Despite the marked impact of the recent wild fires in Sonoma and Napa counties, which resulted in an average 18.7 percent drop in sales activity versus the same time last year, the number of single-family homes and condos that traded hands across the greater Bay Area ticked up 1.9 percent from 7,354 in September to 7,492 in October and were a nominal 0.8 percent lower versus the same time last year.

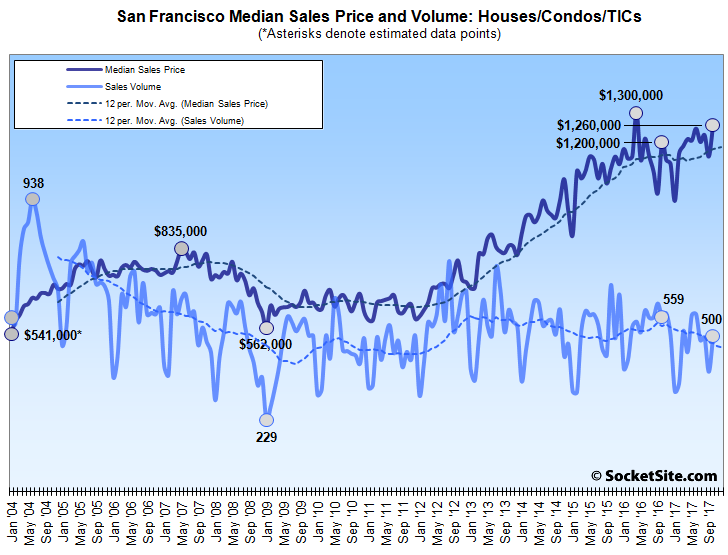

At the same time, while the sales volume in San Francisco proper rebounded an above average 30 percent from September’s sharp decline, sales in October (500) were still down 10.6 percent on a year-over-year basis, according to recorded sales data from CoreLogic.

In Alameda County, recorded homes sales were up 9.9 percent from September (1,558) to October (1,713) and 8.0 percent higher versus the same time last year while sales in Contra Costa County ticked up 3.5 percent to 1,548 (which is 4.9 percent higher, year-over-year) and sales in Solano County inched up 1.8 percent to 627 in October but slipped 2.8 percent versus the same time last year.

Home sales in Santa Clara County slipped 4.7 percent from September (1,737) to October (1,656) and were 1.2 percent lower versus the same time last year while recorded sales in San Mateo County ticked up 2.2 percent to 607 in October and were 1.2 percent higher, year-over-year.

Up in Marin County, sales slipped 1.1 percent to 275 in October and were down a more dramatic 13.8 percent versus the same time last year. And as previously noted, home sales in Napa dropped 15.1 percent to 101 in October and were down 19.8 percent on a year-over-year basis while sales in Sonoma County dropped 18.8 percent to 465 and were down 17.6 percent versus the same time last year.

The median price paid for those aforementioned 500 homes in San Francisco was $1,260,000, up 9.6 percent from the month before and 5.0 percent higher versus the same time last year but 3.1 percent below the record $1.3 million median price recorded in April of 2016.

The median sale price in Alameda County was $775,000 in October, up 1.8 percent from September and 13.1 percent higher versus the same time last year; the median sale price in Contra Costa County was $580,000 (13.0 percent higher versus the same time last year); and the median sale price in Solano County was $404,955 in October, up 1.2 percent from September and 8.0 percent higher, year-over-year.

The median sale price in Santa Clara County was $972,000 in October, up 2.3 percent from September and 16.7 percent higher versus the same time last year while the median sale price in San Mateo County was $1,220,000 in October, up 6.1 percent from September and 16.2 percent higher, year-over-year.

The median sale price in Marin was $975,000 in October, down 2.7 percent from September but 1.4 percent higher versus the same time last year while the median in Napa was $590,000, up 3.5 percent from September and 2.6 percent higher versus the same time last year, and the median in Sonoma was $583,000 in October, up 2.0 percent from September and 9.2 percent higher, year-over-year basis.

And across the greater Bay Area, the median home sale price ticked up 2.6 percent to $765,000 in October which is 10.9 percent higher versus the same time last year.

Keep in mind that while movements in the median sale price are a great measure of what’s selling, they’re not necessarily a great measure of appreciation or changes in value and are susceptible to changes in mix, as opposed to movements in the Case-Shiller Index.

Same story as we’ve been seeing. High demand is driving prices higher. An uptick in SF listings in October, and they were quickly snatched up. Hence sales volume was higher than the prior month. Prices continue to rise, as is expected when demand still outstrips supply even with the October uptick in supply.

November inventory numbers were lower, and prices were even stronger. Simple supply and demand at work here. We’re not going to see price trends change until demand cools or something causes lots more inventory to come onto the market.

As the average time between a new listing on the MLS and its closing is currently running around a month and ticking up, an uptick in October supply would actually impact the sales volume in November, not October.

Regardless, true inventory levels (listings less sales) ticked up in October as the pace of new listings/supply outpaced sales while the decline in inventory levels last month was driven by a seasonal decline in supply.

“True inventory”? No need to make up new metrics. The usual active listings, new listings, months of supply, number of closings, etc. do a good job of telling the story. These are all readily available. Bottom line is active inventory (i.e. supply) remains tight so there is upward price pressure unless demand is very light. Demand is trickier to measure as there is no record of interested or disappointed would-be buyers, but high prices tell that story by implication. The brief uptick in inventory was quickly met with an uptick in closings. That uptick in inventory is now gone and we were back in November to very tight active listing levels and continuing high prices. Not all that complicated.

Sadly, it’s not a matter of making up “new metrics” but having to explain those which are frequently misreported and misunderstood (such as how “inventory” isn’t the number of new listings added to the MLS nor supply as you’re using it, but rather the net number of available homes after accounting for sales).

In fact, current inventory levels are relatively higher now (down an average of 11 percent, year-over-year) than they were in either October (down an average of 19 percent) or November (down an average of 15 percent).

And on an absolute basis, inventory levels are higher now than they were in 2015 (and 2014 as well).

“the net number of available homes after accounting for sales”

That simply makes no sense. Inventory counts take no inexplicable gymnastics. It is all out there and public. There is active inventory. There is in-contract inventory. There are new listings. When you use terms like “true inventory” or “current inventory” which you calculate by some unspecified manner, you’re just being deliberately opaque.

If, as you seem to be asserting, “inventory” (however you are trying to measure it) has gone up, while prices also continue to rise as indicated by your chart above, demand must be exceedingly high. Your point doesn’t go anywhere despite your legerdemain.

While not impossible, It is unlikely you have a better grasp on these numbers than the editor, who reviews and reports on them professionally.

As interesting as this debate is, the short version would be that at the last peak/bobble the “average price” peak was $835,000, and last month the average price was $1,260,000.

Hard to believe that is a sustainable price level, but SF prices has been in that general area for a couple of years now. The CPI has increased about 20% in the same time span.

It’s worth noting that strong housing growth is not limited to Bay Area. Low interest rates and low unemployment rates are driving prices up in every urban area: Sacramento, Los Angeles, central valley, Portland, Seattle, …

True, but prices in many inland locations such as the central valley, inland empire and probably most of Nevada and Arizona are still far below the 2007 peak

Or a little closer to home, the bottom third of the Bay Area market (the index for which remains below its 2006-era peak and has been driving the recent year-over-year gains for the Bay Area index overall).

“Despite the marked impact of the recent wild fires in Sonoma and Napa counties”

Not that I question this statement, but would anyone really expect this to have an effect on SALEs in the (central) Bay Area, at least at this early stage (before insurance settlements)? OTOH, I would think there might be some – albeit limited – effect on rental/leasing, since people have to live somewhere (other than a motel), and the capital needs are much less.

Don’t understand why the median uptick isn’t part of the headline — but to each his own. Surprising change on large levels

How much of the median sales price push is simply due to lower rates? When I bought my condo in 2008, my APR was around 5.5%. When I bought two years ago, it was 3.5%.

Assuming 20% down, consider this:

5.5% –> $2725/month –> $600K

3.5% –> $2730/month –> $760K

So a 2% drop in interest rates from 2008 –> 2014 allows for a 160K increase in purchasing power or a 27% appreciation. The rest of appreciation is driven by supply/demand.

Rates are not irrelevant. But here, rates hit the floor in late 2012. The recent run-up in prices has all happened after that time, with no further rate drops.

I’m not sure “the recent run-up in prices has all happened [in the five years since mortgage rates dropped to historic lows and have yet to return to pre-recession levels]” is all that reassuring.

No doubt low rates have affected housing prices, in SF and everywhere else. Only point was that they can’t have had the effect Martin posits, at least since 2012, as they’ve been pretty much flat during the entire run-up.

Rising rates will affect the monthly payment, which will affect prices, which most importantly will affect sentiment. Because who wants to buy an asset that might fall in value right away?

Someone who wants to buy a home.

Of course it might fall right way, OR it might rise right away.

You can buy a house, but you can’t buy a home.