Purchased as new for $952,000 or roughly $1,213 per square foot back in November 2015, the 785-square-foot, one-bedroom condo #403 at 72 Townsend Street returned to the market this past March priced at $998,000.

While the re-sale of 72 Townsend Street #403 has now closed escrow with a contract price of $940,000, or 1.3 percent below the price which was paid for the unit in the fourth quarter of 2015, the sale was officially “over asking!” according to all industry stats as the list price was dropped to “$899,000” a few days before the listing’s status was changed to “pending” on the MLS.

But if you’re kicking yourself for having missed yet another anomalous and cherry-picked outcome (as some will certainly continue to rationalize), please don’t. Instead, turn your attention to 72 Townsend #502.

Purchased for $1,675,000 in November 2015, the 1,294-square-foot, two-bedroom #502, which boasts a gourmet kitchen and both Bay Bridge and water views from its balcony off the living room, returned to the market priced at $1,746,900 this past May, a sale at which would represent total appreciation of 4.3 percent since the end of 2015 or roughly 2.9 percent per year on an apples-to-apples basis.

But having been reduced to $1,695,000 last month and then to $1,625,000 two weeks ago, the list price for 72 Townsend #502 is now down to $1,585,000 or roughly 5.4 percent below the price which the two-bedroom fetched back in 2015.

I had high hopes for this building. Love the exterior and setback from the old facade, but the units, overpriced to begin with, are slightly upgraded KB Tract Home quality.

Reality is that most of these newer condos in SOMA are anything but luxury. Despite the use of that appellation. I’ve been in One Rincon and the units are tiny. Great view, but view alone does not make for a luxury unit. Just visited friends in Portland and they have a truly luxury unit. 1600 square feet. 3/2. Views of the river, mountains, downtown and a private park like space at the base of the tower.

Maybe 181 Fremont will have truly luxury units, but it seems that is a rarity in SF – despite the price paid.

181 Fremont charges luxury pricing for luxury units. That’s why they’re basically starting at 2.5m+.

The 1-1.5m range in SF is not luxury status, it’s Honda Civic status.

I think the non-luxury goes north of 1.5 in SF. One Rincon has units above 1.5 million and that building is, maybe not Honda Civic status, but surely not luxury. My friends paid 850K a few years back for the Portland condo and a similar unit in the building recently sold for 960K – pricey yes, but about the same as this smaller 72 Townsend unit is asking.

Like I said, Luxury is 2.5m+.

I’m sure everyone on this board can go live like a King in Portland if they want too, but nobody here really cares about Portland.

@that_dude

2.5M in Noe Valley doesn’t get you very far these days, so you might want to adjust your figure a bit.

As for Portland…it’s a great city and considering that there’s a influx of CA residents looking for affordability shoots down your claim that no one really cares about the town.

“Luxury” (IMHO) includes things like a separate dining space, crown molding and nice baseboards, ubandant storage that isn’t just a hall closet, *really* nice bathroom outfitting, can lights, tray ceilings… etc. Little to nothing being built today is any more luxury than a tract home in Danville.

I haven’t seen anything built in SoMa that had finishes anywhere near as nice as the homes I’ve seen in Danville.

But than again, Danville.

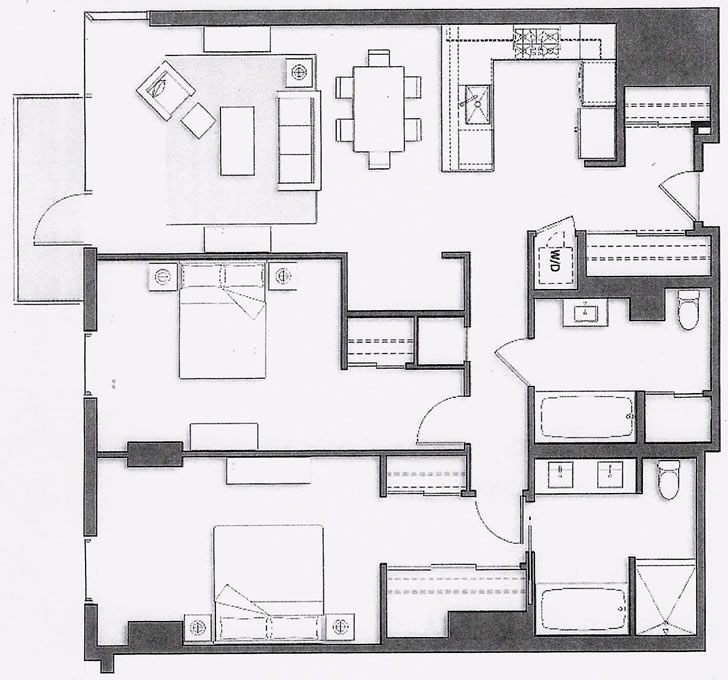

This floor plan is ridiculous but absolutely typical of what “the market” apparently wants. Why two full bathrooms right next to each other? Why two sinks in the master and why two tubs and a shower in one unit. The romance of the bathroom uses a huge chunk of available space. On top of that, the bedrooms are oversized compared to the Living Room kitchen. The end result is that the rooms in which one sleeps or sh#ts are oversized to the rooms in which one actually lives. So boring and predictable, unfortunately.

Why two sinks in the master, really?

I agree with your proposed better allocation of space from private to common areas. All I can figure is that buyers are generally less rational and place higher weight on “two sinks” than really understanding how they would use the unit. Having both a tub and shower in the master bath is also silly since 90% of residents will use one or the other but not both. While it is important (for kids) to have at least one tub in a unit this size, two is overkill.

This floorplan is the result of completing a checklist, not designing for the best livability.

“not designing for the best livability.”

Are builders fools who misunderstand how their target market will live in their condos? Or are so many boom time condos built with poor livability simply because the primary concern of the buyers is not the time spent in the unit, but rather the price they will be able to unload the unit to someone else for in a few years time.

Who wants to pay $1.5M to have bums defecating on your doorstep for three years? Vs who will put up defecating derelicts and a $1.5M price tag in order to cash out $2.5M a few years later?

“Are builders fools who misunderstand how their target market will live in their condos?”

Not sure, but it is reasonable that a builder would construct what they think will sell (a checklist floorplan like this) instead of something that is more livable. Because after all most developers are motivated to maximize profit, not livability.

My question was rhetorical with the implication that builders are not fools, but as you say are building what they think will sell. Which begs the question as to why buyers in the midst of a boom lose interest in livability? If a city got richer and you saw Michelin starred restaurants close and be replaced by cheap fast food, it would make you wonder wouldn’t it? But you don’t see that happen with food do you? In a boom we get more organic, local, high end omakase and the like.

A food purchase is purely consumption and as people get richer (or at least perceive that they’re getting richer) they trend towards higher quality consumption.

But a housing purchase is both consumption and investment. And during a boom, the investment aspect dominates the consumption aspect.

You don’t care about livability, if you don’t plan on living there very long. The main draw is not the living aspect, but the prospect of selling it to someone else for a profit.

Who wants to pay $1.5M to have bums defecating on your doorstep for three years?

Probably those who think that for $870 per month in HOA dues (for #502, entirely reasonable for this kind of building and this price point), the doorstep will be power washed free of feces fairly regularly.

The anomaly of #403 is that the owner was illegally using as an AirBnb rental, was cited by the City and the HOA, then the for sale sign went up. The owner of #502 is aggressively pricing, especially when there are a few developer owned units in the building – hard to be competitive when you have brand new/unlived in spaces to choose from. And this is still a nice, well maintained building…it is an amazingly quiet place, in spite of being near AT&T park.

But many condo’s have absentee owners and are either unlived in or casually rented short term. I often hear people complaining about foreign owners contributing to the bubble. When, first off many times people simply assume that absentee owners are foreign (or even more specifically Chinese) without any justification. Secondly, in many cases absentee owners are the effect of the bubble/momentum chasing mentality.

If you are buying a condo to let sit unlived in or to occasionally rent out, then you clearly aren’t driving by how desirable you find the location nor how good the job market is. At recent prices it would be difficult for the AirBnb income to justify the investment and still stay under the radar of the city or neighbors. But if the primary buying motivation is the expectation of future price increases then absentee ownership makes complete sense. As long as the expectations of future price increases still linger in the air.

These things were over priced to begin with – can’t blame them for shooting for stars.

There is a consistent pattern with these properties: 1) buy a new unit; 2) sell it very quickly, but not so quickly that it is still perceived as “new”; 3) see a decline from the original selling price. I don’t dispute that there is a softening in the condo market, but believe that part of what we are seeing with these units is the loss of the “new” quality, which propped up the original value. I’m sure there are exceptions to this but the pattern is hard to deny.

Counter to what some might suggest or hypothesize, condos typically don’t depreciate, even with the loss of the “new” moniker, unless the unit was trashed by the previous owner/occupant or the market hasn’t moved up since the unit was purchased and there are comparable new units still available for the same price or the market has actually been trending down.

If you buy a brand new condo and then turn around and sell it less then two years later, I have a very hard time believing that the loss of the “newness” has no impact on your selling price. Granted, in a solidly rising market the impact of that depreciation is less significant in the overall scheme of things and will not be noticed because it is erased by the overall market increase. But all else equal, I think a new condo will sell for more than an identical condo that someone else has occupied for ~2 years.

I will also note that the majority of the “price drop” posts here seem to follow this pattern–brand new condo, quick resale. There is probably a reason. This doesn’t mean the condo market is strong.

Well, rather than suggest or hypothesize, why not give us some data points? Show us some examples of condos being purchased new, held for two years or less, and then sold for a profit.

Well, there’s this one in 2013. Or this one in 2014. Or even these two along with a 2015-era read of the market and hint of what was to come. Of course, those were all “cherry picked” and obviously don’t count. And for some strange reason, more recent examples are harder to find.

These examples are completely consistent with my point. I’m not arguing that the condo market has not softened. I’m only arguing that the overall market has not softened as much as these examples suggest, because comparing a “new” condo sales price against a “two year old” condo sales price is not apples-to-apples.

In 2013, the appreciation in the overall market was substantial enough to swamp the effect of the change in condition from “new” to “used.” But now it isn’t. That does not mean that the change in price is not impacted in part by this change in condition.

The examples that would be more compelling are condos that were sold in “used” condition in 2015 and then resold again more recently. Did they fall as much as units like these? I have not studied this data but suspect the answer is “no.”

First off, isn’t the Mark company index for new condo pricing also down? People complain, with some justification, that this is of necessity a synthetic index since you can’t do a repeat sale (apples to apples) index of new condos. Because as you point out, a condo is only new once. But I also doubt that the Mark company chose to pick on SF at this particular time without any basis in fact. And if you dismiss new condo pricing because of the methodology and dismiss resale condo pricing because they aren’t new anymore, what do you have left?

Secondly, isn’t any resold property older than it was before? Is the drop from new to three years old significantly more than from three to six or six to nine or…

Your first point is interesting but rebutting a point I’m not making. I’m not arguing that the condo market is strong, only that these examples likely overstate the degree of the softness by failing to account for the difference between brand new and older units.

Your second point doesn’t change my view. I think it is widely understood that depreciation is most rapid in the early years for just about everything and while I have not looked at data I expect the same applies to condos.

Yes, being lived in often results in some physical depreciation for condition. But, you are forgetting that developers are typically selling the units at a discount, because they have tens up to hundreds of units to move all at the same time (the pesky supply part of “supply and demand”). In a hot market it is not unusual for condo buyers to purchase straight from the developer and flip quickly for a profit.

I’d put luxury in sf at over $3.5M. Lots of average stuff under that price

US median household income is about $56k/year. So $3.5M is about 62x the US median household income and that’s for non-luxury properties by your standard.

Consider that when people float the false dichotomy between current prices and a straw-maned worse case scenario. There’s plenty of room for a large correction while still having the bay area reflect a price premium for its desirability and more skilled job base.

UPDATE: The list price for 72 Townsend #502 has now dropped to $1,549,000 (which is roughly 7.5 percent below the price which the two-bedroom fetched in the fourth quarter of 2015).

UPDATE: The list price for 72 Townsend #502 has just dropped to $1,495,000 which is roughly 10.3 percent below the price which the two-bedroom fetched in the fourth quarter of 2015.

But remember, there’s nothing to see here and these are all just “cherry picked anomalies” rather than indicators of a more significant trend…

UPDATE: 72 Townsend #502 has just been listed anew with “one day on the market” and an “original” list price of $1,595,000 according to all industry stats and future reports.

UPDATE: Another, Bigger, Sub-2015 Sale in South Beach