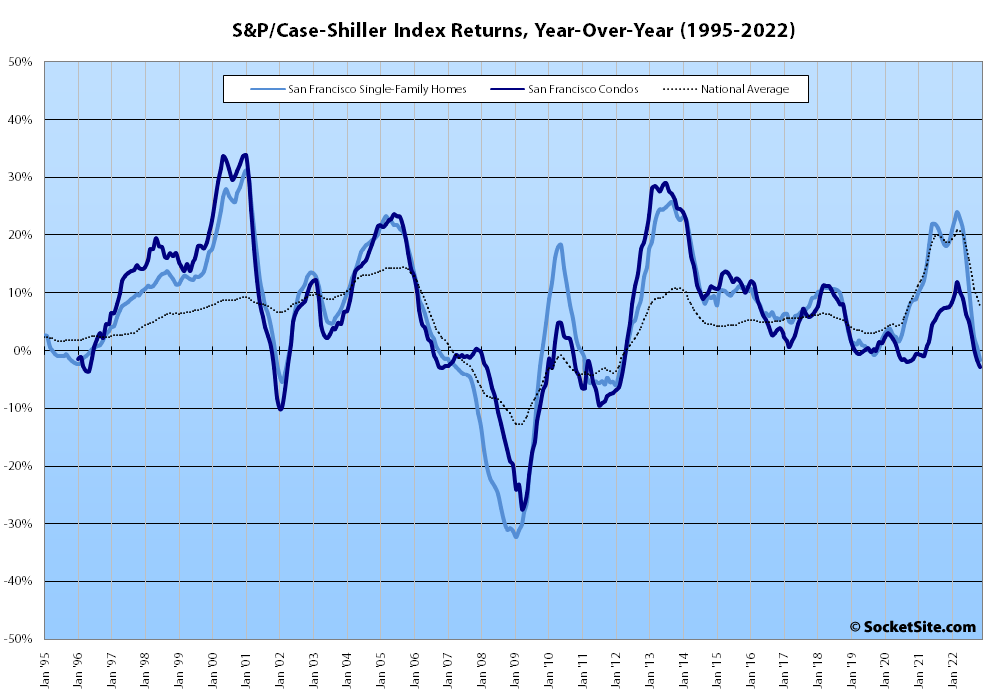

The S&P CoreLogic Case-Shiller Index for single-family home values within the San Francisco Metropolitan Area – which includes the East Bay, North Bay and Peninsula – ticked down another 1.6 percent in November. As such, the “San Francisco” index has dropped over 14 percent since last May. And as we projected, the index is now 1.6 percent lower than at the same time last year, representing the first year-over-year decline for the index since October of 2019 and the largest year-over-year drop in over a decade, and still trending down, none of which should catch any plugged-in readers by surprise.

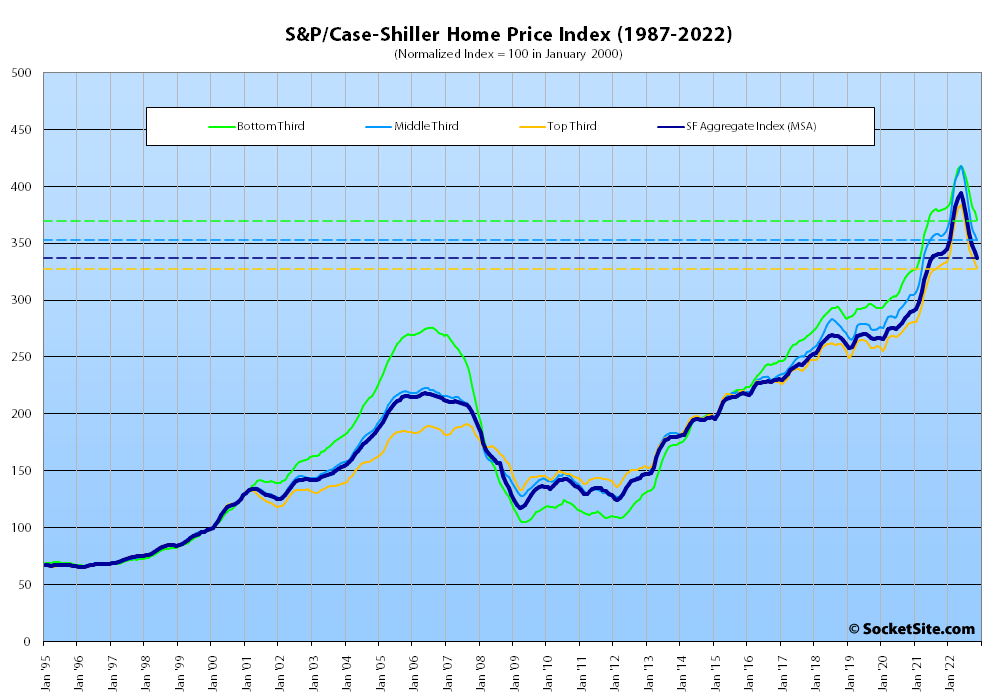

At a more granular level, the index for the least expensive third of the Bay Area market ticked down 1.9 percent in November for a year-over-year decline of 2.6 percent; the index for the middle tier of the market ticked down 1.2 percent for a year-over-year drop of 1.4 percent; and the index for the top third of the market ticked down 1.3 percent for a year-over-year drop of 1.2 percent, as we projected.

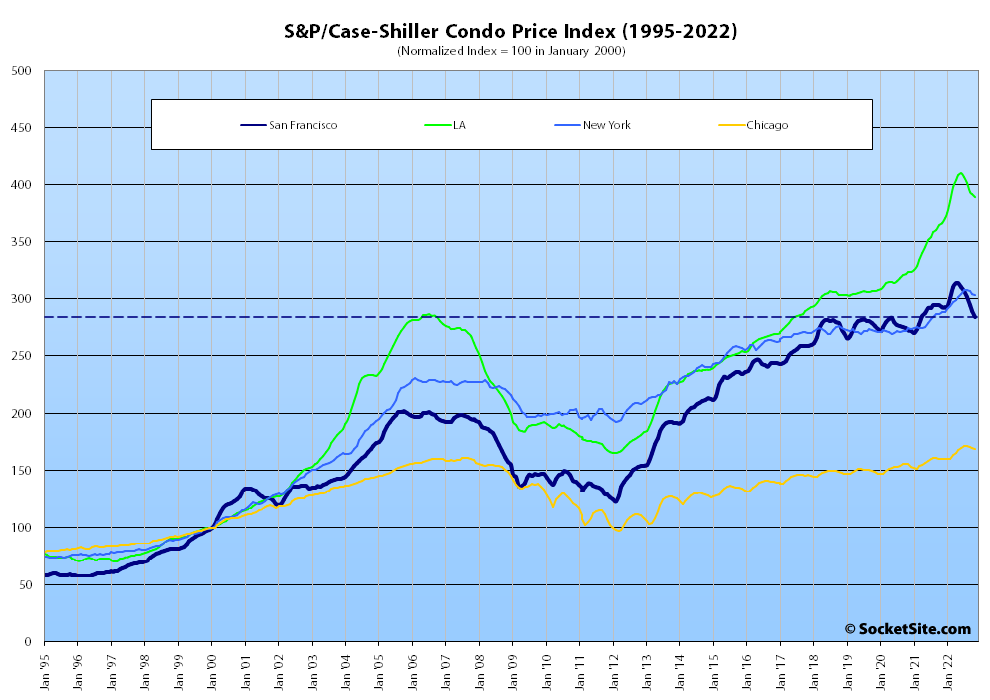

At the same time, the index for Bay Area condo values, which had already dropped on a year-over-year basis and remains a leading indicator for the market as a whole, ticked down another 1.7 percent in November and was 2.9 percent lower than at the same time last year (versus year-over-year gains of 6.3 percent, 5.2 percent and 5.1 percent in Los Angeles, Chicago and New York respectively).

The national home price index slipped 0.6 percent in November but remains 7.7 percent higher than at the same time last year, with Miami, which remains 18.4 percent higher than at the same time last year, continuing to lead the way with respect to exuberantly indexed home price gains, followed by Tampa (up 16.9 percent) and now Atlanta (up 12.7 percent), and the indexes for San Francisco and Las Vegas (down 1.8 percent), followed by Phoenix (down 1.6 percent), having dropped more than any other major metropolitan areas.

Our standard SocketSite S&P/Case-Shiller footnote: The S&P/Case-Shiller home price indices include San Francisco, San Mateo, Marin, Contra Costa and Alameda in the “San Francisco” index (i.e., greater MSA) and are imperfect in factoring out changes in property values due to improvements versus appreciation (although they try their best).

Fed policy works!

We’re getting there. Where’s the next bottom in the aggregate index? Looking at the graph, knowing a little history, and looking around, somewhere between 300 and 250 seems very imaginable.

And the banking industry thought 10% would be a decent equity buffer after the 2008 meltdown. As one of the co-recipients of the “purchased at the worst time in modern history” award, at what point in negative equity do I just hand keys back? I was only ever kind of interested in this neighborhood, but got priced out of the one I wanted to be in. I could just save up another down payment and start over.

Assuming this is a sincere question, I think this is actually a pretty tractable and interesting personal finance problem that came up a lot during and after the so-called housing bubble. But I’ll just quote from:

White, Brent T., The Morality of Strategic Default (May 22, 2010). Arizona Legal Studies Discussion Paper No. 10-15, Available at SSRN, 5th ‘graph:

Emphasis mine. I’ve never had the opportunity to strategically default, but If you don’t have a wealth manager, you’re probably going to have to find a financial advisor with the proper training who would, on a fee-only basis, walk you through that calculation.

I’d like to know how you know you have negative equity if you haven’t had a refinance-driven appraisal recently. Are you looking at online “Zestimates”?

Or people could simply decide after a year or so of plummeting prices that they will never see any kind of return on the money they are pouring into the place. Most of the folks defaulting will not have a “wealth manager”. Tax issues will come later but even so, the math will likely be in their favor.

May was a peak. For some reason there seems to be a sentiment on here that the Fed’s policies, locally, are going to work out to a trough that more resembles the sub-prime crash than the dot com crash. Why would that be? I’ve yet to see anybody make that case.

While not readily apparent to some, the magnitude of the current decline, which hasn’t reached its nadir, is already over twice that of “the dot com crash” and half-way to the sub-prime decline and closing.

No, it isn’t.

Yes, it is. At least for the Bay Area market, which has declined faster, and farther, than nationally.

And “hasn’t reached its nadir” was predictive indeed.

That’s correct.

nope. This website missed talking about spring of ’22 properly in the first place. Then it wants to be accorded the latitude to use spring of ’22 as the highwater mark, discounting that that was a very brief stark runup anomaly. Then it’s like, making predictions, which really are only going to be backward looking datasets in and of themselves as next month will reflect December’s contracts. But on top of that, comparing dot-com bust, which was a year of month over month decline, as if this is going to be that. Nope, nope, nope, and nope.

That’s wholly incorrect. In fact, the backward looking datasets are simply confirming the trends we not only outlined at the time but prior to their occurrences, typically by at least a quarter, if not two, with respect to both volumes and values. And once again, while not readily apparent to some, the magnitude of the current decline, which hasn’t reached its nadir, is already over twice that of “the dot com crash” and half-way to the sub-prime decline and closing. That’s not incorrectly based on some mis-comparison of month-over-month declines but basic maths and data.

So where are the deals? I know what I bought in the Dotcom crash (and we are twice that supposedly) and I know what I bought in the subprime (and we are closing in on that?). I am not seeing anything worth buying that is in the same neighborhood (both literally and figuratively) as we saw at those times.

@sparky-b: “So where are the deals?”

I know, right? Real estate is a highly-liquid, rapidly-obsolesced, fungible consumer good like televisions, so where are the fire sales?!

What’s funny is that’s remarkably poor writing while trying to be arch. Like used TVs hood value or something? Heh. Maybe stick to sloganeering moving forward, pal.

Hold, that was

Yeah well houses weren’t TVs during those events either now were they? But there were really good deals.

And it took years to play out, precisely because RE is not a highly-liquid, rapidly-obsolesced, fungible consumer good.

so your saying even though this is a magnitudes larger decline than Dotcom it will take years before there will be lots of good deal on houses (and of course many things will happen between now and then)? Okay I guess, not what the gloom and doom rhetoric makes it sound like to me.

That’s not what I’m saying. I don’t pretend to know how low prices will go, how long it will take to get there, or how long they will stay there, only that while RE bubbles expand very fast, deflation is usually slower. Curiously, though, the last leg of this one is unwinding even faster than it went up, so you may not have to wait that long for your deals.

No. This downturn has nothing to do with any of the other ones, as it was entirely calculated by the Fed. That it is playing out with both brevity and intensity was part of the plan.

You’re giving the Fed a lot of credit for causing Covid and for convincing Putin to invade the Ukraine.

I’m not at all. What an odd thing to write.

It is an odd thing to write that this downturn was entirely calculated by the Fed. The Fed did not cause Covid nor did it force Putin to invade the Ukraine, which are the driving forces of this downturn.

The Fed sought to calm the post-covid inflationary environment by design. In that, this differs from any of the other downturns referred to above.

Yes, this downturn is different than others. But it was not “entirely calculated by the Fed”. It is illogical to discuss this downturn without considering Covid or the Russian invasion. The Fed did not create Covid, nor did it cause Putin to invade the Ukraine.

You keep on talking about Putin invading Ukraine in a context of American real estate, San Francisco real estate for some reason. You parsed a phrase I wrote, and then expanded it globally, right out of meaning. Go ‘head with your bad self dude.

Not only Putin invading Ukraine. Also Covid. Those two events, yes, have an effect on real estate, including San Francisco real estate. Blaming the Fed without blaming these two events is being blind to the real cause.

Sorry if you’re bothered I took your phrase literally. It’s you who wrote it, not me.

No, this is pretzel logic. Putin invaded Ukraine in February 2022. And over here, unrelated, the San Francisco real estate market proceeded to have all time high levels for about four months. Regarding covid, yes that all time high period was a reaction to the perceived end of the covid era. With that perceived end came lots of government injected liquidity, the net result of periods of forced savings for many households, pent up demand for people timewise in their lives, etc etc. The behavior of people at the end of covid, this is what the Fed reacted to. And it is what I said. But Putin + Ukraine? no. That did not effect this real estate market. And all you’ve done is insist that it has. There’s been nothing cited to support the take.

So you honestly believe that the invasion of Ukraine has not had an effect on the world’s financial markets. Because the global financial market definitely has an effect on San Francisco real estate.

At least now you’re acknowledging Covid, as opposed to saying that this downturn was “entirely calculated by the Fed.”

I never said the Ukraine war did not have an effect upon global markets. Nor did I ever once say that the Fed initiative was not to do with the American economy’s response to a post-covid sentiment. I note that you have not addressed the fact that the SF market spiked for months right after Putin’s invasion.

You said, once again that this downturn “was entirely calculated by the Fed.”

If you agree that the Ukraine war has an effect on global markets, then you also presumably agree that it has an effect on this downturn. Yes, prices in San Francisco might have spiked right after the invasion. But that appears to have been a short term incident. The war is one factor, another is the very long term effects of Covid. Neither one of which is the Fed.

Presumably ? no. Well OK sure. Presume away. But we’re done here.

If you don’t think that the global markets have an effect on San Francisco real estate, then yes we are done.

Good luck blaming the Fed.

I don’t think we’ve seen the “bottom” of the Case Shiller index, but only because it lags by a few months.

If I were in the market to buy (and I’m not), I’d be comfortable buying now. Stock market is up, unemployment at record lows, economy still looks remarkably strong, and mortgage rates are declining (Fed’s comments today sent bond rates lower and stock prices higher – markets now more strongly signaling rate cuts later this year). Yes, rates will be lower a year from now, but you can refi.

Might home prices continue to fall? Sure, they might. But I’d say they’re more likely to be flat to up through 2023. Not great to buy in a fast declining market, but indications are we’re out of that phase. If you see a good deal (and there are a few) and pass on it, you may regret missing your window. Case Shiller data will catch up in 4-5 months to show where we are today, and we’ll see. Prices zoomed up in 2021-22 and that weird pandemic boom effect has now washed out.