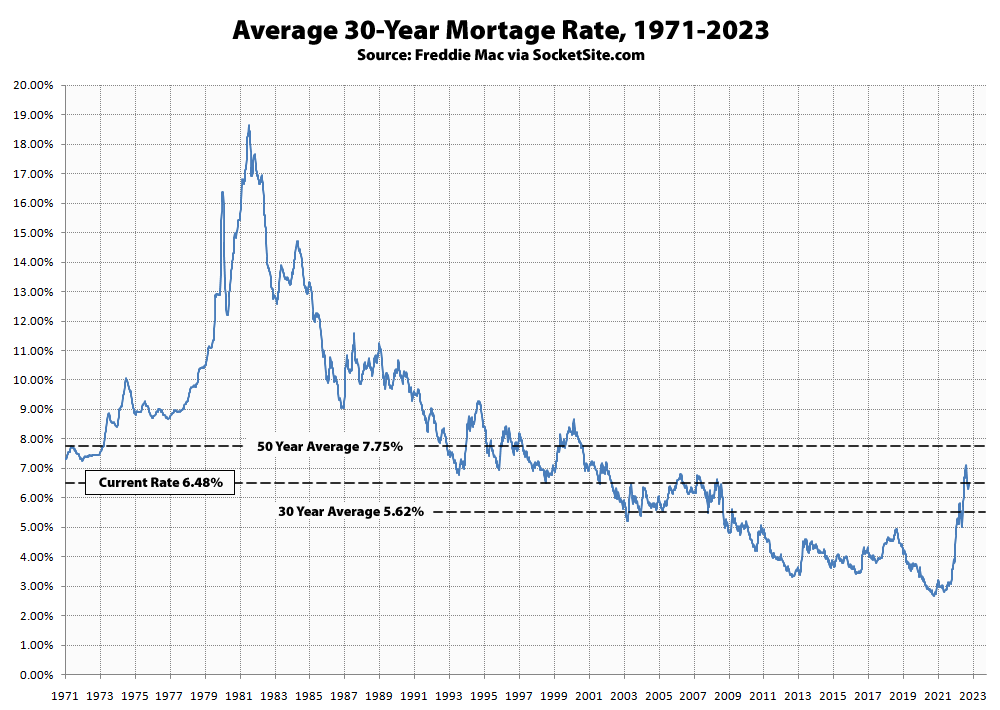

While mortgage application volume dropped to a quarter century low at the end of 2022, despite a pullback in mortgage rates in the fourth quarter of last year, the average rate for a benchmark 30-year mortgage has since inched up another 6 basis points (0.06 percentage points) to 6.48 percent, which is twice as high as it was at the same time last year and 145 percent higher than its all-time low of 2.65 percent two years ago but still below its long-term average by over a full percentage point.

At the same time, the number of new homes on the market across the nation is holding around a 15-year high, driven by a pronounced drop in demand, and the probability of the Fed hiking rates by at least another 50 basis points over the next three months has actually ticked up to over 90 percent, none of which should catch any plugged-in readers, other than the most obstinate, by surprise.

0% interest rate boom about to crash into 8% wall.

Mortgage rates were at 0%? I don’t think so. Dipped a tiny bit below 3% in the depths of the pandemic. Today the 30 year is at 6.2% with jumbos at 5.6%. Inflation is cooling fast. I don’t see a scenario where mortgages hit 8% in the foreseeable future.

The all-time low for the 30-year mortgage rate was 2.65 percent, in January of 2021, with an average rate of around 4 percent over the past two years. The federal funds rate, however, had effectively dropped to zero, from early 2020 through the beginning of last year.

The most plausible scenario would be when/if the federal funds rate reaches anywhere above 5.5 percent.

The Fed’s Summary of Economic Projections released at the time of the December FOMC meeting indicated peak rates around 5 percent next year. From the transcript of Chair Powell’s Press Conference:

Emphasis mine.

If inflation doesn’t continue to come down, and rate hikes continue, it would be pretty easy to get within striking distance of or even reach conforming mortgage rates of 8 percent in that foreseeable future.

Anything can happen! Treasuries have all this baked in, a lot has changed in the month since that speech, and the 10-year is at 3.55%. CPI coming tomorrow morning. Let’s see where the trend is.

And CPI numbers are in with inflation continuing to fall. There was actually deflation in December. With 10-year bond rates now at 3.51%. I don’t see mortgages at 8% in any reasonable scenario in the near future (the bond market appears to agree).

I’d take the other side of any bet the bond market hasn’t priced in well-known information. The spread between 10-year yields and 30-year mortgages is also unusually high, and that should also trend toward the mean (i.e. downward trend in mortgages even if 10-years were to remain at this level). We’re more likely to see mortgage rates in the low to mid 5s than the 8s.

Yeah, but most people would surmise mortgage rates likely go down next week.

UPDATE: The average rate for a benchmark 30-year mortgage ticked down 15 basis points (0.15 percentage points) over the past week to 6.33 percent, which is only 83 percent higher than at the same time last year and 139 percent higher than two years ago.

At the same time, the probability of the Fed hiking rates by at least another 50 basis points over the next three months has ticked down to just under 80 percent.

Interesting times. The spread between 3-month and 2-year rates has gone wildly negative, meaning the bond markets are heavily betting on rate cuts coming soon. My prediction is we’ll see mortgage rates trending down through the end of 2023. Not going to see the crazy low 2021 rates, though (but I’m really glad I re-fi’d when those were available).

It took me a minute to find a relevant chart. Other readers/commenters can find a depiction of the spread between 3-month and 2-year U.S. Treasury Yields at ycharts. As of 13 Jan it’s at -0.73% compared with the all-time low of -2.41% in 1980, so I wouldn’t call the current spread “wildly negative” unless you’re only considering what’s been happening in the last decade of so although I agree that bond markets appear to be pricing in rate cuts fairly soon.

I think that this time, the bond market hasn’t priced in the guidance from The Federal Reserve, which has said recently and often that rates will be held higher and for longer than usual after the terminal rate is reached in order to head off inflation.