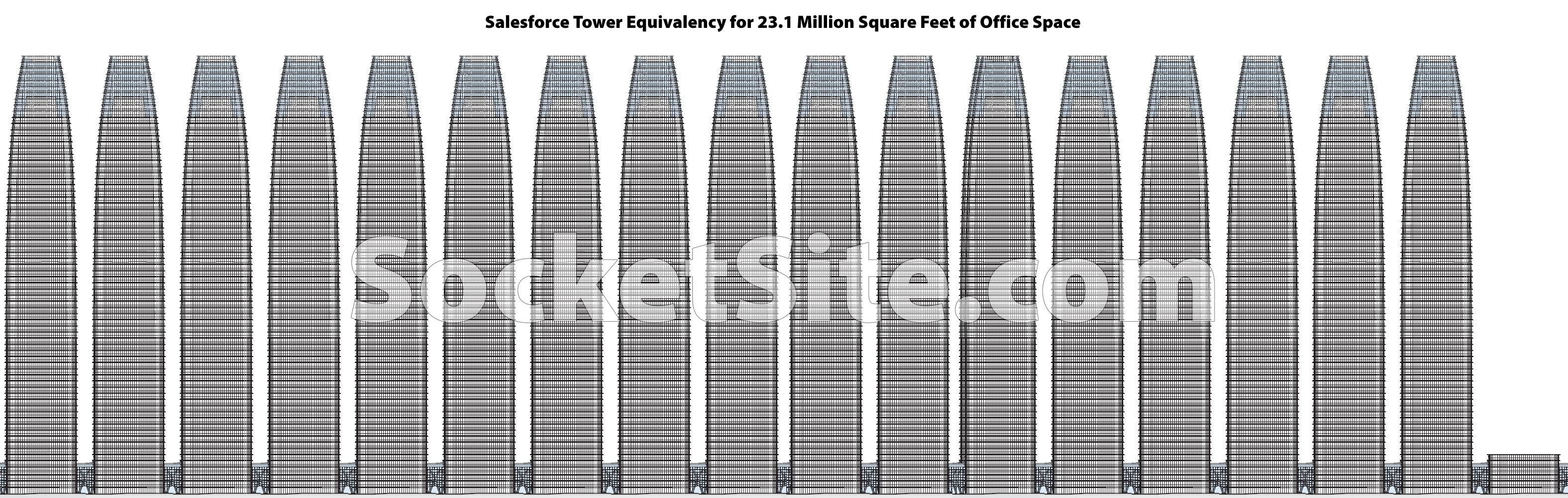

As we outlined last week, the amount of vacant office space in San Francisco has ticked over 23 million square feet. For context, the 1,070-foot-tall Salesforce/Transbay tower at First and Mission, which is the tallest building in San Francisco, contains 1.35 million square feet of office space spread across 59 floors.

Employing the framework we introduced back in 2020, and others have since co-opted as their own, there is now 17.1 Salesforce Towers, or over 1,000 Salesforce Tower floors, worth of empty office space spread across San Francisco, which is roughly enough space to accommodate between 132,000 AI or other employees, based on an average, pre-Covid office density ratios, or up to 178,000 (a la twitter) worker bees.

what is the vacancy rate as a percentage of total office space?

There’s no standard definition for office vacancy rate. This website appears to use cushman wakefield now 27%. SF chron quoting different source 31%.

Yes. The SF Business Times uses CMBR numbers and per that gauge the vacancy rate was just shy of 32% at the end of the second quarter.

And once again, “yes, there are higher vacancy rate numbers making the rounds, but it’s the consistency of the data set and context going back over a couple of decades, as our numbers do, that matters and there’s a lot of poor reporting and cross analysis, between data sets, making the rounds.”

As we also outlined, the effective office vacancy rate in San Francisco, which has averaged closer to 12 percent over the long term, based on the data set we employ, has ticked over 27 percent as of the end of last month.

You mean CBRE? They are competitor of cushman wakefield. There are different methodologies for calculating office vacancy rate, that have different strengths and weakness.

From San Francisco’s Office Demand Surges, Largely Thanks to AI Companies, yesterday:

Go read the whole thing, it’s a short story.

It goes on to quote Mayor London Breed as saying it’s not just artificial intelligence companies, the city is also attracting life science firms needing almost a million square feet of office space.

Well if you – we? – were looking for alight at the end of the tunnelstory, I guess this makes the cut, but it’s hard to put a lot of stock into an article that seems to be based on a single set of data points (I looked up VTS, HQ’ed in NYC, local office at 2EC) And I’m not sure what some of the numbers mean: “demand was up 10%” >> was that for the whole DTSF inventory or just the number of phone calls VTS took or…what, exactly??

Also, Herhonor’s claims don’t seem entirely logical: life science firms generally don’t look for office space for lab space, so I’m not sure where they were looking (Mission Bay? Some development out in the Avenues ?)

In short: maybe…but then again maybe that light is just an emergency light , not the deliverance of daylight.

Or as we outlined two weeks ago, “while the estimated active demand for office space in San Francisco ticked up by 9 percent over the past quarter to 4.9 million square feet of space, which includes 800,000 square feet of space for AI company growth, that’s compared to over 7 million square feet of active demand in the market prior to the pandemic” and versus 23 million square feet of vacant space (which doesn’t include another 4 million square feet of leased space in San Francisco that’s slated to come off lease by the end of this year).

I read the free version on Fortune. Breed claims there are 10 office tenants touring for 1 million SqFt of space? Tenants on tour isn’t reliable indicator of demand. Some of those tenants will be touring in multiple office markets that compete with SF. AI unicorns can find office space down in silicon valley now. Even if SF leased up 1 million SqFt by end of year, that would still leave SF with 22 million SqFt available (or more by other sources). It also acknowledged that current office “utilization” rate is less than half pre-pandemic rate, measured by office tenant key pass use. While leases continue to expire, with office tenants renewing for smaller footprint because work from home. SF life science market with actual lab space is very small and separate segment of the SF market, and isn’t included in office vacancy rate.

(‘Fact’) You’re pretty much hi-lighting the second half of the article…the one ‘Brahma’ didn’t cover (not meant as a criticism, as s/he did suggest we read it and was pushing the limit on direct copying).

This seems like a really good example of what I’d call an “OTOH article”: you have both positve and negative data, and decide what spin you want on the story by what you put first…relegating the OTOH side to the bottom.

Keep in mind , too, that while these rates – whichever particular one(s) you use – are useful for a RE blog (that naturally is interested in leasing), they are going to overstate, perhaps significantly, the actual occupancy of office space on a day-today basis (due to WFH shifts), which is important for metrics like retail sales and transit revenues.

As a matter of perspective, 178,000 people – or even 132,000 – is more than the entire CBD employment of all but a handful of U.S. cities. Of course the number is also an indicator of how relatively large the DTSF workforce is. Or was.

There are 8000 unhoused people in the city of San Francisco, and 40,000 unhoused people in the Bay Area. We could completely solve homelessness in our region if just 20% of that space was creatively re-factored.

Would it be more expensive to convert these towers to residential than to build new ones from scratch (in a lower COL area than SF)? From what I’ve read it doesn’t seem too easy, or cheap, to convert office space to residential.

Yes, it isn’t easy. But in just the most recent thread where we were discussing this, I mentioned the developer of a current office building conversion project in New York City as saying that it costs between $300 and $500 per ft.² of converted space to convert an office building to residential. Yes, the age of the building and floorplate in the building matters. And that was for New York.

According to a report last Summer from brokerage CBRE, The City’s average construction cost is almost $440 per ft.². In several stories about the report available on other sites, Joy Ou of Group I is quoted as saying that they didn’t plan to move forward and build the previously-entitled 321-unit project at 1270 Mission Street in SoMa because they didn’t have an equity partner, and, “It doesn’t pencil.” Of course, that was last Summer. That report also said construction costs were 5 percent more expensive in San Francisco than in New York.

So just to get a ballpark idea you could inflate the NY current office building conversion costs by 5 percent to get an S.F. office building conversion cost. Take the current S.F. new “ground up” construction costs of $440 per ft.² and then add in a year’s worth of construction cost inflation to get a figure to compare against. And understand that these are average values being quoted.

That doesn’t actually answer the question, tho (which is cheaper?) I’m guessing, demolition, plus new construction would still come out to a lot more than ~$500/sf. As for neither one pencilling: I would think not … since the premise seems to be void of any incoming revenue.

Well, the comparison I was addressing was a cost comparison between conversion of an existing office tower to residential and a new residential tower from scratch (on, let’s say an existing parking lot, or a parcel with a single story building like the one at the corner of Mission and Laskie, between 8th and 9th Streets). There is still demand for housing in San Francisco, even high-density condos, but the price point needs to be meaningfully lower than what prevailed last year.

Demolition of existing downtown office towers to build residential…well…I’d expect someone to come up with and implement a productive idea for the Westfield San Francisco Shopping Center before we see even one of those.

Nope. Even if you could magically convert those offices to housing for the homeless, which is a total pipe dream, the minute you housed those people another 40,000 would show up here demanding their own free housing.

Precisely.

And why should some be given downtown condos for free when others have sunk $1.5 million+ of sweat equity and long-term discipline into their own downtown condos?

Exactly! This is the primary issue: how do you address the problem without starting a frenzy. This silly talk of resi-retrofit is a sideshow distraction.

The problem the rest of us are discussing is that S.F. has over 23 million square feet of office space sitting vacant, and that amount is rising. The value of vacant office space is negative because in the real world it costs in the low double digits per ft.² just to maintain existing office space.

Even if you think that placing unhoused people in converted office towers would be a bad idea, if you also believe that S.F. has a deficit of housing, as most of the YIMBY crowd and the chain yankers in these comment threads claim to believe, then residential conversions are not a sideshow distraction.

As has been mentioned here several times in the past, 100 Van Ness is a successful office high rise to residential high rise conversion, so this isn’t “silly talk”. Apartments in that building are currently renting between $3,178 – $5,998.

Such conversions will be even more widely-viable once more vacant commercial real estate properties go back to their lenders, the properties are marked to market, and resold for amounts that are down at a market-clearing price level.

As we first outlined a year ago and have had to mention a few times since, the cost basis of 100 Van Ness was under $200 per existing square foot, including the adjacent building at 150 Van Ness which was then demolished to yield a “bonus” 429 units of housing. That’s why it was successful, an outlier, based on current building values, and actually made (economic) sense.

Acknowledged that it was an outlier, but what I was trying to get at in my last paragraph was that when prices come down sufficiently, residential conversion will make business sense for other buildings. It isn’t silly. Pre-pandemic commercial rents for office space in twitter “worker bee” type configurations aren’t coming back in our lifetimes.

I believe that ‘Hillychilly’ is saying that the idea of “housing the unhoused” in particular is a distraction to the issue of what to do with the (vacant office) space; similarly, commercial>residential conversions are a distraction to the issue of “housing the unhoused”. I agree with both these statements, and for the same simple reason: a process that seems to be marginal even when offered to tenants able to afford a high revenue stream, makes no sense at all offered to those who can offer only a low stream…if anything at all.

Where might these ideas actually work? How bout Baltimore?? A half-million s.f. office building just sold there for $24M (half its 2015 price). For the math challenged, that’s ~$50 s.f.

Better that they remain homeless, then? I’ll never understand the resentment some people feel towards those worse off than them getting something “for free”.

The proposed solution of cramming homeless, most of which are severely mentally ill, together in towers is one of the most ill-conceived ideas I’ve ever heard.

They need to be committed to institutions run by professionals that can bring the ones back to reality (who are able to come back) and to keep the rest of the ones who are gone-for-good off the streets.

As we first outlined seven years ago and others have recently figured out, the vast majority of the homeless living on the streets or in the shelters of San Francisco once had a permanent residence in the city (versus being “drawn to the city for the services it provides,” a notion which remains a popular canard).

“Canard” refers to something often bandied about but lacking any truth.

However, as can be seen from the very recent Benioff funded study, fully 25% of these homeless arrived in the SFBA already homeless. So your statement is correct but 25% is not a small portion and it is not dishonest to discuss it or explore its ramifications.

Further, what do we think (I’m genuinely curious) we will find if we drill deeper into that remaining 75% figure? We know how many people had no housing at all (25%) but how many people were continuously housed for over 12 months? That remainder is the interesting part: people that came here and quickly fell out of housing and were almost immediately an unfair burden on existing residents.

For the entirety of my SF political consciousness this “previously housed in SF” cohort has been used as a conversation ending trump card – and it isn’t. We’re talking about fairness and it isn’t any less unfair if I show up and make myself a burden to my new neighbors immediately, or after six months.

Or once again, as we first outlined over seven years ago and the stats for which haven’t meaningfully changed, other than respect to the number of homeless overall:

“…the vast majority (71 percent) of the nearly 7,000 homeless now living on the streets or in the shelters of San Francisco once had a permanent residence in the city.

Nearly half (49 percent) those who once had a permanent residence in the city had maintained it for at least ten years.

And of the minority of homeless who have migrated here from other parts of the state or country (29 percent), a greater percentage of those have done so in search of work (25 percent) than to partake in the so-called liberal social services the City provides (22 percent).”

Rough estimate of the cost to convert office space to living space could look like this: $100/sqft * 600 sqft/person * 8,000 people = $480m. Which is much less than the annual spend on homeless in San Francisco. So it would seem like an obvious solution. But obviously there is more to consider, like on going costs of rent, maintenance, and other services that the homeless often need.

Very rough.

What if it’s more like

$100/sqft$500/sqft * 600 sqft/person * 8,000 people =$480m$2.4B. Plus of course one would actually have to buy the properties as well…so maybe double this figure. Then you might wish to consider these people in many cases have issues other than simply not having housing….so not all of the “Homeless” budget would go away.Maybe not so obvious, after all?

$100/SqFt not real number for office to residential conversion. $100/SqFt is cost for basic tenant improvements for new office tenant. It covers new paint, new carpet, new blinds, moving few interior privacy walls that aren’t load bearing. No way office conversion to residential could be that cheap. Not even in second tier market out on the edge like central valley.

Actually, $100 does not even cover basic tenant improvements for a typical modern office building. Conversion of office to residential costs almost the same as (and sometime more than) new construction. There are seismic safety requirements for residential that exceed those of many older office buildings, for example. That’s why very few office to residential conversions have happened in San Francisco – that and the fact that our office market was very strong for many years (until 2020, if fact). The truth is that, even in the current office market, very, very few residential conversions are going to happen without massive subsidies from the City and State, including significant reductions in all of the following: impact fees, property taxes, and inclusionary affordable housing requirements.

Schwab announced today it is going fully remote for, and closing, 211 Main, which I think was its primary remaining office in SF.

Schwab had 373,769 square feet in 211 Main the last time I checked. OpenAI’s new SF lease was about 59,000 square feet by comparison. The net loss for these two is about another quarter of a Salesforce tower.

Hines has just listed Parcel F for sale. As expected, given the current situation. The buyer will have to assume a 10-million-dollar penalty owed for missing some project deadlines. Alos, WeWorks’ tower at 600 California is going into foreclosure.

A sale/transfer assumes a penalty ?? That seems weird, as it’s the owner (at the time of violation) that incurred it. Your statment implies the parcel itself is liable….gives a whole new meaning to “property rights (and responsibilities!)”

This from the SFBT:

“In 2022, F4 successfully amended its purchase agreement with the TJPA to reduce the penalty charge to $40 million, to be paid out in four annual installments by 2027. A TJPA spokesperson told me earlier this month that the amended agreement still hinges upon the developers securing a line of credit, which as of Thursday appeared to remain outstanding.

A spokesperson for Hines confirmed that the first chunk of that fee, $10 million, is due to the TJPS in 2024, and that the new investor “would assume these obligations.” The spokesperson added that TJPA’s approval is not required for the sale.”

OK, then, that’s a little different: it’s a buyer agreeing to assume a debt (i.e. it’s an agreement between the buyer and seller, not a legal requirement).

I’d call it a $40M discount (or however many payments are left by the time it sells…if it sells).