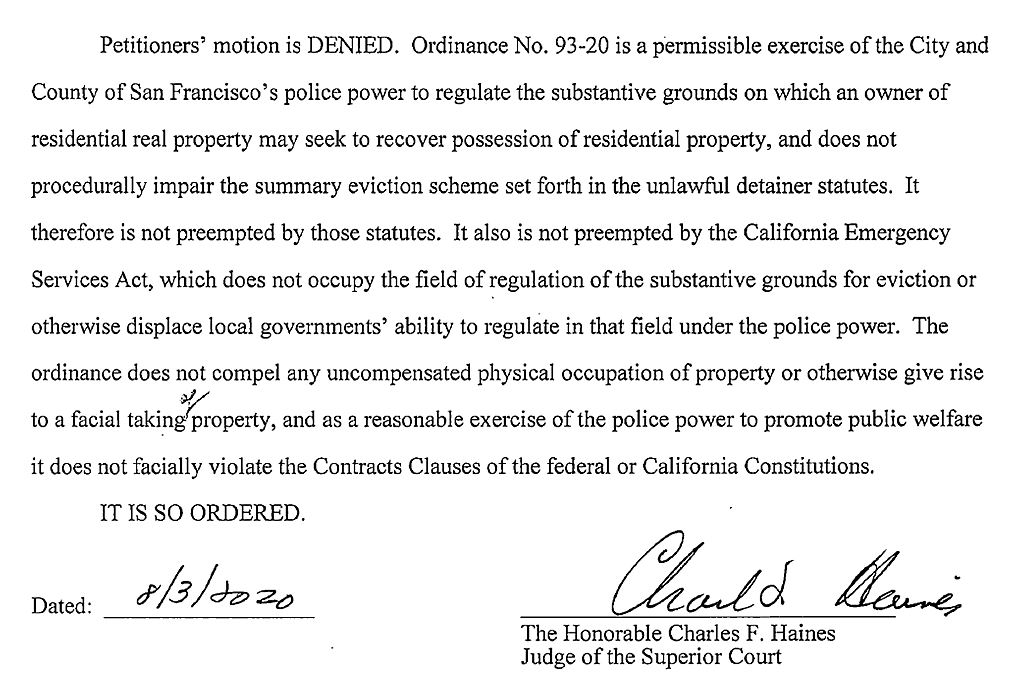

Having been denied by a San Francisco Superior Court Judge last week, the San Francisco Apartment Association, San Francisco Association of Realtors, Coalition for Better Housing, and Small Property Owners of San Francisco Institute have just filed an appeal of the judge’s ruling that upheld San Francisco’s COVID-19 Tenant Protection Ordinance (No. 93-20) which was enacted back in June.

While Ordinance No. 93-20 does not forgive any past due rents or tenant obligations, nor prohibit a landlord from seeking to collect via a civil claim or collection agency once the City’s moratorium period, which was recently extended, has ended, it does remove the threat of eviction due to unpaid rents accumulated during the pandemic and prohibits the charging of any associated late fees and/or interest.

We’ll keep you posted and plugged-in.

I could be wrong, but I believe the government money is more than enough to pay rent. Folks choose NOT to pay rent. Am I correct in that understanding?

Now, I am more sympathetic with commercial lease, where the tenant does not get to use the space at all. I think rent reduction is warranted there.

You are in fact wrong.

The “government money” is currently $0, as the Federal Pandemic Unemployment Compensation program ended in July. Prior to its ending, it paid $600 per week to qualifying unemployed Americans.

You think $2,400 per month is enough to cover rent in San Francisco, let alone rent plus food plus utilities?

Dont you get $900 per two weeks from EDD in unemployment? That would put you at $4000 ish per month, correct?

Up to $900 every two weeks. As little as $90. Somewhere around 50% of wages.

Also don’t forget that unemployment benefits are taxable.

Or to take into account the cost of health insurance, particularly during a pandemic, the average policy for which has been running around $600 per month in CA.

We should also note there’s a backlog of over 1 million unprocessed unemployment/PUA filings across California, including new claims that were submitted back in March and have yet to be approved or paid.

That’s the maximum, pre-tax amount. State benefits, if one qualifies, range from $40 to $450 per week.

Where are you getting these figures from? $2400? $900?

FPUC paid $600 to each qualifying American per week. There are four weeks (average) in a month. $600 times 4 is $2,400.

The maximum Unemployment Insurance benefit in California is $450 per week. Taken every two weeks, that’s $900 biweekly.

Most people aren’t getting the maximum UI payment.

And that’s $2400 *if* you qualified for unemployment… gig workers and others left out to dry… and that’s also only on top of unemployment comp, which is not 100% of the prior earnings.

From One-Third of American Renters Expected to Miss Their August Payment:

Emphasis added. So folks earlier in this thread such as “vlad”, implying that tenants will stop paying rent if there is no threat of eviction are incorrect (granted, these are national numbers, but I have seen no data indicating S.F. tenants are markedly different).

Frankly I am pretty shocked that members of the rentier class thinks that in a pandemic taxpayers should support their passive income stream so they can glide through the current crisis unharmed, while other small business owners such as restaurant operators and the like go bankrupt.

That article switches between talking about renters & homeowners vs just renters and between missing July rent/mortgage and expecting to miss August rent/mortgage. It’s a bit of a mish mash, but all the numbers are around 1/3. So it’s probably the same for renters and homeowners, but it would be nice to see a direct comparison of % renters who missed rent vs % owners who missed their mortgage.

For both owners & renters what “tipster” points out below is going to make it harder and harder to keep up the eviction/foreclosure moratoriums indefinitely. Maybe initially people tried to scrape together money from credit cards and other sources, but as “tipster” points out this is not the rational choice. To “Matt Alenford”, my understanding is that part of the CARES act is that being in forbearance will not affect your credit score.

For both owners & renters unless there is some endgame in place to wind this downI think this 1/3 number is only going to go up.

Non-pymt of rent in SF is still hovering ~6% tops. Folks seem to paying the rent just fine. Of course, those in highly subsidized units are very motivated to continue to pay.

Source for this? Census CA number is close to 30%. What is the motivation to pay if there can be no eviction?

For context, there were a grand total of 123 eviction notices filed in San Francisco related to the late or non-payment of rent from March of 2018 through February of last year (2019), which was down from a grand total of 140 filed during the statistical year before.

Gavin says (name link) the state doesn’t have the $100 of the $400, and the act Trump used to come up with the remaining $300 says the Feds can’t pay all of it without the states chipping in, so currently the [maximum] benefit in California is $1800/mo.

I am a New Jersey single family landlord. My non paying tenant was supposed to move out by March 14 in accordance with our court agreement. They did not. Then our governor put in a blanket moratorium on eviction for any reason at all. No idea when he will lift the emergency and the way he worded his orders, 60 days after lifting of emergency is the earliest I can evict.

Clearly, these orders were too broad and failed to take into account tenants who are simply taking advantage of the order. Now with Harris as VP nominee, if she gets elected, she is on record for wanting one full year of no questions moratorium.

Small mom and pop landlords are absolutely being asked to turn over their properties without any compensation while we still have to keep paying our taxes, mortgage, insurance, maintenance etc.

Sounds very unamerican.

I haven’t read the orders in New Jersey, but if the orders there are like the ones in effect here, “small mom and pop landlords” are not being asked to go without any compensation, as tenants still are liable for back rent. Gjm can still sue a non paying tenant for back rent as well as interest and any penalties covered by the lease and local law, payable after the emergency orders are lifted.

Small mom and pop landlords can always contact their mortgage lender and get forbearance.

What sounds very unamerican to me is turning out hundreds of thousands of people into the street during a pandemic, especially in San Francisco where the sidewalks are already filling up with people living in tents.

I’m in my mid-30s (Raegan was my first president) and throwing people out on the street is actually the most American thing I’ve heard in a while.

Forbearance is only offered if a mortgage is backed by Freddie/fannie,,, Given the SF real estate prices, I wont be surprised if MOST of the loans are NOT backed by Freddie/Fannie…

Exactly. I have four mortgages on four rental properties and not a single one of them is a Fannie/Freddie loan. So no forbearance for me. Nevertheless I am doing my best to work with every single tenant who’s in a bad spot and is doing their best and paying what they can. It’s the ones who are neither communicating nor paying anything at all that I want to get rid of, they are just taking advantage of what is (for them) a great deal: free rent.

There’s no point in suing a broke tenant who can’t pay rent.

You’re aware, I assume – or at least hope – that if Harris gets elected her role in the legislative process will be less than it is now: she’ll merely preside over the body of which she’s currently a full voting member.

@Gjm, I’d say the measures wasn’t broad enough, as there should have been relief for landlords such as yourself. I don’t think it’s American to toss someone out during an unprecedented event, but it shouldn’t be borne on the backs of any private entity.

What the government is doing is insane. There are a myriad of solutions that would help both parties and reduced counter-party risk moving forward. Here are two:

1. They could help tenants having a tough time by giving them “rent stamps” to help pay the rent.

2. They could allow landlords to deduct lost rent on their property taxes, NOT their income taxes (it’s too late).

Forbearance is NOT a solution. Anyone with a mortgage or a FICO score they care about will inform you. Banks, and any other lending institution, will hold it against you.

If the elected officials keep this up, you will soon hear stories similar to how landlords took care of things in the old days. When rental contracts are outlawed, landlords will be forced to work outside the “law”.

Agreed, Government should have stepped in and PAID for tenants to stay in place, and maybe raise tax to cover this expenses… That way, every single america is helping to keep tenants in place…

This site skews to favor landlords. Fine. But any other investment doesn’t expect govt bailouts. If the stock market falls, you lose. Why should non property owning tax payers pay for mom and pop landlords. If you over extended then tough.

I don’t have a fundamental problem if fair market conditions devalue my rental properties, decrease rent rolls, and cause me to lose money on my investment. What I do have a fundamental problem with, is telling me that someone can live in my property for free (and that it’s my responsibility to subsidize someone else’s living costs).

That’s not a bailout. That’s a reimbursement.

The state isn’t giving them permission to live in your property “for free”. They’re still responsible for repaying you 6 months after the end of the emergency order.

The state is temporarily suspending your use of a particular remedy against a tenant who refuses to uphold their end of the bargain.

We’re not talking about leasing a backhoe here. We’re talking about a contract to provide shelter, which is a basic human necessity. Lack of shelter, even temporary, causes a long tail of catastrophe.

Shelter, or providing of it as “a basic human necessity”, is government’s job…not certain private individuals who saved all their lives and purchased a rental property.

On that subject, is food “a basic human necessity”? Why is Safeway still charging you?

Exactly. I don’t understand members of the rentier class, such as ST, who seem to believe that every American should essentially be taxed in order to support their businesses. If you really believe in unrestrained, laissez-faire capitalism, what you should do if you can’t cover your expenses as a mom and pop landlord is sell your properties at the market price to a willing buyer who isn’t as capital-constrained or over-leveraged.

The government doesn’t force Safeway or restaurants to give you free food (or to let you pay for it months or years after provided to you interest free). So why should landlords have to provide this service?

It’s a non sequitur to invoke laissez-faire capitalism on a situation expressly defined by government intervention.

Landlords have recourse to pivot their business to cover their expenses (rent to someone who can pay). Government intervention has taken that recourse away. There is nothing laissez-faire about that.

Exactly – selling my rental is what I’m doing. I don’t have a Fannie or Freddie loan, so when my tenants move out this month (apparently moving to Hawaii), I’m selling. I’m retired and don’t have the income to pay the mortgage without rent.

Brahma – everyone agrees that tenants should be kept in their homes, but who should pay for that ? if government takes their jobs away and take away their ability to pay their rent, shouldn’t government be paying for their rent? Why should the landlord paying for tenant’s rent when the landlord did nothing to the tenant?

Well, there’s no need for me to reply, now it’s moot. California judges lift coronavirus eviction ban:

It’s good to know California’s judges are so mindful of the desires and priorities of the petite bourgeoisie.

that is GREAT news. That is what a lawful society should be like. Government took away a tenant’s ability to make money, then government should be paying for the tenant’s rent. Landlords should not be held liable when he/she did nothing to hurt the tenant.

Nature took away the jobs in businesses that cannot operate safely during this pandemic, not the government. The government is simply making the choice between people’s lives and their livelihoods.

Milkshake – have all other services waived payment as landlords are obligated to? Can I pay my gas groceries and utilities on a to-be-negotiated timeframe that starts a year after the pandemic limits end (or however Choi’s legislation turn out?

How about salaries for our elected officials? Why don’t we halt those outflows temporarily so the government can recover?

I mean, it’s nature’s fault, right?

If you’re a renter and you’ve lost your job and were getting $4200/month from the government and had a $1800 rent payment due and a $6000 credit card balance, wouldn’t the optimal strategy be to stiff the landlord entirely and use the $1800 rent payment to pay down the credit card bill earning 21% interest? When you’re finally forced to pay the landlord in a few years, you’ll owe the landlord $36,000 and have no assets.

You can then make a payment plan to pay back the landlord, interest free and late penalty free, over the next 5 years and threaten to file for bankruptcy if the landlord doesn’t forgive half the rent payments.

And checking Visa stock, it’s back up to where it was before the pandemic. They aren’t suffering. At all. Landlords: VISA thanks you for your sacrifice.

Thinking more about this, I think the focus on the current eviction ban misses the real problem. Right now many are not paying their rents/mortgages, but all those missed payments are piling up. And the real problem is what happens to that pile of debt at the end of all this.

Unless the government changes the rules and forces cramdowns it is very likely that mortgage lenders will get their money. They essentially have the underlying property as collateral. But I think that it is going to be very hard for landlords to collect the accumulated back rent.

Evictions won’t be the problem, I think the problem will be that once tenants run up rent arrears to the maximum it will make much more sense for them to simply leave. Maybe not for tenants with deep rent control discounts, but anyone paying near pre-COVID market prices is going to be seriously tempted to skip out on that debt.

yes, though wouldn’t a non-paying tenant have a difficult time renting another place after running up rent arrears and abandoning the apartment?

True, but I would think the actual order would be to acquire new accommodations prior to walking away from the debt on the old one.

Perfectly stated. That is why we are keeping our rental unit vacant. It would be a far larger loss to have a non-paying tenant in terms of the high cost of utilities in addition to the free rent. Small landlords will fear getting stuck with this headache, I think there will be a bigger long term crisis brewing in SF, vacant units will be kept off the market permanently.