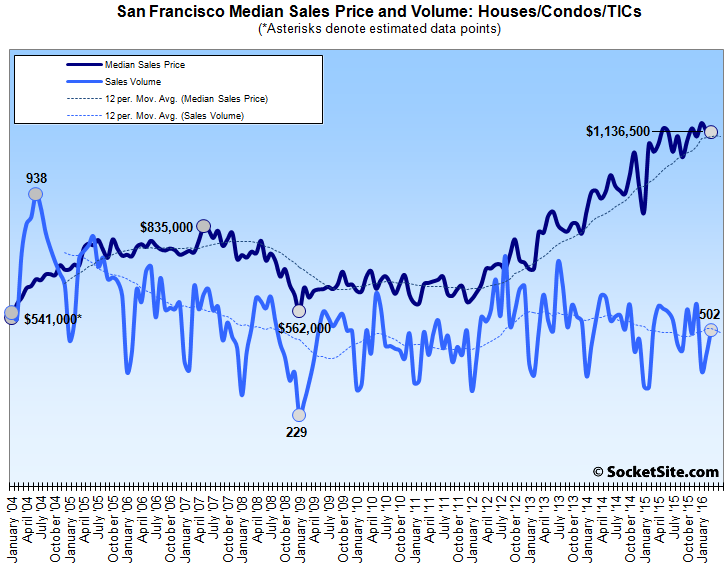

While the recorded sales volume of single-family homes and condos in San Francisco ticked up from 423 in February to 502 in March, the 18.7 percent gain was less than half the typical 40.9 percent seasonal increase for this time of the year and the sales volume slipped 2.1 percent on a year-over-year basis.

At the same time, the median sale price for the San Francisco homes that changed hands in March was $1,136,500, down a nominal 0.5 percent from the month before and 2.6 percent below the record $1,166,750 recorded in January. But the median sale price remained 5.7 percent higher versus the same time last year.

Across the entire Bay Area, recorded home sales jumped 39.2 percent from February to March with typical seasonality in play. But the sales volume was down 2.9 percent versus the same time last year and the median sale price was $643,200, up 5.5 percent from February but only 1.4 percent higher versus the same time last year, the smallest year-over-year gain in four years according to data compiled by Corelogic.

Based on 1,220 sales, which was 8.4 percent lower versus the same time last year, the median sale price in Alameda County was $630,200 in March, down 0.8 percent from February and a nominal 1.7 percent higher versus the same time last year.

In San Mateo, sales were down 12.7 percent on a year-over-year basis in March. And in in Santa Clara, sales were down 8.4 percent.

Keep in mind that while movements in the median sale price are a great measure of what’s selling, they’re not necessarily a great measure of appreciation or changes in value and are susceptible to changes in mix, as opposed to movements in the Case-Shiller Index.

So, Redfin says sales “plunged” 23% from March 2016 to March 2016. Paragon’s numbers show YOY sales down 11.8%. Corelogic’s numbers show sales “slipped” YOY by just 2.1%. And another source from a Coldwell Banker realtor that goes way back (namelink) states that YOY sales were up by 42% (SFRs) and 13% (condos).

Hard to reach any conclusions that are meaningful at all given that one can cherry-pick any data to support conclusions ranging from “the SF market is collapsing” to “the SF market is on fire.” Thus, take any such conclusions with a huge grain of salt.

That said, I appreciate the editors’ consistent use of sources (for the most part), which is about the best one could do. Also, one can just look at the top line in the chart in this post, and it would be a tough sell to claim the local market is presently in any sort of downturn.

CoreLogic reports recorded sales, which includes new construction sales which have closed escrow, and is by far the most meaningful data set with respect to activity/demand.

We might suggest taking a closer look at those moving averages above. And of course there’s the supply side of the equation and a pipeline to consider as well.

True, the corelogic sales reports are comprehensive on the sales side of the equations.

But, as you indicate, the problem is there are no correlating “supply” numbers – there is no listing of all available units that got sold and thus ended up in the corelogic numbers. Thus, you only get a small part of the picture. By contrast, MLS numbers provide both supply (listings) and demand (closings) numbers. But only for listed units. It’s good to look at all sources given the very (and intentionally) opaque market. No one source (including corelogic) gives you anything but a fraction of the overall picture.

There’s a reason we provide an accounting of new construction inventory (which constitutes the vast majority of unlisted supply in San Francisco) and consistently report an inventory level which factors in both listed “supply” and “demand” (rather than simply summing all new listings or crossing sources).

In the chart above, price made a lower high (failed to tag the trendline) and the moving average looks to be rolling over. That’s a meaningful slowdown. You’ll also notice that declining volume was a leading indicator in the last bust, peaking about four years before prices fell, which is exactly where we are now.

But the last bust was driven by a terrible economy. Not the case now, at least not in SF

The local economy is heading that way. Just type “unicorn bubble” into your magic Google machine and filter by news. The info is out there if you go beyond the mainstream media and Realtor cheerleaders. Here is one excellent article that just came out: On the Road to Recap.

Yes, you can definitely find articles on the internet. Personally, I prefer irrelevant statistics like, say, the S&P 500, or stock prices for Google and Apple. But hey, there have been articles out there predicting doom for like five years now. I’m sure it’s juuuuust around the corner.

But no longer San Francisco-based Twitter (which you were daring readers to short six months ago at $31 per share and is trading for $17.50 today)?

Great article

Thanks for that article Sabbie, that helped fill in my understanding of the phenomena

True, but one 12B company (Twitter) is not the same as two 500B+ companies (Apple, Google), which are the real drivers. Or Uber and Airbnb or Salesforce, etc.

Yes, AAPL’s 5% drop over the last week on weak iPhone sales predictions wipes out about 2 Twitter’s worth of market cap. And Intel’s 12,000 layoffs just announced could fill a herd of unicorn riders.

If Apple had a sustained drop, real estate prices would go down. Right now it is where it was 2 years ago. (In those same two years, Facebook has doubled in valuation and Google is up 50%)

“This glut of capital has led to (1) record high burn rates, likely 5-10x those of the 1999 time frame, (2) most companies operating far, far away from profitability…”

Great tidbit from the above article for those who still think this round of startups are financially more sold than those from the first dot com. And that was written by a VC.

Apple stock was up at $133 last summer, and now it’s at $106 after failing to retake its 200 day moving average. When a stock drops 20% it’s considered to be in a “bear market”.

I posted that last comment a little early, sorry. Microsoft and Google just missed earnings. So much for the big names in tech being the pillar of strength.

Well, while it’s true that GOOG’s Q1 profits came in below expectations, its revenues were up 17% YOY (to $20.35 billion) and it had 9000 new hires in the last year. Even the “bad” earnings number is up 14% YOY.

Hardly the stuff of which housing crashes are made. Or any crash.

And yes, Apple is down 20% since last summer. Google is up 50% and Facebook is up 25% since then. So conclude away!

Companies exist to make profit and return it to the shareholders. Profit is revenue minus expenses. Revenue is great, but if you’re burning cash to hire thousands of people with bloated salaries to work on dumb stuff like Google Glass or Apple Watch that ends up in the Salvation Army dustbin, then you are leaving shareholders disappointed.

And that’s the key. During bubbly time periods when start ups are burning through cash on profitless products, the FOMO can induce established companies to spend on vanity projects. But when the mood changes and there’s a renewed focus on profits, the chill can be felt in both startups and established companies.

And remember that a housing market correction doesn’t require every single tech company to go to hell in a handbasket. Most established tech company employees already have housing. During bubbly times of limited supply, it’s the most exuberant buyer or renter that gets the unit and sets the price. It’s their disappearance that can have a profound effect.

Apple keeps breaking its own record for the largest quarterly profits of any American public company in history. You know about that, right?

And, again, GOOG’s “disappointing” Q1 profits were up 14% over last year.

GOOG and APPL are not really strong support for the point you are trying to make.

tech is not the only driving force in SF. Again, tech jobs are only 7% of SF jobs.

other sectors are also doing well. I too think the housing market is overheated and should fall or remain flat for next 3 years, but the broader economy is doing well

and the general stock market is much more correlated as a leading indicator with housing, even on a local level

In relation to Realist’s dubious stock tips. If you make a call six months ago, what happened a year or two years ago is irrelevant. That was already old news when he made the call.

In relation to the housing market, you don’t need for every single tech company to go to hell in a hand basket to see ripples. The unbelievable success of the iPhone coincided with the pop of the housing bubble. Most established tech company employees already have housing.

It will be interesting to see how the market reacts to these negative surprises. When the investment mood supports losses in the name of growth this is reflected in both startup valuations and in those of established companies. When the mood changes startups can feel the pain, but established companies also have divisions that aren’t adding to P&L which can be sacrificed if the market demands profit.

And remember that only the most exuberant bidder for rentals or purchases sets the price. And so when volumes are low small numbers of people can have outsized effects.

SFRealist, if you think the state of the economy can be judged be the current level of the SPX (currently at 24x LTM earnings), well, uh, I have absolutely no words. Good luck with your portfolio.

Net profit margin for domestic corporations at lowest level since 2009. Inventory to sales ratio is highest since 2009. Fed labor market conditions index lowest since 2009. More companies downgraded to junk in Q1 2016 than all of 2015. More companies defaulted in Q1 2016 than any Q1 since 2009.

How did we get this amazing recovery, you ask? Debt!

The Fed balance sheet went up by over a trillion. The US added $9T in public debt. Companies borrowed almost $800B while their output only increased by about $150B; most of this was used to buy back their own stocks, and buybacks are now at 2007 peak levels.

But hey don’t worry, people say the economy is doing awesome.

sabble. do you have a reference for your statements?

“Fed labor market conditions index lowest since 2009.”

You’ve chosen much more strident language to characterize that index than what’s going on. 2009? what part of 2009? the part when it broke hard north and largely stayed around that point? I see some confirmation bias at work in your writing.

Of course I have a reference!

“Of course I have a reference!”

Well, that’s not worth anything obviously. I also challenge your inventory to sales ratio comment. I think it’s made up.

Inventories to Sales Ratio

@Ohlone – I’d guess he was looking at the change in the LMCI.

Something like this. Which as you can see shows great alignment between highly negative change values and recessions (the grey bars).

Now personally, I wouldn’t call the current -2 value definitive. It could be noise or it could be the beginning of a downtrend.

It’s also disingenuous to try and compare to the early part of 2009 when we were in a recession. If if was at that level now, we’d probably already be in a recession.

Oh, OK. I thought that one was in real estate terms. Fair enough.

Seriously though, you guys actually think the economy is doing great? The Markit manufacturing PMI just printed its lowest since September 2009. 47% of Americans just surveyed said they could not come up with $400 for an emergency expense, or would have to borrow it. The number of people over 18 living with their parents is up 2.5% since 2009 and climbing. The Google search for “living in a car” has doubled. Americans who own stock has fallen 10% since 2007. A 25bps Fed rate hike practically crashed the global economy, meanwhile inflation in the Bay Area is printing at 3%, so much for saving for retirement.

what about canned soup sales? are they skyrocketing?

As a sidenote, I said the economy in San Francisco was strong. What’s our unemployment rate again?

[Editor’s Note: San Francisco and East Bay Employment Slip.]

Sabbie- The economy is doing great — for the local landlords and related FIRE industry folks who frequent these pages. But as the original heroes of capitalism, Adam Smith and David Ricardo, both said, rent-seeking is a parasitical, non-productive activity that leeches off of and hinders the productive economy (rent-seeking would include all of the activities of the financialized FIRE economy — banking, property, and insurance — that drag down the ability of the economy at large to produce more and better goods and services for everybody). For people like Ohlone, because they’re still able to collect outrageous rent, they assume the economy is humming along — they neither know nor care that the nationwide “jobless recovery” is a contradiction in terms, and that most people are finding it ever more difficult to keep up, as the rent-seekers gobble up an ever-increasing slice of a decreasing pie.

The irony is that, because of the now-imploding localized VC pizza-delivery app bubble that bailed out local RE after the last crash, this bust is going to hit the Bay Area harder than the rest of the country.

It’s also good to remember that there’s a huge amount of space between “we’re in a perceptual bubble which keep inflating and never crash” and “we’ll all be standing in soup lines and SF will make Detroit look like paradise.”

A 30% hit to a $2M home takes it to $1.4M. Could be quite a shock to someone who stretched to get to $2M hoping for double digit appreciation, but yet a neighborhood of $1.4M homes is hardly likely to be a slum.

Socketsite, I’ll take 3.3%. Isn’t that near or below the theoretical lowest unemployment rate?

oh no. not fair. I’ve not said anything other than I feel as if people are being a bit hyperbolic. You do not know what I collect in rent. I am part of the local progressive solution there, actually. I merely object to the hyperbole, the leaping around from subject to subject, the calling 3.3% local employment and a nominal 300 less locally employed a “slip” several times over, now a hypothetical of a 30% market correction to a 2M house not being a slum, things like that. Why can’t you talk about these things with thoughtful, measured words? We didn’t even see a 30% slip in 2009.

And pizza ap economy too. That’s become a trope. I tend to agree. Some of these business models are asinine if you dig into them. The ones that are piggybacking on other platforms, the ones that have models like chefs preparing meals for you weekly or for events or whatever, and employ 30 people and have gotten VC money. I don’t see these things as anything other than boom time things that only those with discretionary income can afford. So therefore they are ephemeral. That said, the monetization of the internet continues, the popularity of the internet grows, and these things will continue as well, with power centers both local and nearby.

3.3% local unemployment, that was

The point is that you were being hyperbolic talking canned soup sales in respect to a potential slowdown. An my point was that even were we to see a historic drop in home prices we’d be in a very different space than parts of the country that are seriously hurting.

I was being sarcastic, yes. The fact is canned soup producers’ stocks do tend to spike during recessions. And anyway, you’ve been more measured so it wasn’t really at you, although there might be more than one anon in the thead I don’t know. The other poster or two are on about google living in a car and the quarter point fed hike nearly crashing the global economy, things like that.

i love a good debate but when conspiracy theorists show up here, its too much. PS. Bernie Sanders knows less than my Bordie Collie about how the economy works.

That’s why it’s important to point out that rather than being a conspiracy, a bubble just requires conformity and complacency. People get greedy and don’t look to closely at the details. Their peers, friends and neighbors see the “success” that brings and the FOMO kicks in.

It’s not a FIRE bad, biotech good, tech bad situation. In all those cases you could try to create a legitimate business or just try and duct tape something together long enough to sell to the greater fool.

“Diversity reduces adversity” as the saying goes. So if you want to package a bunch of mortgages from different parts of the country together to reduce risk, sounds like a great idea. It’s just when you get bitten by the growth at all costs bug and no longer care about running a sustainable business and just about selling your trash to some other sucker, that the problem. And when enough people do that, the bad money crowds out the good. If you have no concept of risk, you can undercut any competitor that has a solid risk model. If you’ll lend to whoever you can grow volume faster than someone who seeks out sold credit risks.

Bernie Sanders LOL. If you think his supporters, and Trump supporters, are radical… wait and see what happens after four more years of this establishment krony kapitalism nonsense. They will be coming for your stuff with pitchforks and torches.

Yes, you can definitely ignore data, facts, and experts for a long time. Until you can’t.

Not sure why you think increasing home prices are a positive thing. They only benefit Realtors and those looking to use their house an an ATM machine. For people who actually use their home as a place to live while trying to lead productive lives, stable and affordable home prices are preferable. It does not benefit the economy when people are spending 50% of their income on housing, nor does it benefit society when people in their prime are living at home with their parents.

I’m observing the prices. I do NOT think that high prices are good. It would be better if the city had built much more housing over the last several decades, which would have resulted in lower prices. But we didn’t, and I expect prices to plateau.

“But the last bust was driven by a terrible economy.”

Look up “tautology.”

Thanks for not seeing my point, which is that this is not a terrible economy.

“But the last bust was driven by a terrible economy.”

And this isn’t really true. The bursting dot com and housing bubbles may have subsequently caused economic problems, but the fundamental issue was the prior bubbly behavior.

It’s not as if rents dropped in SF which made investors go back in time and throw money at startups with no real plan for profitability back in dot com one. Nor did a recession in 2008 cause bankers to time travel and give huge home loans to people with no job, no income and no assets.

Now true, it’s hard to predict when a bubble will pop and as the analogy would imply sometime you need only a small economic pinprick to precipitate the collapse, but the whole issue with bubbles is that the underlying growth is fictitious.

I think it’s not so much that bubble growth is fictitious, but that it is a wasteful, short-sighted, and inefficiently-distributed allocation of resources. Bubbles result in increased concentration of wealth and consequential social imbalance, and they are unsustainable — and corrections are never “leveling offs” or “returns to normal,” but instead are severe recessions.

I’ve always seen March as a very key month – the volumes increase over the low winter months and it’s often a strong indicator it seems.

This one certainly looks less spectacular than the past 3 or 4, but still steady – medians are increasing still which may be partly due to the mix, as suggested, though I don’t really see the mix being that different from a year ago, on the whole.

Sales didn’t show much of an increase Month on Month compared to seasonality but last month was particularly strong, with sales up I think 33% YOY. Now the YOY comparison is pretty flat, so the MOM drop (vs the normal seasonality) was really due to a very strong Feb and not a weak March.

Increasing signs that we may be plateauing though, but not much beyond that.

[Editor’s Note: Keep in mind that this past February’s 33 percent YOY increase in sales volume was driven by a particularly weak February 2015 in which sales were down 30 percent YOY.]

a year ago it was RE Armageddon. rates were going to spike and jobs were going to leave.

i thought we’d have a choppy top but no real step back in values.

i feel like we’re closer and the end of the “hot season” will come sooner this year, but houses near school are becoming the new apartment buildings (room renting) and forced communal living is like the new SF working class culture.

we have water on 3 sides and we can’t just annex Daly City. high prices are the only control. as long as someone’s willing/able to pay.

i still say choppy top and not even a 10% correction when the poop hits.

Regional Predictions! I believe that we’ll have a 15 to 25% correction, beginning in 2 to 3 years, and it will be longer lasting, as regional job losses steadily balance job creation, which will slow over next 5 years. I predict there won’t be another spikey boom after this one has sputtered, since tech is spreading across the country.

However, the Bay Area will continue to be the leading metro for a while on the strength of Apple, Netflix, Google, Facebook, Salesforce, etc, – just not by miles as it is now. The wobbly consumer plays like Yelp, Pinterest, etc, will shrink in the city dramatically. The city has several other tech employers who I think won’t make it or will shrink. SV companies might continue to expand in the city.

I agree about the long-term future of the Bay Area as a tech center. It will remain dominant but less so over time as the industry continues to spread to other metro areas. Nothing lasts forever. SF was at one time a banking center but not so anymore.

There are a fair number of young hi-tech workers looking to transfer out of the area to less expensive tech hubs with an equal or better quality of life. Plus its hard to attract new employees to the area because of the cost of living. Hence Google getting into developing housing for its employees.