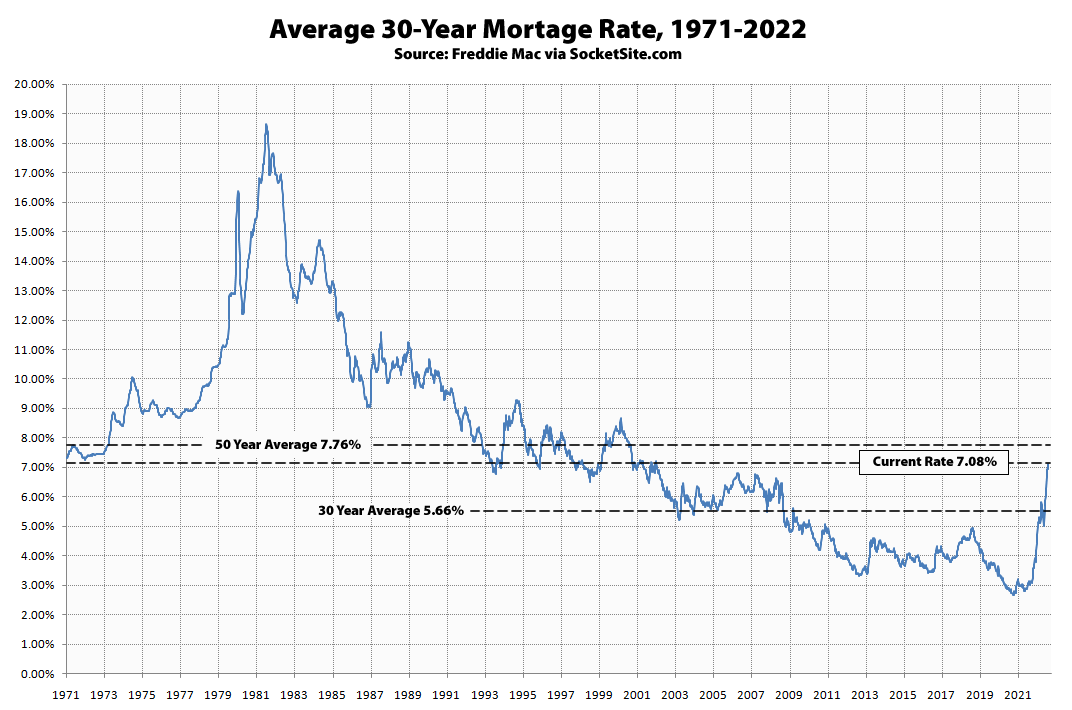

Having hit a 20-year high of 6.92 percent two weeks ago, the average rate for a benchmark 30-year mortgage has since ticked up another 16 basis points (0.16 percentage points) to 7.08 percent, an average rate which is 125 percent higher than at the same time last year, 167 percent above last year’s all-time low, and the highest average 30-year rate since April of 2002 but still below its long-term average of 7.76 percent.

At the same time, the average rate for a 5-year adjustable rate mortgage (ARM) has ticked up another 15 basis points to 5.96 percent, which is not only 133 percent higher than at the same time last year but over double the average 30-year rate on offer early last year, with the probability of the Fed raising rates by at least another full percentage point (100 basis points) by the end of the year holding at 100 percent.

As we outlined at the end of last year, multiple rate hikes this year “should translate into higher mortgage rates, less purchasing power for buyers and downward pressure on home values,” none of which should catch any plugged-in readers, other than the most obstinate, by surprise. We’ll keep you posted and plugged-in rather than looking in the rearview mirror.

Yikes! Almost 3X my 20 year (2.5%) I got less than 2 years ago!

How much value has your property lost?

Schadenfreude much? After all, your 401(k) has probably dropped a lot more.

While easy to take a page out of the industry playbook and dismiss sf’s comment as “schadenfreude,” there are some rather serious implications and headwinds ahead for owners/investors that financed high-cost basis purchases with all-time low rates that have more than doubled but still aren’t historically high.

Are you saying it is bad for borrowers that they borrowed at rates that are now far below prevailing rates? How? Or maybe your point is this is bad for lenders? That I can understand.

While it’s not a problem if said borrowers never need to sell, refinance nor tap the equity in a high-cost basis property that was financed at all-time low rates, properties are typically held for less than 10 years and the cost of capital is dramatically different than it was a year ago, which has, in fact, “translated into less purchasing power for buyers and downward pressure on home values,” which shouldn’t have caught any plugged-in readers by surprise.

What if you purchased a property in 2012, at the bottom of the post-housing crash market, then refinanced 2 years ago at below 3%? You’d be sitting pretty, even with the current ‘headwinds’ considering that your property is worth a lot more than it was in 2012.

Not sure about Big B, but that’s our situation and we can ride out this trough until the next cresting real estate wave.

That’s correct and perfect timing (save not having sold into the market at the end of last year), which is exactly why we focus on market turning points and directionality.

True that if you bought a home (or anything) at a market peak and then must sell during a downturn, you will take a loss. But that has nothing to do with financing at low rates. The owner is still better off having borrowed at lower rates rather than at higher rates. All those owners who bought or refinanced at the very low rates of the last few years are in pretty good shape.

That’s incorrect, unless you’re only worried about the size of your payments and not the value of the underlying asset for which your payments are being made.

There was no indication in u/Big B’s comment about their overall cost, nor down payment percentage – so by extension there was no basis for u/sf’s broadside snarkily gloom-and-dooming about a loss in property value and implying that Big B should be anything but pleased with their mortgage interest rate.

Moreover, yes the market’s changed in the last 6 months and the last year … and it will continue changing. For anyone on here, “optimist” or “pessimist”, to comment in polemic terms about how everything will be rosey, *or* that everyone who purchased in the last 10 years is doomed, is nothing more than speculative nonsense.

[Editor’s Note: Which is exactly why we’ve always focused on market turning points and directionality.]

The thing is, you can’t sell only at the top of the market boom unless you’re prepared to get out of Dodge and move somewhere less expensive (in the US or abroad). Otherwise you’re buying into the same market you’re selling in & will be paying a premium for your new place.

At least, that’s our plan when we’re a couple of years shy of retirement.

Another option is to rent. But you’re right, shorting one’s primary residence is tough.

I sold my home a couple years ago and am happy renting and having 7 figures of dry powder to deploy.

But this RE downturn will be far less severe than during the GFC. The underlying loan credit risk now is massively lower than it was then. Employment is very strong. Why would anyone sell right now and take a loss unless there was no other option? Better to sit on the sidelines for 5-10 years.

As we noted a few weeks ago, despite the poor market conditions and popular notion that nobody would sell unless they had to at the time, over 20,000 homes traded hands in San Francisco from 2008-2011.

TBK – Aside from temporarily renting, another strategy is to own more than one property, allowing you to sell at the top and buy at the bottom while still living in one of the properties.

Granted, picking the lows and highs is not easy. I’m pretty good at recognizing the lows, but bad at seeing the highs. Maybe that’s because I can’t imagine how an irrational mind thinks :-).

keine Schadenfreude hier.

I’m patiently waiting to sweep up my first home during the impending bubble crash. (Or will it be the Hindenburg?)

Much as I’d like to believe that is going to happen in the near future, the reality is there isn’t a bubble this time, so there isn’t going to be a crash in the next 18 months.

You might be able to buy a home for marginally less money during that time frame, but of course, you’re going to be paying more interest on it if you take out a mortgage at today’s higher rates.

Meanwhile, if you’re sitting on cash while waiting for the crash, it’s been getting eaten up at an 8.2 percent over the last 12 months.

I saw a talking head on TV last night saying that the federal reserve will reverse course in the fall of 2023 and mortgage rates will never be 3% but 5% will be the norm from then on, lower than the 7% today.

I suspect that will increase home prices back to 2021 spring prices. I don’t see any “decent properties” north of Cesar Chavez, east of Stanyan for less than 1000$ / SF, even with mortgage rates this high.

“a talking head on TV last night ”

Well, that certainly settles it. Where do I sign?

That’s a whole lot more credible than your ramblings. Taking inapplicable statistics you were taking from various cities and manipulating to fit into SF earlier, across shadow real estate ownership blocs? you didn’t come close to believability or sense. But mortgages coming down to ~5ish eventually? Hell, I’ll google that right now.

Easy. Fannie Mae said it.

You’re full of it, two beers. Stop writing so much drivel.

Just to be clear, your implication is that short term rental, foreign capital flight, speculation and flipping were negligible market components in SF over the last decade. So it was all organic demand. Demand that work from home and the web 3.0 implosion is taking to the cleaners. Got it.

Just to be clear, your “just to be clear” type argument is Trumpian straw whataboutism garbage and utterly worthless. I’ve spoken to you about your fallacies. Address them, or stop talking in my direction moving forward.

While we’re obviously fans of Freddie Mac’s repository of data, their forecasting skills (“We forecast rates to average 3.6% in 2022 and 3.9% in 2023.”) leave a lot to be desired. That being said, one could simply look to the averages and relevant timeframes, based on market conditions, above…

I didn’t see the broadcast that john was referencing, but if you’re looking for a prediction from a non TV pundit, you can just do a web search for news about the recent report from the Mortgage Bankers Association forecasting a recession next year and a subsequent fall in mortgage rates to about 5.4% or so late in 2023. You can view an interview with Glenn Kelman, CEO of Redfin, about this that aired on CNBC a few days ago.

“It’s tough to make predictions, especially about the future” — Yogi Berra