Having gained up 0.6 percent in July, the S&P CoreLogic Case-Shiller Index for single-family home values within the San Francisco Metropolitan Area – which includes the East Bay, North Bay and Peninsula – slipped 0.1 percent in August while the index for Bay Area condos gained 0.9 percent.

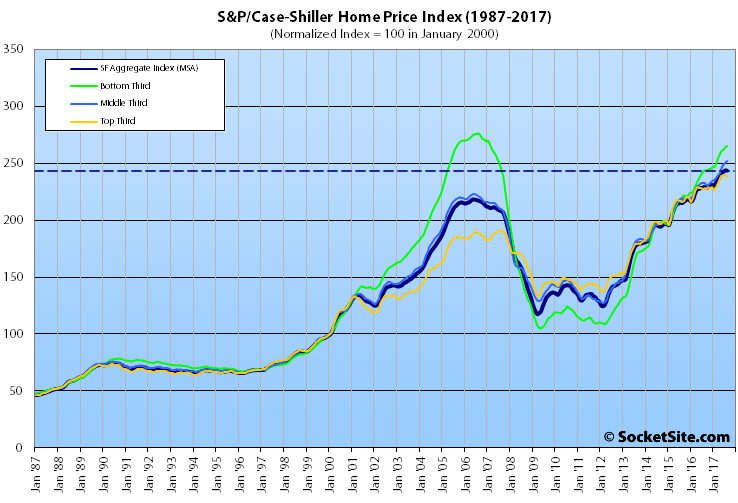

At the same time, the indexed year-over-year gain for single-family home values dropped to 6.1 percent versus 6.7 the month before with outsized gains at the lower end of the market still driving the Bay Area index overall.

In fact, while the index for the bottom third of the market is now running 8.8 percent higher versus the same time last year having gained 0.5 percent in August and the index for the middle third of the market is 8.0 percent higher having gained 0.6 percent in August, the index for the top third of the market dropped 0.9 percent in August and the year-over-year gain dropped to a below average 4.2 percent.

That being said, the index for the top third of the market is still 24.3 percent above its previous peak ten years ago and the middle third is 12.9 percent higher while the index for the bottom third of the market has another 4.0 percent to gain before it’s back to its 2006-era peak level.

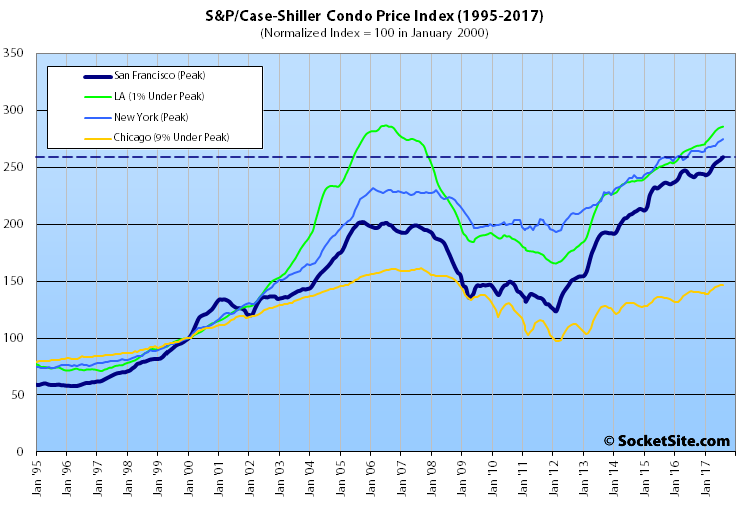

And with its 0.9 percent gain in August to a new all-time high, the index for Bay Area condos is running 7.3 percent higher versus the same time last year and 28.3 percent above its previous cycle peak reached in October 2005.

For context, across the 20 major cities tracked by the home price index, Seattle, Las Vegas and San Diego recorded the highest year-over-year gains in August, up 13.2 percent, 8.6 percent and 7.8 percent respectively versus a national average of 6.1 percent. And on a month-over-month basis, San Francisco was the only major metropolitan area to record a drop for single-family homes.

Our standard SocketSite S&P/Case-Shiller footnote: The S&P/Case-Shiller home price indices include San Francisco, San Mateo, Marin, Contra Costa and Alameda in the “San Francisco” index (i.e., greater MSA) and are imperfect in factoring out changes in property values due to improvements versus appreciation (although they try their best).

It’s different this time! For the 2006 downturn, SF CS Index went negative in June. In 1990, the SF CS Index went negative in July. Do I hear August…

In digging into the details of the proposed tax reform, as it stands it is going to be a significant tax increase on California homeowners, particularly ones in high cost areas like SF.

While I just sold my SF condo and moved to Reno, if I had kept it and stayed in SF, I’d be looking at paying 7% more in federal taxes under the proposed plan for the same amount of income.

While the plan “doubles” the standard deduction it also eliminates the personal exemption which negates most of the increase in the standard deduction. Meanwhile the increase in the standard deduction eliminates most of the prior benefit for deduction housing costs since people will be limited to deducting a maximum of approximately $30,000 combined for mortgage interest and property taxes.

Looks like I sold and moved at the right time.

Details change. But the big picture trend was set as soon as the election results were in. The difference between a situation where hometown Nancy Pelosi was speaker of a Democratic federal government vs a Republican government with CA having no chance of going for Trump in 2020, thus there being no need to lavish pork on the state to try and win votes, is night and day.

Relatively speaking, if this passes as proposed which is a big if, it hurts high tax/high home price states. It would be another factor in slowing home appreciation in San Francisco. California in general will be impacted as it has the highest state income tax rate in the country and the highest home prices in the coastal areas. It could further boost Nevada and the Reno/Sparks area. If anything the exodus of high earners from California will accelerate – a fairly large percentage of home sales in the Vancouver Wa. area are to Californians trying to escape high taxes. BTW, you left in time to miss the big boost in California gas taxes which went into effect yesterday.

Meh, the gas taxes in Reno are pretty steep and are comparable or maybe even a bit more than California even after the recent increase there. Total state & local gas tax in Reno is $0.65 per gallon (which does not include the $0.184 federal gas tax). I always fill up down in Minden (Douglas County) whenever I’m on my way back to Reno from my place up in the Sierras along Highway 88. Douglas County has about $0.40 less per gallon in taxes than Washoe County. If I’m driving to Reno from SF on 80, I don’t really care too much where I fill up as there isn’t that big a difference.

Situation is going to be the same in the affluent suburbs in Midwestern states that went for Trump. Mortgage interest deduction and SALT deduction have always benefited middle class/upper middle class homeowners. Now they don’t. Real estate industry is right to be worried about this. In looking at my own personal situation, I will no longer get any tax advantages for buying a home. I’ll be having to pay the full cost of it myself and not getting any government cheese. I am less likely to spend as much as a result.

This is a transfer of income from the Democratic strongholds (California and New York) to the Republican strongholds. They get lower taxes, paid for by higher taxes for us.

It’s a double whammy of not just mortgage interest, but also non-deductibility of state income taxes over a certain limit. Interest expense will be more expensive after taxes and people who are high earners will flee the state. Now add this to the higher interest rates, and it’s kind of a bad sign.

Will it pass? The market says no, but I think with a lack of progress on Obamacare, congress knows their days are numbered if they don’t pass it.