Bay Area home sales dropped 7.3 percent in April versus the same time last year, with all nine counties recording a decline, ranging from 2.6 percent in Contra Costa to a 15.2 percent drop in San Mateo.

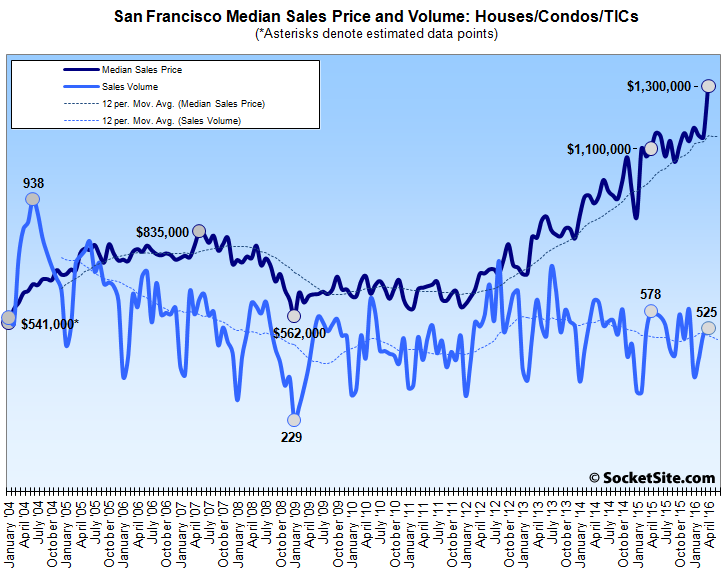

And while the recorded sales volume of single-family homes and condos in San Francisco ticked up 4.6 percent in April versus the month before, which is right in line with typical seasonality, sales dropped 9.2 percent year over year.

At the same time, the median sale price for the San Francisco homes that changed hands in April, which includes new construction sales which closed escrow, was a record $1,300,000, up 18.2 percent versus the month before and 14.4 percent higher versus the same time last year, driven largely by a change in mix which is being amplified by the slowdown in sales.

The median sale price across the entire Bay Area was $686,200 in April, up 6.6 percent from March and 4.1 percent year-over-year with a 4 point jump in jumbo loan activity.

And based on 1,456 sales, which was 5.3 percent lower versus the same time last year, the median sale price in Alameda County, which includes Oakland, was $685,000 in April, 8.7 percent higher versus the month before and 7.0 percent higher versus the same time last year.

Sales volume in Santa Clara was down 7.1 versus the same time last year and dropped 15.1 percent in Marin.

Keep in mind that while movements in the median sale price are a great measure of what’s selling, they’re not necessarily a great measure of appreciation or changes in value and are susceptible to changes in mix, as opposed to movements in the Case-Shiller Index.

At 35% DTI you would need $250k income to afford that median house, which only puts you in the top 4% nationwide. Come on guys, let’s all inhale a bit more of that unicorn hopium and make SF a city that is truly for the 1% and the BMR lottery winners that serve them!

@Sabbie, there are 3 main drivers of SF home prices according to a study going back to the 1940ies:

1. Total supply/construction of homes

2. Number of jobs in the city

3. Level of salaries in the city

I don’t think anyone would be helped if the number of jobs and median salaries would decline. There is only one lever to really raise affordability in the city and this is more housing construction

Going back to the 1940’s the driver of sustainable companies has been profits.

If many current “unicorns” and others are losing boatloads of money, then it calls into question the number of jobs at current salary levels.

And there’s plenty of supply coming down the pipeline.

(only) the 1940’s ???

What, pray tell, was it before that ??

Well there was the great depression where shoe-shine boys were giving stock tips and Irving Fisher made one of the all time worst stock market calls by stating that stocks had “hit a permanently high plateau”

I think that was BEFORE the Depression (and yes, surprisingly enough it turned out they didn’t know sh*t from Shinola….their experience with the latter notwithstanding)

No, what I meant was: haven’t profits always been the driver of sustainable companies…or did you mean 1940’s B.C.?

“No, what I meant was: haven’t profits always been the driver of sustainable companies…or did you mean 1940’s B.C.?”

Yes, I agree. There have been time periods when the market lost sight of the need for profits, but obviously that situation was not sustainable.

The reason the study starts in the 1940s is that it attempts to gain a statistically significant set of factors outside of the the Tech bubble in 2000, the housing crisis in 2007 and the current tech boom.

The study looks primarily at SF rents, but the drivers should be the same (+ interest rates) for the price of real estate in SF. If anyone has statistically more robust research on this topic that yields a different conclusion, I’m happy to change my mind. In the meantime, I won’t be convinced by theories that ‘unicorn bubbles’ and ‘Chinese buyers’ are the main drivers of it.

The study is called: “Employment, construction, and the cost of San Francisco apartments“.

That isn’t a study, it’s a blog post.

This tracks median listed asking rent with no adjustment for change in quality of apartments nor differences between asking and effective rent.

And you can clearly see the run up and drop from the first dot com bubble in the 2000’s. And notice that his graphs are log scaled so that indicates a significant change in rents.

1) Yes, it was not posted in some academic journal, but the depth of data, the thorough methodology and the systematic approach are unmatched.

2)How should the study track changes in quality? Do you think this would change the aggregate results significantly?

3) Yes, the dotcom bubble had a temporary impact, but the underlying drivers continued to drive up rents after 1-2 years. The main conclusion here is that even after a possible tech bubble busts, there is no return to middle class rent affordability in SF without a massive increase in construction.

Also, I’m sure this study is not perfect, but please point me to a higher quality study of SF home price drivers over the long term. Thanks

It’s an admirable piece of research, but the truly shocking thing about this report is that anyone is actually shocked by what its “reveals.”

Namely, that rent prices are determined by the number of people who need and can afford housing (i.e., employment and wages) and its supply.

Other than an increase in construction, can you think of another way that rents could drop? And how that other driver is directly related to the funding and growth of local tech companies or a so-called Unicorn bubble?

Having some academic background and going through peer review can weed out mistakes and fallacious assumptions that might otherwise slip by.

This person appears to only have a few blog posts and be an artist in residence at the Exploratorium so I think you’re overselling his blog a bit.

For the early years (till 1979) he only looks at one day of advertisements in the Chronicle each year and lumps all listings for apartments, condos and houses together regardless of size. So I also think you’re overselling the depth of the data here.

As for adjustments due to change in quality as I mentioned on the thread on inflation, there’s a body of research on hedonistic adjustments. And this again points to a situation where I’d give more deference to someone with a more established background. Robert Shiller did some groundbreaking work on calculating long term housing price changes. And given that he won a Nobel prize for it, there’s probably more basis for taking his work at face value than some unknown artist.

But even if you forget all that, what’s the important result here? That rents are tied to incomes? That SF is an expensive city for the middle class? That limited construction raises prices?

I just don’t see anything very significant here.

Rents could drop due to a decline in demand (typically driven by a poor economy). I’ve seen this three times in SF – in the early 90s, the early 00s, and the great recession.

My main point is that:

1) We should agree on the main drivers of SF house prices. When he house prices stalled recently, I red a few explanations that buyers were ‘fed up’ with the house prices and therefore refused to buy. Before that, the price increases were blamed on all-cash Chinese buyers etc. If we haven’t seen a dip in employment, we should not assume that the trend of rising prices will changes.

2) Going back past the year 2000 shows you a general trend of rising prices that was persistent BEFORE SF became the mecca for Techies. We are witnessing a re-urbanization trend since the 1990ies that applies to most major cities, not just SF.

3) Why is this important? If you’re a home buyer, you should be looking at 10-30 year drivers of home prices in an area, not just the last cycle. I understand that flippers have a much more short-term perspective.

4) In general, Case-Shiller’s work is excellent, but I have one issue with it when it comes to SF. It tracks the same high/mid/low tier homes since the late 1980ies, but can it account for the fact that many parts of SF have been gentrified over the past years. E.g. A house in the Mission might have been classified as lower tier back then, today it would surely be in the mid or high price segment. Any thoughts on that?

Keep in mind that the study you keep referencing wasn’t “primarily for rents,” it was ONLY for rents. You can’t, and certainly shouldn’t, make the leap to the for sale market.

Income is one of the drivers of home prices and rents. But we’ve seen large swings in price/income and rent/income ratios.

Shiller’s books have data on this and this link on the Economist has a nice interactive chart.

Notice how the price/income ratio has spiked and fallen. This indicates times where prices have changed without corresponding changes in income.

In a similar vein, corporate profits are a driver of stock prices but we’ve also seen large variations in price to earnings ratios, both for individual stocks and for the market overall.

Looking at fundamentals such as income and earnings is useful, but your conclusion that there can’t be a price change without a lockstep change in the fundamentals is incorrect.

For your #4, I believe that the intent of the CS price tiers is to approximate the result from buying and holding homes in a particular tier. So if on average low tier homes gentrified strongly during a time period you’ll see a rise in the low tier index.

Pero, your view of demand is much too narrow. It’s not just jobs and salaries. With only 10% of residents able to afford the median home, jobs and salaries alone can’t possibly be driving these prices. The big question is where does all this money come from? Some of the money did come from jobs, but I’d say a lot of it must not have. And of the portion that did come from jobs, how many of these jobs are sustainable, and how many were created by reckless speculation? Why shouldn’t jobs and salaries decline if they are creating neither value for society nor profit for the shareholders, that’s what the business cycle is all about.

On the supply side, the rising inequality and stagflation in America means homebuilders are all focused on luxury housing, there are plenty of articles on this you can find, so they are not likely to meet the existing demand even if the city suddenly rolled back the restrictive policies that you guys are always moaning about.

Sabbie:

Stagflation = economic stagnation + inflation.

While you might argue that we’re experiencing economic stagnation, it is hard to argue that we’re experiencing price inflation right now.

I think you got some things mixed up.

There’s been quite a rise in medical costs, college costs and housing costs. And while there might be technical reasons that these haven’t flowed through to inflation numbers, I do think that there’s a substantial section of the population that has been saddled with wage stagnation and significantly increased costs of living.

anon, the term ‘stagflation’ refers specifically to price inflation. Wage stagnation is in fact a major driver of low inflation. Now, I’m fully aware that high medical costs and college costs are a huge issue of a lot of folks, these don’t help us understand the drivers of real estate prices in SF.

Inflation in the technical sense is about measuring the change in value of the dollar. So when tracking costs, the BLS performs “hedonistic quality adjustments” to account for changes in the qulity of good and services vs changes in the purchasing power of the dollar. This makes perfect sense from the perspective of economics. But it does mean that inflation in the technical sense can diverge from what people experience in their day to day lives.

If one year your wages are $X and expenses $Y, then next year your wages are still $X but your expenses are $Y + 10%, that can feel like stagflation even if it is not in the technical sense.

If your local bodega closes and a whole foods opens up, you might end up paying more for groceries at a higher quality level even if you don’t derive much personal benefit from the higher quality level.

You’re wrong. Look at inflation in the West running around 3%. And these are just the official government numbers, other measures like Shadowstats are showing more like 5%. While wage growth has been pitiful and mostly gone to the upper end. We already know about housing costs. Then the same time, interest rates are zero. Yes, stagflation, if not outright theft from workers and savers.

Sabbie, 3% inflation rates are really not that high compared to historical figures. The inflation rates during the 1970 stagflation were 10-15%. The phenomenon you’re describing might be closer to Secular Stagnation where GDP growth is low despite near-zero interest rates.

As a European, I totally see your point about workers being border-line exploited in the US. Many European countries have universal health care, cheaper child care, longer holidays, more stable jobs and higher top bracket tax rates than the US despite being subject to the same globalization pressures. In my opinion the main problem lies with the 2 party system (rather than multi party one) and the lack of social cohesion in the US, but this is a longer story.

Come on man, do the math, these figures add up. From the table we have a total of 10.7% CPI increase since 2011 and that doesn’t include compounding. And if you are in the bottom 70% your income has gone up 0%, and you are earning 0% on your money in the bank. So, let’s say you had $10,000 in the bank in 2011, it is now worth less than $9,000. Theft. And why? So that we can encourage taking on even more debt and create asset bubbles and cross our fingers that the “wealth effect” will trickle down.

If you still don’t believe me I could send you 1,000 links but here’s a video that just came out today, skip to the 1 minute mark and listen to what he says about wages not keeping up with inflation.

If you want more detail about why people’s actual expenses don’t match inflation figures, the BLS has a helpful FAQ.

An example:

“If the BLS data collector is forced to replace a short-sleeve cotton/poly shirt in the CPI sample with a long sleeve 100% cotton shirt, the CPI would attribute 40 percent of their price difference to increased shirt value (15 percent for sleeve length and 25 percent for fiber). The CPI would treat the remaining 60 percent of the price difference as pure change.

If the price of the original shirt had been $20 and that of the replacement shirt $30, rather than using a $10 increase in price for that sample observation, the CPI would use a $6 increase, attributing the other $4 of the price difference to difference in the quality of the two shirts.”

OK, so you’re out $10 extra, but only $6 of that counts as inflation. But while it’s far too long to cut and paste, look at their example (6) regarding the TV’s. Going from a $250 CRT to a $1,250 Plasma TV is $1,000 extra out of your pocket, but after adjustment this counts as a -7.1% price change!!

And here’s another one hot of the press that backs up what I said about building for the high end: America’s luxury apartment boom is gentrification on steroids

1) During 1970ies stagflation, inflation levels were 10-15% PER YEAR, not 10% on aggregate over 5 years. In fact, a 10% inflation rate over 5 years gets down to 2% or less per year, which is the Fed’s target anyways. We’re not living in a time of high inflation, otherwise the 2016 price tag for the pack of milk would be a multiple of what it was in 2011. I acknowledge that measures of inflation are imperfect and that accounting for quality of goods and asset prices can generate somewhat different results, but nothing that is a complete opposite of what we’re seeing right now.

2) I agree with you on the point that wages are stagnant. Yes, the share of growth going to labor is much lower than it used to be and this is the main issue driving the rise of inequality in the US. But again, this fact does not mean that inflation is high, quite the opposite. Low wage growth leads to low growth in prices for services and goods and thereby to low price inflation. The rise college prices is driven by the fact that people are willing to pay a higher share of their income for it, as rewards for high educated workers have increased.

3) Yes, there is worldwide trend of affluent people moving back to city centers. This drives up prices for downtown rents everywhere. Now, what can you do about it? Demand 100% BMR apartments? In this case, you will see very little new construction in cities and much higher upwards pressure on rents everywhere. I believe SF has a reasonable approach with demanding 20-30% BMR flats, which assures new construction is happening while allocating a share of it to lower income people.

I’m happy to hear your proposal on how to get us back to 1990s levels of rents in city centers with today’s levels of jobs and crime rates.

A dirty bomb would be a sure fire way to lower prices. This provides a perfect example of why lower prices are not a good thing. The only reason prices go down is because whatever is for sale, is now less desirable.

Of course, the 35% is an arbitrary number plucked from thin air. People around here spend higher percentages of their income on housing. Shrug.

Yeah and that’s great for the local economy when all disposable income goes towards housing. I’m sure you’re going to tell me that it eventually “trickles down” into the economy from the landlords LOL.

I did not say it was great. In fact I think it is not good for the city. I was pointing out that the 35% number is arbitrary and observing that it is not accurate for San Francisco.

Buried lede: All time record high median price.

Median Home hits 1.3 million? Isn’t it obvious?

Your comments have increasingly developed a desperate “grasping at straws” feel over the past month.

perhaps “buried lede” doesn’t work. but in terms of the comments? it makes sense. 1.3M in april when these same posters were talking about price drop already having happened is probably soccermom’s point.

And the big driver of that “RECORD $1.3 Million Median Sale Price!” in April? A significant change in the mix. It’s amazing what happens to the median price when a larger share of newer and higher price point properties sell versus the month or year before.

sure, and mix happens not infrequently, and in both directions.

also, who used all caps plus a banger other than yourself?

“driven largely by a change in mix which is being amplified by the slowdown in sales.”

This is the most interesting finding in this article, but there is no further explanation. @Socketsite, could you please expand on this point? Does the slowdown in sales volume mostly apply to the bottom segment of the market?

Aren’t the top segment sellers ‘running to the exit’ as recently reported by some ‘plugged in’ readers?

[Editor’s Note: See below. And any guesses as to how an increase in activity at the top end of the market, while the overall market slows, might affect the overall mix?]

“was a record $1,300,000 . . . driven largely by a change in mix which is being amplified by the slowdown in sales.”

This is merely a hypothesis. It is a plausible one which very well may explain the numbers. But it is only a hypothesis and should be stated as such, and not stated as if it were an established fact. I need more evidence before I will accept it as fact.

That said, it would also just be a hypothesis – and not a fact – to state “prices are at record highs!!!” Because prices can fall while medians go up. But the real estate industry does stuff like that all the time. Two wrongs don’t make a right.

[Editor’s Note: See below.]

“This is merely a hypothesis.”

Not at all. Don’t confuse facts with predictions.

People can mis-state facts, but there’s still an objective reality there.

Sale prices which are used to calculate the median price are public record and you could look at sales vs price and see if the number of low end sales declined more sharply or if “sellers running for the exit” increased the number of high end sales.

I grant you that the editor could be mis-stating the facts, which seems unlikely to me, but is possible. But at the core this is not a matter of opinion.

But the editor made that leap.

We have one fact: “the median price rose to a record $1,300,000”

Then there is a hypothesis: “the record $1,300,000 is driven largely by a change in mix which is being amplified by the slowdown in sales.”

You are correct that one COULD test this hypothesis by doing a deep dive into the specific sales to see if the number of low end sales declined more sharply or if “sellers running for the exit” increased the number of high end sales. But I don’t see any evidence that has actually been done. Until that evidence has been presented, all we have is a hypothesis. An alternative hypothesis (which would also need to be tested with facts/evidence) is “housing prices have risen to record levels and mix has nothing to do with it.”

There is no difference of opinion here, just two competing hypotheses, neither of which (to my knowledge) has been tested.

I see where you’re coming from, but I consider a hypothesis something that requires further testing or results to confirm or deny.

Whereas here all the information, the record of sales and the prices at which they occurred, is already objectively available.

And the point here isn’t just to be pedantic. The point here is that since anyone can check up on facts, it’s a bit irrational to mis-state facts since you’ll probably get caught.

That’s why I thought it was unlikely that someone would make up a story about the pre-sale pipeline in order to bluff home sellers. Because that bluff would be easily caught.

Similarly, I doubt the editor would mis-state this fact about the data since there are a herd of bulls on this site that would just jump on the chance to call him out were the statement untrue.

The only hypothesis/opinion here is yours (that we made a leap of faith), and it’s wrong. Our statement, that mix is driving the jump in the median, was based on data and fact.

We typically analyze three things:

1. Share of unlisted sales (which are primarily new construction and high-end transactions)

2. Share of single family homes sales (which have higher average price points than condos)

3. Mix of neighborhoods in which the sales are occurring

And:

1. The share of unlisted sales has increased YOY

2. The share of single-family home sales has increased YOY

3. The share of sales in higher priced neighborhoods has increased YOY

Regardless, the 14 percent MOM jump alone shouldn’t have passed a basic smell test and raised a red flag (or two).

Then again, we have a bucket of properties purchased in March that we’d be willing to sell you for only 7 percent more than we paid. That’s right, 7 percent instant equity for you!

Ed., thanks for the additional info – you did not mention any of that in your post.

I said that the hypothesis was plausible; it just wasn’t supported by anything concrete. Now you’ve provided more.

Would you provide the details on (1) The share of unlisted sales has increased YOY, (2) The share of single-family home sales has increased YOY, and (3) The share of sales in higher priced neighborhoods has increased YOY? I trust you as this blog has proven to be solid on the facts and the analysis. So no big deal if you don’t care to share the specifics.

Bubble is popping. This is the tail end of the boom — sort of like an F-18 on full afterburner going straight up at Mach 2.0 … everyone knows it can’t last but it sure looks cool when it’s happening! Eventually the market, and the plane, stall out and return to earth.

It may not pop. It might flatten or decrease nominally, but its not going to be like 2008.

I take all my advice from House Flippers. They clearly know how to time the market and have never totally lost their shirts.

Yes! This time the bubble is definitely popping. Not like a year ago when the bubble was popping. Or two years ago. Or three years ago.

You repeat this over and over. But has any bubble in the past not burst because some people predicted it too early?

For a bubble to pop, there has to be a bubble. I challenge the assertion that this is a bubble. Startups are not the driver of our tech economy. It is driven by Apple, Google, Salesforce, Facebook, Oracle, etc.

And though some startups are dumb, others are not. I find Uber to be awful, but it’s not going away anytime soon. Nor is Airbnb, nor plenty of others.

Hoping for a (nonexistent) bubble to burst is not good policy. Instead, we should accept that these companies are here to stay. We are going to have many professionals making lots of money here for the long term. Are we going to ignore that fact or are we going to plan for it?

Nobody is saying tech is going away, just like houses never went away after the mortgage bubble burst, and the internet never went away after the dot com bubble burst, and banks never went away after the S&L crisis. The bubble is in the valuation; these investments will never return what people hoped they would, and everyone rushes for the exit at the same time when that a-ha moment finally arrives.

In fact I am planning for this by not flipping my most prime acquisitions over the past five years — instead renovating them into attractive upper middle class rentals that attract high quality tenants who pay all my mortgages and are essentially funding my long-term retirement.

The flips are now few and far between (I have not made a purchase or sale in over a year now). That’s how I know the market is topping out– I stopped finding value plays and stopped buying, instead moving on to greener pastures elsewhere.

What Sabbie said. And we’re talking many billions in valuation in these money losing tech companies. Twitter alone shed nearly $10B in market cap since you dared people to short it.

VRBO seems to be able to provide a similar product to AirBnB while being based in Austin. And that Chinese company that apple just invested in manages to make an Uber clone.

Ridesharing and homeshareing aren’t going away, but there’s no guarantee that AirBNB and Uber have to stick around at their current valuations.

Wait, when did I “dare” anyone to short twitter?

I think the editor called you out about it here.

You need to work on your definition of the word “dare”. I was an observing that it’s easy to talk about a bubble, but the question is whether you are backing up your talk with action. What about you? Are you shorting any stocks? I presume so, since you think we are in a bubble. Which ones?

Here’s your comment, context and direct quote:

“People have been saying that the tide is turning for a long time and they’ve been wrong for a long time. But talk is cheap. If you have balls, short Twitter and Square (post-IPO). Short Salesforce too, and maybe Apple and Facebook and Google. Good luck!”

At the time:

Twitter was trading at $30.89 per share, it’s currently $14.14 (-54%)

Square closed its first day of trading at $13.07, currently $9.53 (-27%)

Salesforce was trading at $78.22, currently $80.71 (+3%)

Down on the Peninsula:

Apple was trading at $115.28, currently $93.78 (-19%)

Facebook was trading at $103.77, currently $116.21 (+12%)

Google was trading at $712.78, currently $699.52 (-2%)

And the definition of dare.

Jimmy- yeah, but when our economy slows down (not necessarily a spectacular bubble crash, could be just a slow down coming), those higher end rentals are gonna get hammered. Example: a fancy new 2BR condo rental in the mission is $5-5.5k now. A workhorse 2BR is $4k. First one is going to drop much more percent wise than the latter. 5+ goes down to 4, and quickly. 4 goes down to maybe 3.7. Be careful!

Socketsite, my point is that talk is cheap. If someone honestly thought there was a tech bubble, they should short shares and profit.

If you’re not shorting shares, then you don’t really believe we’re in a bubble.

That’s not a dare, that’s an observation. Definitions aside, who is shifting shares? Anyone?

Got it. So when you wrote, “But talk is cheap. If you have balls, short Twitter and Square (post-IPO),” you weren’t “telling someone to do something especially as a way of showing courage,” you were simply observing.

As an aside, despite having dropped 54 percent since your observation, the short interest in Twitter has ticked up to an all-time high (as has the short interest in Square).

And now back to the topic at hand…

And the short interest in Apple? Facebook? Google? Salesforce?

Who among the sage commentators calling this a bubble have shorted? Anyone?

If you don’t think it’s possible in the next few years for 30k, 50k, 75k or even 100k tech jobs to disappear region-wide, you’re going to be in for a learning experience. And, by the way, this has nothing to do with APL, FB, Goog, Oracle, etc.

“but when our economy slows down (not necessarily a spectacular bubble crash, could be just a slow down coming), those higher end rentals are gonna get hammered. […] 5+ goes down to 4, and quickly.”

So you’re saying “when” not “if” the economy slows down and you’re predicting high end rents getting “hammered” quickly to the tune of over 20%? Can you predict exactly when high end rents will be hammered? Are you short high end rents?

The reality is that in addition to being long or short, the other option is merely to go elsewhere.

Just because no one can predict the outcome of a roulette wheel on a particular spin doesn’t mean that you can’t show that on average playing roulette will leave your poorer than when you started. And thus that the best course of action lies not in choosing between numbers on the wheel, but rather in not sitting down at the table.

Anon- but I am sitting at the table, because sitting at the table (and basically winning) sure beats working a 9-5. Plus I also “sit” in a somewhat privileged position (having invested in SF RE for a number of years and successfully built a tidy little assert base.) And yes, I’m sorta shorting high end rentals, as I own more moderate rentals, which I think will weather a potential downturn better.

So from my POV I’m vested in this market. It doesn’t really matter to me if the RE market goes up, down or sideways, as I’ll do just fine and adjust to the circumstances. And looking at the longer term trend (say in 10 year cycles) SF RE tends to goes up. No one can predict the timing and intensity of a correction. You can only hope you’re reasonably prepared for it, and hopefully can capitalize on the next turn around (if you so desire- I may check out and call it a day/year/century, I dunno 😉

From yesterday: “Hedge funds and large speculators raised short positions in the Nasdaq 100 Index e-mini futures for a third straight week, pushing net bearish bets to the highest level in five years, according to data from the Commodity Futures Trading Commission. PowerShares QQQ Trust, the biggest exchange-traded fund tracking the tech-heavy gauge, has seen $5.4 billion pulled this year for the biggest withdrawal among all equity ETFs.”

Talk is cheap. Which stocks are you shorting?

Anyone not an insider who plays the shorts in the era of the currently legal, share buyback-induced short-squeeze can easily and quickly be wiped out. The problem with shorts is that there is no limit to you losses. It’s a game for sociopaths, insiders, and the very rich (the sets of which are not necessarily mutually exclusive).

You’re deploying an idiotic tu quoque fallacy (among others), and you should know better.

I am long and short these stocks all the time. I only stay a few days to a few weeks in any position though. My last tech short was Netflix after earnings. Current tech short is semiconductors index. The “big short” that I am keeping my eye on when the bubble pops is Amazon.

Two beers, you can short safely using options, your loss is limited to what you pay up front.

Sabbie – My comment was directed at the top poster. Good luck playing the market, but I’m sure you know how risky shorting is for the amateur. There’s an internet “trading school” advertised on local radio that supposedly teaches how to short. The rubes will get slaughtered. I think you’re right about Amazon, whose miniscule if any profit margin is due to state sales tax arbitrage.

AWS is generating 67% of their operating income. And AWS is used mostly by other tech companies. So you’ve got that waterfall effect. Amazon is solid in the long run but look at their chart, it’s just crazy.

Well, with put options you can limit the total amount of the downside risk, but they are even riskier than shorts. First, they are expensive on volatile stocks, or stocks with big downside risks. Second, you have to get not only the direction, but the timing right. You buy a put option that expires in 90 days, but the stock crashes only on day 91, you lose it all even though you were 99% right about things.

Options are a sucker’s bet (except, maybe, for wealthy investors who sell – not buy – options). If you think the market will tank, just pull your money out of the market, wait for it to tank, and then get back in. If your planned bet is just fun money and you won’t miss it, then sure, go ahead and make the bigger bet with options or shorts, being aware that you will probably lose (but you won’t care, in this case). Or maybe buy a short ETF (still a sucker’s bet, but less so).

Oh, the Big Short! Of course! If that movie is your blueprint, I hope you spent 2 years meticulously researching the core industry drivers for the tech sector in a similar fashion as The Big Short’s Michael Burry did for the mortgage sector. Also, do you have a set date for the defaults/share price losses similar to the expiration of teaser rates on a large chunk of subprime mortgages in 2007? If not, suggest you stay away from shorting.

I trade 95% based on price action, not fundamentals. I don’t try to predict what will happen in the future, I just follow the chart. I only look at fundamentals because I find them interesting, and will add stuff to my watchlist that way, but you are 100% right in that I am not qualified for that kind of research.

The Real Estate Party and Bull Market is over for now…

Astrologically, regardless if you follow Vedic (Eastern), Geocentric (Western), Elliot Wave, WD Gann, Cycles, Technical, or Fundamental Analysis; the planets are positioned very critically right now and experience demonstrates that something very monumental, life altering will occur between now and June 5 2016, especially on May 22, 23, 24, 25, 26. All stargazers are on full alert.

Terrorism, Financial Collapse, Huge Natural Disasters are highlighted.

Politics will be run on threats and building anger around the world. People are self-centered and corrupt with little concern for their fellow man.

September 11 like Attacks (war), danger, treachery, mass transportation, planes, busses, or trains, etc. will be affected.

Rebellion, sudden unexpected events, disruptive changes in world leadership, secrets will be revealed (corruption like panama papers involving world leaders and powerful people).

On a positive note, spiritual and technological advancements including scientific and significant cures for illness will be initiated.

A high tide of stronger than usual solar activity: M and X-class flares, Coronal Mass Ejections (CMEs) and corresponding geomagnetic storms here on Earth (Kp 5 and higher). Watch for a general fritz of electrical and electronic systems, from individual components to whole networks – including the most marvelous network of all, the human nervous system. Dumping Gigawatts of extra solar energy into the atmosphere and magnetosphere of Planet Earth also stirs up a surety of storms and seismic activity (including volcanic eruptions and M5 and up earthquakes). This directly contributes to volatility in world financial markets…

You ARE joking — aren’t you?

I wish I was joking but I’m serious 😉

You don’t have long to wait…

Well I predict that this is really stupid and we’ll all be fine.

Let us see which prediction is correct!

It’s clear the SF real estate market is strong overall with a record high $1.3M median sale price.

The bears first said the $2M – $3M+ homes are weakening. Now they are saying more higher end homes were sold that’s why we have record high prices.

Come on guys, which is it? We’ve seen a MASSIVE rise since 2012. Just accept the fact the overall market is strong, and foreign buyers are still seeing SF as a value play internationally

It was clear in the summer of 2007 that the SF real estate market was strong overall. Until suddenly it wasn’t. That’s why people who are interested in where the market may go in the future look at other things besides price.

BTW, other places like Australia and Vancouver who actually care about their citizens and not just the wealthy few are taking steps to curb foreign buyers.

maybe you can get a politician to legislate low prices for you.

That would be nice, but that’s not how America works, it’s the exact opposite. The rich people get the politicians to legislate high prices for their assets.

Translation: massive market opportunity for large developers; the little guys, the fix and flippers, get crushed. Nice idea. I think I know where I’d stand on that.

SF already has that in spades: it’s called rent control

Vancouver is NOT meaningfully curbing foreign buyers. Foreign buyers and immigrants are the very heart of Vancouver’s economy — what would they have without the massive influx of (chronologically) Iranian, Hong Kong and now Chinese immigrants. They would have a sleepy Pacific coast logging and farming town with affordable real estate and a stable but uninspiring economy a lot more like Winnipeg than San Francisco, which btw is what it was when I was born, prior to the establishment of the Agricultural Land Reserve (which caused the first major boom in Vancouver real estate back in about 1975) and millions of foreign immigrants. The return to those days will never, ever happen. That is gone forever and you cannot and can never legislate it’s return.

They are taking steps- they are starting to track foreign buyers so that they at least have the data to make decisions in the future, and they have banned a certain kind flipping transaction that was commonly used by these buyers. In contrast, the NAR urges all Americans to extend a warm welcome our new foreign overlords, because ever increasing real estate prices are the key to our prosperity.

Yeah, one kind of flipping (contract assignment) has been curtailed but they will find another way. And in Vancouver’s case, the NAR’s message is absolutely dead-on. Ever increasing real estate prices ARE the key to their prosperity. There really is nothing else.

Big difference between immigrants moving to a place to become part of the local economy, and foreign oligarchs looking to hide their ill gotten gains from a rapidly depreciating foreign currency market.

If increasing real estate prices are the only key to prosperity, what does that mean for the 35% of Americans that do not own homes (lowest since 1993)? Let them eat cake? And for the 65% who are relying purely on the wealth effect from home equity, what happens if that equity suddenly plunges? Hint: 2009.

Well in the case of Vancouver there are a ton of immigrants moving in and taking part in the local economy … largely by taking advantage of generous social programs, claiming $0 in income and “poverty” to collect welfare while living in a $5M house and driving a Mercedes. Don’t laugh … that actually happened. Some of these people are truly psychopathic.

But the economy, such as it is, is in construction — local workers build these houses and condo towers, and then sell them to foreign buyers. It is a form of export … and the net result is that Nat Bosa can live on the waterfront in West Van.

But Vancouver is a very, very tiny little speck in the global economy. A mere dot of a fashionable safe haven, a repository for ill gotten Chinese wealth from corrupt officials and corporate chiefs with huge bad debts in China and huge houses in British Properties to match …

In the grand scheme of things, this means nothing.

San Francisco is a completely different economy — almost all the wealthiest companies on earth (Apple, Google, Facebook and Oracle) with cash reserves rivaling many entire nations, are headquartered or were started here. This is true wealth creation, and we are at ground zero. Regardless of the bumps along the road… there will always been a greater demand than supply in the city, there will NEVER be any net new housing constructed on the Peninsula (except high density low value products in Redwood City and by the train tracks — which everyone hates) — you literally cannot lose in the long term. It is just mathematically impossible to lose money in this market. Every downturn is a buying opportunity and then just ride the wave up to infinity.

So then let’s do what Australia did. Foreign buyers are welcome, but they can only buy new construction. That keeps the local economy chugging along, while keeping existing housing supply reasonable for local buyers.

Either or Both.

The Median price doesn’t take into account any appreciation or depreciation of the property.

A $2M sale raises the median regardless of if the property previously sold for $3M or $1M.

Then high prices can be both a sign of weakness and strength?

Similarly can low prices be a sign of strength?

If one were so inclined, one could attempt to adjust for the change in the mix, using the hedonics factors calculated by the city’s Office of Economic Analysis.

So if sellers are indeed, “rushing to the exist” then currently they are still pretty much being matched by buyers “rushing to the entrances” – and prepared to pay big money to do so, looking at that chart!

If you honestly want to understand how buyers and sellers are matching up, you should of course turn to our inventory report which would be flat when the two sides were even or lower when buyers were more plentiful than sellers. It’s currently running 50 percent higher, year-over-year.