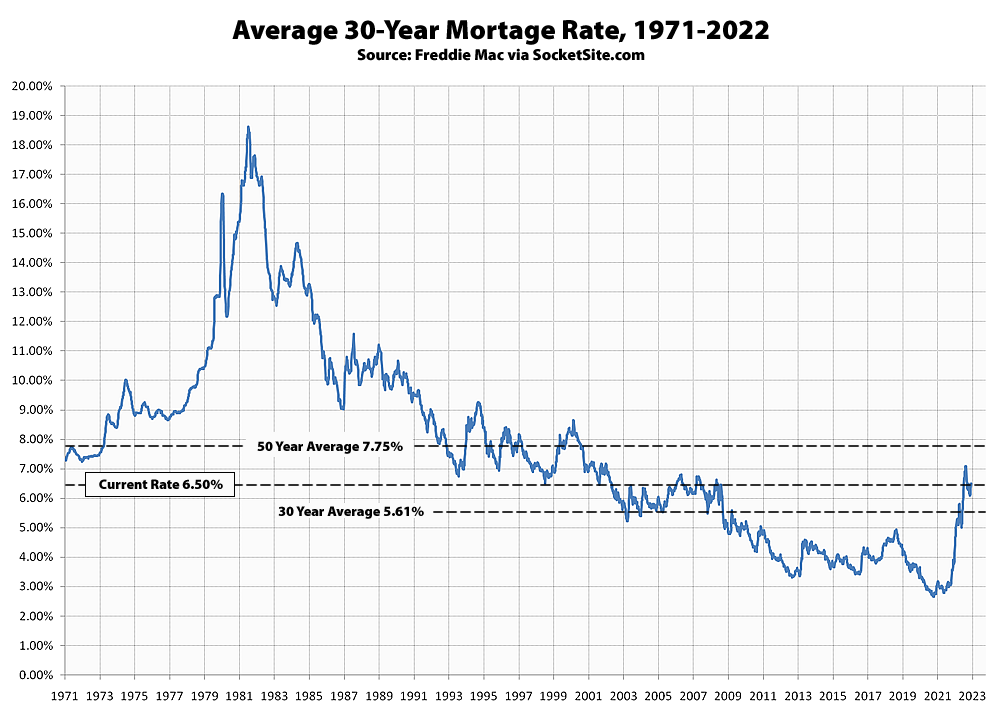

The average rate for a benchmark 30-year mortgage ticked up another 18 basis points (0.18 percentage points) over the past week to 6.50 percent, which is 261 basis points, or nearly 70 percent, higher than at the same time last year and 385 basis points, or nearly 150 percent, higher than its all-time low of 2.65 percent in early 2021 but still well below its long-term average of 7.75 percent.

At the same time, the probability of the Fed hiking rates by at least 50 more basis points over the next couple of months just hit “100 percent,” with less than a one (1) percent chance of an easing by the end of the year, despite some misanalysis that has been making the rounds and which should further depress purchase mortgage activity/demand and home values, right at the start of the spring selling season, none of which should catch any plugged-in readers by surprise.

UPDATE (3/2): The average rate for a benchmark 30-year mortgage ticked up another 15 basis points (0.15 percentage points) over the past week to 6.65 percent, which is 289 basis points, or nearly 80 percent, higher than at the same time last year and 400 basis points, or over 150 percent, higher than its all-time low of 2.65 percent in early 2021 (but still well below its long-term average of 7.75 percent).

Fed can’t pivot to low interest regime without risking overall system stability.

And incomes aren’t at a level to absorb high interest mortgages.

Interesting times ahead.

And incomes aren’t at a level to absorb

highnormal interest mortgages.FTFY

Fed policy works! We will eventually stall out the economy and inflation and get back to a steadier state.

What will the new benchmark for SF real estate be? $800psf?

Inflation up in January.

The fraction of tech jobs lost plus fraction population lost is a reasonable factor for housing price correction estimate independent of all else … that is likely approaching 20% in SF and rising. For high rise condos you will need to additionally account for loss of cred/desirability.

The Columbia Property Trust default could be the vanguard of a new urban doom loop chapter.

If 30y mortgages are 6.5% and quality residential assets line up with those in cap rate terms, what is a 7 cap on a condo at the leaning tower of Millenium, or the punching bag Lumina? $700psf?

Just doing some back of the envelope math here…let’s call the current fed funds futures rate 4.6 percent, and the benchmark mortgage rate 6.5 percent (from the headline in the post above), then the factor to get the benchmark mortgage rate would be about 1.4. When I looked earlier in the week the futures market was predicting a peak rate of 5.37 percent during the summer of this year, so if that turns out to be correct, that would forecast a benchmark mortgage rate at around that point in the year over 7.5 percent!

Sticklers will object that this assumes the relationship between the fed funds futures rate and the benchmark mortgage rate is linear, which I would agree is not the case. But it at least get you in the ballpark for an estimate.

The scenario being talked about around here a couple of months ago where mortgages hit 8 percent in the foreseeable future might not come to pass this year, but reaching striking distance of the fifty year average being shown in the chart above looks likely, unless inflation drops dramatically in the interim.

This is a perfectly rational way to think about interest rates if you lack any understanding of yield curves.

UPDATE: The average rate for a benchmark 30-year mortgage has ticked up another 15 basis points (0.15 percentage points) over the past week to 6.65 percent, which is 289 basis points, or nearly 80 percent, higher than at the same time last year and 400 basis points, or over 150 percent, higher than its all-time low of 2.65 percent in early 2021 but still well below its long-term average of 7.75 percent, none of which should catch any plugged-in readers, other than the most obstinate, by surprise.

And it will go back down too. It’s funny how you have these non-actors on here talking the way the are. Pure comedy. Come springtime they’ll be ignoring reality and talking about the next collapse as well. This site is like q-anon for SF Real estate haters. “Hurry up and wait. It’s a ‘comin. The next one is the big one I tells ya.” Much love, fan.

Whether one is an actor or not, no one can argue with “it [the average rate for a benchmark 30-year mortgage] will go back down too.” Of course that’s true, but the time frame matters. Are we talking about a week? A month? A quarter?

You say “come springtime ” — which begins seventeen days from now and ends June 21 — “they’ll be ignoring reality and talking about the next collapse as well.” Should we interpret that as your forecast that the average rate for a benchmark 30-year mortgage will be lower than 6.50 percent?

Will the average rate for a benchmark 30 year be lower than 6.5 % this spring? Sure. I believe that’s so.

Wells has them right now. https://www.wellsfargo.com/mortgage/rates/

Pretty prescient stuff by yours truly when I wrote that, huh? given the 10 year yield’s activity today? nailed it