Having peaked at 116 in 2014, the number of newly proposed plans for major developments in San Francisco has been trending down ever since, a trend which shouldn’t catch any plugged-in readers by surprise.

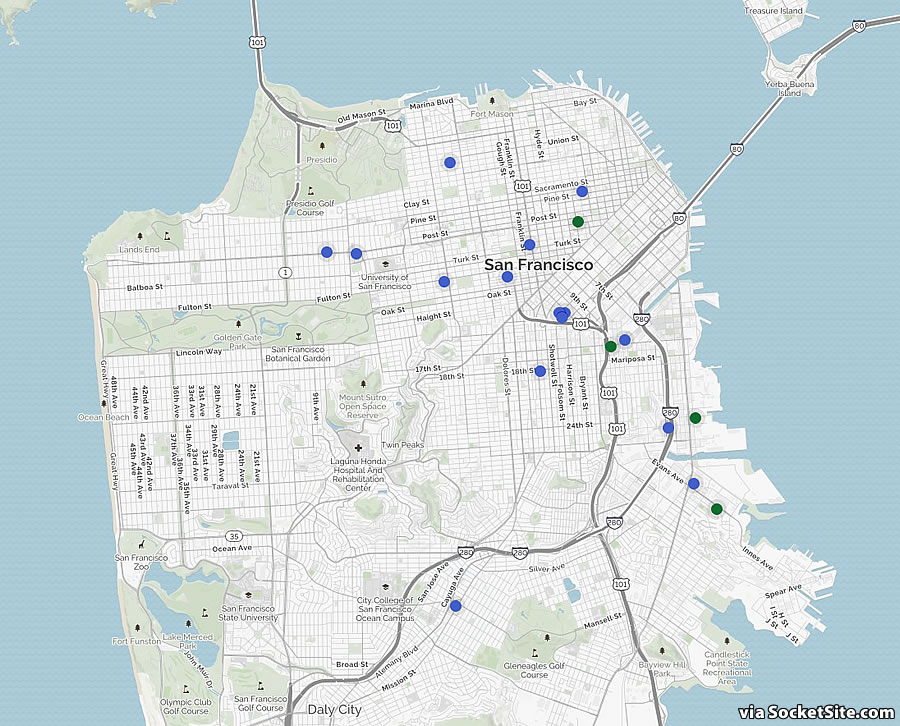

And with fewer than 20 preliminary proposals for major projects in the city having been submitted to San Francisco’s Planning Department since the beginning of the year, which is the fewest in the first five months of a year since 2011 (and 40 percent below the average since), we’re currently on track for a six-year low in activity.

While the passage of San Francisco’s Central SoMa Plan should, or at least could, ramp up activity in the second half of the year, keep in mind that the majority of plans for the most significant developments envisioned to rise within the boundaries of the plan area – such as the pair of swoopy towers envisioned to rise up to 400 feet in height upon the Creamery/HD Buttercup parcels at the corner of Townsend and Fourth, the big redevelopments of the Flower Mart and San Francisco Tennis Club sites, and even the 18-story hotel to rise upon the shuttered LuLu site – have already been accounted for as having been newly proposed in years past.

And of course, actually breaking ground once a project is approved is another matter (as is the overall pipeline of development in the city). We’ll keep you posted and plugged-in.

Great news for property owners like me! Sad news for affordable housing in San Francisco.

Same. No doubt property will start rising in a year or two with no supply and the economy solid. The crash/tech bubble that everyone wished happened.. never did.

Remember when prices were going up and many people saw a correlation between increased construction and rising prices. ‘Supply & Demand are broken in SF’ they said because new construction appears to be causing price increases. Both then, as now, the mistake is that you have causality reversed.

Back then price increases were causing an increase in supply. Suppliers (builders) were chasing profit into a market. Now, we have just had a marked deceleration from double digit up to plateau, as you both have put it. Over a 3-4 year period, the difference between double digit growth vs plateau could be from 30-40% With some actors in the “supply chain” involved in building new units having thin profit margins, that’s a huge change in the tone of the market. And accordingly we’ve seen many entitlements turn over and other disruptions in the supply chain.

But this transitory disruption in the supply chain due to the dramatic deceleration of the market may not reflect what happens in the steady state. In the end, it’s the net, not the gross that drives supply.

If you’re selling gas retail at $3.00/gallon with a long term contract to buy at $2.75 and retail prices drop to $2.75 you are in deep, deep trouble. And with current gas station owners going bankrupt you may be perplexed to eventually see many new gas stations popping up. But if the new wholesale price for gas has dropped to $2.20, a $2.75 retail price is just fine for new entrants.

And lest you think this is ‘bearish logic’, consider also that a similar effect protects SF from the truly disastrous effects that RE downturns can have in other areas.

If $1.5M condos drop to $1M, while that may bankrupt those who bought at $1.5 and send them back to their home state (or country), the fact that new buyers come in at $1M will ensure that the character of the neighborhood stays essentially the same. Similarly a builder with a cost structure contingent on selling $1.5M condos may be bankrupted by a change in price level to $1M, but eventually some other builder will swoop in and meet demand at the $1M level.

The fate of a market is not the same thing as the fate of it’s current participants.

And also consider that while market professionals, such as builders and investors, may be faster and more rational in their response to changes in market conditions, the unyielding exponential nature of compound gains & losses dictates that the length of time that you have ‘skin in the game’ is a dominant factor in determining how changes in price expectations affect someone.

A builder might be on the hook for 3-4 years during the course of a development, but a buyer often signs up for a 30 year mortgage. Ultimately, the buyers are more effected by a change in the market’s slope even if it taken them longer to realize that fact.

It’s also great for long term rent controlled tenants. Terrible for young people who have recently moved here.

Just wait until they repeal Costa Hawkins. Then developers will really stop building.

Construction costs are spiking big time in the Bay Area as well as Seattle so I wonder if developers are already in position where the numbers won’t work for a lot of the high rise proposals.

That’s why market rate developers only build “luxury condos”

If I had to guess it’s because it costs maybe an extra $10K to turn a non-luxury condo into luxury by spending a few thousand here and there for nicer fridge, dishwasher, countertop, and slightly nicer hardwood floor. Cost that’s easy to recoup within a year, so why not?

A better question to ask is to look at today’s “low-end” housing and what kind of housing was it when it was first built.

I’m sure the repeal will fail. there are more homeowners in CA than renters, and they will not want to potentially loose their property rights if their city enacts RC. The lefty tenants that will vote for this are way in the minority. This initiative is ridiculous and a real distraction towards addressing CA housing challenges.

I tend to agree but feel it will be close. Some homeowners will support it. I know several such and they are doing it as their young adult kids are paying through the nose for an apartment. Some will support it out of principle (misguided IMO) that this will do something to alleviate the housing crisis.

Keep in mind this allows localities to impose rent control on new construction and construction since Costa went into effect. And vacancy control. It does not require it. Not all localities will choose to do so. SF would certainly given the political power of renters here, but the smart localities in California would not impose controls and would see a surge of development in their cities as development stops/significantly slows in localities imposing controls.

I haven’t really taken that seriously, but maybe others have put more work into the political handicapping than I have.

But as a point of theory, notice that something like the repeal of Costa Hawkins is something that would affect both current and future market participants. And thus would probably have a more long term effect on the market than just a transitory change in price expectations from up to flat.

The law firms I work with are convinced it won’t pass.

Just curious, what are their rationals for thinking it won’t pass?

Don’t discount the effects of the increased % of BMR mandated by Peskin-Kim in this decline.

This is the real issue. Takes major value out of the land basis for owners of developable land. Projects aren’t penciling.

[Editor’s Note: With respect to the land basis aspect, and its role in the current logjam, see our reference below.]

I suspect this is a big factor.

But remember, this outcome is great for those who already own and for long term rent controlled tenants (i.e. Peskin).

Jane Kim’s goal is to limit housing and she sells it as avoiding gentrification. It’s terrib

Of course, it’s great for Peskin (already owns his home) and Kim (independently wealthy).

But yes, terrible for young people just starting out.

the combined effects of crazy high construction costs (in large part the result itself of the housing crisis) with greater expectations of exactions (esp inclusionary) has pushed most projects past the point of feasibility. Hence, the drop in applications as well as the rapid decline in actual construction starting on entitled projects.

Project under construction now or just kicking off secured their contractors/bids a long time ago. Hard to see what breaks this logjam in the near term to get more recently approved projects underway or get more applications in.

Don’t forget a rapid escalation in land costs, driven by competitive bidding between developers and justified by expectations for continued escalations in sale prices and rents, which hints at a couple of ways said logjam could loosen.

And when expectations change radically, there is always going to be a rough transition period where people within the supply chain jockey for a piece of the new smaller pie. People with large fixed costs are generally going to come out as the losers (people with large mortgage payments on land, builders/contractors with large fixed costs, materials suppliers with unfavorable long term contracts) And of course it takes time for all parties to come to grips with revised price expectations.

But ultimately if nothing gets built, no one gets paid. So it’s very unlikely to have a steady state where nothing gets built because prices are too high.

I agree, it seems that the exponential rise in labor costs due to contractors/sub-contractors having more work than they can reasonably staff and thus being able to demand higher prices would be the first thing to give if all of a sudden that bountiful work dries up.

Absolutely. People, such as contractors, who’s primary product is their time and labor find that they are in much the same position as fishermen before the age of refrigeration. When demand exceeds supply, the world is their oyster and they have great pricing power. When demand drops below supply, they find that a day gone unpaid is a day gone forever, much as a day old fish is a fish that will never be sold. And in both cases buyers are well aware of this fact. So in both cases there is huge pressure to ‘meet the market’ at a price where a transaction will occur. You are unlikely to see fish pile up and rot unsold because the sellers have a reserve price higher then buyers are willing to pay.

This decline in pipeline construction was inevitable. Part of it is due to macro changes between metro areas in terms of job and population growth. Part of it are the rapidly escalating construction costs and inclusionary guidelines which have gotten to the tipping point in terms of making particular projects pencil. That factor may vary depending on project – isn’t the Goodwill site tower now under construction subject to those rules? And the Gang tower? And the Giant’s MR – 40% inclusionary housing. It’s a part of the mix but hard to quantify with prices plateauing at the same time and making certain projects not pencil as with 1274 Mission, One Oak, 524 Howard and the Hines RH tower – not subject to the stiffer rules. Those cancelled or in limbo projects account for almost 900 units. Another 850 or so units in mostly smaller projects are on the market. There are about 64K units in the 20 year pipeline. It’s a safe bet a lot of them will never get to see shovels in the ground.

One thing few mention is that SF is almost built out. The last areas for mega development have been taken and projects proposed. Mostly the SE area of the city. A 2018 Bay Area real estate preview had some developers acknowledging SF is built out with their hope being the Central SOMA Plan is approved. Providing one last area where some mega development could occur. People will say but wait – up-zone Western SOMA, the Richmond, the Sunset, the Geneva/Outer Mission areas. No one seriously believes that will happen. At most there will be small/medium sized infill projects in those areas.

The mega development of the last ten years will not be seen again in SF. It was a perfect storm. Up-zoning of the TTC area and the build out of Mission Bay and the area around AT&T Park physically can’t be replicated in SF in the future. The city is built out mostly and is entering a mature stable phase. Not much more population or job growth. It’s time for SF officials to recognize this and focus on improving the quality of life and undoing some of the damage the mega development has done. It’s not about competing with LA or Seattle or Portland or Atlanta for the tallest building or the latest mega projects and the jobs that fill it. Those cities still have a plentitude of developable land and SF does not. It is what it is.

If I were a developer, why would I want to build in SF right now?

UPDATE: Proposed Development in San Francisco Is Now Tracking a Seven-Year Low