The preliminary plans for over 450 major developments have been submitted to San Francisco’s Planning Department over the past six years.

The peak year was 2014, during which 116 major projects were proposed, up from a mere 34 in 2011.

And if the trend over the first eleven months of 2016 holds, we’ll see under 80 major proposals this year, the fewest since 2012 (54):

At the same time, while the inventory of new condos on the market in San Francisco has been running an average of 38 percent higher on a year-over-year basis since the beginning of the year, new condo sales are down 29 percent and pricing appears to have dropped over 12 percent since August of 2015.

The downswing of the current construction/boom cycle? Reflected perhaps in some entitlements being put up for sale rather than being built out – Mt. Sutro project as an example. The developers conundrum is predicting the next upswing and when to go forward with more projects so they catch the peak, or close to it, of the next upswing.

SS has reported more than 60K units of housing in the pipeline IIRC. Does that 60K figure come from the 450 projects for which preliminary plans have been presented, or is part of that 60K made up of tentative proposals which are not yet even in the pre-planning stages?

See: Number of Apartments and Condos in SF’s Pipeline Holds at 63K for the breakdown.

It was reported elsewhere yesterday that the entitled project that I think you’re referring to (“The Outlook”) has a buyer.

Here’s a good reminder that simply being “in contract” isn’t the same as having found a buyer, and that you should really (re)consider your other sources, as the Outlook parcel is still available for $14 million.

This, and interest rates have gone bezerk too, making holding costs much less predictable. Yup, this up cycle definitely ended months ago…the question is if it flatlines/steady-as-she-goes (as has mostly been the case) or if a decline sets in. The new political order definitely makes this harder to contextualize.

Good points. Politics does make it harder to call, but two things that might have occurred under Clinton that probably won’t under Trump are restrictions on 1031s and also on self-directed IRAs which money is often put into RE.

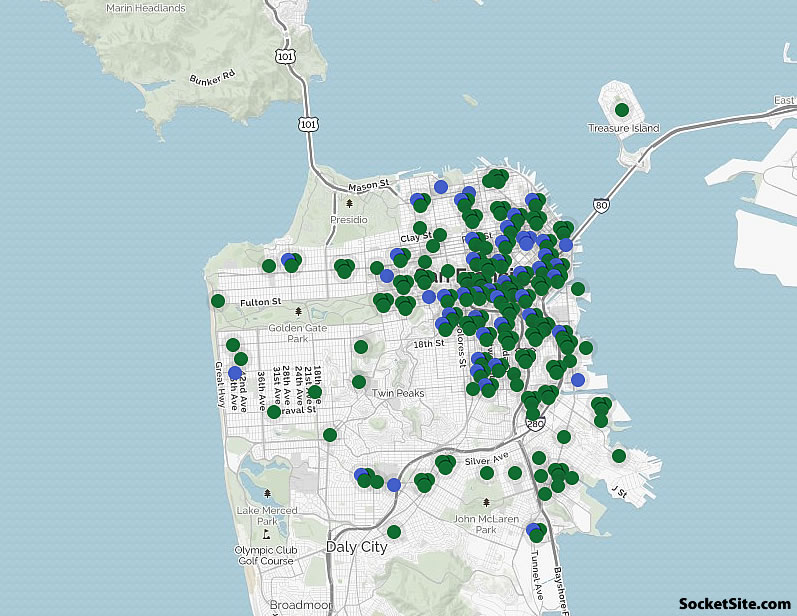

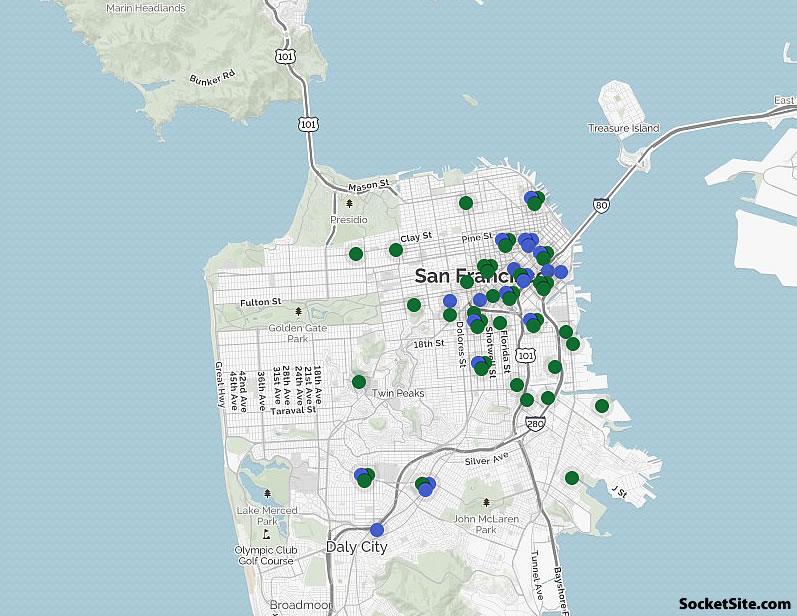

These SocketSite maps with big blobs on them are confusing and never informative.

Totally agree. What does blue represent as oppose to green?

When will the number of new units hitting the market peak and start declining? Have we already passed that point?

How bad will the traffic get before we realize maybe San Francisco should not be adding all these new people?

How expensive will the housing get before we realize maybe San Francisco should be facilitating more housing?

How many Trump Towers should we facilitate to moderate the cost of housing in San Francisco?

Zero

Fortunately, non-Trump Tower development exists.

Yet, many Trumpian Towers have been built in SF recently with the express claim that they would ameliorate the ‘hosing crisis’. More are raising their gilded edifices in SoMa now and many who comment on this site ever wish for more and more in SF. Shall we Make San Francisco Grandiose Again? Who shall earn the heading: Old Gold Mountain?

I’m not sure what you’re talking about with Old Gold Mountain.

But yes we have added some housing (not enough) over the last few years in SoMa. And as the supply increases, prices are not going up. I count this as good for the city. Do you disagree?

“as the supply increases, prices are not going up”, wha? Prices have certainly gone up during the recent years of increasing supply. Seem to be flattish now, but that has more to do with the money-for-fun-ideas-free-from-profits train slowing down a year or two ago. And if you want to be “realistic” about the market for supplying the housing demand of the SF workforce then you need to measure over many counties. Any level much less than the SF MSA is not the real market over which prices are determined.

As much as some SFers would like to think of and treat SF like an isolated self-contained universe, there are about as many people that live and work in SF as there are people that live or work in SF but not both, i.e. live in SF and work in a neighboring county or live in a neighboring county and work in SF.

Flat prices are due to both increased supply and decreased demand. That’s how it works.

I’m not sure your point about other counties, but I think you are countering an argument I am not making. I do not think of San Francisco as an island. Other counties also need to build more housing. These are not mutually exclusive.

ah, but which supply and which demand to include in your ever so simple equationing? If you don’t round em all up and scope em right, then your ever so simple explanation won’t account for the reality of real estate. And that is a very difficult task, as Shiller and others have pointed out, and has been pointed out on SS many a time, including by one of the usual suspects 4 weeks ago:

“FWIW, the area over which to compute your ‘balance’ equation would be a 30-60 min commute of the CBD. Most everyone is willing to commute 30 min, not many are willing to commute more than 60 min. Notice that for the SF CBD that would include a population of 5+ million, more or less the SF MSA. Not clear what any analysis of housing imbalances below that scale would address, as the ‘market’ for housing the SF workforce is spread over many counties.”

And then there is the not so little issue of the free moving cash and free moving peoples seeking the next Gold Mountain (see SF history). And as that history has repeatedly shown, when they converge on our little sandy seaside town, no amount of building can keep up and when their tide recedes….

It’s actually not so complicated. Adding supply will always help limit prices.

Lets do what is in our control. The City of San Francisco can’t order San Jose or Oakland or Palo Alto to build more housing, but it can build its own.

The City of San Francisco by itself can’t build enough housing to have much impact. The City of San Francisco also can’t order private developers to build housing. And the private owners of private property have what is known as an incentive to max their profits, which if you think about it, isn’t so hard to understand. Many of them sit on land for many years, even decades, waiting to catch a boom. Why should they comply with your wish to lower their profits?

What the City of San Francisco could do to reduce the demand for housing in SF would be to reduce the growth of office space while increasing the transportation from the Jersey side of the Bay. What it has been doing is to increase the supply of office space about as fast as possible while barely increasing the transportation from anywhere. Just doing our part to enrich ourselves. No one could have predicted.

Sorry for using shorthand that I thought was obvious.

Yes, the City of San Francisco isn’t building the units. But it does control the development process. It can make it easier or harder to get permits, and make it easier or harder for projects to work their way through the system.

I agree that we should increase connectivity with the East Bay. I’d love to see work move forward on another BART tunnel. But while we do that, we can also work to get more housing built in the city. Those goals are not incompatible.

The City of San Francisco spent ~20 years trying to get Mission Bay developed before developers found it $$$$ attractive enough. And even then it was after the dotcom boom had transformed hundreds of nearby SoMa buildings and UCSF agreed to be the anchor tenant.

Economics controls the development. The “process” and all the rest of the gov’t regs/taxes/subsidies/etc have economic effects, but get real, when the economy booms the developers (or most of them) build (as fast as they can, mostly), when it busts they stop (mostly). I’ve lived through three of these cycles in SF and you can read the history of it going back to the 49ers. SF’s dev process doesn’t create economic booms or busts. Sorry, but I thought that was obvious.

“SF’s dev process doesn’t create economic booms or busts.”

That sentence is true. The rest is nonsense. SF dev’s process imposes costs on developers. We can ratchet those costs up or down. In our case, we have continuously ratcheted them up. That imposes real costs. If a project doesn’t pencil out, it won’t get built, which ends up limiting supply and driving up cost.

The non-sense lies in your over-emphasis on the role of the “development process” while under-playing the role of the economy. Ya know that which provides the pencil, and the top line (revenue) and sets the price of most of the costs. Ya know the economy that creates the “demand” which sets the max price for the “supply.”

Now, you haven’t blessed us with your specific recommendations for how SF could “facilitate” more housing through a cost “rachet”, but I lived through an era when The City attempted to “facilitate” housing, known as the livework loft boom. That didn’t result in cheap housing, well not cheap in price, some of it was cheaply made though. And it was cheaper to build because the developers didn’t have to pay as much to The City in fees. Though that just passed the City budget burden to others. So, not “cheaper” at all for San Franciscans. The developers still charged all they could get. So not cheaper for the buyers either. And then the dotcom bust came and hallelujah, prices dropped, a lot. Until the economy recovered and incomes rose and whaddaya know another hallelujah, prices rose as well. A pricing rollercoaster ride driven faster than The City could possibly flex or deflex their all powerful rachet machinery.

How expensive will the housing have to get before we realize the economy has more impact than anything San Francisco could do to facilitate more housing?

Yes, demand affects prices. As does supply. There are two inputs to determine one output.

Do you really not think that San Francisco’s permitting process for new construction is convoluted?

Here is an example of the sort of way it could be simplified.

[Editor’s Note: Keep in mind that the number of fully-approved and permitted units that have yet to break ground is at a two-year high and that the number of units which have already been entitled, which is the part of the approval process that “as of right” development would streamline, has been ticking up over the past year as well.]

“two inputs to determine one output” — what is this some pre-elementary econofalacy? This is a multivariate system with thousands of inputs and outputs to even get a rough handle on cause and effect.

Do you really not think that if SF lowered the cost of development the savings wouldn’t go into the pockets of the developers?

Sure, there are lots of little inputs for an individual unit. But on a macro level, pricing depends on supply and demand.

As for developer profits, it depends. In good times, developers would increase profits if we streamlined our process. But as demand cools, we’re seeing developers hold off on projects if they don’t expect to make money on them. That’s bad for San Francisco because those are units that aren’t built, which limits supply, which increases the price of housing.

Agreed as to the macro level being the SF MSA of ~4.6 million people and among the many little inputs being the permitting process of a jurisdiction that includes less than 2% of the land of this macro level. Really tiny little wee input.

As I mentioned above, SF did try a version of your “streamlined process” with more permissive permitting and paying lower fees. It was launched when the SF economy was much worse than now. About 3000 livework lofts were built between 1988 and 2000. By the time the BOS pulled the plug in 2000, “the average initial sales price … for the new live/work projects was 32 percent higher than non-live/work housing” (namelink). Yeah, SF got millions less in fees, and the developers still charged over-the-top prices. And then there was a recession and magically the prices dropped. Because the economy sets the price, not the wee little subsides and Willie Brown era streamlined process of SF that may have goosed an additional ~1% of housing stock.

Your supplyside economics response to “as demand cools” would have SF subsidize/fatten developer margins with “streamlining” whatever profits they could squeeze out of such a patsy city into their bank accounts. You seem to have an affliction for rational economic theory, why not just trust the invisible hand of market wisdom?

You are confusing two separate things. The price of housing is not set by the permitting process. Price is set by supply and demand.

The permitting process affects the supply of housing. If we want to limit price increases, we should increase our supply of housing. The way to increase supply is to streamline our permitting process.

The price is set by supply and demand.

But the cost is set by the permitting process. When it is so convoluted and expensive as it is in San Francisco, then developers wait to build until the prices are high enough to justify the risk. It’s not like the customers are going anywhere.

A large part of it is how discretionary the approval is. If we lower the cost, but still make the process very complicated, then the experts at the process will have no competition. They will make out like bandits while prices continue to rise for everyone else.

This makes Jerry Brown’s by-right proposal a shocking refreshment.

Actually, the supply of housing affects the permitting process. Look at your own statements. You judge the current supply of housing too low and want to increase the growth rate of supply and to do so you want to affect changes to the permitting process. That is similar to the reasoning in 1988 when SF changed the law to allow permits for livework condos that went on to account for much of the housing built in SF in the dotcom.

When we think we have too much supply of some kind of buildings, then we affect the permitting process differently. That is what happened when the BOS suspended and then eliminated livework in 2000/2001. Somewhat the same with when the voters passed Prop M limits on office space.

You have the relationship backwards in causation and in history. SF didn’t even have permitting processes or zoning until after there was a supply of housing.

The supply has always been driven by the greed, forecasts, and wherewithal of the property owners and developers.

SFRealist, if you want to stick with your very very simple explanations then fine, but in the real world when the SF economy booms, as it has about once a decade for two generations, and there is a rapid increase in free cash, then RE prices go up as fast as the property owners can grab a piece of the extra pie. And the developers respond by penciling in a yuge increase in permit requests. When we have a recession and the pool of disposable incomes decline, prices go down and developer pencils sleep dreaming of fat margins. And through all the gyrations simple minds think that somehow the meager hands of The City politicians and bureaucrats are the mighty force balancing supply and demand and setting costs and prices instead of the economic tides.

Theodore, many of the potential customers do go elsewhere than SF. Many of them settle in neighboring counties. Sheesh, ~45% of all the people with a job located in SF actually don’t live in SF. And as for SF residents, during each of the past several recessions SF population has declined. Time and tide and BART wait for no customer.

I think you’re now adopting my argument, that the price of housing is set by supply and demand (“through all the gyrations simple minds think that somehow the meager hands of The City politicians and bureaucrats are the mighty force balancing supply and demand and setting costs and prices instead of the economic tides”).

What we could choose to do as a city is to take steps to increase the supply of housing by streamlining our approval process.

No, not at all. The gist of your “argument” was that changes in SF’s permitting process could significantly affect housing costs in SF. I’ve argued that whatever you think you are going on so vaguely about is a mole hill next to the mountain range of other factors. Now if you want to make a real argument, instead of restating the same trivialities, then tell us what process changes and to what expected effect. Make a case for the magnitude of these significant supply and price impacts.

And, sadly, saying merely that less regulation results in less costs is not an argument. Less cost to whom? The less regulation embodied in the livework permit scheme resulted in lower costs for the developers but not for the buyers, nor did it result in lower housing costs in SF despite the millions in subsidies from the City. Millions in fees that would have gone to parks and other neighborhoodie goodies went into the pockets of the developers. Less cost to ….

I put the link up earlier about one way to streamline our approval process.

The decreased costs come from a larger supply of housing. A larger supply will create lower costs. The benefits do not go to the city directly, but rather indirectly because we lower the price of housing for everyone.

(And yes, sigh, I know that prices will still rise. But they will rise LESS with more housing units than they would if we had fewer housing units. Given the same demand, if we increase supply, price will be lower.)

Keep in mind that while the number of units which have already been approved for development but have yet to break ground in San Francisco is at an

three-yearall-time high, construction has dropped to a two-year low. And of course, that sales and pricing are down as well.SF tried a version of what you recommend for more than a decade but did not achieve the results you forecast, as I mentioned above. Also, the market is bigger than SF, as I also outlined above. And, as the moderator has mentioned twice to you, today’s reality doesn’t match your simpleton formulation. Perhaps these many failings of your idealization signal you are overplaying a model based on equilibrium in a market that thrives on the profits of disequilibrium.

I don’t see where you mentioned this once above, let alone twice. If you are referring to the first internet boom, then yes, prices went up even while we built some (not enough) housing. They would have gone up MORE if we had not built more housing, because prices are set by two factors: supply AND demand. That’s how it works, in every market and for every commodity.

Today, supply is (slowly) increasing and demand is dropping, therefore prices are (slightly) dropping. My point all along is that the city has within its powers to do more to increase supply. That would further decrease prices, which would ultimately be healthy for the city.

Uh, please deal with the actual facts of what has happened and is happening here in SF. I provided a link a day ago above to a detailed history and results of the decade long plus livework permissive “streamlining” and Socketsite twice has provided you links to the current situation which does not square with your …. thoughts. And please spare us yet again your freshman econ pablum of “That’s how it works, in every market and for every commodity.” Now if you really believe that and as they say “Is that your final answer?” then you have my heartfelt and deepest sympathies and I will trouble you no longer with disagreeable facts, as true as they may be. 我的天阿

I’ve no idea what you’re talking about. The reason supply and demand is taught in basic economics is because it describes pricing. (Gravity is also taught in basic physics, but that doesn’t make gravity incorrect or unsophisticated.)

Don’t worry, I know that the City of San Francisco WON’T streamline its approval process. I’m only saying that if it were serious about lowering housing prices, it would do so. We all know that it won’t.

SS reports on active proposals to streamline SF processes towards boosting housing, including a rather curious one that would allow for additional density even in the more suburban western SF hoods (Affordable Housing Bonus Program (AHBP)). I don’t follow these much beyond the SS level because the process for approving these ‘streamlinings’ is itself not very fluid or linear. I think it is admirable to advocate for better processes, can’t hurt as long as you don’t go Sonya Trauss and use the T-word to offend the very people that are the deciders.

FWIW, they teach elementary supply & demand makes instant magic price point in intro econ because that is all the students can handle. Same as they teach Newtonian gravity in intro classical mechanics, where they solve problems like computing the moment of inertia of a spherical cow of uniform density. That’s about how realistic is your characterization of the scope and dynamics of our RE market. When you work your way up to more advanced methods for describing non-closed systems of disequilibrium, perhaps we can chat again.

Raise the heights on Geary and start fostering new development towards Ocean Beach of new town/row type housing. Not everyone wants to raise their family in a high rise in soma.

At the same time condo developers could do more to make their properties more family friendly. Offer units with more than 2 bedrooms and amenities such as on-site day care. San Francisco could stand to be more diverse in terms of having a more proper mix of families to singles and couples without children

All those people who bought in the Richmond paid a premium to live in a certain density, you are screwing them over now by raising the density, based on the false promise that it will somehow bring down housing costs for yourself. The vast majority of new Bay Area housing needs to be within walking distance of a BART or Caltrain station, not a distant outpost served by a horrible bus line.

How does raising the height limits on Geary affect someone in a SFH living off Cabrillo?

Besides the aesthetic issues that change the character of the neighborhood and shade the street, there’s the increased population pressure on the whole spectrum of local amenities, more competition for scarce parking, crowded buses, and more traffic which spills across the whole city.

Which is why The City needs to invest in massive transit upgrades – that goes hand in hand with more people and more development. Scarce parking? Tough. Last I checked, street parking wasn’t some kind of “right” bestowed upon anyone with a car. “Paying a premium to live in a certain density” doesn’t give you the right to demand that your neighborhood not change over the course of you home ownerhship.

I agree on your first point, upgrade the transit (not just locally but citywide, “transit friendly” includes both sides of the trip) then we’ll talk. Til then, us NIMBY voters still dominate over you housing nuts. You say “not everyone wants to live in SOMA” but then you want to turn the Richmond into SOMA West.

And here we have a classic NIMBY response: We want to turn the Richmond into SoMa West. not even close. We’d just like to see something a little denser than a one story commercial building along what should be a transit-rich boulevard. 4-6 stories (or, god forbid, even 8) isn’t going to turn the Richmond into “SoMa West” despite your unfounded fears.

I bought in the Richmond hoping it would get more dense. Why is my voice less valuable than others? Why am I getting screwed?

Your voice is not less valuable, it’s the same – one person, one vote. But please tell us why you want more density?

And here we see the classic housing nut folk tale. Although increasing the height along Geary to 4-8 stories may not turn the area into SOMA West, at the same time it will accomplish absolutely zero in terms of making housing affordable in San Francisco. That’s why the majority of people including the planning department reject it.

They did that in the Fillmore district (increased density). And that turned out really great. Inspiring architecture, transformation to an über desirable area to live. Success!

Bingo. Papiversace and Fishchum, listen to SFrentier, he just torpedoed your dreams of “Homeownership Through Greater Supply”. As backed by numerous studies, increasing density in these areas actually makes them more desirable to new buyers, thus driving up housing prices, as opposed to making them more affordable.

In the Fillmore case, they increased density with crap buildings and no real neighborhood plan (other than moving around low income black folks.). That high density area of Fillmore is pretty crappy. But I agree that if your going to densify, it needs to be done thoughtfully. Nice buildings and a well balanced plan with amenities will cost money. And with mandatory affordable units, the market rate units will always be expensive.

Exactly which part of Fillmore is great? North of Pine?