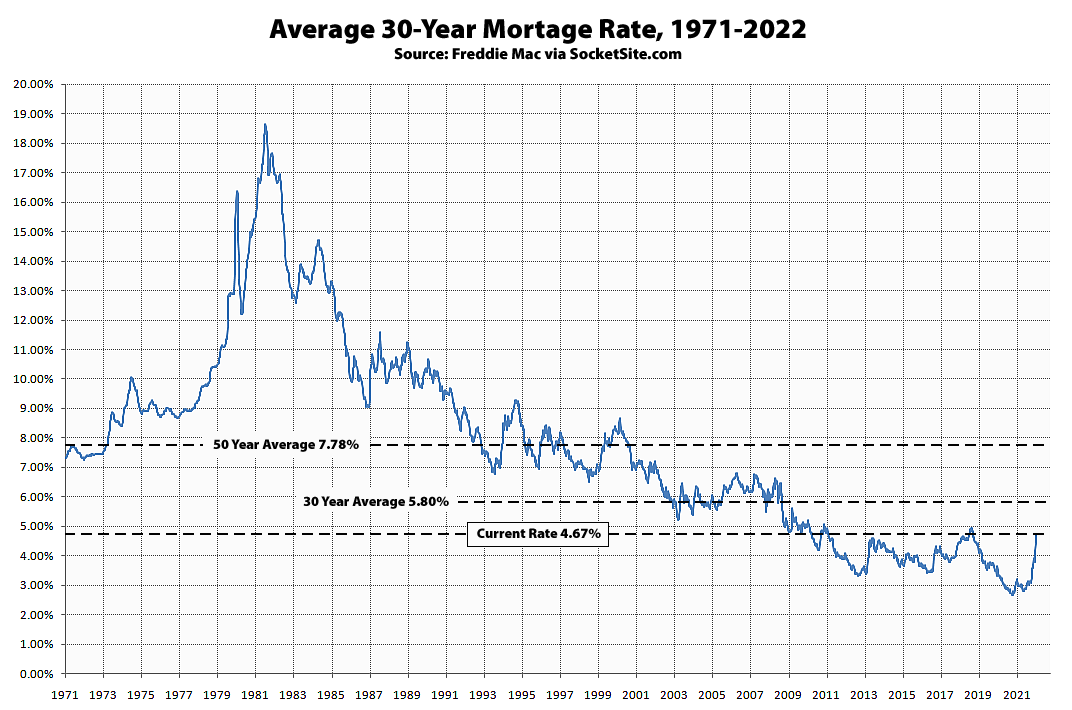

The average rate for a benchmark 30-year mortgage jumped another 25 basis points (0.25 percentage points) over the past week to 4.67 percent, which is 149 basis points, or nearly 50 percent, higher than at the same time last year and the highest average rate since December of 2018.

As such, the benchmark rate has now jumped over two (2) full percentage points (202 basis points) since January of last year and is within 28 basis points of an eleven-year high with the probability of the Federal Reserve raising interest rates by another two (2) full percentage points by the end of the year having jumped as well.

And Boom just like that, 30 yr fixed conventional rates jumped above 5% today to closed the day out at 5.02%.

Great observation – I see plain 30Y vanilla rates at 5.575% today. Mortgage rates really are charging up. We’ve ended one chapter in the story and are starting another. I see:

1. Residential RE Prices moderating.

2. Potential for huge commercial RE price re-sets when you have office spaces that remain unoccupied AND rates going up.

I think a lot will depend on the wage-price spiral. If the Fed actions are enough to prevent wages from going up, then things will settle down in a 12 to 24 month time frame.

For jobs in high demand, wages will continue to go up, and incomes will increase commensurate with financing costs.

Depending on how wages increase, we could see a couple of years of radical inflation-driven increases, or a hard landing recession….

Buckle up, buttercup – opportunities are coming. You can’t change the temperature, you have to jump in the pool and swim.

Yes, and like clockwork 7/1 and 5/1 ARMs programs are of course being looked at more now.

That’s why it’s important to look at these apples to apples where the gains are nearly all due to inflation. In situations like that with little to no real gain in housing prices, you aren’t really making money on real estate. You’re essentially making (or losing) money on interest rate speculation.

The whole S&L industry was nearly wiped out due to writing long term fixed rate loans during our last inflationary episode: “In the 1980s, the financial sector suffered through a period of distress that was focused on the nation’s savings and loan (S&L) industry. Inflation rates and interest rates both rose dramatically in the late 1970s and early 1980s. This produced two problems for S&Ls. First, the interest rates that they could pay on deposits were set by the federal government and were substantially below what could be earned elsewhere, leading savers to withdraw their funds. Second, S&Ls primarily made long-term fixed-rate mortgages. When interest rates rose, these mortgages lost a considerable amount of value, which essentially wiped out the S&L industry’s net worth.”

Conversely some homeowners with long term fixed rate loans made out like bandits.

You can also see a parallel between the price control on S&L interest rates and the SF price control on rent (rent control). It’s almost never politically feasible to fully adjust these government price controls for inflation, so some parties inevitably get squeezed hard in real terms.

You said a broad thing and just ran with it. “Where the gains are nearly all due to inflation.” Then you inserted all sorts of different prisms.

Just looking at the last three apples-to-apples sales.

Apples-to-Apples-to-Apples for Another Sleek Condo – Even a nominal loss at $5k below its 2017 price

Apples-to-Apples to Index for Another Bernal Home – 19.8% nominal gain with 18.2% of that inflation, 1.6% total real gain over nearly 6 years

Officially 25 Percent “Over Asking!” in Bernal Heights, But… – 11% nominal gain with 13% inflation, so -2% real loss over 4 years

The last three that were shown on here? OK. Enjoy. I’m not going down that whole time suck.

UPDATE: Benchmark Mortgage Rate Now Over 50 Percent Higher YOY