socketsite posting: “And once again, keep in mind that inventory levels typically decline from June through August and then peak in October.”

So in a month in which listings typically decline, they spiked. Yes, SOMA is doing poorly but the other areas aren’t declining in inventory either, they are increasing too. Presideo Heights, including Inner Richmond, are hanging on, but this is when inventory should be declining, and 7 out of 47 homes on the market in 94118 have had price reductions, including 3341 Jackson, a 3/2 flat in Presideo Heights in a 2 unit building with 2 parking, which sold for 2.710 in 2016 and is now listed at 2.595, for a ~$250K loss (incl fees and taxes) over its 2016 price if it sells at asking.

The broader measures still indicate record high prices (case shiller) or right up there (mls).

Anecdotes aren’t worth a whole lot, but for those comparing, look at 1571 Grove. Nice 3 BR / 2 Ba TIC in NOPA. Went for $1,525,000 in 2017 after being listed at $1,680,000. Just closed at $1,850,000 after being listed at $1,795,000. Closed 18 days after being listed. We’ll see if prices adjust. So far, not much (or any) compelling evidence of it, much to my surprise.

The Bay Area in general (i.e., the broader measure) has outperformed San Francisco since 2015, as has the least expensive third of the market across the board.

Regardless, the broader index for condo values and the middle of the market – into which the majority of San Francisco properties would fall – effectively peaked back in mid-2018 (with total net changes of 0.2 – 1.0 percent since).

And one again, it’s well past the point of leading indicators, the “anomalous few” or even “some” segments of the market having declined when the index drops, at that point it’s representative of the majority of the market being in decline.

P.S. – the “1571” Grove Street data you’re reporting is wrong, the 2017 sale at $1.525 million was for a different unit in the building (note the listing in 2017 versus 2020). But the 3341 Jackson Street re-sale will effectively be “apples-to-apples” (as were all these).

Don’t think so. The units are separately numbered. Look at all the photos and the unit description. Sure appears to be the same unit, although if you provide something more than two photos taken from different angles, I will admit I’m mistaken about this.

What is your basis for your statement that “The Bay Area in general (i.e., the broader measure) has outperformed San Francisco since 2015.” This sounds like ipse dixit. I can be persuaded otherwise, but please provide whatever you’re basing this on.

Do your due diligence. The photos aren’t simply “taken from different angles.” But here’s a reverse angle from the 2020 listing if you need a little more help.

Don’t see it. It’s just a mirror image. Photographers do that all the time. 1571 is the only unit with that address. You’re going to have to come up with something a little more convincing if you’re going to argue the listing companies got the address wrong. Heck, at most, it’s an identical unit but the mirror image. About as apples to apples as you can get.

In addition to better, or perhaps simply some, due diligence, you might want to work on your spatial reasoning skills, because those aren’t mirror images of the same unit. In fact, they’re not even close.

We might also suggest working on your understanding of how TICs are structured, in terms of sharing a single parcel number to which sales are assigned.

And no, two different units in the same building aren’t “about as apples to apples as you can get” (but all these are).

Look again sfres. The 2020 listing has crown molding and a glass guardrail at the stairs. The 2017 listing has no crown molding and a cable guardrail at the stairs.

Beyond the cosmetic, one might notice a difference in the number/size of the windows as well.

There’s absolutely no way that SF real estate doesn’t decline within the next 6 months. For the next 3 months, restaurants will be outdoor dining only, no theaters, music, etc. Not much advantage to living in the city if most of the amenities and close proximity to work benefits are removed. Due to Covid many companies are realizing how much work can be done remotely without overpriced office space. The prices will not hold up once more inventory hits market in late August/early September.

its hard not to imagine a 15-20% drop over the next 2 years, but will it be followed by the rapid rise (like happened in 2011 to 2018)? thats a more important question to most homeowners

i think this will have more to do with local political decisions and whether we can continue down our anti-business plans as envisioned by board of supervisors. i mean just look at all the increased tax measures coming on Nov ballot

After years of giving absolutely massive tax breaks to huge companies, most of which did nothing to improve things in the way they had implied they would in order to help secure those tax breaks.

What tax breaks? And what was the total cost?

Jake T, one example was the Central Market Street and Tenderloin Area Payroll Expense Tax Exclusion, commonly known as Twitter’s tax break. From SF supervisors slam ‘Twitter tax break’: ‘This was a terrible piece of public policy’:

Emphasis mine. I guess if you’re a real estate agent, a landlord or a shareholder in Twitter, it was a successful policy, but for almost everyone else, it was terrible.

Agreed although I think a 15-20% drop might be generous.

We’re already down ~10%

Down 10% in what measure?

Interesting podcast on the Calmatters site with an interview with the Zillow economist Skylar Olson about the resiliency of home prices.

Cue: “Yeah but that’s Zillow, they’re pro real estate prices and they are totally wrong about my home’s value.” Okay, boomer. Maybe listen and make your own evaluation.

Her main point is that sellers pulled back just as much as buyers did. But she specifically called out SF as an exception to that. And the data shows SF inventory already shooting up to 2008 crisis levels.

She also mentions how forbearance/unemployment/eviction moratoriums are temporarily keeping things afloat. Which I agree with, but what happens when that runs out? She even mentions that she expects rents to take another leg down when the unemployment runs out.

She also points out that people who were homeowners pre-COIVD are a more financially stable group. This is true but anecdotally the tech class people aren’t leaving because they are broke, they are leaving because given the reasons jimbo lists above they think they get more bang for their buck elsewhere.

Who is going to live in a city when that rat Mayor shuts every business down. People come into the city because of the beauty, which it still has, the restaurants which are now closed, and the friendliness of people in which now one talks to each other with this fake plandemic. Expect 50% price drop then your Hedge funds can buy everything up.The city is finished due to these rats!

Way to out yourself by calling the black female mayor a “rat” for following the recommendations of public health experts.

Did someone miss the recent announcement that the air conditioning system is considered the primary reason for the COVID outbreaks on the cruise ships? How healthy are all those buildings with windows that do not open but rely on shared air circulation?

Regardless of the health issues, people value their personal freedoms and controlling one’s environment and ability to travel is primary motive for leaving an uncomfortable situation. A private vehicle is the safest transportation, but the city continues to fight them.

Homeowners have lost the right to keep unobstructed windows and views. Residents can no longer rely on their sunny rooms and yards to remain sunny. Citizens who invest in solar power systems cannot protect them from shadows from nearby neighbors future building projects.

If none of these issues effect you, the desire for privacy and personal space during a pandemic, may be enough to convince you to leave your cramped, close quarters. Lifestyle is a primary reason many came and when that changes, there is no reason to stay.

Wow. Complaining about the shadow of a building on your PV panel. Entitled much? Keep unobstructed views. Lol. You realize this is an urban environment/ city, yes? Perhaps you can love to a more rural community, and drive around your safe private vehicle and if you wont need to complain about building shadows on your roof.

“Citizens who invest in solar power systems cannot protect them from shadows from nearby neighbors future building projects.”

Wow that is a new one. You’re way past the expiration date of city living if you’re complaining about the shadows effecting your PV panels.

“A private vehicle is the safest transportation,…”

Only if you disregard the safety of everyone outside of your vehicle.

In related news: Price Cutting Picking Up Steam

UPDATE: Number of Homes for Sale Nearing Recession-Era Levels in S.F.

I assume the increased inventory has a lot to do with tech workers being told they can telework for the next year or so. Do you have any idea what a million dollars can buy in Kansas?