Having hit the market priced at $12 million in early 2015, the asking price for Gurbaksh “G” Chahal’s 3,355-square-foot penthouse atop the Infinity was subsequently reduced down to $7.995 million before being withdrawn from the MLS in mid-2016.

Subsequently whitewashed, with the master bedroom having been repainted in muted colors and stripped of G’s monogrammed bed, the pendant lights in the living room (which plugged-in readers frequently called out) finally replaced and the signature “G” spot rug removed, the penthouse returned to the market at the end of last year priced at $12 million anew.

Reduced to $10.6 million this past May, to $9.5 million in August and then to $8.999 million last month (at which point the unit was relisted with an official “1” day on the market and no official reductions according to all industry and agent stats), the list price for 301 Main Street #37B has just been “improved” to $7.999 million anew.

And once again, the penthouse was purchased by Chahal for $6.925 million in early 2008, after which another million was invested in upgrading the condo, including a reported $250,000 for the marble flooring alone.

This is an outlier. There surely has been significant appreciation since 2008 and it is likely this will sell anew at above the new asking price.

Two factors to consider – the purchaser paid more than market value at the time of the original purchase and both The Infinity and Lumina complexes are the fulcrum for what seems to be less than average price appreciation, Neither complex is luxury and the neighborhood is a wasteland on weekends.

Any word on the fate of the Chahal-branded humidor?

Or the oxymoronic penthouse wine “cellar” ?

Remove desk; install wet bar.

Such a weird unit. A unit at this price should not contain kitchen appliances that appear to belong in a Phoenix suburb. And why is the “office,” which is really just a nook, directly attached to the living room? That is the worst possible place to be if you are trying to work and someone else is there–it evokes a hotel lobby PC where you can print out your boarding pass. There is a ton of potential here but I can see why people have not been moved by it at a high price point.

Agree. I don’t know much about luxury style, but this place feels a bit cheap to me. The slab-like walls, intrusive pillars, even the closet & kitchen seem Ikea-ish.

$1 Million Dollar Price Improvement!

We are holding a special Open House on Dec 7th from 6-9 PM.

Stop by and have some eggnog and a professional photo taken with the Bay Bridge Lights in the Background!

Please RSVP.

Happy Holidays!

Shouldn’t the seller market to international buyers for this unit i.e. work with the real estate crew at Million Dollar Listing NYC? Everything is easily searchable online nowadays so the death by a thousand price cuts doesn’t work in seller’s favor.

Post when it closes escrow.

Yes, a shame to work with a small local company with no offices outside of SF.

That is a nice closet…to have been beaten up in!

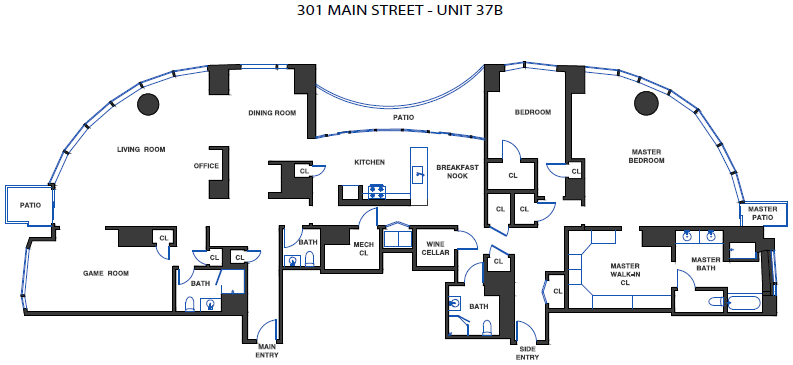

Which closet? I count 12 of them, 13 if you include the wine cellar.

Am I alone in not wanting to sit out on a balcony 500 feet up in the air? Also, some very awkward pillars, and a “view” of another building from one room. No sale at this price.

The pillar issue I agree with. I assume it is a cheaper method of construction as opposed to a “central core” method which does not require external “pillar” supports. As to the view, at least it has views from some rooms. Many of these towers further in from the Bay are surrounded by other towers blocking their view from every room. The Claw tower’s paired condo/hotel tower will have it’s views towards the Bay pretty much blocked by the Claw as well as its views in “less desirable” directions blocked at least at the first 40 or so floors.

Even a “center core” will require outside pillars, unless it has either very short floors or a very massive cantilevering (perhaps you’re confusing “outside” with “interim”); that’s not to say, of course, that this is the optimal solution … let alone the only one

This unit has been on and off the market with multiple different brokers for the past 5 years or so and has slowly be “G”noculated – his trade mark “G” cigar humidifier deleted. When will G stop hiring jaded brokers who promise him an unrealistic price and stop the bleeding. His carrying costs over the past 5 years must be close to 500k.

I don’t think anyone could care less about this monster’s carrying costs. He is a disgrace.

nothwithstanding prices have declined 10-15% from last year and he now competes with the penthouse in Lumina and Rincon Hill

It’s an odd layout. I find 12 random closets (other than master closer), odd “nooks”, what looks like a destroyed bedroom turned into a game room and disconnected from its bathroom. It’s like they took a home with 2+1 bedrooms turned it into a bachelor pad, which is fine, but it reduces the market for this home.

The marble floors also dramatically reduce the market for this home, or buyers need to figure in the cost and hassle of ripping that out and replacing it with something less cold. Most people don’t want a bathroom floor throughout their house. I get that in India, marble floors are often considered a luxury and make sense in a very hot environment, but that’s not a preference shared by anyone outside India, and as we are in San Francisco, there is a price to pay for customizing a house to the Indian bachelor market.

If the agent were to undo all of G’s customizations, they could get a better price.

Well for 250k spent on flooring, I assume they are heated marble floors. Marble flooring is popular in many countries, but I guess that’s not the point you were trying to make.

Verdict is in. Almost everything about this unit is “builders grade” except for the view.

So it didn’t sell at 7.995 last year and now it’s been reduced to 7.995. If you’re going to park $8M in real estate, Seattle is a much better investment right now. The building is nice, but the common areas are nice for the $1-2M price point, not $8M.

I disagree about the decor. At this price point, everyone brings their decorator and plans to tear everything out anyway. The floor is fine. You just get rid of the over the top stuff, and he’s done that.

The tax laws may be changing and that may start to empty out the rich from high tax states. The demand for these things is falling and will only continue to fall and the supply has gone up since 2008. I think Paul has his work cut out for him, but Paul is an excellent salesperson. If there’s one person who can get $8M for this place, it’s Paul. It’s yet another data point that things are heading DOWN.

The rest of these comments just seem to be excuses for the loss on the 2008 price. In 2008, prices were already falling, so no one over paid. The game room has been decorated as a bedroom and is still directly connected to the bathroom, so that just seems a ridiculous excuse. The fact is that Seattle is a better investment market right now and the effect of any tax law changes will only be negative, and that’s what’s hurting this place. But it is what it is.

Seattle is indeed a far, far better value market. And investment market. Not just Seattle though, “luxury” condos in many other markets such as LA are truly luxury. Changes in the tax law will impact RE in high tax states such as California more than in low/tax free states. If the tax bill eliminates mortgage and state income tax deductibility Seattle will get another boost relative to SF and the Bay Area if the tax changes are enacted. It will be the “gold rush city” of the West for the coming decade. Not just Seattle. other parts of Washington. Vancouver is seeing the start of a RE boom too.

“Vancouver is seeing the start of a RE boom too.”

You may want to read up on what has happened in Vancouver the last 30 years.

Actually I’m quite familiar with Vancouver and own several rental properties there and in Washougal just to the east. Vancouver’s recent home appreciation has been 7.9%. Not as great as its more famous neighbor, but quite solid. Clark County will grow by 25% by 2030. Vancouver is the county seat thereof. It is the 3rd fastest growing county in the state and most recently grew at a rate of 2.3%.

The thing that make’s Vancouver an even better RE investment than it already is will be the tax bill as proposed. There is no state income tax, home prices are about 20% less than it’s cross river neighbor and 75% less than SF – making mortgages much smaller and far less impacted by restrictions on mortgage interest deductibility. Californians and others are flocking to Vancouver – about 70% of the growth is from new arrivals from out of the area. Retirees are flooding in to escape high taxes and there is a very appealing banana belt just to the east of Vancouver. The tax bill would accelerate this large in-migration. Plus there would be an increased local relocation from the other side of the river.

So yeah, I see a growing boom there.

i wonder if SFRealist and Dave are referring to same “vancouver”.

My fault, you are correct. I was the one who did not realize that real estate trends in Vancouver, WA (pop. 170,000) are relevant to real estate trends in San Francisco. My mistake!

Wow, people plan on ripping up floors as a matter of course now? I didn’t realize that.

In terms of the game room, perhaps I misread the floor plans. It looks like there is no door to that game room on the left and the right, just open space to walk through. Just having a floating wall — a bit like bookcases set up back when I was in college to provide some privacy — does not make a real bedroom for me. I would want doors so that you can only enter the bathroom via the bedroom and it’s clear that this is not a common bathroom but a bathroom only for the bedroom. But maybe that’s been done and the floor plans are out of date. Anyways, that was just my impression of the floor plan.

Putting in doors and a wall to the bath (and another closet!) would be less than $5,000. No one walks away from an $8M condo because of such trivial items. That’s like saying a $1M condo isn’t selling because the kitchen drawer pulls are outdated. No one looks at that floorplan and doesn’t just mentally add the doors and wall if they want them.

Well I hope the property sells at a high price because it would be good for the market and the good for the building too, however I think we are avoiding the elephant in the room and that is that this condo is stigmatised and it will unfortunately affect the price.

When one buys a 6-8 million dollar condo they usually hang out with people that will know the history here and when u say you bought this particular condo they will say…”oh really ?!?” and word will be passed around. IMHO it would be better to be arrested in the condo with a few kilos of powder than to be arrested in this condo with the current past felony history, SF residents/ buyers dont want to be apart of a history like that when paying big bucks. They will forgive the past history of illegal substances but dont on abuse, and maybe that’s rightfully so. The felony acts cost the current owner a mill if not more on the resale of the condo, they wont get even the price paid in 2008 because of the stigmatization. $2000-2200/per foot imho.

Its a great unit and great views but wont get 7 or 8 mill because of the history here. Also i would increase the selling office to 3% because of these issues; once again imho.

It’s a great unit, but savvy real estate investors don’t care if Elvis slept here or not. In my experience they make decisions based on facts and future hypothesis, not little angels or devils whispering in their ears.

For the most part I agree. But if G invested $7.925 million in 2008 and none of the “savvy real estate investors” have been willing to pay $12 million, $10.6 million, $9.5 million, $9 million or even $8 million for the unit last year, I’m not sure the facts and future hypotheses for San Francisco match the story you’re trying to sell.

Savvy? What’s not savvy is listing a property for $12MM and then chasing the market down to $7.9MM.

If you don’t ask the answer is no.

True. And no skin off the agent’s nose. But what were the client’s holding costs over the past year? $500K? A million over the past two?

No one cares about his holding costs. IMO, the entire price of this condo should go to the woman who he beat so badly in that condo she was unrecognizable.

Am I too understand that you’ve never had a boss before?

@Paul Hwang, you’re this monster’s realtor, I know you’re just after your commission but I wouldn’t work for this [person] if my life depended on it. He should reap no reward for selling this condo. He cannot be disgraced enough for his actions.

“G” spot rug… I see what you did there, SocketSite 😉

UPDATE: The asking price for 301 Main Street #37B has just been dropped another $211,000 to $7.788 million and the unit has been listed anew with an official “1” day on the market, and no official reductions, according to all industry stats and reports.