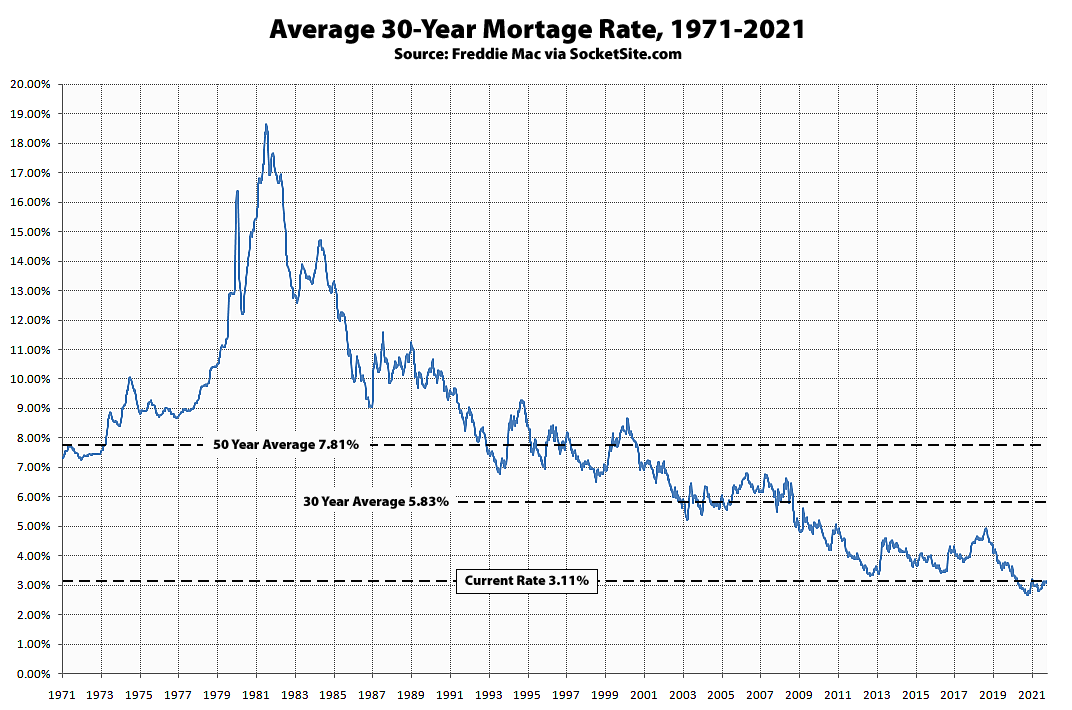

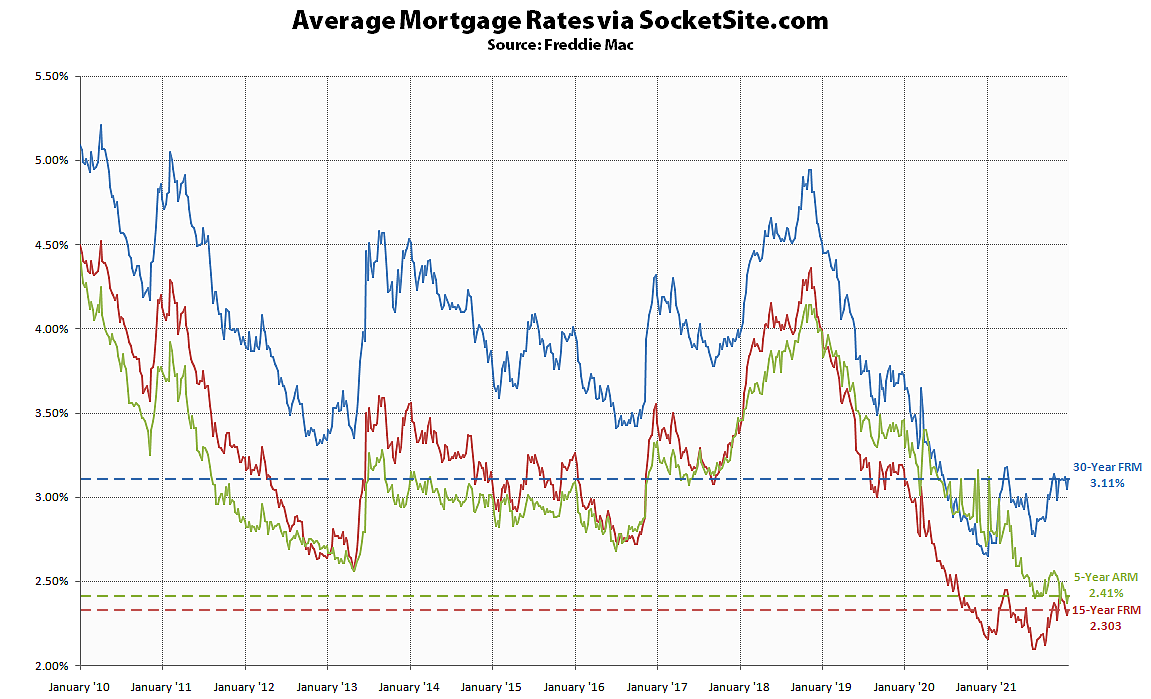

The average rate for a benchmark 30-year mortgage inched up 6 basis points (0.06 percentage points) or bips over the past week to 3.11 percent, ending the year 44 basis points higher than at the end of 2020 and 46 basis points above its all-time low of 2.65 percent back in January.

At the same time, the average rate for a 15-year fixed-rate mortgage is ending the year at 2.33 percent, which is 16 basis points higher than at the end of 2020, and the average rate for a 5-year adjustable has inched up to 2.41 percent, but is still 30 basis points lower than at the same time last year, with the specter of multiple rate hikes next year (which should translate into higher mortgage rates, less purchasing power for buyers and downward pressure on home values).

Rates are at a all time low. Monetary inflation is at a high. Borrow as much as you can for the longest term you can – interest only. You will be able to pay your home loan off for the price of car in 30 years.