With proposals for over 3,000 units of housing having been submitted to the City in the fourth quarter of last year, San Francisco’s housing pipeline now totals a record 62,000 units, including 8,700 units which are already under construction and should be ready for occupancy within the next year or two.

In addition to the 8,700 net-new units of housing under construction in San Francisco, there are another 12,900 net-new units for which building permits have either been issued, approved or have been requested, which is double the number from the quarter before, and 23,100 units in projects that have been approved but not yet permitted (which does include 10,500 units by Candlestick, 7,800 units on Treasure Island and 5,680 units at Parkmerced, projects which have overall timelines measured in decades, not years).

And with proposals for another 17,900 units of housing being reviewed by the City’s Planning Department, San Francisco’s Housing Pipeline now totals 62,000, which is up from 59,000 in the third quarter of last year and 50,400 in the fourth quarter of 2014, of which 8,900 will be below market rate (BMR).

At the same time, demand for the current crop of new construction condos in San Francisco has slowed and at least one index suggests that prices have been dropping for the past five months and are approaching year-over-year declines in value.

do you have an estimate of how many may come online per year? particularly interested in expected number of units coming online in 2016 and 2017. i think there is a reasonable chance of a recession in 17 or 18, so we might expect some price drops in 17′-20′

As reported in our first paragraph above, “including 8,700 units which are already under construction and should be ready for occupancy within the next year or two” (2016-2017).

Yea, “next year or 2” in SF years is like 5 to 10 years, esp. if EIR is needed…its kinda like dog years math:-)

Don’t get too Sassy. If the project is permitted then all necessary EIR steps have been completed. The only possible remaining step is financing before construction start. Once permits are granted, shovels can turn. And once shovels turn it’s a year or two before project completion (depending on the complexity of the project).

Unless neighbors file suit and halt construction, as occurred at 1050 Valencia.

It’s worth pointing out that 62,000 is a large number. 8700 is a small number. It’s a start, don’t get me wrong, but it’s nowhere near what we need

Even if 8700 was all we got in the next 2 years, 4,350 units/year is record-breaking for recent history in SF. We probably need about 10k a year, but its a good incremental improvement over last year (3k), and a continuation of the recent acceleration trend.

I honestly think 4300-4400 might end up being the high watermark. A recession is likely over the next 2 years, and with the city forcing so much affordable housing, developers will back away at some point again.

I agree… that really is a crappy map.

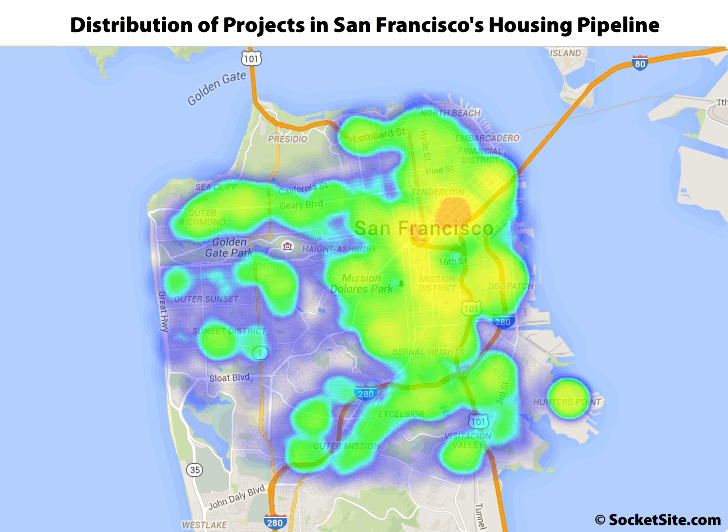

My recollection from a previous post on the pipeline is that your heat map reflects the number of projects. Is it possible to make one that reflects the number of units?

editor is pulling the graphic from the Planning Dept website, I believe. It’s one of the least useful “intensity” maps I’ve ever seen. It wouldn’t be that difficult for the Planning Dept to make one that actually provided real nformation and not just “OMG Housing EVERYWHERE!”

We generated the map using Planning’s data and limited toolset.

And while we agree that a map based on unit counts, versus the concentration of projects, would be more compelling, we don’t find the map above to be without merit. It tells a compelling story with respect to where developers are focused, which corridors are poised for change, and which areas are relative deserts in terms of development and growth.

The “green fog” tool seems, like fog, to be more about obscuring than clarifying anything.

Looks like someone spilled anti-freeze on the map.

The past couple years has seen completion of approximately 3,500 units per year, which is the highest rate since the mid-20th century. I would expect that 8,700 units now under construction to be completed over at least a couple years. So we might see more than 3,500 completed in the next year or two, but probably not drastically more, at least not averaged over the next 2-3 years.

Using on the 14% BMR derived from the numbers above, 502 of them will be BMR .

Does anyone know what percentage of the 62, 000 units in the pipeline are condos vs. apartments?

It’s not always clear during planning. The decision is often made closer to construction, depending on the availability of construction and/or permanent financing and the relative marketability of units.

I believe that most for market (not affordable housing projects) units are mapped as separate condo units. They may be intended as rentals, but once luxury rentals in SF take a haircut, I wouldn’t be surprised if at the next up cycle they are put up for sale. I know some HNW developers and institutional investors became fond of building and renting new units (at very high rents, like $4000-5500+ for 1 and 2BR), but once that party is over I’m sure they’ll be singing another tune (the sales tune.)

Worth noting that SPUR’s studies indicate that an annual new units number of 5000 would be enough to stabilize prices. I’m sure that’s available on their website. Still, 3500 per year is pretty bad, though not horrendous like 1500 units per year.

45,000 people have moved to SF since 2010, I saw somewhere. Sorry, no citation. Wonder how many will leave when tech jobs begin to drop. Not all, but a decent portion, I’d guess

There’s no hard basis behind SPUR’s oft-quoted “5,000” number.

And in terms of the demand stat that really counts: Employment in San Francisco Slips Again While East Bay Gains.

FrankC, SPUR only said their “best guess is that if we added 5,000 units a year for a sustained period of time, prices would stabilize.” They don’t provide any justification for that number, BTW. Just another WAG from a long time WAGer.

Given all the other economic factors that affect RE prices, it doesn’t make sense to expect a simple number like this to “stabilize” prices. SF has been getting richer than the country as a whole for ~30 years. As long as that continues there should be enough wealth to increase SF RE prices faster than the US in general or inflation.

FWIW, SF’s population increased about 47k from 2010 to 2014, according to the US Census Dept. Nearly 30% of that was ‘natural’ (births – deaths). 90% of the rest was from international migration.

Thx, yeah, I suspected as such, but that number still “feels” (yeah, I know) pretty good to me. Still, I like what SPUR does.

Also, ummm, “when” tech jobs begin to drop? Don’t hold your breath

You can exhale:

“Not long ago, employees at Practice Fusion Inc. reveled in the technology boom, munching daily on free healthy food, enjoying “Phenomenal Friday” gatherings and racing around the office on tricycles.

Today, the Silicon Valley extravaganza is waning. The San Francisco electronic medical-records company has booted its founding CEO, laid off a quarter of its staff and cut back on projects to save costs…”

[Editor’s Note: A related aside: The Ultimate Swinger’s Pad On South Park Sells For $5.7M.]

Ha, as if I dont’ work in tech and don’t follow this stuff closely. Yeah, we’re on a permanent rocketship ride that will never stop, or even pause……

Oh right, that’s why Mountain View’s population has been so cyclical.

It used to be that we were predicting a collapse; are we now calling it a hangover? I know it’s been eagerly predicted for the last five years as ‘right around the corner’.

Now if Salesforce + Apple + Google + Facebook all disappeared, granted, then we would have a population drop. They are the ones driving our real estate market, not the stupid pet-breeding apps.

wow, you know not so much re: the breadth of the tech industry in the Bay Area. . There are literally many tens of thousands of tech jobs that are not salesforce, apple,,google, and facebook. Far more than those companies, which of course are not likely to take big hits near-term. And the number of jobs in santa clara cty dwarfs SF proper.

As an angel investor, I can tell you that many young startups have capitulated and either 1. moved their companies to LA, Seattle, NYC, Austin, etc., 2. moved out of SF to the east bay or 3. are opening second offices where they can put the bulk of their sales teams, developers, etc.

in other words, we’ve hit the “it’s illogical to scale your company in SF” moment — even with the recent mini-correction. When the cost of housing breaks $3k per person it’s kind of the end of the line in my experience (for young startups), and the $60-100 per sq foot for office space is also the end of the line.

Right, but that’s because SF is so expensive! That’s not a sign of the weakness of our real estate market, that’s a sign of our strength.

Except that that wasn’t always the expectation.

If you’re soon to be worth billions, what’s a few extra $k per employee? And for the employee soon to be a stock option millionaire, why not spend a very high % of your income on rent? No need to save if you’ve got your options.

It seems these expectations are beginning to change.

It’s not that SF is so expensive (yeah it is, but we deal with it), it’s the fact that: 1) it’s ridiculously tolerant of homeless and they pretty much ruin everything; 2) it’s disgustingly dirty (a lot attributed to my point above, but not completely. There is a reprehensible culture here — regardless of income or race — that littering is FINE! It’s OK! Our high taxes mean someone cleans it up (not!) 3) petty (non-life-threatening) crime is high and no gives a flying F about it; and lastly, 4) tech people are a persecuted class.

Jesus, any real-world city would be bending over backwards to keep Tech and its money rolling in. Clean up the streets, provide an enjoyable place for people and business, and grow baby grow.

#sf fails

I’ll tell you this: when the really big one comes, and it will come, a city packed to the hilt with towers, squeezed into within its last millimeter with grubby apartments and people who ONLY came here to make a quick buck, and a city “family” that chooses, mostly to live elsewhere… no new infrastructure, no financial buffer because we blew it all on non-profit, INC and insane benefits… it — the quake that will happen — will make 1989 like a picnic in Malibu at David Geffen’s house.

Cutting through the clickbait, those production numbers are pathetic. A significant portion of that eye-popping housing unit pipeline is embedded in a small handful of large-scale redevelopment projects – Treasure Island, Bayview/Hunters Point, Park Merced – whose unit production timeline is over the course of a decade or more.

What matter in terms of analysis of whether SF is keeping up with demand is actual units built and delivered to market. With 8,700 units actually under construction for delivery in 2016 or 2017, that’s about 4,350 units delivered to market per year. As someone noted above, SF last few years delivered 3,500 units to market, which was a high-water market this cycle.

In comparison, Seattle delivered over 7,500 units to market, net of demolition, in 2014, in a city that is 75% of San Francisco’s size. (And even then, those production numbers are short of population growth for Seattle.) To match those production numbers, SF would need to be delivering 10,000 net new units per year to market. Which is a number, frankly that feels a lot closer to what is actually needed than the 5,000 units per year SWAG from SPUR.

SF is definitely improving in terms of housing unit production. But it still has a LOOOOOONG way to go. 30 years of under-building is going to require 30 years of over-building to catch up.

Queue length isn’t an indication of throughput.

“23,100 units in projects that have been approved but not yet permitted (which does include 10,500 units by Candlestick, 7,800 units on Treasure Island and 5,680 units at Parkmerced[…])”

Um, 10,500 + 7,800 + 5,680 is greater than 23,100…