Having slipped 0.1 percent in August, the S&P CoreLogic Case-Shiller Index for single-family home values within the San Francisco Metropolitan Area – which includes the East Bay, North Bay and Peninsula – inched up 0.5 percent in September while the index for Bay Area condos inched up 0.2 percent.

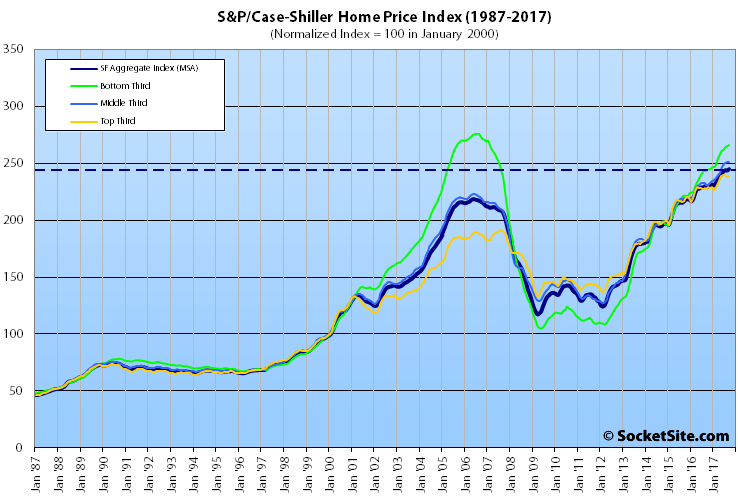

With September’s gain, the index for single-family home values is running 7.0 percent higher on a year-over-year basis, led by outsized gains at the lower end of the market.

And having gained 0.3 percent in September, the index for the bottom third of the market is running 9.2 percent higher versus the same time last year while the index for the middle third of the market is 8.9 percent higher on a year-over-year basis having slipped 0.1 percent and the index for the top third of the market is running 5.2 percent higher versus the same time last year having gained 0.6 percent in September.

That being said, while the index for the top third of the market is 25.0 percent above its previous peak ten years ago, and the middle third is 12.7 percent higher, the index for the bottom third of the market has another 3.7 percent to gain before it’s back to its 2006-era peak.

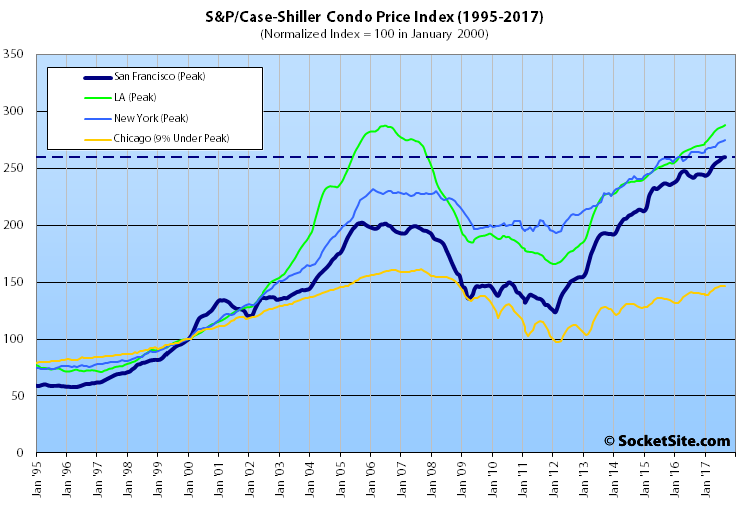

And having inched up 0.2 percent in September to an all-time high, the index for Bay Area condos is now running 6.4 percent higher versus the same time last year, versus 7.3 percent higher on a year-over-year basis in August, and 28.5 percent above its previous cycle peak in October 2005.

For context, across the 20 major cities tracked by the home price index, Seattle, Las Vegas and San Diego recorded the highest year-over-year gains in August, up 12.9 percent, 9.0 percent and 8.2 percent respectively versus a national average of 6.2 percent.

Our standard SocketSite S&P/Case-Shiller footnote: The S&P/Case-Shiller home price indices include San Francisco, San Mateo, Marin, Contra Costa and Alameda in the “San Francisco” index (i.e., greater MSA) and are imperfect in factoring out changes in property values due to improvements versus appreciation (although they try their best).

Ahhh it’s becoming clear the bottom tier is decoupling now and will overshoot/peak on the upside before tanking. Give it a year or so? Who knows when but the party is getting quite late now.

I checked my old place in concord, still under the previous sale peak sell price in 2006 but only by 10% according to redfin. So my local observation is roughly in line with this data on the low tier. Btw the place I had fell ~70% from the 2006 sale price as a foreclosure sale in 2009 before flippers bought it, fixed it and sold to it me…..extreme case but it’s helpful to read macro trends while experiencing them first hand as well.

Headline should accurately read: “New Bay Area Record Highs For Both Houses and Condos.” Again. I hope this finally puts the lie to the oft-repeated comments that the peak was hit in 2015 or 2016. The decline may come, but it has not happened yet.

You’re absolutely correct, the Bay Area market as a whole hasn’t peaked (not that we can recall anyone having actually suggested as much). Of course, if one is able to segment the market with a bit finer brush, it’s a bit more nuanced, to say the least.

Well, your “bit more nuanced” SF-specific link indicates a 10.2% year to year price increase in SF vs. 7% via case shiller. So I guess one can conclude SF is outperforming neighboring counties, if one could draw any conclusions at all from this.

The notion that SF price trends are materially different from those in neighboring counties is just silly. It is a very inter-connected market. Case shiller is a perfectly valid indicator of SF proper and the attempts to argue against that have all been pretty lame.

As always, while movements in the median sale price are a great measure of what’s selling, they’re not a great measure of actual appreciation or changes in value and are highly susceptible to changes in mix.

But if that’s the horse to which you’re tying your cart, keep in mind that the median price paid for a home in San Francisco proper was $1.13 million in September, down 7.7 percent from the month before, down 9.3 percent since June, and 13.1 percent below the record $1.3 million median price recorded in April of 2016.

Wait, then, SS are you suggesting the market has peaked? It sounds as if that is your position.

I’m not tying my horse to anything. That was your link. I’m saying that Case Shiller has proven, over many years, to be a very reliable indicator of SF market trends. It shows steady increases in SF, with no downturn at all (yet).

You are the one trying to argue that SF has performed worse than SF Case Shiller. And you pointed to SF medians. Now, when I point out that your SF median link indicates SF prices have risen even higher than SF Case Shiller in the past year, you respond (to your own link) that medians are not reliable. It’s becoming comical. Look at Case Shiller – SF housing continues to steadily appreciate. Look at medians – SF housing continues to steadily appreciate. You’re left with “it’s all wrong just because I say so and trust us, not your own eyes” and a small number of down anecdotes while ignoring the up anecdotes. Not too compelling. You remind me of the realtors in 2008 arguing that SF was totally different from the Case Shiller numbers, just because. I’ll stick with a proven indicator, Case Shiller, unless provided with some pretty decent evidence to the contrary.

‘You are the one trying to argue that SF has performed worse than SF Case Shiller.’

You seemed pretty willing to hop on the train of SF performing worse than Case Shiller when it made recent appreciation look strong.

i.e. The ‘CS may have gone up 5% for two years, but sf was flat for a year and then resumed its double digit rise’ argument.

601 4th street #310 hasn’t sold 18 days after its last price reduction, and 1101 Green Street #303 hasn’t sold two months after its last price reduction, both listed for around 10% under what their owners paid in 2014 and 2015, respectively. Seems like the decline is happening for them.

[Editor’s Note: And of course, there’s our Thanksgiving Food for Thought home in the Mission along with a growing list of others.]

I love the new write up. It highlights correctly the year over year changes rather than the insignificant month over month noise.

I don’t believe the development at the bottom of the market is any indication for a bubble pre se and here is why: the bottom of the market consists mostly of East Bay (Oakland) houses. The index starts in the late 80ies, which represents the most difficult period in Oakland’s history. Today, Oakland and other East Bay towns have become desirable places to live (with less crime, more jobs and more amenities), so you should expect to see a higher RELATIVE appreciation there than in the middle and top segments.

On the Case-Shiller website I found these ranges:

– Bottom third: < $668,425

– Middle third: $668,425 – $1,083,101

– Top third: Over $1,083,101

Are those still the correct ranges? That would mean that most of the transactions in SF proper would be in the "Top" range.

Those are the correct ranges coupled with a misunderstanding of what they actually represent.

The ranges aren’t based on the current market values of the home’s being measured, but the original purchase price of said properties prior to their most recent sale.

In other words, a home which was purchased for $1 million in 2007 and resold for $1.15 million today would actually be part of the middle tier, not the top.

Keep in mind that the median sale price for single-family homes in San Francisco didn’t cross the million dollar mark until 2014.

For all those highly anticipating a quick decline. Lets note that housing prices bottomed at winter 2011 and the global financial crisis happened 2007/8. Thats a 3ish year lag. If we have a recession soon, which we should as we are due, in all likelihood housing prices won’t hit bottom for a while. Also, depending on interest rates at the time of the recession, the fed may have very few tools at their disposal in order to fight it. Get your popcorn…